|

市场调查报告书

商品编码

1440436

不锈钢 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Stainless Steel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

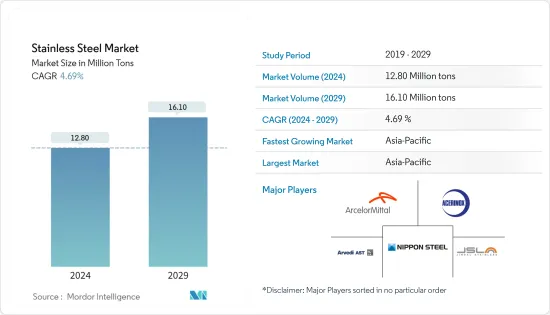

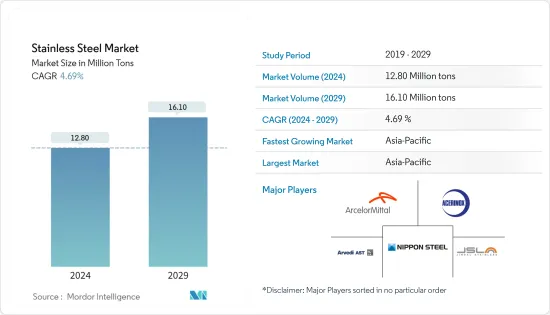

2024年不锈钢市场规模预估为1,280万吨,预估至2029年将达到1,610万吨,在预测期间(2024-2029年)CAGR为4.69%。

主要亮点

- COVID-19 大流行对市场产生了负面影响。这是因为製造设施和工厂因封锁和限製而关闭。供应链和运输中断进一步对市场造成了障碍。然而,2021年该产业出现復苏,使研究市场的需求反弹。

- 短期内,建筑和汽车行业需求的增加是推动所研究市场成长的一些因素。

- 另一方面,高昂的生产成本和原材料价格的波动可能会阻碍所研究市场的成长。

- 然而,亚太地区的工业和基础设施发展可能为所研究的市场提供机会。

- 亚太地区预计将主导市场,并且在预测期内也可能出现最高的CAGR。

不銹钢市场趋势

增加建筑业的使用

- 不銹钢用于建筑、建筑和建筑的各个方面。由于具有更好的耐腐蚀性,大多数建筑设计和结构工程公司更喜欢在腐蚀性更强的场所使用合金含量更高的含钼不銹钢。

- 不銹钢是建筑业中成长最快的部门。不銹钢产品用于梁、柱等结构应用及一般建筑应用。它可用于多种应用,包括栏桿、屋顶、电梯、楼梯、游泳池遮阳帘和中庭。

- 由于人口增长和城市化进程,世界各地对住宅和商业建筑以及医院建设的需求不断增长。都市化进程的加速需要开发更多的建筑物和基础设施。例如,预计印度仍将是二十国集团经济成长最快的国家。印度政府宣布三年(2023-2025年)基础建设投资目标为3,765亿美元,其中1,205亿美元用于发展27个产业集群,753亿美元用于公路、铁路和港口互联互通计画。因此,基础设施项目投资的增加预计将为不銹钢市场创造上行需求。

- 此外,沙乌地阿拉伯正在进行许多商业项目,这可能会导致该国出现更多的商业建筑。耗资5000亿美元的未来巨型城市「Neom」计画-红海计画一期预计于2025年完工,拥有14家豪华和超豪华酒店,共3000间客房,分布在五个岛屿和两个内陆度假村, Qiddiya 娱乐城、超豪华健康旅游目的地阿玛拉以及让努维尔位于欧拉的 Sharaan 度假村。因此,商业建设项目投资的增加预计将为不銹钢市场创造上行需求。

- 美国是世界上最大的建筑业之一,2022年建筑业产值为17,920亿美元,2021年为16,265亿美元。此外,2022年建筑业为美国国内生产毛额(GDP)增加价值约1兆美元。这比上年GDP增加9588亿美元有大幅成长。

