|

市场调查报告书

商品编码

1441688

碳酸钙:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Calcium Carbonate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

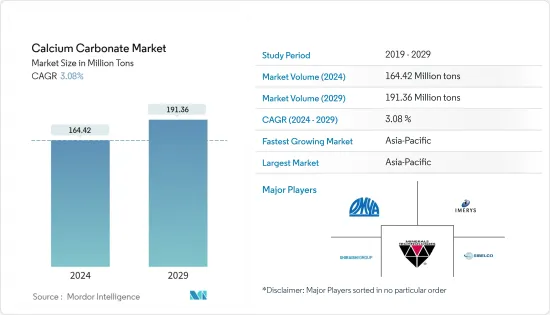

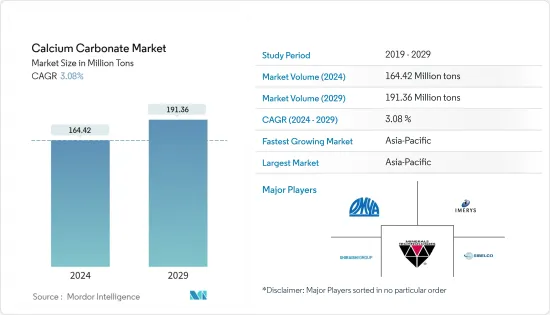

预计2024年碳酸钙市场规模为1,6,442万吨,预估至2029年将达到19,136万吨,预测期间(2024-2029年)复合年增长率为3.08%。

冠状病毒感染疾病(COVID-19) 的爆发以及由此产生的封锁和社会疏远规范导致汽车、建筑和其他製造业等多个行业完全关闭。然而,目前估计市场已达到疫情前的水准。

主要亮点

- 从中期来看,推动全球碳酸钙市场的主要因素是亚太地区建设活动的成长以及造纸工业中碳酸钙取代高岭土。

- 与碳酸钙相关的健康危害预计将阻碍预测期内的市场成长。

- 绿色应用的重要性日益增加,预计将为所研究的市场提供新的机会。

- 亚太地区包括中国、印度、日本等主要消费国,主导全球市场。

碳酸钙市场趋势

造纸业主导市场

- 碳酸钙是造纸工业应用中考虑的基本成分之一,因为它用于填料和涂料目的。 CaCO3 具有不透明度、亮度和平滑度等优异特性,使其成为生产书写、印刷和包装用纸的理想成分。

- 这是一种矿物填料,可显着降低造纸成本。矿物质比纤维更容易干燥,这也降低了基础材料的成本。碳酸钙也用于纸张涂料,赋予印刷纸表面光泽和平滑度。

- 在目前的情况下,CaCO3 比其他纸张填充材占主导地位。偏好碳酸钙的主要原因是对光泽度更高、体积更大的纸张的需求。在碱性造纸製程中使用CaCO3具有很大的优势。

- 在造纸工业中,碳酸钙用作高岭土的替代品。合成沉淀碳酸钙比高岭土更亮、更白,因此许多製造商将其用于纸张填充和涂层用途。实现更好的不透明度、光泽度、高亮度和表面光洁度,以提高适印性。

- 碳酸钙不仅用作高岭土的替代品,而且还用于木浆和作为添加剂。在碱性造纸过程中,碳酸钙在造纸厂中用作填充材。碳酸钙占造纸用填料和颜料总合的32%。

- 目前,亚太地区引领着造纸业碳酸钙的市场需求,其中中国是最大的消费国。纸包装和纸巾产品的需求不断增长预计将推动亚太地区的市场。根据印度造纸製造商协会(IPMA)统计,印度造纸工业约占世界纸张产量的4%。该产业预计营业额为7,000 亿印度卢比(约847,456 万美元)(国内市场规模为8,000 亿印度卢比(约968,521 万美元)),财政贡献约为500 亿印度卢比(约968,521 万美元)。美元)。

- 该地区经济的快速成长和食品消费的增加推动了对包装材料的需求。对纸巾的需求是由人口增长和卫生标准提高所推动的。

- 所有上述因素预计将在预测期内增加碳酸钙的需求。

亚太地区预计将主导全球市场

- 由于该地区建设活动的增加,预计亚太地区将引领碳酸钙市场。

- 随着该地区建筑业的成长,碳酸钙的需求预计将受到经济活动增加和新投资机会的推动,特别是在中国、印度和印尼等新兴国家。

- 中国是全球最大的纸浆和纸张生产国,森林资源丰富,覆盖国土面积的22.5%。工业现代化、机械化程度高、劳动廉价。在中国,由于政府的植树造林计划,森林面积正在增加。

- 中国是世界上最大的塑胶、黏剂和密封剂、橡胶、油漆和涂料的生产国和消费国。大多数塑胶、黏剂和密封剂、油漆和涂料被汽车和建筑行业消耗。汽车工业是橡胶的主要消费产业。

