|

市场调查报告书

商品编码

1440354

计划合管理:全球市场占有率分析、产业趋势与统计、成长预测(2024-2029)Global Project Portfolio Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

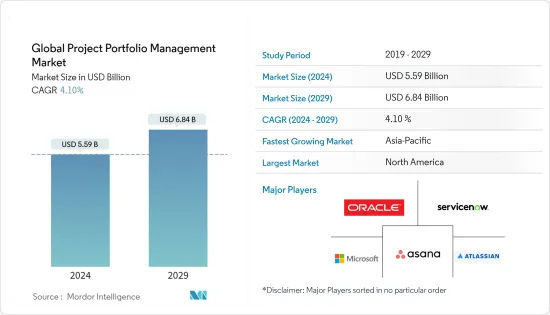

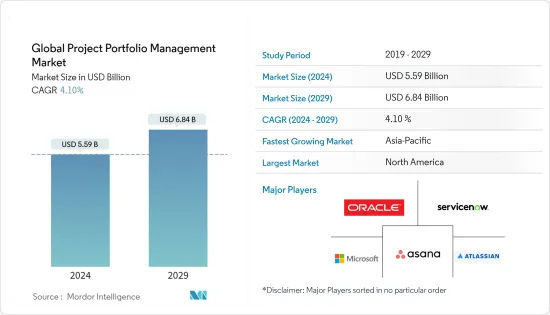

预计2024年全球计划合管理市场规模为55.9亿美元,预计到2029年将达到68.4亿美元,在预测期内(2024-2029年)市场规模将增加41亿美元,复合年增长率为%。

计划合管理 (PPM) 是对组织计划的集中管理。这些计划可能彼此相关,也可能不相关,但它们是集中管理的,称为专案组合,并且具有允许您监视和管理竞争资源的重要优势。

主要亮点

- 计划合管理在分配资金、人员和进度之前根据成功的可能性和相关风险考虑潜在计划,以最大限度地提高组织绩效。它还包括高层控制和监督,以确保持续的努力与公司的整体策略和目标直接相关。

- 工作文化的变化和向远端团队的转变正在推动 PPM 市场的成长。新兴企业和大公司的不断变化允许员工在家工作工作或以混合模式工作,从而提高了生产力,提高了员工士气,减轻了大多数员工的压力水平,节省了营运费用。随着这种做法越来越流行,许多人称之为工作的未来,但公司却认为远距办公是理所当然的,即使对于参与混合模式的员工也是如此。这种情况经常发生。因此,实施计划合管理解决方案可以为您的公司带来多种好处。

- 云端基础的计划合管理市场包括云端 PPM 解决方案的销售,这些解决方案处理组织中经过选择和管理以提高计划投资收益的计划和流程。专案组合旨在实现组织目标并使企划团队能够管理跨计划的风险。对云端基础的解决方案和服务不断增长的需求增加了对 PPM 的需求。

- 此外,组织花费大量时间和金钱来建立合适的人才库。因此,当所有资源的技能和能力都被充分利用时,整体效率和盈利就会提高。计划为中心的企业对提高资源利用率越来越感兴趣,从而更加关注透过指标、政府和管理进行最佳化。

- 在过去的几十年里,远距工作的趋势不断增加。然而,COVID-19的感染疾病在短期内显着加速了这一趋势,各种规模的企业都迅速遵守世界各国政府建议的自我隔离措施,我们被迫适应。随着COVID-19感染疾病迫使更多的人远距工作,计划合管理软体对于企业帮助管理远端工作环境和高效执行计划至关重要,它已成为一个很好的工具。

- 计划合管理解决方案在 COVID-19感染疾病期间透过远端管理各种计划帮助组织实现其目标。虚拟和视讯会议、文件共用和同步、计划状态追踪和报告等计划协作是 PPM 解决方案提供的高效管理计划的关键要素。

计划合管理市场趋势

最近的工作文化变化和市场领先的远距团队转变

- 未来的工作和工作文化正在拥抱变化,办公室的想法正在逐渐消失。虽然新兴企业和新兴企业普遍接受持续变革的概念,但世界各地的大公司也被迫面对同样的概念。

- 这场流行病对职场文化产生了深远而直接的影响。全球封锁和旅行禁令颠覆了人们对工作和商业互动的假设。人们已经意识到大多数事情都可以远端完成。在适应大流行期间的业务并为恢復做准备时,组织领导者需要考虑他们想要维持哪些文化转变以及需要抵制哪些文化转变,这就是 PPM 解决方案和服务的用武之地。从而产生需求。