- 根据美国人口普查局统计,美国商业建筑市场在2008年经济衰退期间明显下滑后,已完工商业建筑价值已恢復至经济衰退前的水平,到2022年将达到1150亿美元,与2021 年相比增长了21.4%。2022 年 美国商业建筑开工价值因房产类型而异。学校和学院开工建设以及製造业是市场份额最高的类别。 2022年仓库开工金额将超过270亿美元。因此,预计该国的不銹钢市场将受到该国商业建筑业的上行需求。

- 此外,根据美国建筑师协会 (AIA) 建筑共识预测小组的数据,2023 年美国非住宅建筑支出可能会增加 5.8%。到 2023 年,所有主要商业和机构类别预计将增加 5.8%。见证至少相当健康的收益。随后的成长预计将增强预测期内不銹钢市场的成长。

- 由于所有这些因素,不銹钢市场在预测期内可能会在全球范围内增长。

亚太地区将主导市场

- 亚太地区不銹钢产业显着成长;中国和印度等国家占据了重要的消费份额。外国公司在亚太地区的不断增长也产生了建造新办公室和建筑的需求。

- 在预测期内,汽车产业不断增长的需求进一步提振了该地区的不銹钢市场。

- 随着消费者对电池驱动电动车的偏好上升,中国汽车产业正在经历转变的趋势。中国汽车产业的扩张预计将有利于不銹钢需求。根据国际汽车製造商组织(OICA)的数据,中国是世界上最大的汽车生产国,占全球产量的近34%。 2022年,全国汽车产量为2,70,20,615辆,较2021年的2,61,21,712辆增长24%。因此,汽车产量的增加预计将带动不銹钢需求的上升市场。

- 此外,中国在不銹钢市场上占有亚太地区最大的市场份额。由于该国投资和建设活动的增加,预计在整个预测期内不銹钢市场的需求将上升。中国是一个巨大的贡献者,因为它在过去几年中一直是全球基础设施的主要投资者之一。例如,根据中国国家统计局(NBS)的数据,2022年,中国建筑工程产值达27.63兆元人民币(41,085.81亿美元),比2021年增长6.6%。建筑业投资的增加预计将为该国不銹钢市场创造上行需求。

- 此外,印度汽车工业的投资增加和进步预计将增加高强度钢材的消费。例如,2022年4月,塔塔汽车宣布计画未来5年向乘用车业务投资30.8亿美元。预计这将对国内不銹钢市场产生正面影响。

- 基础设施部门是印度经济的关键驱动力。该产业对推动印度整体发展负有重要责任。例如,根据印度品牌资产基金会 (IBEF) 的数据,2022 年 12 月,AAI 和其他机场开发商的目标资本支出约为 100 卢比。未来五年,机场部门将投入 9,800 亿卢比(118 亿美元),用于扩建和改造现有航站楼、新航站楼以及加固跑道等活动。因此,这种扩张预计将为不銹钢市场创造上行需求。

- 据OEC称,2022年2月至2023年2月期间,日本不锈钢线材出口额从17.5亿日圆(0.134亿美元)下降至16.5亿日圆(0.127亿美元),减少了9,680万日圆(- 5.54%)[74.5万美元]。),进口额增加1,340 万日元(+1.09%)[10.3 万美元],从12.3 亿日元(0.009471 亿美元)增至12.4 亿日元(0.009548 亿美元) 。因此,国内不銹钢丝的减少预计将影响该国的不銹钢市场。

- 由于所有这些因素,预计该地区的不銹钢市场在预测期内将稳定成长。

不锈钢业概况

不銹钢市场本质上是部分整合的。该市场的主要参与者(排名不分先后)包括新日本製铁公司、Acerinox、安赛乐米塔尔、金达尔不銹钢有限公司和 Acciai Speciali Terni SpA 等。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 司机

- 建筑业不断增长的需求

- 汽车产业需求不断成长

- 其他司机

- 限制

- 替代品的可用性

- 其他限制

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第 5 章:市场区隔(市场规模按数量计算)

