|

市场调查报告书

商品编码

1441482

UV-C LED:市场占有率分析、产业趋势与统计、成长预测(2024-2029)UV-C LED - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

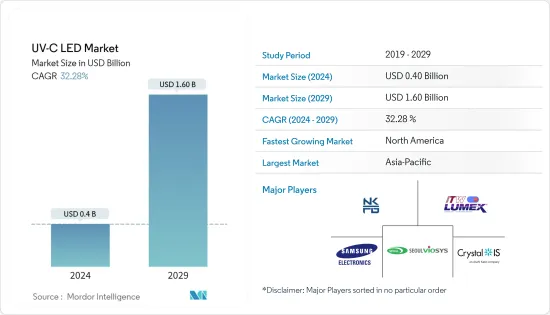

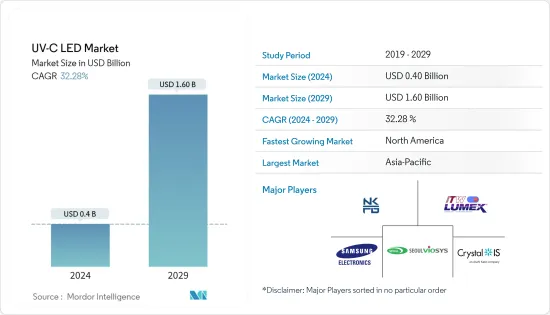

UV-C LED市场规模预计到2024年将达到4亿美元,预计到2029年将达到16亿美元,在预测期内(2024-2029年)复合年增长率为32.28%。

UV-C LED 透过半导体结晶的电致发光产生紫外线光子。这些半导体结晶通常由生长在蓝宝石或 AlN基板上的 AlGaN 化合物製成。这些固态设备不含汞,且不依赖受环境法规约束的其他物质。其结果是传统含汞紫外线灯的潜在法律规章替代品。

主要亮点

- 在预测期内,UV-C LED 融入消费性产品和家用电器预计将为 UV-C LED 市场的成长提供重大机会。产量和可靠性的提高以及最近 UV-C LED 单价的下降是显着推动市场成长的其他因素。

- UV-C LED 技术正在逐步完善。水净化消毒的商业化为该产品创造了巨大的市场。这是推动全球 UV-C LED 需求的因素之一。 UV-C LED 提供聚焦波长,用于选择性和有针对性的测量。

- 此外,UV-C LED 不仅可以消毒水,还可以消毒表面和空气。在商业环境中,用于 HAVC(暖气、通风和空调)的 UV-C LED 空气清净机的使用不断增加。 UV-C LED 正在广泛的行业中找到新的服务,包括住宅、商业、医疗保健、交通、生命科学、国防和紧急应变。

- 由于 UV-C LED 仍处于起步阶段,因此其温度控管是一个大问题。 LED 与其他电子元件一样,对热极为敏感。 UV-C LED 仅将约 5% 的输入功率转换为光。这是因为LED的外量子效率(EQE)特别低。透过转换剩余 95% 的电力来产生热量。

- COVID-19的爆发影响了全球UV-C LED市场的扩张。这导致人们对杀菌紫外线 (UV) 技术的兴趣突然增加。传统光源或 LED 光源产生的 UV-C频宽辐射(100-280 nm)可惰性表面、空气和水中的 SARS-CoV-2 和其他病原体。世界各地的许多大学和实验室都在开发基于 UV-C LED 的产品,以帮助阻止感染疾病的传播。因此,COVID-19 推动了市场成长。

UV-C LED 市场趋势

水消毒引领市场

- UV-C LED 提供了一种安全有效的水处理方法,无需使用污染河流、海洋和其他水体的危险化学物质。 UVC-LED 可用于在水回收、污水处理、饮用水、工业和商业工艺用水、泳池和水疗中心、水产养殖和生命科学等应用中有效净化水。