- 办公室模式正在不断发展,Twitter、Facebook、Square 和 Shopify 等公司宣布永久在家工作政策证明了这一点。许多其他公司也可能提供混合模式。沟通方式已经改变。过去几年,与同事的协作(即使在办公室内)也发生了显着变化,而 COVID-19 进一步加速了这种方法向主要数位化方法的转变。这包括电子邮件、Slack 和 Workday 等共用工作计划管理工具。

- 虚拟协作变得越来越普遍。例如,《哈佛商业评论》指出,在受访的 1,700 名知识工作者中,79% 的人表示他们经常或通常在分散式团队中工作。各种类型的虚拟团队不断涌现,越来越普及,虚拟团队也越来越受欢迎。这种向远端团队的转变将推动 PPM 市场的发展。

- 跨产业的新课责措施会影响组织内的多重职责,通常需要地理分散的团队和办公室之间的协作和沟通。资源是有限的,管理者有责任明智地使用它们。

- 此外,组织相关人员要求提高大型计划、服务和支援活动价值的透明度。一旦满足于核准计划章程和预算,业务部门现在需要更新的计划和指标来显示实际绩效。

北美占有很大份额

- 与其他区域市场相比,北美预计将占据较大的收益占有率。该地区的财政状况可能需要对尖端技术和资源进行大量投资才能有效实施计划。此外,微软公司、甲骨文公司和Workfront等北美一些知名计划合管理解决方案供应商的强大影响力预计将显着推动该领域的市场成长。

- 由于多家公司致力于开发计划合管理工具,北美是一个相当发达的市场。可以最有效地实施大量资料整合技术和工具来识别关键的最终用户资料同步模式,例如 BFSI 和政府措施。

- 本公司正致力于开发计划合管理工具。目前正在最有效地实施整合技术和工具来识别关键的最终用户资料同步模式,例如 BFSI 和政府措施。北美是一个相当发达的市场。

- 该地区IT预算的增加也是市场成长的关键驱动力之一。调查显示,IT未来状况显示,预计2022年预算增加的企业数量大幅增加,预算成长预期明显高于往年。总体而言,53% 的公司位于北美。对于计划在 2022 年增加技术支出的公司来说,IT 预算预计平均增加 26%(北美为 31%,欧洲为 21%)。

- 到 2022 年,IT计划将成为企业增加预算的首要任务(49%),远端工作加速了多年的现代化工作,并且从传统技术稳步转向云端基础的服务。已删除。

计划合管理产业概述

全球计划合管理市场分散,许多大公司争夺市场占有率。工作环境的变化也导致球员之间的竞争加剧。

- 2022 年 7 月,Wrike(Citrix 的一部分,也是一款多功能计划管理解决方案,旨在供整个企业的团队在各种工作环境中使用)宣布推出新的自订,旨在帮助使用者建立专案类型功能。透过可自订的仪表板、共用日历以及用于组织整个计划合的多个选项,根据团队的特定要求自订工作项目类型。

- 2022 年 5 月,提供智慧人员配备、人才和计划合管理的 SaaS 解决方案 Whoz 宣布已筹集 2,500 万欧元资金,主导PSG 股权领投。作为合作伙伴关係的一部分,这笔资金筹措将使 Whoz 能够利用 PSG 的 B2B 软体专业知识和国际网络来加强其在欧洲的业务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 最近工作文化的变化和向远端团队的转变使得开发任务管理和资源利用的中心视图变得至关重要

- 透过及时使用规划和调度工具以及对云端基础的PPM 不断增长的需求,实现长期成本效益

- 多个相关模组和协作的整合扩展了 PPM 的范围,涵盖整个工作区的相关任务

- 市场挑战

- 最新进展正在解决的整合和安全挑战

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 竞争公司之间的敌意强度

- 替代品的威胁

- 评估 COVID-19 对市场的影响

第五章市场区隔

- 依部署类型

- 云

- 本地

- 按类型

- 解决方案

- 服务

- 按最终用户产业

- 资讯科技和电信

- 医疗保健和生命科学

- 製造业

- 建造

- 零售和消费品

- BFSI

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争形势

- 公司简介

- Oracle Corporation

- Servicenow Inc.

