|

市场调查报告书

商品编码

1440536

水溶性肥料:全球市场占有率分析、产业趋势与统计、成长预测(2024-2030)Global Water Soluble Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

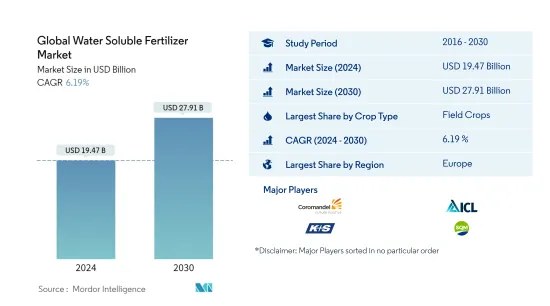

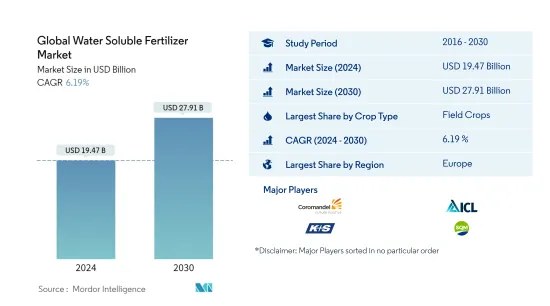

预计2024年全球水溶性肥料市场规模为194.7亿美元,2030年预计将达到279.1亿美元,在预测期(2024-2030年)成长61.9亿美元,复合年增长率为%。

主要亮点

- 按类型划分最大的部分 - 磷肥:磷肥是仅次于氮肥的消耗最多的肥料。水溶性型态的需求量很大,因为它们可以透过施肥或叶面喷布来施用。

- 生长最快的类型 - 微量营养素:叶面喷布是一种行之有效的根据植物需求提供微量营养素的方法。肥料直接施用于植物的维管系统,提高养分利用效率并使作物更快做出反应。

- 按作物类型分類的最大部分 - 草坪和观赏植物:随着世界各地对污染的日益关注和生态旅游的扩展,耕地面积不断增加,导致此类作物对肥料的需求增加。

- 最大的国家:美国:随着国内微灌溉系统的发展和效率的提高,氮肥等水溶性肥料越来越受欢迎。

水溶肥市场趋势

按作物类型划分,田间作物是最大的部分。

- 全球范围内,田间作物种植是主流,约占水溶性肥料总消费量的80.0%。 2021年,水溶肥消费量3,405万吨,金额247.6亿美元。由于田间作物作物面积大,水溶性肥料消耗量大。全球90.0%以上的农业用地用于种植田间作物。

- 一般来说,由于喷灌和微灌系统等灌溉设备的存在,园艺作物对水溶性肥料的需求量很大。水溶性肥料可采用叶面喷施或追肥的方法施用。园艺作物是水溶性作物的第二大消费领域,2021年约占全球水溶性肥料市场价值的12.2%。叶面水溶性肥料在果树作物中扮演重要角色。众所周知,叶面喷布可以提高水果品质。

- 草坪和观赏作物约占全球水溶性肥料市场价值的7.12.29%,2021年消耗水溶性肥料300万吨,价值10亿美元。

- 对环境污染的担忧以及世界各地美丽的花园和生态旅游日益重要,导致草坪和观赏作物的种植面积不断增加。

- 因此,在预测期内,全球每种作物类型的水溶性肥料消费量预计将增加。

按地区划分,欧洲是最大的部分。

- 研究期间,全球水溶肥市场稳定成长,2021年市场规模达309.5亿美元。 2021年欧洲占最大市场占有率,为35.2%,其次是亚太地区和南美洲。

- 由于法国和俄罗斯等国家越来越多地使用特种肥料,欧洲的水溶性肥料市场正在成长。 2021年,该地区的水溶性肥料约占特种肥料市场总量的54.5%,占当年特种肥料总量的约46.7%。

- 为了养活不断增长的人口,到 2030 年,中国和印度等新兴国家将需要超过 1.2 亿公顷的农业面积。儘管农业沙漠化和土壤品质下降,水溶性肥料仍然是农民永续耕种的重要工具。提高产量。

