|

市场调查报告书

商品编码

1440397

全球自动贩卖机 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Global Vending Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

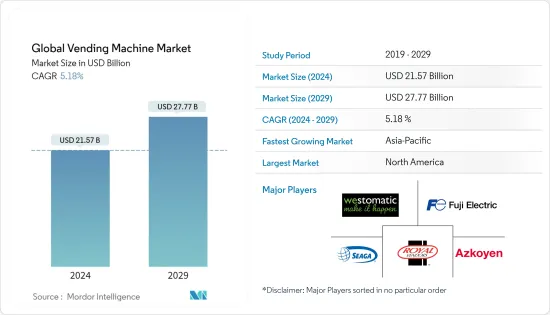

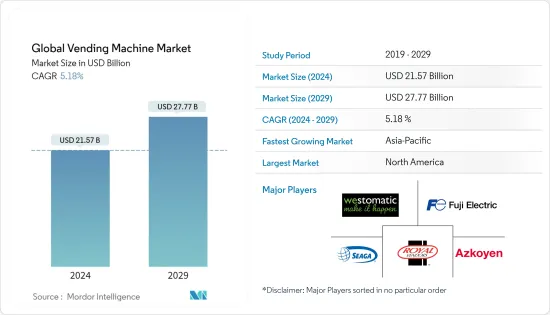

2024年全球自动贩卖机市场规模估计为215.7亿美元,预计到2029年将达到277.7亿美元,在预测期内(2024-2029年)CAGR为5.18%。

由于城市人口生活方式的改变,对随身携带的零食、食品和饮料的需求不断增长,以及自动售货机技术的进步等因素,这使得他们能够快速交付产品,使其成为一种极其方便的选择对于消费者来说,正在推动所研究市场的成长。

主要亮点

- 世界各地零售业的成长正在为所研究的市场成长创造有利的市场情景。例如,根据美国人口普查局的数据,2022年第一季零售总额预计为17,473亿美元,较2021年第四季成长3.7%。

- 自动贩卖机越来越多地应用于商业场所和公司办公室,以提高产品的可及性并保持场所的清洁和美观。由于这些系统是自动化的,因此可以显着减少获得产品所需的时间。

- 此外,考虑到不断增长的需求,自动贩卖机製造商越来越注重开发新型自动贩卖机,利用人工智慧、生物辨识和物联网等先进技术,使其高效、用户友好且安全。例如,2022 年 3 月,自动贩卖机製造商 Digital Media Vending International 选择了 Vending Tracker(由 SECO MIND USA LLC 的 CLEA 支援的自动贩卖机系统管理解决方案)来开发支援人工智慧的自动贩卖机。

- 然而,高昂的安装和营运成本以及与在公共和商业场所销售不健康垃圾食品相关的多项法规等因素可能会对所研究市场的成长产生负面影响。

- 在 COVID-19 大流行最初爆发期间,由于各种限制性法规以及公共场所和办公室的关闭减少了自动贩卖机的需求,对自动贩卖机的需求产生了重大影响。然而,大流行提高了消费者对卫生重要性的认识,预计这将支持预测期内所研究市场的成长。

自动贩卖机市场趋势

商业场所自动贩卖机安装量增加

- 根据CCPIA的规定,商业房地产是指专门用于商业目的并旨在产生利润的建筑物、构筑物和改良物。

- 最近世界各地商业空间的扩张正在创造对自动贩卖机的巨大需求。自动贩卖机呈上升趋势的一些最常见的商业场所包括零售、酒店和住宿以及製造设施等。

- 例如,2021 年 7 月,快速消费品主要品牌印度斯坦联合利华 (HUL) 为其家庭护理产品推出了店内自动贩卖机 Smart Fill。作为试点项目,该公司已在孟买的 Reliance Smart Acme Mall 安装了这些机器。

- 考虑到不断增加的使用案例和需求,自动贩卖机供应商也专注于开发创新产品。例如,2022年3月,美国新泽西州马林纽波特中心开设了第一家「RoboBurger」门市。最近安装的餐厅是一个 12 英尺见方的盒子,里面有一个机器人系统,只需六分钟即可烹饪并为顾客提供新鲜的牛肉汉堡。

亚太地区将实现高成长

- 亚太地区快速成长的商业和企业部门正在为研究市场的成长创造重大机会。此外,由于城市化进程的加速和西方文化的接触,年轻人生活方式的改变极大地推动了对即食食品的需求。

