|

市场调查报告书

商品编码

1441627

身份验证:市场占有率分析、行业趋势和统计、成长预测(2024-2029)Identity Verification - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

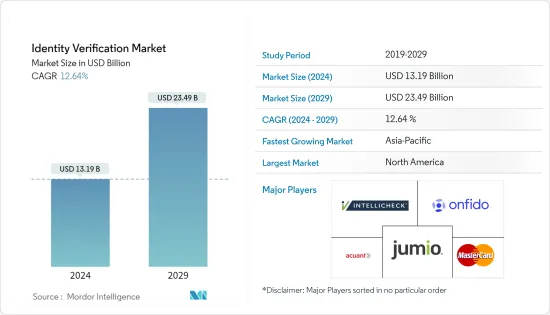

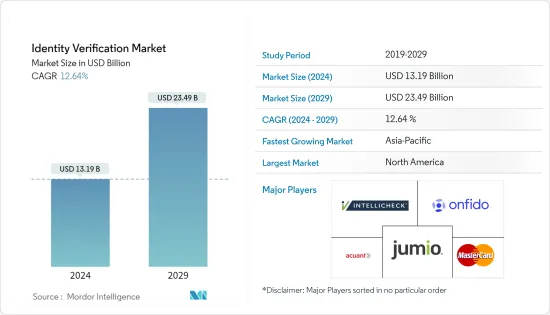

身分验证市场规模预计2024年为131.9亿美元,预计到2029年将达到234.9亿美元,在预测期内(2024-2029年)复合年增长率为12.64%增长。

由于严格的法规而采用解决方案、企业合规性需求以及 BYOD 趋势的采用等几个关键因素,预计身份验证市场将在预测期内增长。市场规模估计值是由市场供应商透过提供身份验证解决方案来产生的,以防止对金融服务、零售和电子商务、游戏/赌博、政府和其他最终用户等各种最终用户的攻击风险。反映收益。

主要亮点

- 根据严格的政府法规,供应商也推出了符合准则的新解决方案。企业需要遵守特定地区的 KYC 法律并防止帐户被接管,这正在推动新解决方案的推出,从而推动所研究的市场。

- 随着诈欺的增加,监管的引入,更重要的是合规性,已成为减少损失的关键。这一因素可能会推动预测期内的市场成长。

- 企业采用自带设备 (BYOD) 的趋势是身分验证市场的强大驱动力,预计将产生重大的长期影响。在当今的行动世界中,员工希望能够使用行动电话、平板电脑、笔记型电脑和穿戴式装置随时随地自由工作。各组织正在实施 BYOD 计划来实现这一目标。

- 由于预算限制,小型企业通常无法获得银行级技术和安全解决方案,这使得它们很容易成为网路犯罪分子的目标。小型企业不太热衷于在其他地方提取资源来满足全面的网路安全立法。

- COVID-19感染疾病后,数位付款方式的广泛接受度显着提高,预计将在长期发挥更重要的作用。现金被认为是病毒的潜在载体,政府和监管机构不鼓励使用现金。疫情期间,数位转型加速,线上市场采用数位转型计画来服务客户并维持营运。

身份验证 (ID) 市场趋势

金融服务正在经历显着成长

- 在金融服务业,身分诈骗案件的增加、对了解你的客户 (KYC) 的需求不断增长、对自动化入职和检验流程以改善客户体验的关注日益增加,以及不断上升的AML 要求,验证解决方案的采用是取得重大进展。

- 此外,新的政府法规,例如欧盟修订后的付款服务指令(PSD2),要求银行相互提供帐户资讯和交易资料的存取权限。这表明整合数位身分系统比以往任何时候都更有奖励,该系统允许用户在不同的金融机构之间无缝验证自己的身分。身分验证解决方案有助于维持严格的合规计划,并增加额外的安全层,以防止金融服务公司意外捲入洗钱或恐怖主义融资计划。

- 数位身分检验正在成为银行业务日益重要的一部分,预计该行业在预测期内将占据全球市场的重要份额。银行和金融服务供应商(包括退休金和保险公司)有严格的身份和个人资料要求,即 KYC。金融服务与市场供应商合作,为客户提供无缝的入职体验。例如,2023 年 5 月,人工智慧身分验证Start-UpsiDenfy 与 Fincapital Partners 合作。该公司利用 iDenfy 先进的 KYC 和 AML 解决方案提供无缝的客户入职流程。

