|

市场调查报告书

商品编码

1441579

高级摩托车头盔:市场占有率分析、行业趋势和统计、成长预测(2024-2029)Premium Motorcycle Helmets - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

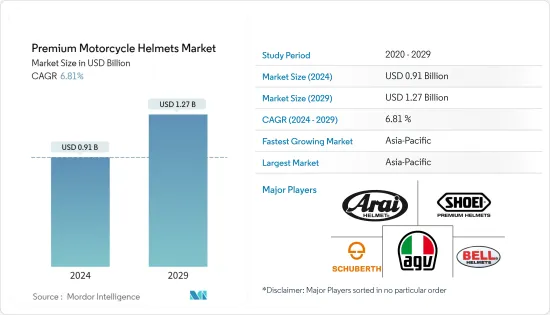

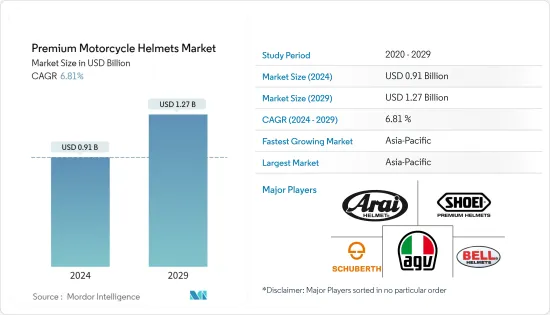

高级摩托车头盔市场规模预计到 2024 年为 9.1 亿美元,预计到 2029 年将达到 12.7 亿美元,在预测期内(2024-2029 年)增长 6.81%,复合年增长率增长。

从长远来看,消费者对提高舒适性和安全性的认识不断增强、运动自行车日益普及、政府对安全标准的严格监管以及千禧一代售后市场的自订修改将推动全球增长。头盔市场。

机车安全帽安全欧洲标准ECE 22.05测试认证已大幅更新,将于2023年生效。新标准对製造商提出了严格的规定,只有通过ECE认证才能在欧洲销售其产品。从2024年1月起,将适用22.06法规。

此外,高檔摩托车头盔市场受到高檔自行车和运动自行车销售不断增长的推动,因为高檔自行车买家更喜欢购买高檔头盔以增加安全性和保护。多家公司正积极致力于推出优质头盔产品并建立长期合作伙伴关係,以提高其在全球的品牌影响力。例如,

2023 年 1 月,Ignyte Helmets 宣布扩大其头盔系列,推出符合 BIS 标准的新型 IGN-7 ECE 22.06。此外,该公司表示,其摩托车头盔获得了更严格的欧洲经济委员会 22.06 (ECE 22.06) 认证,并且还获得了美国联邦机动车辆安全标准认证。

亚太地区是最大的市场,受到印度和中国电动二轮车和运动自行车销量不断增长以及在这些国家运营的大量两轮车OEM的推动。由于强大的高性能马达文化和豪华超级摩托车的高销量,以及许多马达安全帽OEM公司的存在,预计欧洲和北美将成为下一个最大的市场。

高级摩托车安全帽市场趋势

通勤市场在预测期内受到关注

随着都市化的提高和消费者个人可支配收入的增加,对高端摩托车的需求巨大,这对高檔摩托车头盔市场的需求产生了积极的影响。高级头盔越来越受到非赛车摩托车手的青睐,以提高安全性并防止发生事故时头部受伤。通勤市场预计在预测期内将呈现快速成长,因为这些消费者有经济能力购买更昂贵的优质摩托车安全帽。

根据人口研究所的数据,到 2022 年,北美、拉丁美洲和欧洲的都市化程度将最高。在北美,2022年城市人口占总人口的比例达到83%,而在欧洲,同期城市人口的比例为75%。

此外,由于交通事故的增加,对自行车头盔,包括高端头盔的需求也在增加。根据联合国欧洲经济委员会 (UNECE) 对道路事故的研究,摩托车骑士死于道路事故的可能性是小客车驾驶者的 26 倍。戴上正确的头盔可将您的生存机会提高 42%,并防止 69% 的骑士受伤。例如,

根据道路运输和公路部统计,印度道路交通事故数量从2021年的412,430起急剧增加至2022年的461,310起,2021年至2022与前一年同期比较增11.8%。

此外,随着旅游旅行和摩托车探险等巡航活动的增加,消费者的偏好已转向更高品质的头盔,这些头盔更安全,并且在旅行时头部受伤的风险更低。这种情况正在开始发生。因此,由于安全问题的日益严重以及具有内置蓝牙等功能的技术先进的优质头盔的推出,预计通勤市场在预测期内将出现快速增长。

