|

市场调查报告书

商品编码

1851274

绿色建筑材料:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Green Building Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

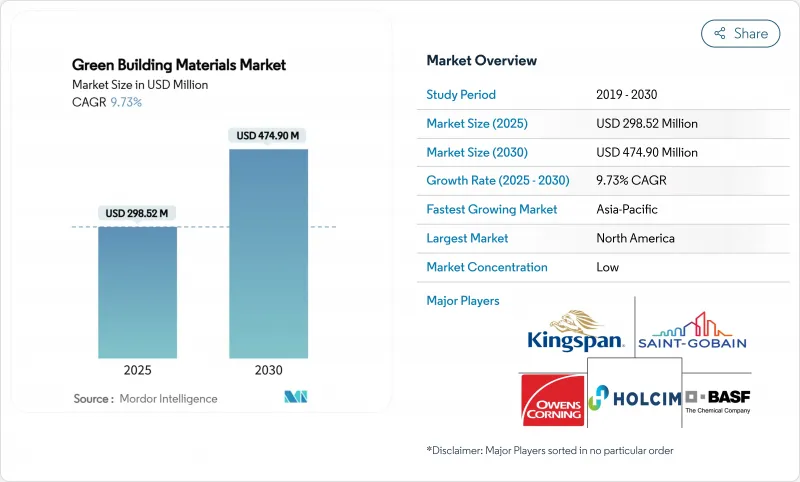

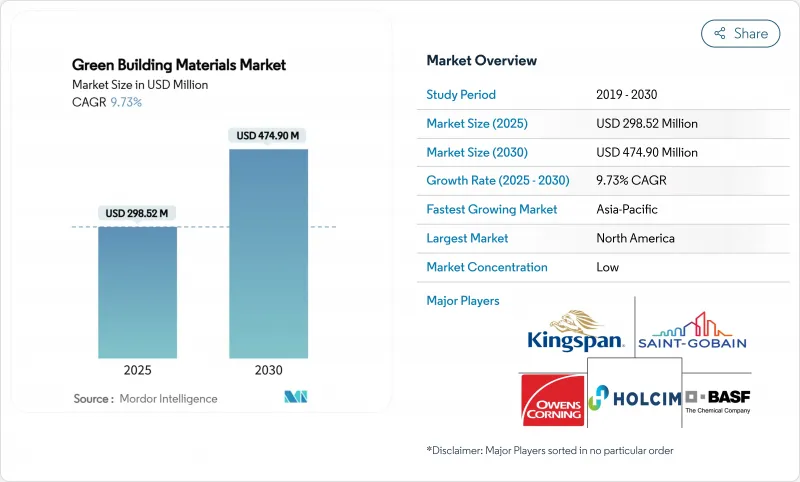

预计到 2025 年,绿色建筑材料市场规模将达到 2.9852 亿美元,预计到 2030 年将达到 4.749 亿美元,在预测期(2025-2030 年)内复合年增长率为 9.73%。

这一前景反映了政府对零排放建筑的持续政策压力、企业净零排放承诺的不断增加以及低碳材料技术的快速发展。欧盟、美国和其他主要经济体之间的监管协调正在弥合历史遗留的分歧,使全球製造商能够获得规模效益并加速产品创新。财政奖励进一步支撑了市场需求,缩小了绿色建材与传统产品之间的价格差距,而数位化材料追踪工具也开始实现报废产品价值链的货币化。这些因素共同推动绿色建材市场进入前所未有的快速普及週期。

全球绿建筑材料市场趋势与洞察

强制性且更严格的能源效率标准

世界各地的建筑规范正从自愿性指南转向具有约束力的性能标准。在欧洲,修订后的《建筑能源性能指令》要求所有新建建筑到2030年实现现场石化燃料零排放,现有住宅也必须在同年之前升级至至少E级能源效率。美国也紧追在后,推出了2024年版《国际节能规范》。更严格的标准将推动对高性能隔热材料、低碳混凝土和先进建筑幕墙的需求,并奖励那些能够透过数位化合规平台检验其产品永续性的供应商。加强执法力度将进一步提高传统材料的合规成本,从而为经过认证的替代材料创造持久的竞争优势。

政府奖励和认证计划

税额扣抵、绿色债券和优惠融资正在改变计划的经济格局。美国《第45L条通货膨胀削减法案》为符合条件的住宅单元提供高达5000美元的补贴,而179D条款的扣除额现在也涵盖了规模较大的商业维修。加拿大已累计100亿美元用于清洁能源基础建设,并将资金导向认证材料。 LEED、WELL和能源之星等认证项目现在与折扣融资挂钩,使开发商能够抵消先进产品15%至25%的溢价。这些奖励加速了成本敏感产业的采用,并为维持最新认证组合的製造商创造了可靠的收入来源。