- 此外,UV-C LED 可以添加到按需 POU水质净化系统中,以保护您的家庭免受水传播疾病的常见致病原因的影响。这些系统中使用 UV-C LED 来防止微生物污染物,包括寄生虫、病毒和细菌(例如大肠桿菌、假单胞菌和退伍军人菌)。

- 水消毒有两种类型:一次通过式和储水式。单一途径透过家用水质净化的自来水照射紫外线来消毒水。储水型透过对加湿器等储水槽内的水进行照射来杀菌。

- 饮用水从源头到消费的处理过程的各个阶段均使用 UV-C LED 进行消毒。新技术允许将 LED 放置在不同位置以确保净化。对于 UV-C 型号,水可能需要几秒钟才能清澈。最初,它的工作原理是将水箱暴露在一些强大的 LED 灯下对水进行消毒。它们会发射 200 nm 至 280 nm 之间的强大 UV-C 光子,这些光子在水中传播并防止水生细菌的生长。

亚太地区占最大市场占有率份额

- 按地区划分,亚太 UV-C LED 市场预计将在预测期内占据最显着的市场占有率,因为主要 UV-C LED 供应商位于韩国和日本。此外,该地区科学研究对 UV-C LED 的需求也在增加。多家韩国 LED 公司预计将推出新的 UV-C LED 产品系列,这将有助于增加韩国供应商的收益。

- 紫外线具有很强的杀菌力,可以对水进行消毒,对抗原生动物、细菌和病毒,因此随着水传播感染疾病病例的增加(主要是在亚洲新兴国家),需求可能会增加。越来越多地采用先进技术来处理工业废水和污水,推动了市场的成长。

- 领先公司为工业水处理和市政饮用水等大容量应用提供高性能解决方案。此外,政府政策、快速工业化以及对高效水和污水处理的关注等因素都将加速市场成长。

- 医疗保健产业越来越多地采用 UV-C LED 设备也推动了市场成长。这些设备可以针对病房、手术室和其他区域进行有效设计和定制,以有效消毒并降低院内感染风险。

- 由于尼泊尔、不丹、孟加拉和印度等亚洲国家对城市和家庭饮用水处理系统的接受度不断提高,水和废水处理产业正在经历成长。水处理领域(包括城市、商业和住宅应用)主导紫外线消毒设备市场。

UV-C LED 产业概览

UV-C LED 市场较为分散,并由主要参与者组成。从市场占有率来看,没有一家公司能够绝对控制市场;每个人都有公平的份额。

- 2022 年 10 月:Crystal IS Inc. 的母公司旭化成展示如何应用 UV-C LED 技术在水处理中实现比传统汞灯系统更高的消毒效率。 Crystal IS 和旭化成在 UV-C LED(发光)技术方面的进步正在为社会永续性做出重大贡献,也是实现无汞世界的重要一步。

- 2022 年 9 月:AMS-欧司朗补充其用于精製应用的高功率UV-C LED 产品组合。 Osram 的 OSLON UV 6060 透过单一 265 奈米晶片源提供强大的 100 毫瓦功率。发射波长提供最佳的灭菌效果。 AMS-OSRAM 的 OSLON UV 6060 可满足工业应用的需求,并为清洁和净化的环境提供永续的UV-C 处理解决方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- COVID-19 对市场的影响

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

- 价格分析

- 紫外线灯整体分析

- UV-C LED 技术-製造工艺

第五章市场动态

- 市场驱动因素

- UV-C LED 具有高杀菌效果

- 水质净化引进量快速增加

- 市场限制因素

- UV-C LED温度控管

第六章市场区隔(按价值和数量分類的市场规模)

- 按用途

- 表面消毒

- 空气消毒

- 水消毒

- 按地区

- 美洲

- 亚太地区

- 欧洲、中东/非洲

第七章 竞争形势

- 公司简介

- NKFG Corporation

- Nitride Semiconductor Co. Ltd

- Samsung Electronics Co. Ltd

- Lumex Inc.(ITW Inc.)