- 例如,根据中国国家改革和发展委员会的数据,中国农村人口向城市转移的趋势呈上升趋势。此外,根据2021-2025年的「十四五」规划,中国的目标是将都市化率提高到65%。

- 此外,印度、菲律宾和中国等国家资讯通讯科技产业的成长极大地推动了对办公空间的需求,为该地区自动贩卖机市场的成长创造了积极的前景。例如,根据印度国家软体和服务公司协会 (Nasscom) 的数据,印度 IT 产业的收入预计将从 2021 财年的 1,960 亿美元增至 2,222 财年的 2,270 亿美元。

自动贩卖机产业概况

全球自动贩卖机市场竞争适度,由于自动贩卖机的需求增加,预计在预测期内竞争将加剧,预计将吸引新的参与者。市场上的供应商专注于为其产品带来创新,以获得竞争优势。该市场的一些主要参与者包括 Westomatic Vending Services Ltd.、富士电机有限公司、Seaga Manufacturing Inc. 和 Royal Vendors Inc.。

- 2022 年 5 月 - 瑞典自动贩卖机公司 RVM Systems 宣布将在新加坡安装一系列可同时消费 100 个货柜的反向自动贩卖机。这些机器的主要目的是鼓励人们负责任地处理不需要的塑胶瓶和饮料罐。这些机器还发放购物奖励、ActiveSG 积分和其他奖励。

- 2022 年 3 月 - 法国夏朗德镇的一家餐厅设立了一台自动贩卖机,让顾客可以购买新鲜的美食,包括安杜耶干酪、鹅肝酱,甚至是小菜。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

- 产业价值链分析

- 评估 COVID-19 对市场的影响

第 5 章:市场动态

- 市场驱动因素

- 快节奏的生活方式对包装食品的需求不断增加

- 科技投资为不同能力的民众和新用户提供更多支持

- 市场挑战

- 安装维护成本高

第 6 章:市场细分

- 依技术

- 自动贩卖机

- 半自动自动贩卖机

- 按类型

- 包装食品

- 饮料

- 其他类型

- 按应用

- 商业场所

- 公司办事处

- 其他(游乐园、运动场馆、医疗设施、交通设施等)

- 按地理

- 北美洲

- 欧洲

- 亚太

- 拉丁美洲

- 中东和非洲

第 7 章:竞争格局

- 公司简介

- Westomatic Vending Services Ltd.

- Fuji Electric Company Ltd.

- Seaga Manufacturing, Inc.

- Royal Vendors, Inc.

- Azkoyen Vending Systems

- Crane Merchandising Systems Inc

- Vending.com

- JOFEMAR SA

- EVOCA Group

- GUANGZHOU BAODA INTELLIGENT TECHNOLOGY CO., LTD

- Armark Corporation

第 8 章:投资分析

第 9 章:市场的未来

The Global Vending Machine Market size is estimated at USD 21.57 billion in 2024, and is expected to reach USD 27.77 billion by 2029, growing at a CAGR of 5.18% during the forecast period (2024-2029).

Factors such as growing demand for on-the-go snacks, food, and drinks due to changing lifestyle of the urban populations, along with the advancement in vending machine technology, which is enabling them to deliver products quickly, making it an extremely convenient option for consumers, are driving the growth of the studied market.

Key Highlights

- The growth of the retail industry across various parts of the world is creating a favorable market scenario for the studied market growth. For instance, according to the US Census Bureau, the total retail sales for the first quarter of 2022 were estimated at USD 1,747.3 billion, an increase of 3.7% from the fourth quarter of 2021.

- Vending machines are increasingly being used in commercial places and corporate offices to enhance the accessibility of products and maintain the place's cleanliness and aesthetics. As these systems are automated, they significantly reduce the time it takes to get a product.

- Furthermore, considering the growing demand, vending machine manufacturers are increasingly focusing on developing new vending machines that use advanced technologies such as AI, biometrics, and IoT to make them highly efficient, user-friendly, and secure. For instance, in March 2022, Digital Media Vending International, a vending machine manufacturer, selected Vending Tracker, a Vending System Management Solution powered by CLEA from SECO MIND USA LLC, to develop AI-enabled vending machines.

- However, factors such as high installation and operating costs along with several regulations pertaining to the sales of unhealthy junk food products in public and commercial places may negatively impact the growth of the studied market.