认证材料的初始成本较高

经认证的产品通常价格高出15%至25%,这是因为需要进行测试、特殊加工和小批量生产。这种溢价在住宅建筑领域尤其明显,因为购屋者往往更关注初始成本而忽略了全生命週期的成本节约。负碳混凝土和生物基隔热材料等新产品也需要投入研发成本。虽然随着产量增加和碳定价缩小成本差距,这些成本会逐渐降低,但较高的领先成本仍然是阻碍产品快速普及的一大障碍,尤其是在缺乏强有力的奖励机制的发展中地区。

细分市场分析

到2024年,低碳混凝土和水泥将占绿色建材市场份额的24.45%,凸显了该产业迫切需要减少传统水泥造成的全球8%的温室气体排放。一些突破性技术,例如矿物碳化製程(可在保持强度的同时封存45%的二氧化碳),正从试点阶段走向有限的商业化规模。海德堡材料公司的伦格福特计划每年可捕获7万吨二氧化碳,展现了该技术广泛应用的潜力。复合板正被开发人员广泛采用,其优势在于组装速度更快、地基更轻以及可现场碳储存。由于新型不燃产品系列的推出,矿棉隔热材料仍是主流选择;而纤维素和生物泡沫隔热材料则以10.59%的复合年增长率增长,这主要得益于可再生原材料和优异的隔热性能。由于生命週期评估引发了人们对微塑胶脱落问题的担忧,再生塑胶复合材料的成长更为谨慎,但木塑板材仍在户外露臺和建筑幕墙领域占有一席之地。

不同材料的成长前景各不相同。低碳黏合剂受益于碳捕获津贴,随着碳定价的扩大,其成长速度可能会加快。散装木材市场取决于认证森林产能的扩张和建筑规范高度限制的修订。纤维素的成长轨迹取决于能否确保充足的消费后废纸资源以及酵素加工厂的扩建。整体而言,材料创新将增强竞争差异化,迫使现有企业在其所有产品线中融入循环经济特性、检验的碳足迹和数位护照。

区域分析

到2024年,北美将占全球绿色建材市场规模的40.80%,这主要得益于长期以来实施的能源之星(ENERGY STAR)和LEED认证项目,以及各州推行的零能耗建筑法规。根据《通货膨胀削减法案》,联邦税额扣抵正在加强全国范围内的协调一致,而加州2025年的标准週期预计将进一步收紧建筑隐含碳排放的限制。加拿大的「绿色住宅倡议」正引导低利率贷款用于维修升级,从而刺激了对纤维素和矿物棉隔热材料的需求。

在欧洲,《建筑能源性能指令》和即将实施的碳边境调节机制透过提高高碳进口成本和奖励国内低碳生产,维持了较高的低碳基准采纳率。斯堪地那维亚国家已强制要求所有大型建筑进行全生命週期碳排放评估,从而刺激了对数位碳护照和大型木材的需求。德国和法国在公共部门采购低碳混凝土方面处于主导,而英国正在试点循环建筑中心,以回收都市区拆除产生的可再利用材料。

亚太地区预计到2030年将以11.36%的复合年增长率成长,这主要得益于快速的都市化和不断发展的绿色建筑规范。中国将要求所有新计画到2025年至少达到基础级绿建筑认证标准。印度的节能建筑规范和印尼的绿色建筑委员会评级体係正在推动绿色建筑规范的早期应用,但地方政府执法力度的分散将限制其短期内的普及。澳洲和新加坡的绿建筑规范体系已经成熟,正在全部区域输出专业知识,加强供应链在地化和区域认证标准的发展。

南美洲和中东/非洲地区虽然发展尚处于起步阶段,但随着基础设施投资的不断增长,这些地区极具吸引力。巴西的Procel Edifica认证体系和阿联酋的Estidama Pearl评级系统正鼓励材料供应商实现在地化生产,以满足特定的气候性能需求。资金筹措仍然是一大障碍,但多边银行正越来越多地向这些市场发行绿色债券,预计在下一个规划週期中,绿色环保的普及速度将加快。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 加强能源效率法规

- 政府激励措施和认证

- 企业净零排放、嵌入式碳采购

- 针对老旧建筑的改装浪潮

- 将使用价值货币化的数位材料护照

- 市场限制

- 认证原料的初始成本较高

- 跨区域认证和绩效复杂性

- 自2027年起,供不应求

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 依材料类型

- 低碳混凝土和水泥

- 回收金属

- 工程/再生木材

- 矿棉隔热材料

- 纤维素和生物泡沫隔热材料

- 再生塑胶复合材料

- 透过使用

- 框架

- 绝缘

- 屋顶

- 墙板

- 室内装修

- 其他用途

- 按最终用户行业划分

- 住宅

- 商业的

- 工业和机构用途

- 基础设施

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- BASF

- Binderholz GmbH

- Cemex SAB de CV

- Coromandel International Ltd.

