|

市场调查报告书

商品编码

1441704

稀土元素(稀土):市场占有率分析、产业趋势与统计、成长预测(2024-2029)Rare Earth Elements - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

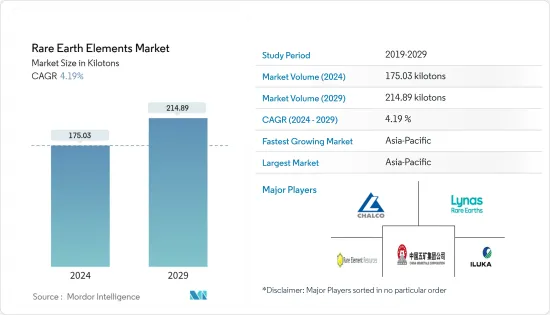

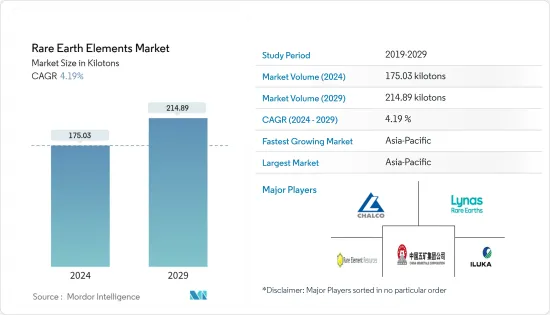

稀土元素(稀土)的市场规模预计2024年为175,030吨,预计到2029年将达到214,890吨,在预测期内(2024-2029年)增长4.19%,以复合年增长率增长。

COVID-19 对稀土元素的需求产生了负面影响,因为在长期严格的遏制法规之后,全球需求已经放缓。但2021年,随着全球经济復苏、工业活动恢復,情况逐渐改善。

主要亮点

- 推动市场成长的因素是新兴国家的高需求以及对稀土元素「绿色技术」的依赖。

- 相反,稀土元素供应不稳定可能会阻碍市场成长。

- 在航太应用中增加钪的使用可能会在预测期内为市场创造机会。

- 由于稀土金属产量增加以及消费性电器产品等行业需求增加,亚太地区主导了全球市场。

稀土元素市场趋势

磁铁需求增加

- 磁铁是稀土元素的最大用途之一。磁铁在电子、汽车、发电和医药等多个行业有着广泛的应用。

- 磁铁用于电脑硬碟、微波功率管、防锁死煞车、汽车零件、磁碟马达马达、无摩擦轴承、发电、磁冷冻、麦克风和扬声器、通讯系统和核磁共振成像。

- 汽车、电子和医疗保健等行业的创新和发展正在增加对磁铁的需求。

- 2021年,约85%的汽车製造商将使用掺有钕的永磁马达,预计2022年汽车对稀土的需求将成长25%。

- 电动车和风力发电机中使用的磁铁是钕、镨和镝,钐和钴也是潜在的替代品,并且可能在未来进一步推动市场发展。

- 此外,磁铁也用于医疗设备,如核磁共振造影系统、心律调节器、睡眠呼吸暂停机和胰岛素帮浦。医疗保健产业在亚太地区、中东和非洲进行了大量投资。

- 因此,所有这些趋势预计将推动对磁铁的需求,从而预计将在未来几年进一步增加对稀土元素的需求。

亚太地区预计将主导市场

- 亚太地区主导了全球市场占有率。随着医疗保健产业投资的增加以及陶瓷需求和产量的增加,预计该地区稀土元素的消费量将大幅增加。

- 这些昂贵稀土元素的全球供应大部分来自中国,使得全球稀土元素市场供应对中国製造业的变化敏感。美国地质调查局资料显示,2021年,全球稀土元素产量的78%来自中国。

- 根据OICA统计,2021年中国和印度汽车总产量分别为2,608万辆和439万辆。因此,中国汽车产量与前一年同期比较%,印度汽车产量年增30%。

- 由于冠状病毒感染疾病暴露了与中国的供应链问题,亚太地区已成为全球COVID-19生产中心,在印度、越南和日本等国家设立了据点,我们已获得多家公司的投资。

- 稀土元素为印度经济贡献了近2000亿美元。印度拥有世界第五大稀土元素蕴藏量,大约蕴藏量澳洲的两倍。然而,它时不时地从地缘政治竞争对手中国进口地球所需的几乎所有东西。

- 日本期待增加稀土矿物库存。此外,预计将支持国内企业收购海外矿山权益,并将原材料加工成下一代汽车和通讯设备等尖端技术所需的有价值的矿物。联合国贸易资料显示,10年内,日本从中国进口的稀土供应量从占其进口量的90%以上减少到58%。我们的目标是到 2025 年将这一比例减少到 50% 或更少。

