|

市场调查报告书

商品编码

1440434

醋酸纤维素 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029 年)Cellulose Acetate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

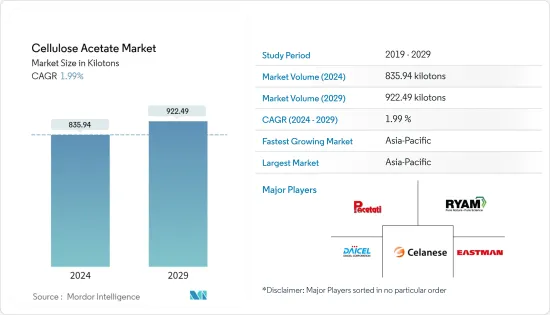

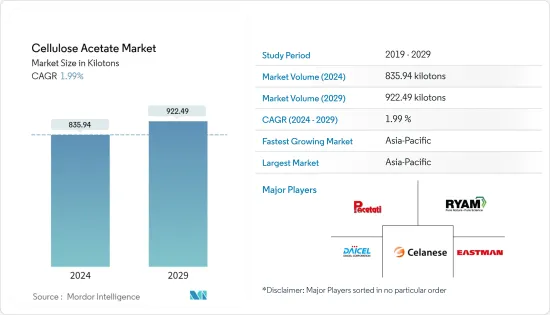

醋酸纤维素市场规模预计到2024年为835.94千吨,预计到2029年将达到922.49千吨,在预测期内(2024-2029年)CAGR为1.99%。

COVID-19 对 2020 年市场产生了负面影响。由于供应链中断,COVID-19 大流行影响了醋酸纤维素市场。疫情期间,许多相关工厂停工,导致产量下降。然而,市场正在恢復到新冠疫情前的水准。

主要亮点

- 短期来看,纺织业、家具业对醋酸纤维素的需求不断增长以及烟草的持续使用是刺激市场需求的一些驱动因素。

- 摄影胶卷对醋酸纤维素的需求下降阻碍了市场成长。

- 越来越多地使用醋酸纤维素进行水处理可能会在未来几年为市场创造机会。

- 预计亚太地区将主导市场,并且在预测期内复合CAGR也将最高。

醋酸纤维素市场趋势

捲烟过滤嘴将主导市场

- 捲烟包括四个主要组成部分:过滤烟丝、添加剂和捲烟包装纸。香烟过滤嘴的设计目的是吸收蒸气并积聚颗粒烟雾成分。过滤嘴还可以防止烟草进入吸烟者的嘴中,并提供在吸烟时不会塌陷的烟嘴。

- 市面上的捲烟过滤嘴大部分由醋酸纤维素製成,也有少数由纸和人造丝製成。两种醋酸纤维素纤维非常细,紧密地堆积在一起,形成看起来像棉花的过滤器。尝试了其他几种材料,但因喜欢醋酸纤维素的味道而被拒绝。

- 全球最大的烟草製造公司是中国烟草总公司、英美烟草公司、菲利普莫里斯国际公司、帝国品牌公司、奥驰亚集团和日本烟草国际公司。

- 主要参与者正在投资研发,以便为客户提供更好的产品。此外,甲醇、丁香巧克力等新型口味捲烟过滤嘴等创新预计将增加捲烟需求并推动醋酸纤维素需求。

- 印度政府商务部发布的报告显示,印度未加工烟草的出口额从2021年的517.64百万美元增加到2022年的570.64亿美元。

- 因此,预计未来几年吸烟者的逐年增加将增加对作为捲烟过滤嘴的醋酸纤维素的需求。

亚太地区将主导市场

- 亚太地区预计将主导市场。在该地区,以GDP计算,中国是最大的经济体。中国和印度是世界上成长最快的新兴经济体之一。

- 醋酸纤维素纤维用于製造服装纺织布料。在纺织工业中,这些布料可用于製作针织品、婚纱、正式衬衫、西装、外套、毛衣、运动服、帽子、衬衫和内衣。它们还可用于雨伞、窗帘、窗帘、地毯和其他家居装饰,例如柔软奢华的面料。

- 印尼是世界十大纺织品生产国之一。纺织及纺织製品业是印尼经济最重要的产业之一,为超过370万印尼人提供了就业机会。

- 孟加拉是美国、欧洲国家、印度、中国等国家的主要纺织品出口国。根据出口促进局公布的资料,2021-2022年,该国服装出口额为426.13亿美元。

- 中国是世界上最大的烟草生产国和消费国。中国有超过3.5亿烟民。同样,印度的吸烟人口也非常多。该国约有 2.5 亿 16 岁至 64 岁的吸烟者。印度也是戒烟率最低的国家之一。

- 亚太地区也是全球油漆和涂料市场的领先地区。由于建筑活动的增加、汽车产量的增长、中产阶级的壮大以及消费者支出的增加等多种因素,该地区对油漆和涂料的需求预计将增加。

- 由于所有这些因素,预计该地区的醋酸纤维素市场在预测期内将稳定成长。

醋酸纤维素行业概况

醋酸纤维素市场本质上是整合的。该市场的一些主要参与者包括塞拉尼斯公司、大赛璐公司、伊士曼化学公司、RYAM 和四特朗普什醋酸酯公司等(排名不分先后)。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 司机

- 纺织业需求不断增加

- 持续吸烟

- 家具业需求不断成长

- 限制

- 底片需求下降

- 其他限制

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第 5 章:市场区隔(市场规模按数量计算)

- 类型

- 纤维

- 塑胶

- 应用

- 香烟过滤嘴

- 摄影胶卷

- 塑胶

- 纺织品

- 其他应用

- 地理

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 世界其他地区

- 南美洲

- 中东和非洲

- 亚太

第 6 章:竞争格局

- 併购、合资、合作与协议

- 市占率(%)**/排名分析

- 领先企业采取的策略

- 公司简介

- Borregaard AS

- Celanese Corporation

- Cerdia International GmbH

- Daicel Corporation

- Eastman Chemical Company

- Mitsubishi Chemical Corporation

- Rotuba

- RYAM

- Sichuan Push Acetati Co.,Ltd.