- DuPont

- Heidelberg Materials

- Holcim Ltd

- Interface Inc.

- Kingspan Group

- Owens Corning

- PPG Industries Inc

- Rockwool A/S

- Saint-Gobain

- Sika AG

- SmartLam

- Steico SE

- Weyerhaeuser Company

第七章 市场机会与未来展望

The Green Building Materials Market size is estimated at USD 298.52 million in 2025, and is expected to reach USD 474.90 million by 2030, at a CAGR of 9.73% during the forecast period (2025-2030).

The outlook reflects sustained policy pressure for zero-emission construction, rising corporate net-zero commitments and rapid scaling of low-carbon material technologies. Regulatory alignment between the European Union, the United States and other major economies is eliminating historical fragmentation, enabling global manufacturers to capture scale efficiencies and accelerate product innovation. Demand is further supported by financial incentives that narrow the price gap with conventional products, while digital material-tracking tools are beginning to monetise end-of-life value streams. Together, these forces are triggering the fastest adoption cycle the green building materials market has experienced to date.

Global Green Building Materials Market Trends and Insights

Mandatory Energy-Efficiency Codes Tightening

Worldwide building codes are shifting from voluntary guidelines to binding performance standards. In Europe, the revised Energy Performance of Buildings Directive requires all new buildings to achieve zero on-site fossil-fuel emissions by 2030, and existing residential stock must upgrade to at least an E rating by the same year. The United States is following with the 2024 International Energy Conservation Code, which streamlines state adoption and adds life-cycle carbon provisions. Stricter codes boost demand for high-performance insulation, low-carbon concrete and advanced facades, rewarding suppliers that can verify product sustainability through digital compliance platforms. Enhanced enforcement further raises compliance costs for traditional materials, creating durable competitive advantages for certified alternatives.

Government Incentives and Certification Schemes

Tax credits, green bonds and preferential financing are transforming project economics. The US Inflation Reduction Act's Section 45L offers up to USD 5,000 per qualifying housing unit, and the 179D deduction now covers larger commercial upgrades. Canada has earmarked CAD 10 billion for clean-energy infrastructure, funnelling capital toward certified materials. With programs such as LEED, WELL and ENERGY STAR now linked to discounted financing, developers can offset the 15-25% price premium associated with advanced products. These incentives accelerate adoption in cost-sensitive segments and create reliable revenue streams for manufacturers that maintain up-to-date certification portfolios.

High Upfront Cost of Certified Materials

Certified products typically command 15-25% price premiums owing to testing, specialised processing and smaller production runs. The premium is most acute in residential construction, where buyers focus on first-cost and may overlook lifecycle savings. Novel products such as carbon-negative concrete or bio-based insulation also carry R&D amortisation charges. While declining as volumes rise and carbon pricing narrows cost differentials, elevated upfront expense remains a near-term adoption barrier, particularly in developing regions without robust incentive programs.

Other drivers and restraints analyzed in the detailed report include:

- Corporate Net-Zero, Embodied-Carbon Procurement

- Retrofit Wave for Ageing Building Stock

- Certification and Performance Complexity Across Regions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Low-carbon concrete and cement captured 24.45% of green building materials market share in 2024, underscoring industry urgency to abate the 8% of global greenhouse-gas emissions linked to conventional cement. Breakthrough technologies such as mineral-carbonation processes that sequester 45% CO2 while preserving strength have transitioned from pilot to limited commercial scale. Heidelberg Materials' Lengfurt project will capture 70,000 t of CO2 per year, signalling mainstream viability. Recycled metals retain reliable demand as structural steel routinely contains 93% scrap content and achieves 98% recovery rates at end-of-life. Engineered wood products, notably cross-laminated timber, are expanding as developers capitalise on faster assembly, lighter foundations and on-site carbon storage. Mineral-wool insulation remains a staple thanks to new non-combustible product lines, while cellulose and bio-foam insulation is progressing at a 10.59% CAGR, supported by renewable feedstocks and high thermal performance. Recycled-plastic composites are growing more selectively as lifecycle assessments raise concerns over micro-plastic shedding, although wood-polymer boards continue to penetrate exterior decking and facade niches.