亚太地区在预测期内主导市场

由于印度和中国等国家两轮车销量的增加,预计亚太地区将在未来几年主导两轮车豪华头盔市场。由于这些国家的人口成长和交通拥堵加剧,消费者更喜欢使用摩托车而不是小客车,对亚太地区的豪华安全帽市场产生正面影响。

根据印度汽车工业协会(SIAM)预测,2023年印度国内摩托车销量将达到1590万辆,而2022年为1360万辆,2022年至2023年与前一年同期比较%。记录下来了。

此外,根据工业协会(CAAM)的数据,2022年1月单月中国摩托车销量达145万辆。

此外,由于政府制定了严格的安全标准法规,以防止道路事故造成严重死亡,全部区域对优质摩托车头盔的需求庞大。该地区对两轮车的消费者需求最高,因此从长期需求角度来看仍然是最盈利的地区。摩托车安全帽安全监管机构正在努力更新安全帽製造商的安全标准,以帮助他们为客户提供最安全的安全帽并避免头部受伤。例如,

印度标准局 (BIS) 取消了两轮车头盔 1.2 公斤的重量限制,此前该限制阻碍了进口头盔在该国的销售。这可能使多个优质头盔品牌能够在该国销售和分销最新的优质头盔。

此外,未来几年,印度、中国和韩国等国家电动二轮车销量的成长预计将推动亚太全部区域的优质两轮车头盔市场。该地区电动二轮车的销售已经在加速,这为优质头盔製造商巩固市场提供了有利可图的机会。

根据电动车製造商协会(SMEV)的数据,2023 财年印度电动二轮车的销量将达到 728,000 辆,而 2022 财年为 252,000 辆,与前一年相比,2023 财年至22 财年增长了与前一年同期比较188.8%。

全部区域两轮车销售的乐观前景,加上各国政府积极推动引入严格的安全标准,将推动该地区的优质摩托车头盔市场在预测期内呈现显着增长。

高级摩托车头盔行业概览

由于生态系统中存在各种国际和地区参与者,优质马达头盔市场分散且竞争激烈。主要厂商包括AAGV(Dainese子公司)、Shoei、Schuberth GmbH、Arai Helmet Limited、HJC Helmets、Shark Helmets、Bell Helmets、Airoh Helmets、MT Helmets、LS2 Helmets等。这些公司不断致力于新产品的推出、合作伙伴关係和扩大生产能力,以扩大其业务活动并在市场上立足。例如,

2023年11月,SteelBird Hi-Tech India Limited将斥资1.5亿卢比(1260万美元)将其产能提高到每天50,000个头盔,并正在考虑在泰米尔纳德邦建立新工厂,宣布扩大其零售足迹并推出头盔。各种优质头盔,包括蓝牙版本。此外,该公司表示,计划在 2024 年推出 10 款新的优质头盔型号,包括碳纤维製成的高端型号,内置蓝牙,售价约为 15,000-20,000 卢比(180-240 美元)。

2022 年 11 月,Schuberth 发布了下一代 E2 翻转式冒险头盔。 E2 配备了一个新的、更大的扰流板,具有两个位置的可调节顶部通风口和一个抽气装置,以确保在最困难的条件下骑行时获得最佳的气流。

2022年9月,Arai Helmets与勒芒公司宣布达成新的合作协议,在美国销售Arai Helmet产品。这些公司之间的新合作伙伴关係将透过其 Parts Unlimited 和 Drag Specialty 分销业务,向美国各地的经销商及其客户销售手工製作的 Arai 头盔和原始 Arai 零件和配件。

由于这些参与者希望在行业中获得竞争优势,预计未来几年市场将推出各种具有蓝牙和智慧型手机连接功能的高级头盔产品。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 运动自行车的日益普及推动市场成长

- 市场限制因素

- 优质头盔的高成本阻碍了市场成长

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔(以金额为准的市场规模)

- 依材料类型

- 玻璃纤维

- 碳纤维

- 塑胶

- 其他材料类型(丙烯腈-丁二烯-苯乙烯(ABS)等)

- 按分销管道

- 离线

- 机车展示室

- 头盔製造商展示室

- 售后市场

- 在线的

- 离线

- 按最终用户

- 通勤者

- 赛车手

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东和非洲

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- AGV(Subsidiary of Dainese)

- Shoei Co., Ltd

- Schuberth GmbH

- Arai Helmet Limited

- HJC Helmets

- Shark Helmets

- Bell Helmets

- Nolan Helmets

- Airoh Helmets

- MT Helmets

- Studds Helmets

- Suomy Motorsport SRL

- LS2 Helmets

第七章市场机会与未来趋势

- 执行严格的政府安全标准规定,促进市场需求

第 8 章:按品牌/型号分類的高级脚踏车安全帽价格分析

The Premium Motorcycle Helmets Market size is estimated at USD 0.91 billion in 2024, and is expected to reach USD 1.27 billion by 2029, growing at a CAGR of 6.81% during the forecast period (2024-2029).