- Crystal IS Inc.(Asahi Kasei Group)

- Seoul Viosys Co. Ltd

- Hongli Zhihui Group

- LiteOn Technology Corporation

- Luminus Inc.

- AMS-Osram AG

- International Light Technologies Inc.

- Nichia Corporation

第八章供应商市场占有率分析

第九章 市场未来展望

The UV-C LED Market size is estimated at USD 0.4 billion in 2024, and is expected to reach USD 1.60 billion by 2029, growing at a CAGR of 32.28% during the forecast period (2024-2029).

UV-C LEDs produce UV photons through the electroluminescence of a semiconductor crystal. These semiconductor crystals are typically made of AlGaN compounds grown on sapphire or AlN substrates. These solid-state devices contain no mercury and do not rely on other substances that are subject to environmental restrictions. As a result, they may provide a regulatory-proof alternative to traditional mercury-containing UV lamps.

Key Highlights

- During the forecast period, the incorporation of UV-C LED into consumer goods and home appliances is anticipated to present a significant opportunity for the growth of the UV-C LED market. Improvements in output power and reliability and the recent unit cost price reduction for UV-C LEDs are additional factors significantly fueling the market growth.

- The technology of UV-C LEDs is gradually becoming better. The commercialization of water purification and disinfection has resulted in a sizeable market for the products. This is one of the factors driving UV-C LED demand globally. UV-C LEDs provide a focused wavelength for selective and targeted measurements.

- Moreover, UV-C LEDs offer surface and air disinfection in addition to water. In the commercial environment, the use of UV-C LED air purifiers for HAVC (heating, ventilation, and air conditioning) is rising. UV-C LEDs are finding new services in a wide range of industries, including residential, commercial, healthcare, transportation, life sciences, defense, and emergency response.

- The thermal management of UV-C LEDs is a major problem because the technology is still in its infancy. LEDs are extremely heat-sensitive, just like any other electronic component. UV-C LEDs only convert about 5% of the input power into light, which is a particularly low external quantum efficiency (EQE) for LEDs. Heat is created by converting the remaining 95% of the power.

- The COVID-19 outbreak had affected the expansion of the global UV-C LED market. It sparked a meteoric rise in interest in germicidal ultraviolet (UV) technology. SARS-CoV-2 and other pathogens can be rendered inactive on surfaces, in the air, and in water by UV-C band radiation (100-280 nm) produced by conventional or LED sources. Around the world, numerous universities and laboratories are creating UV-C LED-based products to stop the spread of infections. As a result, COVID-19 boosted the market's growth.

UV-C LED Market Trends

Water Disinfection to Drive the Market

- UV-C LEDs provide a safe, efficient method of treating water without the use of risky chemicals that contaminate rivers, oceans, and other bodies of water. UVC-LEDs are used to efficiently purify water in applications such as water reclamation, wastewater treatment, drinking water, industrial and commercial process water, pools and spas, aquaculture, and life sciences.

- Moreover, UV-C LEDs can be added to on-demand POU water purification systems to safeguard households against common pathogenic causes of waterborne illnesses. UV-C LEDs are used in these systems to protect against microbial contaminants, which include parasites, viruses, and bacteria like e. coli, pseudomonas, and legionella.

- There are two types of water disinfection, namely single-pass type and water storage type. A single-pass type irradiates ultraviolet to disinfect running water, such as a household water purification system. A water storage type irradiates and disinfects water inside a water storage tank, such as a humidifier.

- Drinking water is sanitized with UV-C LEDs at various stages of the treatment process, from the source to consumption. With the new technology, LEDs can be positioned at different points to ensure decontamination. In a UV-C model, it can take a few seconds for the water to become clean. It initially functions by disinfecting the water by exposing a reservoir to several powerful LEDs. They release potent UV-C photons between 200 nm and 280 nm, which travel through the water and prevent aquatic bacteria from being able to procreate.