- 施肥方法在巴西越来越受欢迎,2021年占特种肥料市场总量的47.78%。巴西微灌溉系统的增加以及施肥的便利性和效率的提高增加了对水溶性肥料的需求。

- 南非水溶性肥料施用量中施肥占58.78%,叶面喷布占41.21%。这表明肥料施用方法的适应性以及由于施用的简便性和效率而导致的水溶性范围。

- 温室中使用水溶性肥料、减少地下水消费量的诱因、政府补贴以及对微灌溉系统的需求不断增加是推动市场成长的一些主要因素。

水溶肥产业概况

全球水溶肥市场较为分散,前5家企业占20.89%。该市场的主要企业包括 Coromandel、Israel Chemical Limited、K+S AKTIENGESELLSCHAFT、Sociedad Quimica YMinera SA (SQM) 和 Yara International ASA(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章执行摘要和主要发现

第二章 提供报告

第三章简介

- 研究假设和市场定义

- 调查范围

- 调查方法

第四章 产业主要趋势

- 主要作物种植面积

- 平均养分施用量

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 类型

- 复杂的

- 直的

- 按营养成分

- 微量营养素

- 含氮的

- 磷酸盐

- 钾

- 次要大量营养素

- 如何使用

- 滴水

- 叶面

- 作物类型

- 田里的作物

- 园艺作物

- 草坪和装饰

- 地区

- 亚太地区

- 澳洲

- 孟加拉

- 中国

- 印度

- 印尼

- 日本

- 巴基斯坦

- 菲律宾

- 泰国

- 越南

- 其他亚太地区

- 欧洲

- 法国

- 德国

- 义大利

- 荷兰

- 俄罗斯

- 西班牙

- 乌克兰

- 英国

- 其他欧洲国家

- 中东和非洲

- 奈及利亚

- 沙乌地阿拉伯

- 南非

- 土耳其

- 其他中东和非洲

- 北美洲

- 加拿大

- 墨西哥

- 美国

- 北美其他地区

- 南美洲

- 阿根廷

- 巴西

- 南美洲其他地区

- 亚太地区

第六章 竞争形势

- 重大策略倡议

- 市场占有率分析

- 公司形势

- 公司简介

- BMS Micro-Nutrients NV

- Compo Expert

- Coromandel

- Haifa Group

- IFFCO

- Israel Chemical Limited

- K+S AKTIENGESELLSCHAFT

- Sociedad Quimica YMinera SA(SQM)

- Yara International ASA

第七章 CEO 面临的关键策略问题

第8章附录

- 世界概况

- 概述

- 波特的五力框架

- 全球价值链分析

- 市场动态(DRO)

- 来源和参考文献

- 表格和图形列表

- 重要见解

- 资料包

- 词彙表

The Global Water Soluble Fertilizer Market size is estimated at USD 19.47 billion in 2024, and is expected to reach USD 27.91 billion by 2030, growing at a CAGR of 6.19% during the forecast period (2024-2030).

Key Highlights

- Largest segment by Type - Phosphatic : phosphatic fertilizers are the most consumed fertilizers after nitrogen. The demand for its water-soluble form is increasing as it can be applied through fertigation and foliar spray.

- Fastest growing by Type - Micronutrients : Foliar application is a proven effective method of supplying micronutrients according to plant requirements. Since the fertilizer is applied directly to the plant vascular system, the nutrient use efficiency will be increased, and quick response is observed by crop plants

- Largest Segment by Crop Type - Turf & Ornamental : The increasing area under cultivation with increasing concern over pollution and growing ecotourism across the globe has increased the fertilizer demand for such crops.

- Largest segment by Country - United States : With the developing micro-irrigation system in the country and increased efficiency, water-soluble fertilizers such as nitrogenous fertilizers have increased in popularity.

Water Soluble Fertilizer Market Trends

Field Crops is the largest segment by Crop Type.

- Field crop cultivation dominates globally, and it accounts for about 80.0% of the total water-soluble fertilizer consumption. The consumption amounted to 34.05 million metric ton of water-soluble fertilizers worth USD 24.76 billion in 2021. The large consumption of water-soluble fertilizers by field crops is due to the large area under the cultivation of these crops. More than 90.0% of the global agricultural land is dedicated to the cultivation of field crops.

- Generally, there is more demand for water soluble fertilizers in horticultural crops, as they are well-equipped for irrigation like sprinkler or micro irrigation systems. Water-soluble fertilizers can be applied by the foliar or fertigation method of application. The Horticultural crops are the second-largest crop types that consume water-soluble fertilizers, and they accounted for about 12.2% of the global water-soluble fertilizer market value in 2021. Foliar water-soluble fertilizers play an important role in fruit crops, as foliar spraying is known to improve the quality of the fruits.

- Turf and ornamental crops account for about 7.12.29 % of the global water-soluble fertilizer market value and consumed 3.0 million metric ton of water-soluble fertilizers worth USD billion in 2021.

