|

市场调查报告书

商品编码

1441652

石油和天然气行业的气体压缩机:市场占有率分析、行业趋势和统计、成长预测(2024-2029)Oil And Gas Industry Gas Compressor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

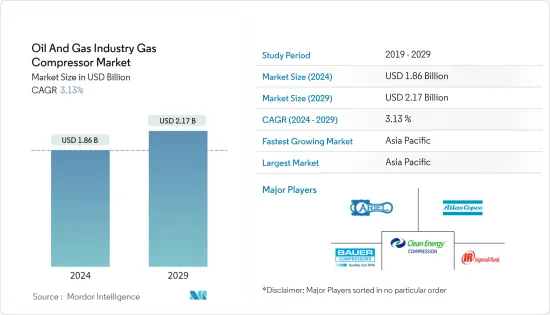

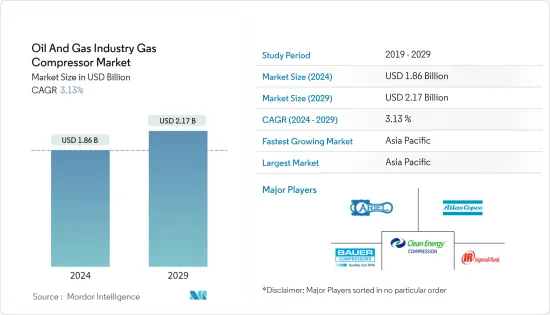

石油和天然气工业气体压缩机市场规模预计到 2024 年为 18.6 亿美元,预计到 2029 年将达到 21.7 亿美元,在预测期内(2024-2029 年)复合年增长率为 3.13%。

主要亮点

- 长期来看,市场主要受到各应用领域天然气消费量增加的推动,而在当前情景下,导致更多的天然气生产和输送计划以及合理的天然气价格,对上游部门产生了积极影响。

- 另一方面,可再生能源在能源领域的普及不断提高,对天然气消耗造成了激烈的竞争,并阻碍了许多应用中气体压缩机部署的成长。

- 儘管如此,天然气探明蕴藏量的增加,特别是近来海上天然气田的探明储量的增加,正在为气体压缩机市场创造巨大的机会。俄罗斯集团最近在墨西哥海岸发现的卢克石油公司油气天然气田就是一个类似的例子。在未来的新生产领域,收集线气体压缩机的引进将更加普遍。

石油和天然气行业气体压缩机的市场趋势

中游产业可望主导市场

- 中游石油和天然气产业使用的气体压缩机部署在天然气输送管网或压缩气体储存单元。管道中流动的气体会经历压力降,随着流速和管道长度的增加而增加。因此,每行驶 50 至 100 英里,就需要一个压缩机站重新压缩气体并补偿压力损失。

- 过去10年天然气消费量呈现持续成长趋势,2022年消费量量约39,413亿立方公尺。随着许多国家政府推广清洁能源产出方法,预计未来几年需求将会增加。未来几年,许多中游公司的已完工计划清单中将增加大量管道和液化天然气计划。

- 例如,阿德尔菲亚网关计画获得美国联邦能源管理委员会(FERC)核准建造计划的第二期。该计划包括将现有 84 英里长的石油管线改造成天然气输送管道,发行到费城地区。开发商 Adelphia Gateway LLC 预计能够在年终前从管线输送第一批天然气。

- 此外,2023 年 2 月,印度国营碳氢化合物巨头石油和天然气公司启动了一项大型管道更换计划,该项目对该公司西海岸主要油田的生产至关重要。该计划耗资4.46亿美元,将确保ONGC油井覆盖西海岸4万平方公里的油气稳定供应。由于压缩机通过增加天然气压力并将其从生产现场运输出来,在石油和天然气行业中发挥着至关重要的作用,因此此类计划反过来将促进压缩机在整个行业中的使用。我会做它。

- 这种发展将不可避免地对预测期内的石油和天然气工业气体压缩机市场产生积极影响。

预计亚太地区将主导市场成长

- 由于运输和工业部门消费量的增加,亚太地区可能在不久的将来占到天然气需求增加的一半。为了满足发电业和其他应用对天然气的需求,该地区的管道网路不断扩大,主要是在印度和中国等国家。