- 产品

- 冷平

- 热线圈

- 冷吧

- 热吧

- 热板和片材

- 其他产品

- 应用

- 汽车与交通

- 建筑与施工

- 金属製品

- 马达

- 机械工业

- 其他应用

- 地理

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太

第 6 章:竞争格局

- 併购、合资、合作与协议

- 市占率(%)**/排名分析

- 领先企业采取的策略

- 公司简介

- Acciai Speciali Terni SpA

- Acerinox

- Aperam

- ArcelorMittal

- Baosteel Group

- China Baowu Steel

- JFE Steel Corporation

- Jindal Stainless Limited

- NIPPON STEEL CORPORATION

- Outokumpu

- POSCO

- thyssenkrupp Stainless GmbH

- TSINGSHAN HOLDING GROUP

第 7 章:市场机会与未来趋势

- 亚太地区工业和基础设施发展

- 其他机会

简介目录

Product Code: 91424

The Stainless Steel Market size is estimated at 12.80 Million tons in 2024, and is expected to reach 16.10 Million tons by 2029, growing at a CAGR of 4.69% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic negatively impacted the market. This was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

- Over the short term, increasing demand from the building and construction and automotive industries are some of the factors driving the growth of the market studied.

- On the flip side, high production costs and rising fluctuations in raw material prices is likely to hinder the growth of the market studied.

- However, industrial and infrastructure development in Asia-Pacific is likely to act as an opportunity for the studied market.

- The Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Stainless Steel Market Trends

Increasing Usage in the Construction Industry

- Stainless steel is used in all aspects of architecture, construction, and building. Due to the better corrosion resistance, most architectural design and structural engineering firms prefer more highly alloyed molybdenum-containing stainless steels for more corrosive locations.

- Stainless Steel is the fastest-growing sector in the construction industry. Stainless Steel products are used in structural applications such as beams, columns, and general architectural applications. It is used in a variety of applications, including railings, roofing, lifts, staircases, swimming pool shades, and atriums.

- Due to rising population and urbanization, there is a growing demand for the construction of residential and commercial buildings, as well as hospitals, all over the world. Increased urbanization necessitates the development of more buildings and infrastructure. For instance, India is anticipated to remain the fastest-growing G20 economy. The Indian government announced a target of USD 376.5 billion in infrastructure investment over three years (2023-2025), including USD 120.5 billion for developing 27 industrial clusters and USD 75.3 billion for road, railway, and port connectivity projects. Therefore, the increasing investments in infrastructure projects are expected to create an upside demand for the stainless steel market.

- Moreover, Saudi Arabia is working on a lot of commercial projects, which will likely lead to more commercial buildings in the country. The USD 500 billion futuristic mega-city "Neom" project, the Red Sea Project - Phase 1, which is expected to be completed by 2025 and has 14 luxury and hyper-luxury hotels with 3,000 rooms spread across five islands and two inland resorts, Qiddiya Entertainment City, Amaala - the uber-luxury wellness tourism destination, and Jean Nouvel's Sharaan resort in Al-Ula. Therefore, the increasing investments in commercial construction projects are expected to create an upside demand for the stainless steel market.

- The United States has one of the world's largest construction industries, valued at USD 1,792 billion in 2022 and USD 1,626.5 billion in 2021. Furthermore, in 2022, the value added to the gross domestic product (GDP) of the United States by the construction industry was around USD 1 trillion. This was a large increase from the previous year when USD 958.8 billion were added to the GDP.

- According to the US Census Bureau, after a noticeable drop in the United States commercial construction market during the 2008 recession, the value of commercial construction that has been put in place has recovered to pre-recession figures, reaching USD 115 billion in 2022, which showed an increase of 21.4% compared to 2021. The value of commercial construction starts in the United States in 2022 varied significantly depending on the property type. School and college construction starts were the categories, along with manufacturing, with the highest market share. The construction starts of warehouses amounted to over USD 27 billion in 2022. Therefore, the stainless steel market in the country is expected to have an upside demand from the country's commercial construction industry.

- Furthermore, according to the American Institute of Architects (AIA) Construction Consensus Forecast Panel, nonresidential building construction spending in the United States is likely to witness a growth of 5.8% in 2023. By 2023, all the major commercial and institutional categories are projected to witness at least reasonably healthy gains. The subsequent increase is expected to enhance the growth of the stainless steel market in the forecast period.

- Owing to all these factors, the market for stainless steel is likely to grow globally during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region has seen significant growth in the stainless steel industry; countries such as China and India account for significant consumption shares. The growing presence of foreign companies in the Asia-Pacific region has also created a demand for the construction of new offices and buildings.