- 印度政府的「2022 年全民住宅」计画也改变了该产业的游戏规则。此外,联邦内阁核准设立35.8亿美元的替代投资基金(AIF),以重振全国主要城市约1,600个停滞的住宅计划。

- 据印度造纸製造商协会(IPMA)称,儘管印度的纸浆和纸张市场每年以6-7%左右的速度增长,但该行业的产量在过去三年中却出现了下降。这与消费稳定成长形成鲜明对比。

- 总体而言,由于该地区各个最终用户行业的需求不断增加,预计亚太地区碳酸钙市场将主导全球市场。

碳酸钙产业概况

碳酸钙市场本质上是部分整合的。市场主要企业包括 Omya AG、Mineral Technologies Inc.、Imerys、Shiraishi Group、Sibelco 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 扩大亚太地区的建设活动

- 快速成长的包装和造纸工业

- 在造纸工业中以碳酸钙取代高岭土

- 抑制因素

- 与碳酸钙相关的健康危害

- 其他限制

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔(市场规模(数量))

- 类型

- 研磨碳酸钙 (GCC)

- 沉淀碳酸钙(PCC)

- 目的

- 建筑材料原料

- 饮食补充剂

- 热塑性塑胶添加剂

- 填料和颜料

- 黏剂成分

- 瓦斯脱硫

- 土壤中和剂

- 其他用途

- 最终用户产业

- 纸

- 塑胶

- 黏剂和密封剂

- 建造

- 油漆和涂料

- 药品

- 车

- 农业

- 橡皮

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 澳洲和纽西兰

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业采取的策略

- 公司简介

- Chemical &Mineral Industries Pvt. Ltd

- FUJIAN SANMU NANO CALCIUM CARBONATE CO. LTD

- GLC Minerals

- Gulshan Polyols Ltd

- Huber Engineered Materials

- Imerys

- Kemipex

- Lhoist

- Maruo Calcium Co. Ltd

- Minerals Technologies Inc.

- Mississippi Lime Company

- Newpark Resources Inc.

- OKUTAMA KOGYO CO. LTD

- Omya AG

- Provale Holding SA

- SCHAEFER KALK GmbH &Co. KG.

- Shiraishi Kogyo Kaisha Ltd

- Sibelco

第七章市场机会与未来趋势

- 塑胶和橡胶产业对奈米碳酸钙的需求不断增长

- 绿色应用的新重要性

The Calcium Carbonate Market size is estimated at 164.42 Million tons in 2024, and is expected to reach 191.36 Million tons by 2029, growing at a CAGR of 3.08% during the forecast period (2024-2029).

The outbreak of COVID-19 and resultant lockdowns and social distancing norms led to the complete shutdown of various industries in the automotive, construction, and other manufacturing segments. However, the market is currently estimated to have reached pre-pandemic levels.

Key Highlights

- Over the medium term, major factors driving the global calcium carbonate market are growing construction activities in the Asia-Pacific region and the replacement of kaolin with calcium carbonate in the paper industry.

- Health hazards associated with calcium carbonate are expected to hinder the market's growth during the forecast period.

- The emerging importance of green applications is expected to provide new opportunities for the market studied.

- The Asia-Pacific region, which includes the major consumption countries, such as China, India, and Japan, dominates the global market.

Calcium Carbonate Market Trends

Paper Sector to Dominate the Market

- Calcium carbonate is one of the essential ingredients considered for applications in the paper industry, as it is employed as fillers and for coating purposes. The working qualities of CaCO3, like opacity, brightness, and smoothness, make it an ideal component for the manufacturing of writing, printing, and packaging-grade paper.

- It is a mineral filler, which substantially reduces the production cost of paper. As the minerals are easier to be dried than fibers, it also reduces the cost of basic materials. Calcium carbonate is also used in paper coating, as it brings out the brightness and smoothness on the surface of printing paper.

- In the present scenario, CaCO3 is dominant over other papermaking filler materials. The main reason behind the preference for calcium carbonate is the demand for brighter and bulkier paper. There are significant advantages to the use of CaCO3 in the alkaline papermaking process.

- In the paper industry, calcium carbonate is used as a replacement for kaolin. Since the synthesized precipitated calcium carbonate is brighter and whiter than kaolin, many manufacturers have been using it for paper filling and coating purposes. It offers better opacity, gloss, high brightness, surface finishing, and improves printability.

- Calcium carbonate is not only used as a substitute for kaolin but also for wood pulp and additives. In the alkaline papermaking process, calcium carbonate is used in a paper mill as a filler material. Calcium carbonate amounts for 32% of the total share of filler and pigments used in paper production.