- 2022年中国液化天然气和天然气管道进口量将达到创纪录水平,过去十年液化天然气进口量增加超过16.6%,而每月管道天然气进口量将达到接近400万吨的峰值水平。进口激增可能会导致国内管道基础设施的扩建。此外,预计到 2023 年印度将开通 34,384 公里的新管道。

- 2023年3月,阿美公司与合资伙伴盘锦新城工业集团和北方工业集团宣布计画在中国东北地区开始建造大型炼油石化联合体。该综合设施将整合一座日产30万桶的炼油厂和一座年产165万吨乙烯和200万吨对二甲苯的石化厂。计划获得行政核准后,预计将于 2023 年第二季开工。计划于 2026 年全面运作。

- 此外,CNG加气站网路的快速成长带动了亚太地区气体压缩机市场的发展。例如,2023年4月,印度政府宣布,决定2030年在全国建立约17,700个CNG加气站的目标。

- 由于这些发展,预计在研究期间,亚太地区的气体压缩机市场将最为繁荣。

石油和天然气产业的气体压缩机产业概述

石油和天然气行业的气体压缩机市场是半整合的。主要企业包括(排名不分先后)Atlas Copco AB、Ariel Corporation、Bauer Compressor Inc.、Clean Energy Fuels Corp. 和 Ingersoll Rand PLC。

阿特拉斯·科普柯公司采取了多项策略,包括专注于研发、扩大市场覆盖范围、提高业务效率以及开发新的永续产品和解决方案,以提供更好的价值和更高的能源效率。我做到了。例如,该公司于2023年2月推出了下一代GA和GA+定速智慧工业空气压缩机。这些创新将使公司能够透过多样化的产品系列来更好地满足工业客户不断变化的需求。这些新型压缩机也可用于天然气加工和氢气生产等清洁能源应用。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 调查先决条件

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2028 年之前的市场规模与需求预测(美元)

- 最新趋势和发展

- 政府政策法规

- 市场动态

- 促进因素

- 各种应用的天然气消费量增加

- 抑制因素

- 可再生能源在能源领域的普及

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 类型

- 往返

- 拧紧

- 目的

- 上游

- 下游

- 中产阶级

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 西班牙

- 英国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 马来西亚

- 印尼

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 奈及利亚

- 南非

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 併购、合资、合作与协议

- 主要企业采取的策略

- 公司简介

- Ariel Corporation

- Atlas Corporation AB

- Bauer Compressors Inc.

- Burckhardt Compression Holding AG

- Clean Energy Fuels Corp.

- General Electric Company

- HMS Group

- Howden Group Ltd

- Ingersoll Rand PLC

- Siemens AG

第七章市场机会与未来趋势

- 天然气探明蕴藏量增加,特别是海上天然气田

The Oil And Gas Industry Gas Compressor Market size is estimated at USD 1.86 billion in 2024, and is expected to reach USD 2.17 billion by 2029, growing at a CAGR of 3.13% during the forecast period (2024-2029).

Key Highlights

- Over the long term, the market is largely driven by the growth in natural gas consumption for various applications, which has led to more gas production and transmission projects and reasonable natural gas prices in the current scenario, which has a positive impact on the upstream sector.

- On the other hand, the growing penetration of renewables in the energy sector offers stiff competition to natural gas consumption and thus impedes the growth of gas compressor deployment in numerous applications.

- Nevertheless, the increase in natural gas proved reserves, particularly offshore gas fields in the recent picture, places a tremendous opportunity for the gas compressor market. The very recent Russian group's Lukoil's oil and gas field discovery off the coast of Mexico is an example of the same. The new upcoming producing fields will lead to a greater deployment of gas compressors for gathering lines.

Oil and Gas Compressor Market Trends

Midstream Sector Expected to Dominate the Market

- The gas compressors used in the midstream oil and gas industry are deployed either within the gas transmission pipeline network or at the compressed gas storage units. Gas flowing in pipelines suffers from pressure losses that increase with flow velocity and the length of the pipe. Therefore, every 50 to 100 miles, a compressor station is necessary to recompress the gas and compensate for the pressure losses.

- Natural gas consumption continuously showed an advancing trend over the last 10 years, with around 3941.3 billion cubic meters of consumption in 2022. The demand is expected to grow in the coming years due to the government's push for cleaner methods of energy generation in many countries. A number of pipeline and LNG projects are about to be added to the list of accomplished projects of many midstream companies in the coming years.