- The growing demand from the automotive industry further boosted the market for stainless steel in the region during the forecast period.

- The automobile industry in China is experiencing shifting trends as consumer preference for battery-powered electric vehicles rises. The expansion of China's automotive sector is expected to benefit stainless steel demand. According to the International Organization of Motor Vehicle Manufacturers (OICA), China is the world's largest automobile producer, accounting for nearly 34% of global volume. In 2022, the country produced 2,70,20,615 units of automobiles, registering an increase of 24% compared to 2,61,21,712 units in 2021. Therefore, increasing in the production of automobiles is expected to create an upside demand for stainless steel market.

- Moreover, China holds the largest Asia-Pacific market share for stainless steel market. The demand for the stainless market is expected to rise throughout the forecast period due to rising investments and construction activity in the country. China is a huge contributor, as it has been one of the leading investors in infrastructure worldwide over the past few years. For instance, according to the National Bureau of Statistics (NBS) of China, in 2022, the output value of construction works in China amounted to CNY 27.63 trillion (USD 4108.581 billion), an increase of 6.6% compared with 2021. Therefore, the rising investments in the construction industry is expected to create an upside demand for stainless steel market in the country.

- Furthermore, increased investments and advancements in the automobile industry in India is expected to increase the consumption of high strength steel. For instance, in April 2022, Tata Motors announced plans to invest USD 3.08 billion in its passenger vehicle business over the next five years. This is expected to have a positive impact on the stainless steel market in the country.

- Infrastructure sector is a key driver for the Indian economy. The sector is highly responsible for propelling India's overall development. For instance, according to India Brand Equity Foundation (IBEF), in December 2022, AAI and other Airport Developers have targeted capital outlay of approximately Rs. 98,000 crore (USD 11.8 billion) in airport sector in the next five years for expansion and modification of existing terminals, new terminals and strengthening of runways, among other activities. Therefore, this expansion is expected to create an upside demand for stainless steel market.

- According to OEC, between February 2022 and February 2023 the exports of Japan's Stainless Steel Wire have decreased by JPY 96.8 million (-5.54%) [USD 0.745 million] from JPY 1.75 billion (USD 0.0134 billion) to JPY 1.65 billon (USD 0.0127 billion), while imports increased by JPY 13.4 million (+1.09%) [USD 0.103 million] from JPY 1.23 billion (USD 0.009471 billion) to JPY 1.24 billion (USD 0.009548 billion). Therefore, decrease in the stainless steel wires from the country is expected to affect the stainless steel market in the country.

- Due to all such factors, the market for Stainless Steel in the region is expected to have a steady growth during the forecast period.

Stainless Steel Industry Overview

The Stainless Steel Market is partially consolidated in nature. The major players in this market (not in a particular order) include NIPPON STEEL CORPORATION, Acerinox, ArcelorMittal, Jindal Stainless Limited, and Acciai Speciali Terni S.p.A., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from Construction Industry

- 4.1.2 Increasing Demand from Automotive Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Substitutes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product

- 5.1.1 Cold Flat

- 5.1.2 Hot Coils

- 5.1.3 Cold Bars

- 5.1.4 Hot Bars

- 5.1.5 Hot Plate and Sheet

- 5.1.6 Other Products

- 5.2 Application

- 5.2.1 Automtoive and Transportation

- 5.2.2 Building and Construction

- 5.2.3 Metal Products

- 5.2.4 Electrical Machinery

- 5.2.5 Mechanical Engineering

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Acciai Speciali Terni S.p.A.

- 6.4.2 Acerinox

- 6.4.3 Aperam

- 6.4.4 ArcelorMittal

- 6.4.5 Baosteel Group

- 6.4.6 China Baowu Steel

- 6.4.7 JFE Steel Corporation

- 6.4.8 Jindal Stainless Limited

- 6.4.9 NIPPON STEEL CORPORATION

- 6.4.10 Outokumpu

- 6.4.11 POSCO

- 6.4.12 thyssenkrupp Stainless GmbH

- 6.4.13 TSINGSHAN HOLDING GROUP

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Industrial and Infrastructural Development in Asia-Pacific

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219