- Currently, the Asia-Pacific leads the market demand for calcium carbonate in the paper industry, with China being the leading consumer. Increasing demand for paper packaging and tissue products is expected to drive the market in the Asia-Pacific region. According to the Indian Paper Manufacturers Association (IPMA), the Indian paper industry accounts for about 4% of the world's production of paper. The estimated turnover of the industry is INR 70,000 crore (~USD 8,474.56 million) (domestic market size of INR 80,000 crores (~USD 9,685.21 million)), and its contribution to the exchequer is around INR 5,000 crore (~USD 605.33 million).

- The packaging demand is driven by rapid economic upticks and growing food consumption in the region. The tissue demand is driven by population growth and improving hygiene standards.

- All the aforementioned factors are expected to boost the demand for calcium carbonate during the forecast period.

Asia-Pacific Expected to Dominate the Global Market

- The Asia-Pacific region is projected to lead the market for calcium carbonate owing to increasing construction activities in the region.

- Along with the growing construction industry in the region, the demand for calcium carbonate is expected to be driven by increasing economic activities and new investment opportunities in emerging economies, such as China, India, and Indonesia, among others.

- China is the largest pulp and paper producing country in the world, owing to large forest reserves, which amount to 22.5% of the land area. The industry is modern and highly mechanized, and labor is cheap. Forest cover is increasing in China owing to the government's afforestation initiatives.

- China is globally the largest manufacturer and consumer of plastics, adhesives and sealants, rubber, and paints and coatings. The majority of plastics, adhesives and sealants, and paints and coatings are consumed by the automotive and construction industries. The automotive industry is the major consumer of rubber.

- The Indian government's 'Housing for All by 2022' scheme is also a major game-changer for the industry. Additionally, the Union Cabinet has approved the setting up of a USD 3.58 billion alternative investment fund (AIF) in order to revive around 1,600 stalled housing projects across the top cities in the country.

- According to the Indian Paper Manufacturers Association (IPMA), even though India's pulp and paper market has been growing around 6-7% per annum, the industry witnessed a drop in production over the past three years. This contrasts with the consumption, which is exhibiting a steady rise.

- Overall, with the demand increasing from various end-user industries in the region, the Asia-Pacific market for calcium carbonate is projected to dominate the global market.

Calcium Carbonate Industry Overview

The calcium carbonate market is partially consolidated in nature. Some of the major players in the market include Omya AG, Mineral Technologies Inc., Imerys, Shiraishi Group, and Sibelco, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Construction Activities in the Asia-Pacific Region

- 4.1.2 Rapidly Increasing Packaging and Paper Industry

- 4.1.3 Replacement of Kaolin with Calcium Carbonate in Paper Industry

- 4.2 Restraints

- 4.2.1 Health Hazards Associated with Calcium Carbonate

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Ground Calcium Carbonate (GCC)

- 5.1.2 Precipitated Calcium Carbonate (PCC)

- 5.2 Application

- 5.2.1 Raw Substance for Construction Material

- 5.2.2 Dietary Supplement

- 5.2.3 Additive for Thermoplastics

- 5.2.4 Filler and Pigment

- 5.2.5 Component of Adhesives

- 5.2.6 Desulfurization of Fuel Gas

- 5.2.7 Neutralizing Agent in Soil

- 5.2.8 Other Applications

- 5.3 End-user Industry

- 5.3.1 Paper

- 5.3.2 Plastic

- 5.3.3 Adhesives and Sealants

- 5.3.4 Construction

- 5.3.5 Paints and Coatings

- 5.3.6 Pharmaceutical

- 5.3.7 Automotive

- 5.3.8 Agriculture

- 5.3.9 Rubber

- 5.3.10 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Australia and New Zealand

- 5.4.1.7 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chemical & Mineral Industries Pvt. Ltd

- 6.4.2 FUJIAN SANMU NANO CALCIUM CARBONATE CO. LTD

- 6.4.3 GLC Minerals

- 6.4.4 Gulshan Polyols Ltd

- 6.4.5 Huber Engineered Materials

- 6.4.6 Imerys

- 6.4.7 Kemipex

- 6.4.8 Lhoist

- 6.4.9 Maruo Calcium Co. Ltd

- 6.4.10 Minerals Technologies Inc.

- 6.4.11 Mississippi Lime Company

- 6.4.12 Newpark Resources Inc.

- 6.4.13 OKUTAMA KOGYO CO. LTD

- 6.4.14 Omya AG

- 6.4.15 Provale Holding SA

- 6.4.16 SCHAEFER KALK GmbH & Co. KG.

- 6.4.17 Shiraishi Kogyo Kaisha Ltd

- 6.4.18 Sibelco

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand from the Plastic and Rubber Industry for Nano-calcium Carbonate

- 7.2 Emerging Importance of Green Applications