|

市场调查报告书

商品编码

1637773

锆 -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Zirconium - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

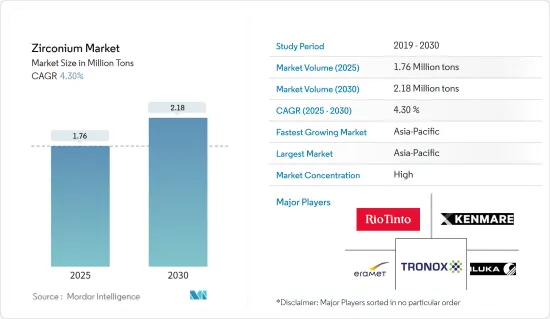

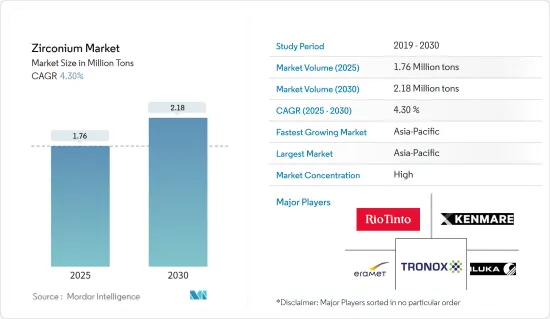

预计2025年锆市场规模为176万吨,2030年将达218万吨,预测期内(2025-2030年)复合年增长率为4.3%。

由于COVID-19感染人数迅速增加,许多国家实施了封锁措施,对全球经济产生了重大影响。由于经济和工业活动暂时停止,锆市场受到钢铁、水泥、能源化学、陶瓷等终端用户产业生产和需求的影响。然而,由于对核能资源开发的日益关注,预计市场在预测期内将出现正增长。

主要亮点

- 从中期来看,铸造厂和耐火材料的成长、亚太地区核能发电厂数量的增加以及表面涂层的加速使用是市场成长的关键驱动力。

- 另一方面,对锆石依赖的减少可能会严重阻碍市场成长。

- 整形外科医疗领域对锆的需求不断增长以及汽车行业严格的排放标准预计将为所研究的市场创造机会。

- 中国占整个市场收益的大部分,预计在预测期内将呈现最快的复合年增长率。

锆市场趋势

锆英石粉/砂需求增加

- 锆石之所以受欢迎,主要是因为它具有多种特性,例如能够与所有有机和无机砂粘合剂粘合、低酸度、低热膨胀係数、高温下的高空间稳定性、高温下的化学稳定性以及良好的可回收性。

- 在陶瓷中,锆砂因其非常有价值的特性而被使用,例如用于遮光的高屈光。附带的好处,例如赋予陶瓷体和玻璃基体材料高机械强度、韧性和耐久性的能力,是公认的特性,使它们能够在陶瓷行业的特定领域找到应用,从而迎合更喜欢的市场。

- 在铸造应用中,它被广泛用作砂型铸造、熔模铸造和考斯沃斯铸造(铝)的成形基材。它还用作压铸和耐火材料涂料的模具涂层和清洗,以降低其他铸砂的润湿性。

- 锆英砂用于製造模具和型芯,由于其耐火性、低膨胀、降低钢水润湿性以及高导热性,与硅砂相比具有显着优势。

- 锆石铸造砂可提供更好的金属光洁度、减少「烧伤」的机会并改善金属凝固。提高金属渗透阻力并赋予铸件均匀的光洁度。

- 由于上述因素,预计预测期内对锆英粉/砂的需求将会成长。

中国主导市场

- 中国在全球市场占有率中占据主导地位,并作为当前成长最快的核能消费国而受到欢迎。由于人们对核能资源开发的兴趣增加,预计对锆的需求将会增加。

- 中国是世界上最大的钢铁生产国。根据世界钢铁协会发布的报告,中国钢铁产量占全球总产量的53%(1,950.5吨)。此外,2021年,我国政府核准新建电弧炉43座,粗钢总合达2,933万吨/年。因此,新钢厂的建设很可能带动耐火材料市场,从而增加国内锆消费量。