- 金融服务公司正在与市场供应商合作,整合身分验证解决方案以推动入职流程。例如,2023 年 12 月,Intellicheck, Inc. 宣布 Versatile Credit 已将 Intellicheck 整合到其领先的全通路贷款平台中。 Intellicheck 的身份检验解决方案使 Versatile Credit 商家能够充满信心地提供信贷并快速获得新客户。由于身分检验解决方案在全国范围内的广泛采用,印度储备银行 (RBI) 的银行诈骗在过去十年中有所下降。超过-

- 总体而言,由于在履行 KYC 合规义务和满足不断变化的金融监管要求的同时,身分验证的需求不断增长,金融服务业在全球身分验证市场中占有最大的市场占有率。此外,身分验证解决方案已显示出显着成长,并且正在分析以提供无缝的客户入职流程并改善客户体验。

亚太地区市场显着成长

- 推动亚太身分验证市场的关键因素包括数位化力度的加大、过去十年诈骗和身分盗窃的增加以及跨行业的先进数位身分使用案例。此外,政府和企业致力于数位化以及在身分验证解决方案中采用人工智慧、机器学习和自动化等新技术,将为身分检验供应商提供利润丰厚的机会。

- 亚太地区有印度、中国等几个人口稠密的国家。该地区是该技术采用最快的地区之一,网路普及很高。由于持续的数位转型,该地区许多国家都出现了资料外洩事件。例如,2022 年 12 月,印度联邦政府透露,全印度医学科学研究所 (AIIMS) 遭受网路攻击,五台伺服器上约 1.3 Terabyte的资料被加密。

- 此外,2023 年 8 月,骇客渗透到一个负责保卫日本免受网路攻击的组织,并可能存取了长达 9 个月的敏感资料。为了防止此类事件,该地区迫切需要身份盗窃预防解决方案。

- 此外,在亚太地区,数位身分已成为低收入国家的优先事项,作为身分的主要资讯来源和促进数位、金融和社会包容性的机会。因此,各国都在关注数位身份,以打击网路诈骗,确保网路安全,并实现数位、社会和基于信任的转型。因此,许多主要企业正在推出新产品,以满足该地区不断增长的身份验证需求。

- 此外,根据部署类型,亚洲对本地身份验证的需求正在增加。本地解决方案为组织提供了弹性,可以根据特定的当地需求自订检验流程并遵守不同的法律体制,从而确保无缝、本地化的身份检验方法。

- 因此,由于多种因素,包括资料隐私问题、监管合规性、市场多样性、不断增长的网路安全需求和特定产业要求,亚太地区对身分验证的需求不断增加。预计该市场在未来几年将会成长。

身份验证行业概况

身分验证市场高度分散,竞争对手众多,技术竞争激烈,参与者之间竞争激烈。此外,我们预期会收购强调创新并与Start-Ups合作的大公司。参与公司包括 Mastercard Incorporated、Onfido Limited、Idology Inc. (GB Group PLC)、Intellicheck Inc. 和 Jumio Corporation。

- 2023 年 11 月 - 数位身分检验提供者 IDVerse 与万事达卡参与合作伙伴计画合作,提供全面、无缝的数位优先体验。作为该计划的 eKYC 供应商,IDVerse 为万事达卡客户提供全自动的全球身分验证解决方案。这有助于快速开发和部署采用数位优先方法设计的入职解决方案。

- 2023 年 5 月 - Onfido 宣布收购全球私人数位身分共用技术供应商 Airside Mobile, Inc.。 Airside 隐私优先的身份管理技术与Onfido 的创新身份验证相结合,使消费者能够管理储存在智慧型手机上的数位身份,并使用它们解锁新服务,而无需再次进行身份验证。我们将创建一个您可以访问“身份验证”的世界一次即可在任何地方使用”。这将改变电子商务、互联网平台、旅游、金融服务等领域的客户体验,并重新定义身分验证流程。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 由于严格的法规和合规性需求而实施解决方案

- 公司中 BYOD 采用趋势

- 市场挑战

- 实施身分验证解决方案时的预算限制

- 不同类型解决方案的市场观点

- 文件/身份验证

- 数位/电子身份验证

- 认证

第六章市场区隔

- 按配置

- 本地

- 一经请求

- 按最终用户产业

- 财务业务

- 零售与电子商务

- 游戏/赌博

- 政府

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争形势

- 公司简介

- Mastercard Incorporated

- Onfido Limited

- Idology Inc.(GB Group PLC)

- Intellicheck Inc.