Over the long term, rising awareness of enhanced comfort and safety among consumers, the heightened popularity of owning a sports bike, government strict regulations on safety standards, and custom-made modifications in the aftermarket among the millennials will serve as the major determinants for the growth of the premium motorcycle helmet market across the world.

The European standard for motorcycle helmet safety, ECE 22.05 test certification, got a major update, which is effective from 2023. The new standard imposes strict regulations on manufacturers who will only be able to sell their products in Europe if it has been certified under ECE 22.06 regulation from January 2024.

Moreover, the premium motorcycle helmet market is driven by the rising sales of premium and sportbikes since buyers of these bikes prefer purchasing premium helmets for enhanced safety and protection. Various companies are actively engaging in launching premium helmet products and forming long-term partnerships to enhance their brand presence across the world. For instance,

In January 2023, Ignyte Helmets announced the expansion of its range of helmets with the new IGN-7 ECE 22.06, which meets BIS standards. Further, the company stated that their motorcycle helmets have received the more stringent Economic Commission For Europe 22.06 (ECE 22.06) certification and have additionally been homologated for the US Federal Motor Vehicle Safety Standards.

Asia-Pacific is the largest market, driven by the rising sales of electric two-wheelers and sports bikes in India and China, coupled with the large number of two-wheeler OEMs operating in these countries. Europe and North America are projected to be the next biggest markets because of the strong culture of performance motorcycling and high sales of premium superbikes, along with the presence of many motorcycle helmet OEMs.

Premium Motorcycle Helmets Market Trends

Commuters Segment of the Market to Gain Traction during the Forecast Period

With the rising urbanization rate and increasing personal disposable income of consumers, there exists a massive demand for high-segment motorcycles, which, in turn, is positively impacting the demand for premium motorcycle helmets market. Premium helmets are being increasingly preferred by two-wheeler riders other than racers for enhancing their safety and preventing head damage in case of any adverse event. Since these consumers have the financial capability to purchase higher-priced premium motorcycle helmets, the commuter segment of the market is expected to showcase surging growth during the forecast period.

According to the Population Reference Bureau, North America, Latin America, and Europe had the highest degree of urbanization as of 2022. In North America, the share of the urban population touched 83% of the overall population in 2022, while in Europe, the share of the urban population stood at 75% during the same period.

Moreover, the growing number of road accidents is also increasing the demand for bike helmets, including premium helmets. According to the United Nations Economic Commission for Europe (UNECE) study on road accidents, motorcyclists are 26 times more likely to die in a traffic crash than drivers of passenger cars. Wearing an appropriate helmet improves their chances of survival by 42% and helps avoid 69% of injuries to riders. For instance,

According to the Indian Ministry of Road Transport and Highways, the number of road accidents in India sharply increased to 461.31 thousand in 2022 compared to 412.43 thousand in 2021, representing a Y-o-Y growth of 11.8% between 2021 and 2022.

Further, with the increasing cruising activities, like traveling using motorcycles to tourist spots and adventure rides, consumers are shifting their preference to premium quality helmets, as these offer higher safety and lower risk of head injuries during tours. Therefore, with increasing safety concerns and the launch of technologically advanced premium helmets with features such as built-in Bluetooth, the commuter segment of the market is expected to witness rapid growth during the forecast period.

Asia-Pacific Region to Dominate the Market during the Forecast Period

The Asia-Pacific region is expected to dominate the premium motorcycle helmet market in the coming years, attributed to the increasing sales of two-wheelers in countries such as India and China. The growing population in these countries, coupled with increasing traffic congestion, is leading to consumers' preference towards availing motorcycles rather than passenger cars, which, in turn, positively impacts the market for premium helmets across the Asia-Pacific region.

According to the Society of Indian Automobile Manufacturers (SIAM), two-wheeler domestic sales in India touched 15.9 million units in FY 2023 compared to 13.6 million units in FY 2022, recording a Y-o-Y growth of 16.91% between FY 2022 and FY 2023.

Further, according to the Association of Automobile Manufacturers (CAAM), motorcycle sales in China touched 1.45 million units in a single month of January 2022.