- A significant impact on the demand for vending machines was observed during the initial outbreak of the COVID-19 pandemic as various restrictive regulations, and the closure of public places and offices reduced its demand. However, the pandemic has raised awareness among consumers regarding the importance of hygiene which is expected to support the growth of the studied market during the forecast period.

Vending Machine Market Trends

Commercial Places to Witness Increased Installation of Vending Machines

- According to CCPIA, commercial property is a building, structure, and improvements used specifically for business purposes and intended to generate a profit.

- The recent growth in the expansion of commercial spaces across various parts of the world is creating significant demand for vending machines. Some of the most common commercial places where vending machines have witnessed an upward trend include retail, hotels & lodging, and manufacturing facilities, among others.

- For instance, in July 2021, Hindustan Unilever (HUL), a major FMCG brand, launched an in-store vending machine, Smart Fill, for its home care products. The company has installed these machines at Reliance Smart Acme Mall in Mumbai as a pilot project.

- Considering the increasing use cases and demand, the vending machine providers are also focusing on developing innovative products. For instance, in March 2022, Newport Centre Mallin, New Jersey, in the United States, installed the first 'RoboBurger outlet. The recently installed outlet is a 12ft-square box containing a robotic system that'll cook and serve customers fresh beef burgers in just six minutes.

Asia-Pacific Region to Register High Growth

- The fast-growing commercial and corporate sector of the Asia Pacific region is creating significant opportunities for the growth of the studied market. Furthermore, changing lifestyles of youth owing to growing urbanization and exposure to western culture has significantly driven the demand for Ready-to-Eat meals.

- For instance, according to the National Reform and Development Commission of China, the country is witnessing an upward trend of rural residents moving to cities. Furthermore, according to its 14th Five-Year Plan for 2021-2025, China aims to raise its urbanization rate to 65%.

- Additionally, the growth of the ICT sector in countries such as India, the Philippines, and China is significantly driving the demand for office spaces, creating a positive outlook for the growth of vending machines market in the region. For instance, according to the National Association of Software and Service Companies (Nasscom), the Indian IT industry's revenue is expected to increase to USD 227 billion in FY22 from USD 196 billion in FY21.

Vending Machine Industry Overview

The Global Vending Machine Market is moderately competitive and is expected to grow in competition during the forecast period owing to increasing demand for vending machines, which is expected to attract new players. Vendors operating in the market focus on bringing innovation to their products to gain a competitive edge. Some major players operating in the market include Westomatic Vending Services Ltd., Fuji Electric Company Ltd., Seaga Manufacturing Inc., and Royal Vendors Inc.

- May 2022 - RVM Systems, a Swedish vending machine company, announced that it would install a range of reverse vending machines that can consume 100 containers simultaneously in Singapore. The primary objective of these machines is to encourage people to dispose of unwanted plastic bottles and responsibly drink cans. These machines also dispense shopping rewards, ActiveSG credits, and other incentives.

- March 2022 - Andouillette, foie gras, or even ris de veau - a restaurant in France's Charente town had set up a vending machine to enable customers to buy fresh gourmet dishes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Packaged Food Products Due to Fast-Paced Lifestyle

- 5.1.2 Technological Investments To Enable Greater Support For The Differently Abled Populace & New Users

- 5.2 Market Challenges

- 5.2.1 High Installation and Maintenance Cost

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Automatic Vending Machines

- 6.1.2 Semi-Automatic Vending Machines

- 6.2 By Type

- 6.2.1 Packaged Food

- 6.2.2 Beverages

- 6.2.3 Other Types

- 6.3 By Application

- 6.3.1 Commercial Places

- 6.3.2 Corporate Offices

- 6.3.3 Others (Amusement Parks, Sports Venues, Healthcare Facilities, Transport Facilities, etc.)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Westomatic Vending Services Ltd.

- 7.1.2 Fuji Electric Company Ltd.

- 7.1.3 Seaga Manufacturing, Inc.

- 7.1.4 Royal Vendors, Inc.

- 7.1.5 Azkoyen Vending Systems

- 7.1.6 Crane Merchandising Systems Inc

- 7.1.7 Vending.com

- 7.1.8 JOFEMAR SA

- 7.1.9 EVOCA Group

- 7.1.10 GUANGZHOU BAODA INTELLIGENT TECHNOLOGY CO., LTD

- 7.1.11 Armark Corporation