- Jumio Corporation

- Trulioo Information Services Inc.

- Mitek Systems Inc.

- Veriff

- IBM Corporation

- AuthenticID

- Experian PLC

- TransUnion

- Lexisnexis Risk Solutions Inc.(RELX Group PLC)

- Pindrop

- ComplyCube

- Nuance Communications Inc.

第八章投资分析

第9章市场的未来

The Identity Verification Market size is estimated at USD 13.19 billion in 2024, and is expected to reach USD 23.49 billion by 2029, growing at a CAGR of 12.64% during the forecast period (2024-2029).

The market for identity verification is expected to grow over the forecast period due to some imperative factors, such as the adoption of solutions through stringent regulations and the need for compliance and adoption of BYOD trends in enterprises. The market sizing estimates reflect the revenue generated by the market vendors by offering identity verification solutions to various end-users such as financial services, retail and e-commerce, gaming/gambling, government, and other end-users to prevent attack risks.

Key Highlights

- In line with the stringent regulations brought by the government, the vendors are also launching new solutions in compliance with the guidelines. The need for companies to align with region-specific KYC laws and prevent account takeovers has fueled the introduction of new solutions driving the studied market.

- With the growing number of fraudulent activities, the introduction of and, more importantly, compliance with the regulations have become imperative to mitigate the loss. This factor may promote the growth of the market over the forecast period.

- The trend of adopting your own devices (BYOD) in enterprises is a strong driver for the identity verification market, which is expected to have a significant impact in the long term. In the current mobile world, employees want the freedom to work from anywhere using their mobile phones, tablets, laptops, or wearables. Organizations are adopting BYOD programs to make it happen.

- Due to budget restraints, SMBs typically have limited access to bank-grade technology and security solutions, making them an easy target for cybercriminals. Small businesses are less keen on extracting resources elsewhere to fit the comprehensive cybersecurity bill.

- The broader acceptance of digital payment methods has significantly improved post the COVID-19 pandemic and is expected to play a more substantial role in the long term. With cash being seen as a potential carrier for the virus, governments and regulatory bodies discourage its use. There has been a sudden push toward digital transformation during the pandemic, with online marketplaces adopting digital transformation programs to serve customers and maintain operations.

Identity (ID) Verification Market Trends

Financial Services to Witness Major Growth

- The financial services industry is witnessing significant adoption of identity verification solutions owing to the growing incidents of identity fraud, the rising need for Know Your Customer (KYC), and AML requirements coupled with an increasing focus on automating onboarding and verification processes to enhance customer experience.

- Furthermore, new government regulations, such as the European Union's Revised Payment Services Directive (PSD2), require banks to provide each other access to account information and transaction data. This suggests more incentive than ever for a unified digital identity system that allows users to verify their identities seamlessly across a range of Fis. Identity verification solutions aid in the maintenance of stringent compliance programs, adding a layer of security that protects financial services firms from being accidentally involved in money laundering or terrorist financing schemes.

- Digital ID verification is increasingly becoming a vital part of banking, and the industry is expected to command a significant share of the global market during the forecast period. Banks and financial service providers, including pension and insurance providers, have strict identity and personal data requirements, often known as KYC. Financial services are partnering with market vendors to offer a seamless onboarding experience to customers. For instance, in May 2023, iDenfy, an AI-enabled identity verification startup, partnered with Fincapital Partners. The company will leverage iDenfy's advanced KYC and AML solutions to deliver a seamless customer onboarding process.

- Financial services firms are partnering with market vendors and integrating identity verification solutions to advance onboarding processes. For instance, in December 2023, Intellicheck, Inc. announced Versatile Credit had integrated Intellicheck into their preeminent omnichannel lending platform. Intellicheck's identity validation solution allows Versatile Credit merchants to extend credit confidently, allowing them to onboard new customers quickly. The Reserve Bank of India (RBI) saw a decrease in bank fraud over the past decade due to the increased deployment of ID verification solutions nationwide. an over

- Overall, the financial services industry is analyzed to hold the largest market share in the global identity verification market owing to the growing demand to verify identity while fulfilling KYC compliance obligations and meeting ever-changing financial regulatory requirements. In addition, the identity verification solutions are analyzed to witness substantial growth, offer a seamless customer onboarding process, and enhance customer experience.