- 随着基础建设步伐的加快,中国的住宅和商业建筑不断增加。为此,水泥、钢铁业对耐火材料的需求预计将增加,市场研究可望推进。

- 目前,中国作为核能成长最快的消费国而越来越受欢迎。该国拥有 50 座运作中的核子反应炉,总合容量为 47,518 兆瓦。随着人们对核能资源开发的关注增加,对锆的需求也预计会增加。

- 根据中国核能研究计划,到2035年,核能发电厂运作将达到180GW左右。因此,核能发电产能的增加可能会增加该国的锆消耗量。

- 耐火材料和陶瓷等行业的成长预计将推动预测期内的市场研究。

锆行业概况

全球锆市场整合,前五名公司占据全球消费的主要份额。锆消费的大部分集中在亚太地区和欧洲。该市场的主要参与企业包括 Iluka Resources Limited、Rio Tinto、Tronox Holdings PLC、Kenmare Resources PLC 和 Eramet。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 亚太地区核能发电厂的成长

- 铸件和耐火材料稳定成长

- 加速在表面涂料中的使用

- 抑制因素

- 减少对锆石的依赖

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 导入/汇出

- 贸易监理政策分析

- 价格趋势

第五章市场区隔(市场规模(基于数量))

- 生产类型

- 锆石

- 氧化锆

- 其他的

- 目的

- 锆英石粉/碎砂

- 锆石乳浊剂

- 耐火材料(氧化锆)

- 锆石化学品

- 金属锆石

- 地区

- 生产

- 澳洲

- 巴西

- 中国

- 印度

- 印尼

- 南非

- 乌克兰

- 其他的

- 消耗

- 中国

- 美国

- 日本

- 欧洲联盟

- 印度

- 俄罗斯

- 其他的

- 生产

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)分析

- 主要企业策略

- 公司简介

- Australian Strategic Materials Ltd

- Base Resources Limited

- Binh Dinh Minerals Company

- Doral Mineral Sands Pty Ltd

- Eramet

- Iluka Resources Limited

- INB

- Kenmare Resources PLC

- Lanka Mineral Sands Limited

- MZI Resources Ltd

- Rio Tinto

- Tronox Holdings PLC

第七章 市场机会及未来趋势

- 扩大在医疗领域的应用,特别是整形外科植入

- 严格的汽车排放标准

The Zirconium Market size is estimated at 1.76 million tons in 2025, and is expected to reach 2.18 million tons by 2030, at a CAGR of 4.3% during the forecast period (2025-2030).

A sharp increase in the number of COVID-19 cases led to numerous countries resorting to lockdowns, which significantly affected the global economy. The economic and industrial activities came to a temporary halt, which led the zirconium market to witness repercussions in terms of both production and demand from end-user industries, such as iron and steel, cement, energy and chemicals, and ceramics. However, the increasing focus on developing nuclear power resources is expected to help the market achieve positive growth during the forecast period.

Key Highlights

- Over the medium term, the major factors driving the market's growth are the growth in foundries and refractories, the increasing number of nuclear power stations in Asia-Pacific, and the accelerating usage of surface coatings.

- On the other hand, the reducing dependence on zircon is likely to hinder the growth of market significantly.

- The rising demand for zirconium in the healthcare sector for orthopedics and stringent emission standards pertaining to the automotive industry are expected to create the opportunities for the market studied.

- China dominated the market studied, accounting for a major share of the total revenue, and it is expected to witness the fastest CAGR over the forecast period.

Zirconium Market Trends

Increasing Demand from Zircon Flour/Sand

- Zircon is widely used in ceramics and foundry, mostly in the form of sand and flour (milled sand), due to its various properties, such as the ability to bind with all organic and inorganic sand binders, low acidity, low thermal expansion coefficient, and high spatial stability at increased temperatures, chemical stability at high temperatures, and good recyclability.

- In ceramics, zircon sand is used for its highly valuable properties, such as its high refractive index for opacification. Its ancillary benefits, including its ability to impart greater mechanical strength, toughness, and durability to ceramic bodies and glass matrices, are established attributes and enable it to find applications in specific segments of the ceramic industry, thereby catering to markets with a preference for these attributes.

- In foundry applications, it is used widely as a molding base material for sand casting, investment casting, and Cosworth casting (aluminum). It is also used as a mold coating in die casting and refractory paints and washes, as it reduces the wettability of other foundry sands.