Growth prospects vary across materials. Low-carbon binders benefit from inflight carbon-capture subsidies and will accelerate once carbon pricing regimes scale. Mass-timber markets hinge on expanded certified forestry capacity and revisions to height limits in building codes. Cellulose's trajectory depends on securing sufficient post-consumer paper streams and scaling enzymatic treatment plants. Overall, material innovation reinforces competitive differentiation, compelling incumbents to integrate circular-economy features, verified carbon footprints and digital passports into every product line.

The Green Building Materials Market Report is Segmented by Material Type (Low-Carbon Concrete and Cement, Recycled Metals, and More), Application (Framing, Insulation, and More), End-Use Industry (Residential, Commercial, Industrial and Institutional, and Infrastructure), and Geography (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 40.80% of the green building materials market size in 2024, reflecting long-standing ENERGY STAR and LEED programmes and state-level zero-energy-ready building mandates. Federal tax credits under the Inflation Reduction Act strengthen national alignment, while California's 2025 code cycle is expected to tighten embodied-carbon limits further. Canada's Greener Homes Initiative funnels low-interest loans into retrofit upgrades, stimulating demand for cellulose and mineral-wool insulation.

Europe maintains a high adoption baseline due to the Energy Performance of Buildings Directive and the forthcoming Carbon Border Adjustment Mechanism, which together raise the cost of high-carbon imports and incentivise domestic low-carbon production. Scandinavian countries have already mandated whole-life-carbon assessments for all large buildings, accelerating demand for digital passports and mass timber. Germany and France lead public-sector procurement of low-carbon concrete, while the United Kingdom pilots circular-construction hubs to harvest reusable materials from urban demolition.

Asia-Pacific is forecast to expand at an 11.36% CAGR through 2030 as rapid urbanisation meets evolving green-building codes. China requires all new projects to achieve at least Basic Grade green certification by 2025, while several provinces have introduced embodied-carbon benchmarks. India's Energy Conservation Building Code and Indonesia's Green Building Council rating system are driving early adoption, though fragmented municipal enforcement tempers near-term volumes. Australia and Singapore, already mature, are exporting expertise across the region, reinforcing supply-chain localisation and regional certification standards.

South America and the Middle East and Africa remain nascent but attractive as infrastructure investment expands. Brazil's Procel Edifica labelling system and the United Arab Emirates' Estidama Pearl Rating System are encouraging material suppliers to localise production to meet climate-specific performance needs. Financing remains the principal hurdle; however, multilateral banks increasingly channel green bonds into these markets, setting the stage for accelerated uptake during the next planning cycle.

- BASF

- Binderholz GmbH

- Cemex S.A.B. de C.V.

- Coromandel International Ltd.

- DuPont

- Heidelberg Materials

- Holcim Ltd

- Interface Inc.

- Kingspan Group

- Owens Corning

- PPG Industries Inc

- Rockwool A/S

- Saint-Gobain

- Sika AG

- SmartLam

- Steico SE

- Weyerhaeuser Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mandatory Energy-Efficiency Codes Tightening

- 4.2.2 Government Incentives and Certification Schemes

- 4.2.3 Corporate Net-Zero, Embodied-Carbon Procurement

- 4.2.4 Retrofit Wave for Ageing Building Stock

- 4.2.5 Digital Material Passports Monetising End-Of-Life Value

- 4.3 Market Restraints

- 4.3.1 High Upfront Cost of Certified Materials

- 4.3.2 Certification And Performance Complexity Across Regions

- 4.3.3 Bio-Based Feedstock Supply Crunch Post-2027

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Material Type

- 5.1.1 Low-carbon Concrete and Cement

- 5.1.2 Recycled Metals

- 5.1.3 Engineered / Reclaimed Wood

- 5.1.4 Mineral-wool Insulation

- 5.1.5 Cellulose and Bio-foam Insulation

- 5.1.6 Recycled-plastic Composites

- 5.2 By Application

- 5.2.1 Framing

- 5.2.2 Insulation

- 5.2.3 Roofing

- 5.2.4 Exterior Siding

- 5.2.5 Interior Finishing

- 5.2.6 Other Applications

- 5.3 By End-user Industry

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial and Institutional

- 5.3.4 Infrastructure

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/ Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 BASF

- 6.4.2 Binderholz GmbH

- 6.4.3 Cemex S.A.B. de C.V.

- 6.4.4 Coromandel International Ltd.

- 6.4.5 DuPont

- 6.4.6 Heidelberg Materials

- 6.4.7 Holcim Ltd

- 6.4.8 Interface Inc.

- 6.4.9 Kingspan Group

- 6.4.10 Owens Corning

- 6.4.11 PPG Industries Inc

- 6.4.12 Rockwool A/S

- 6.4.13 Saint-Gobain

- 6.4.14 Sika AG

- 6.4.15 SmartLam

- 6.4.16 Steico SE

- 6.4.17 Weyerhaeuser Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment