|

市场调查报告书

商品编码

1441577

聚光太阳能发电(CSP):市场占有率分析、产业趋势与统计、成长预测(2024-2029)Concentrated Solar Power (CSP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

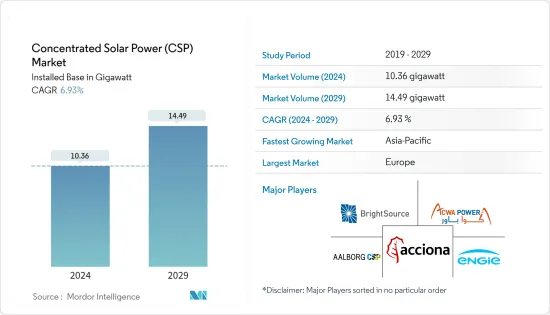

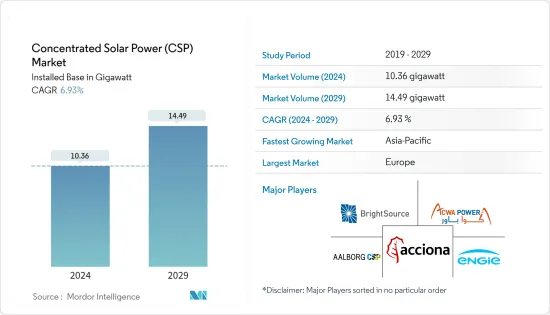

聚光太阳能发电(CSP)市场规模预计到2024年为10.36吉瓦,预计到2029年将达到14.49吉瓦,在预测期内(2024-2029年)增长6.93%,复合年增长率为

主要亮点

- 从长远来看,聚光太阳能发电技术成本的下降预计将推动市场发展。

- 另一方面,太阳能和其他可再生技术的日益采用预计将阻碍预测期内的市场成长。

- 儘管如此,技术的进步以及将聚光太阳能整合到混合发电厂。这将对环境产生积极影响,预计气候变迁将为未来关注太阳能市场创造一些机会。

- 随着电力需求的增加,新计划的推出以及重点是利用再生能源来源来控制污染水平,预计欧洲将主导该地区太阳能发电市场,这预计将导致欧洲对光热发电的需求增加预测期。

聚光太阳能发电(CSP)市场趋势

抛物线谷部分主导市场

- 槽式抛物面集热器 (PTC) 由具有线性轴追踪系统的长 U 形镜组成。镜子沿着吸收管所在的焦线直接反射太阳辐射。接收器/吸收器管由钢製成。它具有选择性涂层,可在太阳频谱波长范围内保持高吸收,同时在红外频谱中保持高反射率(即最大限度地减少辐射)。

- 最常用的流体是热感,但在此配置中也使用水/蒸气或熔盐。这些是一些最广泛部署的 CSP 配置。

- 槽式抛物面集热器是全球最常部署的 CSP 之一。这些可以安装在家庭供暖、海水淡化、冷冻系统、工业供热、发电厂、灌溉抽水等。根据国家可再生能源实验室(NREL)的数据,截至2022年6月,抛物线槽的份额为63.5%。全球整体CSP 总总合。

- 与同类产品相比,抛物面槽式集热器(PTC)的操作和维护部分稍微复杂一些。与太阳能发电厂的运作和维护相关的最常见的活动是定期测量镜面反射率和清洗。镜子的反射率直接影响太阳能集热器提供的宝贵热能的多寡。也可能需要高架车辆和起重机来进行日常清洁和维护。

- 例如,2020年,印度马德拉斯理工学院的研究人员开发了一种低成本太阳能抛物面槽式集热器(PTC)装置,可集中太阳能用于海水淡化、加热和冷却等工业应用。该系统在印度创建和开发,重量轻,在各种气候和负载条件下都非常有效率。

- 因此,预计抛物线槽将在预测期内主导聚光太阳能发电市场。

欧洲主导市场

- 在欧洲,电力产业占该地区温室气体排放的 75% 以上。增加可再生能源的份额是该地区应对气候变迁的潜在选择。

- 在太阳能发电领域,随着电力需求的增加,新计划不断涌现,重点是利用再生能源来源来抑制全部区域的污染水平。 2022年,欧洲已安装约2.3吉瓦的CSP容量。据 IRENA 称,到 2030 年,欧洲可能会安装 4 吉瓦的聚光太阳能发电 (CSP)。