- Zircon sand is used for mold and core manufacturing, where its refractoriness, low expansion, reduced wettability by molten steel, and high thermal conductivity offer significant advantages over silica sand.

- Zircon foundry sands produce a better metal finish, a lesser likelihood of 'burn-on,' and improved metal solidification. It increases the resistance to metal penetration and imparts a uniform finish to the casting.

- Owing to the aforementioned factors, the demand for zircon flour/sand is expected to grow over the forecast period.

China to Dominate the Market

- China dominated the global market share for zirconium, and it is gaining popularity as the fastest-growing consumer of nuclear energy in the present scenario. The increasing focus on developing nuclear power resources is expected to increase the demand for zirconium.

- China is the largest steel producer in the world. According to the report published by World Steel Association, China accounted for 53% of the overall production of steel in the world, which is 1950.5 metric tons. Additionally, in 2021, the Chinese government approved the construction of 43 new EAFs with a total crude steel capacity of 29.33 million mt/year. Thus, the construction of new steel plants is likely to drive the market for refractories, thereby increasing the consumption of zirconium in the country.

- The increased pace of infrastructural activities has led to an increase in residential and commercial buildings in China. This is expected to drive the demand for refractories in the cement and iron steel industries, thereby driving the market studied.

- China is currently gaining popularity as the fastest-growing consumer of nuclear energy. The country has 50 operable nuclear reactors, with a combined net capacity of 47,518 MW. The increasing focus on the development of nuclear power resources is expected to increase the demand for zirconium.

- According to China's Atomic Energy Research Initiative, by 2035, nuclear plants operation should reach around 180 GW. Thus, increasing nuclear power production capacities is likely to increase the consumption of zirconium in the country.

- The growth in industries, such as refractories and ceramics, is expected to drive the market studied in the forecast period.

Zirconium Industry Overview

The global zirconium market is consolidated, with the top five companies accounting for major shares of global consumption. Most of the consumption of zirconium is in the Asia-Pacific region and Europe. The major players in the market include Iluka Resources Limited, Rio Tinto, Tronox Holdings PLC, Kenmare Resources PLC, and Eramet.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growth of Nuclear Power Stations in the Asia-Pacific

- 4.1.2 Consistent Growth in Foundries and Refractories

- 4.1.3 Accelerating Usage in Surface Coatings

- 4.2 Restraints

- 4.2.1 Reducing Dependence on Zircon

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Import and Export

- 4.5.1 Trade Regulatory Policy Analysis

- 4.5.2 Price Trends

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Occurrence Type

- 5.1.1 Zircon

- 5.1.2 Zirconia

- 5.1.3 Other Occurrence Types

- 5.2 Applications

- 5.2.1 Zircon Flour/Milled Sand

- 5.2.2 Zircon Opacifier

- 5.2.3 Refractories (Zirconia)

- 5.2.4 Zircon Chemicals

- 5.2.5 Zircon Metal

- 5.3 Geography

- 5.3.1 Production

- 5.3.1.1 Australia

- 5.3.1.2 Brazil

- 5.3.1.3 China

- 5.3.1.4 India

- 5.3.1.5 Indonesia

- 5.3.1.6 South Africa

- 5.3.1.7 Ukraine

- 5.3.1.8 Rest of the World

- 5.3.2 Consumption

- 5.3.2.1 China

- 5.3.2.2 United States

- 5.3.2.3 Japan

- 5.3.2.4 European Union

- 5.3.2.5 India

- 5.3.2.6 Russia

- 5.3.2.7 Rest of the World

- 5.3.1 Production

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Australian Strategic Materials Ltd

- 6.4.2 Base Resources Limited

- 6.4.3 Binh Dinh Minerals Company

- 6.4.4 Doral Mineral Sands Pty Ltd

- 6.4.5 Eramet

- 6.4.6 Iluka Resources Limited

- 6.4.7 INB

- 6.4.8 Kenmare Resources PLC

- 6.4.9 Lanka Mineral Sands Limited

- 6.4.10 MZI Resources Ltd

- 6.4.11 Rio Tinto

- 6.4.12 Tronox Holdings PLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Usage in the Healthcare Sector, Especially Orthopedic Implants

- 7.2 Stringent Emission Standards Pertaining to Automotive