- Microsoft Corporation

- Atlassian Corporation Plc

- Asana Inc.

- SAP SE

- Wrike(citrix Systems Inc.)

- Monday.com

- Workday Inc.

- Planview Inc.(changepoint)

- Smartsheet Inc.

- Upland Software Inc.

第七章 投资分析

第八章市场机会及未来趋势

The Global Project Portfolio Management Market size is estimated at USD 5.59 billion in 2024, and is expected to reach USD 6.84 billion by 2029, growing at a CAGR of 4.10% during the forecast period (2024-2029).

Project portfolio management (PPM) is the centralized management of the organization's projects. While these projects may or may not be related to one another, they are managed centrally, which is called a portfolio, having a key benefit of overseeing and managing any competing resources.

Key Highlights

- Project portfolio management examines possible projects based on their likelihood of success and associated risks before allocating money, staff, and timelines to maximize organizational performance. It also comprises high-level controls and monitoring to ensure that ongoing initiatives are directly related to the overarching strategy and goals of the company.

- The change in work culture and the move toward remote teams drive the growth of the PPM Market. The constant change with startups and large enterprises allows employees to work from home or a hybrid model, which enhances productivity, raises employee morale, lowers stress levels for most workers, and saves operating expenses. As the practice grows in popularity, many have called it the future of work, and yet, businesses often take remote workers for granted, even those participating in hybrid models. So, Implementing project portfolio management solutions provide various benefits to businesses.

- The cloud-based project portfolio management market consists of sales of the cloud PPM solutions that handle the organization's group of projects and processes that are selected and managed to offer better returns on project investments. The portfolio is set to fulfill the organization's goals and allows the project team to manage the project's overall risk. The rising demand for cloud-based solutions and services drives the need for PPM.

- Furthermore, organizations spend a lot of time and money creating the right talent pool. Hence, when all the resources' skills and competencies are tapped to their maximum potential, it enhances overall efficiency and profitability. Improved resource utilization is a growing concern in project-focused businesses, resulting in an increased focus on optimization through metrics, government, and management.

- The trend toward remote work has been continuously growing for the past decades. However, the effect of COVID-19 has significantly accelerated this trend in a brief time, forcing companies, irrespective of their size, to adapt quickly to the self-isolation measures governments across the globe were recommending. With the COVID-19 pandemic requiring more people to work remotely, project portfolio management software has become an essential tool for companies as it can help manage the remote working environment and deliver projects efficiently.

- Project portfolio management solutions helped meet organization goals by managing various projects remotely during the COVID-19 pandemic. Project collaborations such as virtual meetings and video conferencing, file sharing and synchronization, project status tracking, and reporting were the essential elements provided by the PPM solutions for efficient management of projects.

Project Portfolio Management Market Trends

Recent Changes In Work Culture And Move Towards Remote Teams to Drive the Market

- The future of work and work culture is embracing change, and the office idea has been gradually diminishing. While startups and new companies have generally supported the concept of constant change, large enterprises worldwide are also forced to confront this same concept.

- The pandemic has had tremendous and swift effects on workplace culture. The global lockdown and travel bans have upended assumptions about work and corporate interactions. People have discovered that they can get most things done remotely. As they adjust to operating during a pandemic and prepare for recovery, organizational leaders must consider which culture changes they want to retain and which they must counteract, leading to the demand for PPM Solutions and services.

- The office model has evolved, evident from companies such as Twitter, Facebook, Square, Shopify, and others announcing permanent work-from-home policies. Many other companies are likely to offer hybrid models. Communication has changed; even in the office, working with colleagues has shifted significantly over the last several years and has been further accelerated into a primarily digital approach owing to COVID-19. This includes email, Slack, shared work project management tools such as workday, and more.

- Virtual cooperation is becoming more and more common. For instance, the Harvard Business Review stated that 79% of the 1,700 knowledge workers surveyed said they regularly or usually work in distributed teams. Various virtual team types have emerged as they spread, and virtual teams have become more common. This shift toward remote teams drives the PPM Market.