- The area under cultivation of turf and ornamental crops is increasing with concern over pollution and the growing importance of aesthetic landscaping gardens and ecotourism globally.

- Therefore, the global consumption of water-soluble fertilizers in respective crop types is anticipated to grow during the forecast period.

Europe is the largest segment by Region.

- The global water-soluble fertilizer market grew at a stable rate during the study period, with a value of USD 30.95 billion in 2021. Europe occupied the largest market share of 35.2% in 2021, followed by Asia Pacific and South America.

- Due to an increase in the use of specialized fertilizers in nations like France and Russia, the market for water-soluble fertilizers in Europe has been growing. The water-soluble fertilizers in the region accounted for about 54.5% of the total specialty fertilizer market value in 2021 and for about 46.7% of the total volume of specialty fertilizers in the same year.

- To feed their rising populations, developing countries like China and India will need more than 120 million hectares of agriculture by 2030. Despite the desertification of farmland and the decline in soil quality, water-soluble fertilizers remain an essential tool for farmers to help them sustainably increase yields.

- The fertigation mode of application has grown in popularity in Brazil and accounted for 47.78% of the total specialty fertilizer market in 2021. With the country's increasing micro irrigation system and ease of application and increased efficiency, the demand for water-soluble fertilizers.

- Fertigation accounts for 58.78% of water-soluble fertilizer applications in South Africa, and foliar spraying accounts for 41.21%. This indicates the rate of fertigation method adaptation and the scope of water-soluble because of the ease of application and efficiency.

- The use of water-soluble fertilizers in greenhouses, incentives to reduce groundwater consumption, government subsidies, and an increase in demand for micro irrigation systems are some of the main factors boosting the growth of the market.

Water Soluble Fertilizer Industry Overview

The Global Water Soluble Fertilizer Market is fragmented, with the top five companies occupying 20.89%. The major players in this market are Coromandel, Israel Chemical Limited, K+S AKTIENGESELLSCHAFT, Sociedad Quimica YMinera SA (SQM) and Yara International ASA (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Acreage Of Major Crop Types

- 4.2 Average Nutrient Application Rates

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Complex

- 5.1.2 Straight

- 5.1.2.1 By Nutrient

- 5.1.2.1.1 Micronutrients

- 5.1.2.1.2 Nitrogenous

- 5.1.2.1.3 Phosphatic

- 5.1.2.1.4 Potassic

- 5.1.2.1.5 Secondary Macronutrients

- 5.2 Application Mode

- 5.2.1 Fertigation

- 5.2.2 Foliar

- 5.3 Crop Type

- 5.3.1 Field Crops

- 5.3.2 Horticultural Crops

- 5.3.3 Turf & Ornamental

- 5.4 Region

- 5.4.1 Asia-Pacific

- 5.4.1.1 Australia

- 5.4.1.2 Bangladesh

- 5.4.1.3 China

- 5.4.1.4 India

- 5.4.1.5 Indonesia

- 5.4.1.6 Japan

- 5.4.1.7 Pakistan

- 5.4.1.8 Philippines

- 5.4.1.9 Thailand

- 5.4.1.10 Vietnam

- 5.4.1.11 Rest Of Asia-Pacific

- 5.4.2 Europe

- 5.4.2.1 France

- 5.4.2.2 Germany

- 5.4.2.3 Italy

- 5.4.2.4 Netherlands

- 5.4.2.5 Russia

- 5.4.2.6 Spain

- 5.4.2.7 Ukraine

- 5.4.2.8 United Kingdom

- 5.4.2.9 Rest Of Europe

- 5.4.3 Middle East & Africa

- 5.4.3.1 Nigeria

- 5.4.3.2 Saudi Arabia

- 5.4.3.3 South Africa

- 5.4.3.4 Turkey

- 5.4.3.5 Rest Of Middle East & Africa

- 5.4.4 North America

- 5.4.4.1 Canada

- 5.4.4.2 Mexico

- 5.4.4.3 United States

- 5.4.4.4 Rest Of North America

- 5.4.5 South America

- 5.4.5.1 Argentina

- 5.4.5.2 Brazil

- 5.4.5.3 Rest Of South America

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BMS Micro-Nutrients NV

- 6.4.2 Compo Expert

- 6.4.3 Coromandel

- 6.4.4 Haifa Group

- 6.4.5 IFFCO

- 6.4.6 Israel Chemical Limited

- 6.4.7 K+S AKTIENGESELLSCHAFT

- 6.4.8 Sociedad Quimica YMinera SA (SQM)

- 6.4.9 Yara International ASA

7 KEY STRATEGIC QUESTIONS FOR FERTILIZER CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms