|

市场调查报告书

商品编码

1441671

香草醛:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Vanillin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

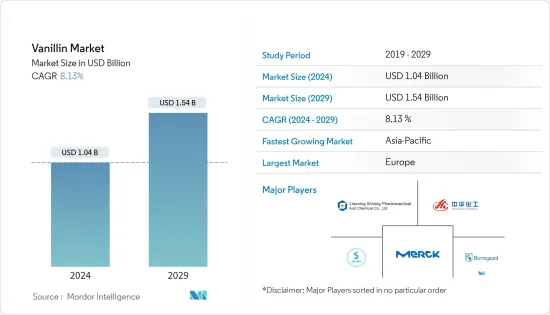

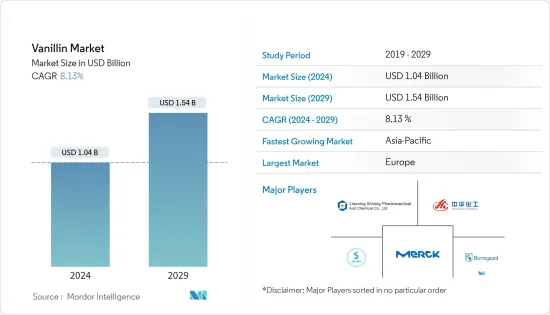

2024年香草醛市场规模预计为10.4亿美元,预计到2029年将达到15.4亿美元,在预测期内(2024-2029年)复合年增长率为8.13%。

香草醛因其在各行业的广泛应用,在食品工业的渗透率很高,尤其是在已开发国家。在製药和个人护理领域,香草醛在牙膏、清洗产品和药品中用作香气遮罩剂和调味剂。芳香疗法的日益普及,以及对室内和汽车空气清新剂的需求激增,预计将推动化妆品和洗护用品应用中香草醛的需求。香草醛的广泛用途、可用性和实惠的价格正在推动其广泛普及并加速全球市场的成长。

香草醛市场趋势

香草醛在最终用途行业中的多种功能

香草醛是少数广泛用于食品和饮料、药品、个人护理以及动物和家禽饲料等行业的成分之一。因此,香草醛在世界各地的需求量很大。生产商在饮料中使用香草醛,以减少其产品中砂糖和其他人造甜味剂的使用。由于香草醛具有赋予风味和甜味的能力,添加香草醛的酒精和非酒精饮料越来越受到消费者的欢迎。根据宾州州立大学的研究,在牛奶饮料中添加香草可以减少 20% 至 50% 的砂糖用量。

另外,香草醛作为调味剂,因其香甜的香气,已成为冰淇淋和巧克力行业的主流。香草醛也用于香料和金属电镀等多种行业。其他用途包括润滑剂中的消泡剂、杀虫剂的诱引剂和核黄素的增溶剂。香草醛对富含多不饱和脂肪酸(PUFA) 的食品具有温和的抗氧化作用,为食品领域的独特应用开闢了新的机会,例如作为水果奶油和澄清黄油中的防腐剂。除了用作发炎剂外,香草醛还可用于製造治疗痛风、过敏和关节炎的药物。

由于其抗细胞致病和抗突变特性,香草醛也被用作包装行业的抗菌薄膜。因此,该公司正在马达加斯加进行种植工作,以增加香草的产量,这些香草主要来自最纯净的来源,马达加斯加以其风味和香气而闻名。 2021年10月,苹果香精香料集团为苹果集团全资子公司上海申春食品建立食品原料研发及製造地。

欧洲拥有出色的市场份额

由于新兴国家的需求不断增长,欧洲成为香草醛市场的关键地区之一。欧洲市场香草醛的主要最终用户是食品加工、化妆品和製药/製药业。由于有机产品市场的不断增长,英国对天然香草的需求正在增加。根据《全球有机贸易指南》,2021年英国有机商品市场规模将达21亿美元,约占全球有机商品需求的3.6%,人均价格为31.83美元。

香草醛是一种常见的香味成分,用于各种香水产品和其他个人保健产品。欧莱雅、宝洁等品牌在化妆品中使用香草醛作为香精,显示香草醛市场有潜力与化妆品产业一起成长。德国、法国和义大利最重要的化妆品产业正在增加该地区对香草醛的需求。据Cosmetic Europe资料显示,2021年德国化妆品市场规模为136亿欧元。这一巨大数字显示化妆品产业的成长,进而显示香草醛市场的成长。

香兰素产业概况

全球香草醛市场高度一体化,主要企业控制着香草醛市场的主要份额。全球主要公司拥有广泛的地理足迹和强大的品牌认知度,这给了他们竞争优势。

主要生产商正致力于提高产能以满足香草醛的需求。公司正在实现产品多元化并扩大业务,以获得竞争优势。例如,2022年5月,索尔维推出了新的可再生材料和生物技术平台,利用可再生原料和生物技术为各个市场永续解决方案。该公司是瓜尔胶、生物来源溶剂和天然香草醛等生物基产品的知名公司,后者透过生物技术实现。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争公司之间敌对的强度

第五章市场区隔

- 类型

- 天然香草醛

- 合成香草醛

- 目的

- 食品与饮品

- 药品

- 香味

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 澳洲

- 日本

- 其他亚太地区

- 其他地区

- 北美洲

第六章 竞争形势

- 最采用的策略

- 市场定位分析

- 公司简介

- Solvay SA

- Merck KGaA

- Evolva Holding SA

- Camlin Fine Sciences Ltd

- Borregaard AS

- Liaoning Shixing Pharmaceutical &Chemical CO. Ltd

- Jiaxing Zhonghua Chemical Co. Ltd

- FoodChem International Corporation

- Apple Flavor &Fragrance Group Co. Ltd

- Prinova Group LLC

第七章市场机会与未来趋势

The Vanillin Market size is estimated at USD 1.04 billion in 2024, and is expected to reach USD 1.54 billion by 2029, growing at a CAGR of 8.13% during the forecast period (2024-2029).