- For instance, the Adelphia Gateway Project received approval for the construction of the second phase of the project from the Federal Energy Regulatory Commission (FERC), United States. The project includes the conversion of an existing 84-mile oil pipeline to a gas supply pipeline for distribution in the Philadelphia region. The developer, Adelphia Gateway LLC, is expected to be able to supply the first gas from the pipeline by the end of 2023.

- Furthermore, in February 2023, Oil and Natural Gas Corporation, India's state-owned hydrocarbon giant, initiated a big-buck pipeline replacement project, a crucial project for the company's production from key west coast fields. The USD 446 million project will ensure a stable supply of oil and gas from ONGC wells covering an area of 40,000 square kilometers along the western coast. Since compressors play a crucial role in the oil and gas industry in increasing the pressure of natural gas and allowing natural gas transportation from the production site, this kind of project will, in turn, promote the usage of compressors across the industry.

- Such developments will inevitably have a positive impact on the gas compressor market in the oil and gas industry during the forecast period.

Asia-Pacific Expected to Dominate Market Growth

- Asia-Pacific can account for half of the incremental gas demand in the near future due to increased consumption in the transport and industrial sectors. To serve the natural gas demand for the power generation industry and other applications, the region has witnessed an expansion in the pipeline network, mainly in countries like India and China.

- China's LNG and pipeline imports of natural gas reached record levels in 2022, with an increment of more than 16.6% in LNG imports during the last decade, whereas the gas pipeline monthly imports approached a peak level of 4 million metric tons. The surge in imports will lead to an expansion of the supporting pipeline infrastructure in the country. Moreover, India is expected to bring 34,384 km of new pipelines online by 2023.

- In March 2023, Aramco and joint venture partners Panjin Xincheng Industrial Group and NORINCO Group announced plans to start the construction of a significant integrated refinery and petrochemical complex in northeast China. The complex is going to have combination of a 300,000 barrels per day refinery and a petrochemical plant with an annual production capacity of 1.65 million tons of ethylene and 2 million metric tons of paraxylene. Construction is expected to start in the second quarter of 2023 after the project has secured administrative approvals. It is expected to be fully operational by 2026.

- Also, the rapidly growing network of CNG fueling stations has led to the development of the gas compressor market in the Asia-Pacific region. For example, in April 2023, the government of India announced the target has been fixed to establish around 17,700 CNG stations across the country by 2030.

- Owing to such developments, the gas compressor market is expected to flourish to the greatest extent in the Asia-Pacific region during the study period.

Oil and Gas Compressor Industry Overview

The oil and gas industry's gas compressor market is semi-consolidated. Some of the major companies (in no particular order) include Atlas Copco AB, Ariel Corporation, Bauer Compressor Inc., Clean Energy Fuels Corp., and Ingersoll Rand PLC, among others.

Atlas Copco AB has adopted many strategies like focus on research and development, increase market coverage, increase operational efficiency, develop new sustainable products and solutions offering better value and improved energy efficiency. As an example, in February 2023, the company launched its next generation GA and GA+fixed speed smart industrial air compressors,. Such technological innovations would enable the company to better respond to the changing needs of the industrial customers with diversified product portfolio. These new type of compressors can also be used for clean energy applications like natural gas processing, and hydrogen production.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growth in Natural Gas Consumption for Various Applications

- 4.5.2 Restraints

- 4.5.2.1 Growing Penetration of Renewables in the Energy Sector

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Reciprocating

- 5.1.2 Screw

- 5.2 Application

- 5.2.1 Upstream

- 5.2.2 Downstream

- 5.2.3 Midstream

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 Spain

- 5.3.2.4 United Kingdom

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Malaysia

- 5.3.3.4 Indonesia

- 5.3.3.5 Rest of Asia-Pacifc

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirated

- 5.3.5.3 Nigeria

- 5.3.5.4 South Africa

- 5.3.5.5 Rest of Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Ariel Corporation

- 6.3.2 Atlas Corporation AB

- 6.3.3 Bauer Compressors Inc.

- 6.3.4 Burckhardt Compression Holding AG

- 6.3.5 Clean Energy Fuels Corp.

- 6.3.6 General Electric Company

- 6.3.7 HMS Group

- 6.3.8 Howden Group Ltd

- 6.3.9 Ingersoll Rand PLC

- 6.3.10 Siemens AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increase in Natural Gas Proved Reserves, Particularly Offshore Gas Fields