- The new drive to accountability across industries affects multiple responsibilities within the organization and typically necessitates cooperation and communication between teams and offices spread out geographically. Resources are limited, and managers are being held accountable for wisely utilizing resources.

- Additionally, organizations' stakeholders request more transparency regarding the worth of their big projects and their service and support activities. Business units that once were content to approve a project charter and budget currently demand updates to the plans and metrics demonstrating actual performance.

North America to Account for a Significant Share

- North America is expected to have a significant revenue share compared to other regional markets. Due to the region's financial status, significant investments in cutting-edge technology and resources for effective project execution can be undertaken. Furthermore, the strong presence of several well-known project portfolio management solution providers in North America, such as Microsoft Corporation, Oracle Corporation, and Workfront, is likely to drive the market's growth in this area significantly.

- North America is a considerably developed market, owing to several companies working on project portfolio management tools. Bulk data integration techniques and tools are most efficiently implemented to identify data synchronization patterns in critical end-users such as BFSI or government initiatives.

- Companies are working on project portfolio management tools. The integration techniques and tools are currently most efficiently implemented to identify data synchronization patterns in critical end-users such as BFSI or government initiatives. North America is a considerably developed market.

- The growing IT budgets in this region are also one of the significant key driving factors of the market's growth. According to the research, IT's future state indicates that the number of companies expecting budget increases will soar in 2022, and budget growth expectations have risen significantly higher than in previous years. Overall, 53% of businesses are in North America. Among companies planning to boost tech spending in 2022, IT budgets are expected to grow by 26% (31% in North America vs. 21% in Europe) on average.

- In 2022, the top factor driving companies to boost budgets is a high priority on IT projects (49%), indicating multi-year modernization efforts accelerated by remote work and a steady shift to cloud-based services have chipped away at legacy technology.

Project Portfolio Management Industry Overview

The global Project Portfolio Management Market is fragmented, with a lot of major players vying for market share. The shift in the work environment has also led to an increase in competition among the players.

- In July 2022, Wrike, which is part of Citrix and a versatile project management solution that is designed to be used by teams across the enterprise in a wide range of work settings, has unveiled its new custom item types capability, designed to help users create their work item types tailored to their team's specific requirements and get customizable dashboards, shared calendars, and multiple options to organize entire portfolios of projects.

- In May 2022, Whoz, a SaaS solution delivering smart staffing and talent and project portfolio management, announced that it had raised EUR 25 million in funding led by PSG Equity. This funding as a part of the partnership enables Whoz to leverage PSG's B2B software expertise and international network to bolster its presence in Europe.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Recent Changes In Work Culture and Move toward Remote Teams has Made It Imperative to Develop A Centralized View of Task Management and Resource Utilization

- 4.2.2 Long-term Cost Benefits Enabled By Timely Use of Planning & Scheduling Tools, Coupled With Growing Demand For Cloud-based Ppm

- 4.2.3 Integration Of Several Allied Modules And Collaborations Have Increased The Span of PPM to Cover The Entire Workspace Related Tasks

- 4.3 Market Challengess

- 4.3.1 Challenges Pertaining To Integration And Security Albeit They Are Being Addressed By Recent Advancements

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Intensity of Competitive Rivalry

- 4.4.5 Threat of Substitutes

- 4.5 Assessment of COVID-19 Impact on the Market

5 MARKET SEGMENTATION

- 5.1 By Deployment Type

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.2 By Type

- 5.2.1 Solution

- 5.2.2 Services

- 5.3 By End-user Verticals

- 5.3.1 IT And Telecom

- 5.3.2 Healthcare And Lifesciences

- 5.3.3 Manufacturing

- 5.3.4 Construction

- 5.3.5 Retail And Consumer Goods

- 5.3.6 BFSI

- 5.3.7 Other End-user Verticals

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Oracle Corporation

- 6.1.2 Servicenow Inc.

- 6.1.3 Microsoft Corporation

- 6.1.4 Atlassian Corporation Plc

- 6.1.5 Asana Inc.

- 6.1.6 SAP SE

- 6.1.7 Wrike (citrix Systems Inc.)

- 6.1.8 Monday.com

- 6.1.9 Workday Inc.

- 6.1.10 Planview Inc. (changepoint)

- 6.1.11 Smartsheet Inc.

- 6.1.12 Upland Software Inc.