第 7 章:市场机会与未来趋势

- 增加醋酸纤维素在水处理中的使用

- 其他机会

The Cellulose Acetate Market size is estimated at 835.94 kilotons in 2024, and is expected to reach 922.49 kilotons by 2029, growing at a CAGR of 1.99% during the forecast period (2024-2029).

COVID-19 negatively impacted the market in 2020. The COVID-19 pandemic affected the cellulose acetate market because of disruption in the supply chain. During the pandemic, many factories responsible were shut down, leading to a decline in production. However, the market is returning to pre-COVID levels.

Key Highlights

- Over the short term, the growing demand for cellulose acetate from the textile industry, furniture industry, and continued tobacco usage are some driving factors stimulating the market demand.

- The declining demand for cellulose acetate for photographic films hinders market growth.

- The increasing use of cellulose acetate for water treatment will likely create opportunities for the market in the coming years.

- The Asia-Pacific region is expected to dominate the market and will also witness the highest CAGR during the forecast period.

Cellulose Acetate Market Trends

Cigarette Filters to Dominate the Market

- Cigarettes include four major components: filter tobacco, additives, and cigarette wrappers. Cigarette filters are designed to absorb the vapors and accumulate the particulate smoke components. Filters also prevent tobacco from entering a smoker's mouth and provide a mouthpiece that will not collapse as the cigarette is smoked.

- Most of the cigarette filters in the market are made of cellulose acetate, and a few are made from paper and rayon. The two cellulose acetate fibers are very thin and are packed tightly together to create a filter that can look like cotton. Several other materials were tried but were rejected in favor of the taste of cellulose acetate.

- The largest tobacco manufacturing companies in the world are China National Tobacco Company, British American Tobacco, Philip Morris International, Imperial Brands, Altria Group, and Japan Tobacco International.

- Major players are investing in research and development to offer better products to customers. Furthermore, innovations such as new flavored cigarette filters such as methanol, clove chocolate, and others are expected to increase the cigarette demand and drive the cellulose acetate demand.

- As per the report published by the Department of Commerce, Government of India, the export value of unmanufactured tobacco from India increased from 517.64 USD million in 2021 to 570 USD million in 2022.

- Therefore, increasing smokers yearly is expected to increase the demand for cellulose acetate as cigarette filters in the coming years.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market. In the region, China is the largest economy in terms of GDP. China and India are among the fastest emerging economies in the world.

- Cellulose acetate fiber is used to make textile fabrics for clothing. In the textile industry, these fabrics can be used to make knitwear, wedding attires, formal shirts, suits, coats, sweaters, sportswear, hats, blouses, and undergarments. They can also be used in umbrellas, drapes, curtains, carpets, and other home decor, such as soft and luxurious fabrics.

- Indonesia is among the top 10 textile-producing countries in the world. The textile and textile product industry is among the most important industries for Indonesia's economy, providing jobs to more than 3.7 million Indonesians.

- Bangladesh is a major exporter of textiles to countries such as the United States, European countries, India, China, and others. As per data published by Export Promotion Bureau, 2021-2022, the country exported garments worth USD 42.613 billion.

- China is the world's largest producer and consumer of tobacco. China includes more than 350 million smokers. Similarly, India also contains a very high population of smokers. The country includes around 250 million smokers between 16 and 64. India is also one of the countries with the lowest rate of quitting smoking.

- Asia-Pacific is also the leading region globally in the paints and coatings market. The region's demand for paints and coatings is expected to increase due to numerous factors, such as increasing construction activity, growing automobile production, growing middle class, and increasing consumer spending.

- Due to all such factors, the market for cellulose acetate in the region is expected to grow steadily during the forecast period.

Cellulose Acetate Industry Overview

The cellulose acetate market is consolidated in nature. Some of the major players in the market include Celanese Corporation, Daicel Corporation, Eastman Chemical Company, RYAM, and Sichuan Push Acetati Co., Ltd., among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Textiles Industry

- 4.1.2 Continued Usage of Tobacco

- 4.1.3 Growing Demand from Furniture Industry

- 4.2 Restraints

- 4.2.1 Declining Demand for Photographic Films

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Fiber

- 5.1.2 Plastics

- 5.2 Application

- 5.2.1 Cigarette Filtres

- 5.2.2 Photographic Films

- 5.2.3 Plastics

- 5.2.4 Textiles

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Borregaard AS

- 6.4.2 Celanese Corporation

- 6.4.3 Cerdia International GmbH

- 6.4.4 Daicel Corporation

- 6.4.5 Eastman Chemical Company

- 6.4.6 Mitsubishi Chemical Corporation

- 6.4.7 Rotuba

- 6.4.8 RYAM

- 6.4.9 Sichuan Push Acetati Co.,Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Use of Cellulose Acetate for Water Treatment

- 7.2 Other Opportunities