Asia-Pacific Accounts for the Largest Market Share

- Geographically, the UV-C LEDs market in Asia-Pacific is expected to hold the most prominent market share during the forecast period because the main UV-C LED suppliers are in South Korea and Japan. Moreover, the region is also experiencing a rise in the demand for UV-C LEDs for scientific research. It is anticipated that several South Korean LED companies are going to launch new series of UV-C LED products contributing to expanding the revenue of South Korean suppliers.

- Increasing cases of water-borne diseases, primarily in emerging countries across Asia, are poised to augment demand as UV radiation holds a strong germicidal ability to disinfect water with protozoans, bacteria, and viruses. The market growth is stimulated by the increasing adoption of advanced technologies to treat industrial liquid waste and wastewater.

- Leading companies are offering high-performance solutions for large-volume applications like industrial water treatment and municipal drinking water. In addition, factors such as government policies, rapid industrialization, and a strong focus on efficient water and wastewater treatment are poised to expedite the growth of the market.

- The growth of the market is also favored by the increasing adoption of UV-C LED-based equipment in the healthcare industry. These devices can be effectively designed and customized for patient wards, operating rooms, and other areas for efficient disinfection and mitigating the risk of hospital-acquired infections.

- The water and wastewater treatment segment is witnessing growth owing to increased acceptance of both municipal as well as household drinking water treatment systems across Asian countries such as Nepal, Bhutan, Bangladesh, and India. The water treatment segment, which includes municipal, commercial, and residential applications, dominates the UV disinfection equipment market.

UV-C LED Industry Overview

The UV-C LED market is fragmented and consists of major players. In terms of market share, no company has absolute control over the market, and everyone has their fair share. Major players include NKFG Corporation, Nitride Semiconductor Co. Ltd, Samsung Electronics Co. Ltd, Lumex Inc. (ITW Inc.), and Crystal IS Inc. (Asahi Kasei Group).

- October 2022: Asahi Kasei, the parent company of Crystal IS Inc., demonstrated how the UV-C LED technology could be applied to achieve higher disinfection efficiency in water treatment than conventional mercury lamp systems. Crystal IS and Asahi Kasei's advancements in UV-C LED (light-emitting) technology contribute majorly to society's sustainability and are essential steps toward actualizing a mercury-free world.

- September 2022: AMS-OSRAM complemented its high-power UV-C LED portfolio for purification applications. Osram's OSLON UV 6060 offers powerful 100 milliwatts out of a single die source at 265 nanometers. The emission wavelength provides the highest germicidal effectiveness. The OSLON UV 6060 from AMS-OSRAM meets the needs of industrial applications delivering sustainable UV-C treatment solutions for a clean and purified environment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Impact of COVID-19 on the Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Pricing Analysis

- 4.5 Overall UV Lamp Analysis

- 4.6 UV-C LED Technology - Manufacturing Process

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 UV-C LED is Highly Effective for Disinfection

- 5.1.2 Surge in Adoption of Water Purification

- 5.2 Market Restraints

- 5.2.1 Thermal Management of UV-C LED

6 MARKET SEGMENTATION (MARKET SIZE BY VALUE AND VOLUME)

- 6.1 By Application

- 6.1.1 Surface Disinfection

- 6.1.2 Air Disinfection

- 6.1.3 Water Disinfection

- 6.2 By Geography

- 6.2.1 Americas

- 6.2.2 Asia Pacific

- 6.2.3 Europe, Middle East, and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 NKFG Corporation

- 7.1.2 Nitride Semiconductor Co. Ltd

- 7.1.3 Samsung Electronics Co. Ltd

- 7.1.4 Lumex Inc. (ITW Inc.)

- 7.1.5 Crystal IS Inc. (Asahi Kasei Group)

- 7.1.6 Seoul Viosys Co. Ltd

- 7.1.7 Hongli Zhihui Group

- 7.1.8 LiteOn Technology Corporation

- 7.1.9 Luminus Inc.

- 7.1.10 AMS-Osram AG

- 7.1.11 International Light Technologies Inc.

- 7.1.12 Nichia Corporation