Further, with the enforcement of strict government regulations on safety standards to prevent any extreme fatalities due to road accidents, there exists a massive demand for premium motorcycle helmets across the Asia-Pacific region. As this region has the maximum consumer demand for motorcycles, it remains the most lucrative region from a long-term demand perspective. The motorcycle helmet safety regulators are involved in updating the safety standards for helmet manufacturers so that they are bound to provide the safest helmets to their customers and avoid any head injuries. For instance,

The Bureau of Indian Standards (BIS) removed the weight limit of 1.2 kg for two-wheeler helmets, which previously prevented the sales of imported helmets in the country. This is likely to allow several premium helmet brands to market and distribute the latest premium helmets in the country.

Moreover, the premium motorcycle helmet market across the Asia-Pacific region will be driven by the increasing electric two-wheeler sales in countries such as India, China, and South Korea in the coming years. The sales of electric two-wheelers are already picking its pace in this region, and therefore, present a lucrative opportunity for premium helmet manufacturers to integrate the market.

According to the Society of Manufacturers of Electric Vehicles (SMEV), electric two-wheeler sales in India touched 728 thousand in FY 2023 compared to 252 thousand in FY 2022, representing a Y-o-Y growth of 188.8% between FY 2023 and FY 2022.

With the optimistic outlook of two-wheeler sales across the Asia-Pacific region, coupled with the aggressive push by the government to implement strict safety standards, the premium motorcycle helmet market in this region is expected to showcase substantial growth during the forecast period.

Premium Motorcycle Helmets Industry Overview

The premium motorcycle helmet market is fragmented and highly competitive due to the presence of various international and regional players operating in the ecosystem. Some of the major players include AAGV (Subsidiary of Dainese), Shoei Co., Ltd, Schuberth GmbH, Arai Helmet Limited, HJC Helmets, Shark Helmets, Bell Helmets, Airoh Helmets, MT Helmets, and LS2 Helmets, among others. These players constantly engage in new product launches, partnerships, and capacity expansions to expand their business activities and cement their market positions. For instance,

In November 2023, SteelBird Hi-Tech India Limited announced the increase of its production capacity to 50,000 helmets per day at an outlay of Rs 105 crore (USD 12.6 million), exploring a new plant in Tamil Nadu and expanding its retail reach to launch a range of premium helmets including a Bluetooth variant. Further, the company stated that they are strategizing to launch 10 new premium helmet models by 2024 - made with carbon fiber, built-in Bluetooth, and high-end variants costing about Rs.15,000-20,000 (USD 180-240).

In November 2022, Schuberth introduced the next-generation E2 Flip-Up adventure helmet. The E2 comes with a two-position adjustable top vent as well as a newly enlarged spoiler featuring an air extractor to ensure optimal airflow when riding in the most challenging conditions.

In September 2022, Arai Helmet and Le Mans Corp. announced a new partnership agreement for distributing Arai Helmet products in the United States. The new partnership between these companies will enable the sales of Arai hand-crafted helmets and Arai genuine parts and accessories to dealers and their customers across the United States through their Parts Unlimited and Drag Specialties distribution operations.

The market is anticipated to witness the launch of various advanced premium helmet products with Bluetooth and smartphone connectivity in the coming years as these players try to gain a competitive edge in the industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Popularity of Sports Bike to Foster the Growth of the Market

- 4.2 Market Restraints

- 4.2.1 High Cost of Premium Helmets Deter Market Growth

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Material Type

- 5.1.1 Fiber Glass

- 5.1.2 Carbon Fiber

- 5.1.3 Plastics

- 5.1.4 Other Material Types (Acrylonitrile Butadiene Styrene (ABS), etc.)

- 5.2 By Distribution Channel

- 5.2.1 Offline

- 5.2.1.1 Motorcycle Showrooms

- 5.2.1.2 Helmet Manufacturer Showrooms

- 5.2.1.3 Aftermarket

- 5.2.2 Online

- 5.2.1 Offline

- 5.3 By End-User

- 5.3.1 Commuters

- 5.3.2 Racers

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 AGV (Subsidiary of Dainese)

- 6.2.2 Shoei Co., Ltd

- 6.2.3 Schuberth GmbH

- 6.2.4 Arai Helmet Limited

- 6.2.5 HJC Helmets

- 6.2.6 Shark Helmets

- 6.2.7 Bell Helmets

- 6.2.8 Nolan Helmets

- 6.2.9 Airoh Helmets

- 6.2.10 MT Helmets

- 6.2.11 Studds Helmets

- 6.2.12 Suomy Motorsport SRL

- 6.2.13 LS2 Helmets

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Implementation of Strict Government Regulations on Safety Standards to Fuel the Market Demand