- 在欧洲,MUSTEC等能源合作和太阳热能发电的市场吸收将专注于在该地区共同开发CSP计划,同时考虑到欧盟2030年气候和能源框架。 MUSTEC旨在南欧发展光热发电计划,满足中欧和北欧国家的电力需求。

- 同样,CSP/太阳能热能欧洲研究基础设施 EU Solaris ERIC 旨在开发与 CSP 研究相关的活动和应用。开发工具和技术、新功能、解决方案、日常标准和通讯协定,以增强该地区的光热发电技术。

- 此外,德国政府于2022年对光热发电安装提供55%的补贴,以加速工业应用从清洁能源转向绿色供热的转变。我们也预计将 CSP 技术的投资回收期缩短至三年以下。这将大大促进德国光热发电安装量的增加。

- 同样,西班牙是第一个于 2002 年推出 CSP 上网电价补贴的欧洲国家,这有助于 CSP 的广泛采用。此外,西班牙于 2007 年委託了PS10 太阳能发电塔,这是全球首个采用塔式技术的商业 CSP 发电厂。

- 此外,2022年,西班牙生态转型部透过竞标机制授予220兆瓦的光热发电装置容量,促进该国光热发电计划的发展。西班牙政府也宣布,将在2025年之前对600MW的CSP容量进行竞标。

- 因此,随着装置容量的增加,预计欧洲将在预测期内主导CSP市场。

聚光太阳能发电 (CSP) 产业概览

聚光太阳能发电(CSP)市场适度整合。该市场的主要企业包括(排名不分先后)Aalborg CSP、Acciona SA、ACWA Power、Brightsource Energy Inc.、Engie SA 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 调查先决条件

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2028年之前的市场规模和需求预测(金额)

- CSP装置容量和预测(兆瓦)(到 2028 年)

- 最新趋势和发展

- 政府政策法规

- 市场动态

- 促进因素

- 降低聚光太阳能发电技术的成本

- 抑制因素

- 政府对其他再生能源来源的支持政策

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 科技

- 抛物线槽

- 线性菲涅耳

- 电力塔

- 菜/英镑

- 热介质

- 熔盐

- 水性的

- 油腻的

- 其他热介质

- 地区

- 北美洲

- 美国

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 义大利

- 法国

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 智利

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 併购、合资、合作与协议

- 主要企业采取的策略

- 公司简介

- Nextera Energy Inc.

- Acciona SA

- ACWA Power

- Brightsource Energy Inc.

- Engie

- SR Energy

- Aalborg CSP

- Chiyoda Corporation

第七章市场机会与未来趋势

- 改进技术并将聚光太阳能整合到混合发电厂

简介目录

Product Code: 49456

The Concentrated Solar Power Market size is estimated at 10.36 gigawatt in 2024, and is expected to reach 14.49 gigawatt by 2029, growing at a CAGR of 6.93% during the forecast period (2024-2029).

Key Highlights

- Over the long term, the declining cost of concentrated solar power technologies is expected to drive the market.

- On the other hand, the increasing adoption of solar photovoltaics and other renewable technologies is expected to hinder the market growth during the forecast period.

- Nevertheless, technology improvements and integration of concentrated solar power in hybrid power plants. This will positively impact the environment, and climate change is expected to create several opportunities for Concentrating the solar power market in the future.

- Europe is expected to dominate the market as the solar sector in the region is witnessing new projects at the outset of growing electricity demand and focusing on using renewable energy sources to curb pollution levels, therefore resulting in increasing demand for CSP during the forecast period.

Concentrated Solar Power (CSP) Market Trends

Parabolic Trough Segment to Dominate the Market

- Parabolic-trough collectors (PTCs) consist of long U-shaped mirrors with a linear axis tracking system. The mirrors reflect direct solar radiation along their focal line, where an absorber tube is located. The receiver/absorber tube is made of steel. It has a selective coating that maintains high absorbance in the solar spectrum wavelength range but high reflectance in the infrared spectrum (i.e., it emits as little as possible).

- The most commonly used fluid is thermal oil, although water/steam or molten salt are also used for this configuration. These are some of the most widely deployed configurations for CSPs.