Asia-Pacific to Witness Significant Market Growth

- The major factors driving the identity verification market in the Asia-Pacific include increased digitization initiatives, increased fraudulent activities and identity theft over the last decade, and advanced digital identity use cases across verticals. Furthermore, initiatives by governments and businesses focusing on digitalization and implementing new technologies, such as AI, ML, and automation in identity verification solutions, would present lucrative opportunities for identity verification vendors.

- The Asia-Pacific region is home to some densely populated countries, such as India and China. The region is one of the fastest adopters of technology with increasing internet penetration. Due to the ongoing digital transformation, many countries in the region have witnessed a breach of data. For instance, In December 2022, the Union government of India disclosed that the All-India Institute of Medical Sciences (AIIMS) experienced a cyberattack resulting in the encryption of approximately 1.3 terabytes of data across five servers.

- Moreover, in August 2023, The organization responsible for Japan's national defenses against cyber attacks was infiltrated by hackers, who may have gained access to sensitive data for as much as nine months. To prevent such incidences, the demand for identity theft prevention solutions has been increasing in the region.

- Moreover, in Asia-Pacific, digital identity is a priority in lower-income countries as a primary source of identification and an opportunity to foster digital, financial, and social inclusion. Hence, countries emphasize digital identities to combat online fraud, ensure cybersecurity, and enable digital, societal, and trust-based transformation. Thus, many key players are launching new products to meet the region's growing demand for identity verification.

- Further, by deployment type, there has been an escalating demand for on-premise-based identity verification in Asia. On-premise solutions offer flexibility for organizations to tailor their verification processes to specific regional needs and comply with diverse legal frameworks, ensuring a seamless and localized approach to identity verification.

- Therefore, Asia-Pacific is witnessing a growing demand for identity verification driven by various factors, including data privacy concerns, regulatory compliance, market diversity, heightened cybersecurity needs, and industry-specific requirements. The market is expected to grow in the coming years.

Identity (ID) Verification Industry Overview

The identity verification market is highly fragmented, with numerous competitors and competing technologies that provide intense rivalry among the players. Further, acquisitions and collaborations of large companies with startups are expected, focusing on innovation. Some of the players include Mastercard Incorporated, Onfido Limited, Idology Inc. (GB Group PLC), Intellicheck Inc., and Jumio Corporation.

- November 2023 - IDVerse, a digital ID verification provider, partnered with the Mastercard Engage Partner Program, aiming to offer an all-inclusive, seamless digital-first experience. As an eKYC provider in the program, IDVerse will provide Mastercard customers with a wholly automated global identity verification solution. This would aid in the fast-paced development and deployment of onboarding solutions designed with a digital-first approach.

- May 2023 - Onfido announced the acquisition of Airside Mobile, Inc., a global private digital identity-sharing technology provider. Airside's privacy-first identity management technology, combined with Onfido's innovative verification, enables a 'verify once, use anywhere' world, where consumers can manage their own digital identity stored on their smartphone and can use it to access new services without needing to verify again. This will transform the customer experiences across e-commerce, internet platforms, travel, financial services, and more, redefining the identity verification process.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Adoption of Solution Through Stringent Regulations and Need For Compliance

- 5.1.2 Adoption of BYOD Trends in Enterprises

- 5.2 Market Challenges

- 5.2.1 Budgetary Constraints During the Adoption of Identity Verification Solutions

- 5.3 Market View of Different Types of Solutions

- 5.3.1 Document/ID Verification

- 5.3.2 Digital/Electronic Identity Verification

- 5.3.3 Authentication

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 On-demand

- 6.2 By End-user Industry

- 6.2.1 Financial Services

- 6.2.2 Retail and E-commerce

- 6.2.3 Gaming/Gambling

- 6.2.4 Government

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mastercard Incorporated

- 7.1.2 Onfido Limited

- 7.1.3 Idology Inc. (GB Group PLC)

- 7.1.4 Intellicheck Inc.

- 7.1.5 Jumio Corporation

- 7.1.6 Trulioo Information Services Inc.

- 7.1.7 Mitek Systems Inc.

- 7.1.8 Veriff

- 7.1.9 IBM Corporation

- 7.1.10 AuthenticID

- 7.1.11 Experian PLC

- 7.1.12 TransUnion

- 7.1.13 Lexisnexis Risk Solutions Inc. (RELX Group PLC)

- 7.1.14 Pindrop

- 7.1.15 ComplyCube

- 7.1.16 Nuance Communications Inc.