The penetration of vanillin in the food industry is high, especially in developed countries, owing to its wide application across different industries. In pharmaceuticals and personal care, vanillin is used as an aromatic masking and flavoring agent in toothpaste, cleaning products, and medicines. The surging demand for room and car fresheners, along with the growing popularity of aromatherapy, is projected to drive the demand for vanillin in the cosmetics and toiletries application segment. The wide application and easy accessibility and affordability of vanillin have resulted in its increased penetration across the world, which, in turn, is accelerating the growth of the market.

Vanillin Market Trends

Diverse Functionality of Vanillin in End-use Industries

Vanillin is one of the few ingredients employed in a wide range of industries, including food and beverage, pharmaceutical, personal care, and animal and poultry feed. Thus, vanillin is experiencing high demand globally. Vanillin is used in beverages by producers to cut back on the use of sugar and other artificial sweeteners in their products. Owing to vanillin's taste and ability to impart sweetness, both alcoholic and non-alcoholic beverages infused with vanillin are becoming more popular among consumers. According to Penn State's research in Pennsylvania, adding vanilla to milk-based beverages can cut the amount of sugar used by 20-50%.

In addition, vanillin as a flavoring also dominates the ice cream and chocolate industry because of its sugary sweet aroma. Vanillin has also been used in various industries, including perfume and metal plating. Other miscellaneous uses are as an anti-foaming agent in lubricants, an attractant in insecticides, and a solubilizing agent for riboflavin. Vanillin has a mild antioxidant potential for foods high in polyunsaturated fatty acids (PUFA), thereby creating new opportunities for its unique usage in the food sector as a preservative in fruit creams and clarified butter, among other uses. In addition to acting as an anti-inflammatory, vanillin can be used to create medications to treat gout, allergies, and arthritis.

Vanillin is also being utilized in the packaging industry as an antimicrobial film because of its anticlastogenic and antimutagenic properties. Therefore, companies are establishing cultivation initiatives in Madagascar, where vanillin is known for its flavor and aroma, primarily to increase the production of vanillin from the purest sources. In October 2021, Apple Flavor & Fragrance Group Co. Ltd established a food ingredient R&D and manufacturing base of Shanghai Shenshun Food Co. Ltd, a wholly-owned subsidiary of the Apple Group.

Europe Holds a Prominent Share in the Market

Europe is one of the leading regions in the vanillin market due to the rising demand from emerging economies. The food processing, cosmetics, and pharmaceutical/medicinal industries are the primary end users of vanillin in the European market. The growing demand for natural vanillin in the United Kingdom is due to the growing market for organic products. According to the Global Organic Trade Guide, the market for organic goods in the United Kingdom reached USD 2.1 billion in 2021, accounting for roughly 3.6% of the world's demand for such goods, with an average price of USD 31.83 per person.

Vanillin is a common scent component used in various aromatic goods and other personal care products. The usage of vanillin as a fragrance in cosmetics by brands like Loreal and P&G indicates that the vanillin market may grow along with the cosmetic industry. The most significant cosmetic industries in Germany, France, and Italy are augmenting the demand for vanillin in the region. As per the data from Cosmetic Europe, the market for cosmetic products in Germany in 2021 was EUR 13.6 Billion. This large number indicates the growth of the cosmetic industry and hence, the growth of the vanillin market.

Vanillin Industry Overview

The global vanillin market is highly consolidated, with the top players controlling the major shares in the vanillin market. The major global players have a wide geographical reach and brand awareness, which gives them a competitive edge. Some key players in the global vanillin market include Jiaxing Zhonghua Chemical Co. Ltd, Solvay SA, Liaoning Shixing Pharmaceutical & Chemical Co. Ltd, Borregaard AS, and Merck KGaA.

The major manufacturers are focusing on increasing their production capacities to meet the demand for vanillin. Companies are diversifying their products and expanding their operations to gain a competitive advantage. For instance, in May 2022, Solvay introduced a new renewable material and biotechnology platform to innovate sustainable solutions for various markets, using renewable feedstocks and biotechnology. The company is a well-known player in some bio-based products, including guar, bio-sourced solvents, and natural vanillin, the latter enabled by biotechnology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Subsitute Products and Services

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Natural Vanillin

- 5.1.2 Synthetic Vanillin

- 5.2 Application

- 5.2.1 Food and Beverage

- 5.2.2 Pharmaceuticals

- 5.2.3 Fragrances

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 Italy

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Japan

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Positioning Analysis

- 6.3 Company Profiles

- 6.3.1 Solvay SA

- 6.3.2 Merck KGaA

- 6.3.3 Evolva Holding SA

- 6.3.4 Camlin Fine Sciences Ltd

- 6.3.5 Borregaard AS

- 6.3.6 Liaoning Shixing Pharmaceutical & Chemical CO. Ltd

- 6.3.7 Jiaxing Zhonghua Chemical Co. Ltd

- 6.3.8 FoodChem International Corporation

- 6.3.9 Apple Flavor & Fragrance Group Co. Ltd

- 6.3.10 Prinova Group LLC