- Parabolic trough collectors are one of the most commonly deployed CSPs around the globe; they can be deployed in domestic heating, desalination, refrigeration systems, industrial heat, power plants, pumping irrigation water, etc. According to the National Renewable Energy Laboratory (NREL), as of June 2022, Parabolic trough accounts for a share of 63.5% of total global CSP installed capacity.

- The Parabolic Trough Collector (PTC) 's operations and maintenance part is slightly complicated compared to its counterparts. The most frequent activities related to solar field operations and maintenance are the periodic measurement of mirror reflectivity and washing. Mirror reflectivity directly affects the amount of valuable thermal energy solar collectors deliver. It may also require tall vehicles or cranes to perform routine cleaning and maintenance.

- For instance, in 2020, researchers from the Indian Institute of Technology Madras created a low-cost Solar Parabolic Trough Collector (PTC) device for concentrating solar energy for industrial uses such as desalination, space heating, and space cooling. This system, created and developed in India, is lightweight and highly efficient under various climate and load circumstances.

- Hence, the parabolic trough is expected to dominate the market for concentrated solar power during the forecast period.

Europe to Dominate the Market

- In Europe, the power sector accounts for more than 75% of greenhouse gas emissions in the region. Increasing the share of renewable energy has become a potential option for the region to tackle climate change.

- The solar sector is witnessing new projects at the outset of growing electricity demand and focusing on using renewable energy sources to curb pollution levels across the region. In 2022, Europe had about 2.3 GW of installed CSP capacity. As per IRENA, by 2030, Europe will likely install 4 GW of concentrated solar power (CSP)

- In Europe, Energy cooperation such as MUSTEC or Market Uptake of Solar Thermal Electricity intends to focus on the collaborative development of CSP projects in the region, given the EU 2030 climate and energy framework. MUSTEC aims to deploy CSP projects in Southern Europe to meet the electricity demand of Central and North European countries.

- Likewise, the EU Solaris ERIC, the European Research Infrastructure for CSP/Solar thermal energy, aims to develop CSP research-related activities and applications. The development of tools and techniques, new capacities, solutions, everyday standards, and protocols to ramp up CSP technology in the region.

- Further, in 2022, the German government introduced a 55% subsidy to install CSP to speed up the clean energy transition to green heating for industrial applications. It also envisages lowering payback time to below three years for CSP technology. This would significantly help CSP installations to increase in Germany.

- Similarly, Spain was the first European country to initiate feed-in-tariff mechanisms for CSP in 2002, which helped ramp up CSP deployment. Moreover, in 2007, Spain commissioned the PS10 solar power tower as the first commercial CSP plant to use tower technology worldwide.

- Further, in 2022, the Ministry of Ecological Transition, Spain, awarded 220 MW capacity for CSP installation through an auction mechanism that would give rise to the development of CSP projects in the country. Spain's government also announced to float tenders for 600 MW of CSP capacity by 2025.

- Hence, with the increasing installed capacities, Europe is expected to dominate the CSP market during the forecast period.

Concentrated Solar Power (CSP) Industry Overview

The concentrated solar power (CSP) market is moderately consolidated. Some of the key players in this market (in no particular order) include Aalborg CSP, Acciona SA, ACWA Power, Brightsource Energy Inc., and Engie SA., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Installed CSP Capacity and Forecast in MW, till 2028

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Declining Cost of Concentrated Solar Power Technologies

- 4.6.2 Restraints

- 4.6.2.1 Supportive Government Policies for Other Renewable Energy Sources

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Parabolic Trough

- 5.1.2 Linear Fresnel

- 5.1.3 Power Tower

- 5.1.4 Dish/Stirling

- 5.2 Heat Transfer Fluid

- 5.2.1 Molten Salt

- 5.2.2 Water-based

- 5.2.3 Oil-based

- 5.2.4 Other Heat Transfer Fluids

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Mexico

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 Italy

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 South Korea

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Chile

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Nextera Energy Inc.

- 6.3.2 Acciona SA

- 6.3.3 ACWA Power

- 6.3.4 Brightsource Energy Inc.

- 6.3.5 Engie

- 6.3.6 SR Energy

- 6.3.7 Aalborg CSP

- 6.3.8 Chiyoda Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technology Improvements and Integration of Concentrated Solar Power in Hybrid Power Plants

02-2729-4219

+886-2-2729-4219