- 此外,亚太地区的陶瓷需求和产量最高。航太、国防、能源、医疗保健和消费品等产业对陶瓷的需求不断增长,正在推动该地区的陶瓷生产。

- 因此,这样的市场趋势将对未来几年的稀土元素市场产生重大影响。

稀土元素产业概况

稀土元素市场分散,众多参与者持有份额微不足道,各自影响着市场动态。市场上的知名企业包括(排名不分先后)Lynas Rare Earths Ltd、五矿置地有限公司、中国铝业有限公司、Iluka Resources Limited、Rare Element Resources Limited等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 新兴国家的高需求

- 「绿色技术」对稀土元素的依赖

- 抑制因素

- 稀土元素供应不稳定

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔(市场规模(数量))

- 元素

- 铈

- 氧化物

- 硫化物

- 其他的

- 钕

- 合金

- 镧

- 合金

- 氧化物

- 其他的

- 鎝

- 铽

- 钇

- 钪

- 其他的

- 铈

- 目的

- 催化剂

- 陶瓷製品

- 磷光体

- 玻璃/抛光

- 冶金

- 磁铁

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业采取的策略

- 公司简介

- Aluminum Corporation of China Ltd

- ARAFURA RESOURCES

- Avalon Advanced Materials Inc.

- Minmetals Land Limited

- China Nonferrous Metal Industry's Foreign Engineering and Construction Co. Ltd

- Eutectix

- Iluka Resources Limited

- Lynas Rare Earths Ltd

- MEDALLION RESOURCES LTD

- NORTHERN MINERALS

- Peak Resources

- Rare Element Resources Ltd

- Rio Tinto

- Shin-Etsu Chemical Co. Ltd

- Ucore Rare Metals Inc.

- Xiamen Tungsten Co. Ltd

第七章市场机会与未来趋势

The Rare Earth Elements Market size is estimated at 175.03 kilotons in 2024, and is expected to reach 214.89 kilotons by 2029, growing at a CAGR of 4.19% during the forecast period (2024-2029).

COVID-19 negatively impacted the demand for rare earth elements as the global demand witnessed a slowdown following stringent containment restrictions for a long time. However, the situation gradually improved in 2021 with the global economy's revival and industrial activities' resumption.

Key Highlights

- The factors driving the market's growth are the high demand from emerging economies and dependency on "Green Technology" on rare Earth elements.

- On the flip side, an inconsistent supply of rare earth elements may act as a barrier to the market's growth.

- The increasing scandium usage in aerospace applications will likely provide opportunities for the market during the forecast period.

- Asia-Pacific dominated the global market, owing to the increasing production of rare Earth metals and rising demand from industries such as consumer electronics.

Rare Earth Elements Market Trends

Increasing Demand for Magnets

- Magnets stand to be one of the largest applications for rare earth elements. Magnets find extensive applications in various industries, such as electronics, automotive, power generation, and medical.

- Magnets are used in computer hard drives, microwave power tubes, anti-lock brakes, automotive parts, disk drive motors, frictionless bearings, power generation, magnetic refrigeration, microphones and speakers, communication systems, and MRI.

- Industries such as automotive, electronics, and healthcare have witnessed innovation and development, driving the demand for magnets.

- In 2021, approximately 85% of automakers were using neodymium-incorporated permanent magnet motors, and there are projections that the automotive demand for rare earth will rise by 25% in 2022.

- Magnets used for EVs and wind turbines are neodymium, praseodymium, and dysprosium, with samarium and cobalt as potential substitutes, which may further drive the market in the future.

- Additionally, magnets are used in medical equipment, such as MRI machines, pacemakers, sleep apnea machines, and insulin pumps. The healthcare industry has seen considerable investments in Asia-Pacific, the Middle East, and Africa.

- Hence, all such trends are expected to drive the demand for magnets, which is further projected to increase the demand for rare earth elements in the coming years.

The Asia-Pacific Region is Expected to Dominate the Market

- The Asia-Pacific region dominated the global market share. With increasing investments in the healthcare industry and the rising ceramic demand and production, the consumption of rare earth elements is projected to increase noticeably in the region.

- Most of the world's supply of these high-value rare earth elements originates from China, making the global rare earth elements market supply sensitive to changes in China's manufacturing sector. In 2021, 78% of the worldwide production of rare earth elements came from China, as per data from the US Geological Survey.

- According to OICA, the total number of motor vehicles produced in 2021 in China and India was 26.08 million and 4.39 million units, respectively. Thus, motor vehicle production in China grew by 3% and 30% in India compared to the previous year.

- Asia Pacific has been the electronics production base of the world, with investments coming in from several companies establishing their presence in countries like India, Vietnam, and Japan, as the COVID-19 pandemic exposed the supply chain problems with China.

- Rare earth elements contribute a total value of nearly USD 200 billion to the Indian economy. India has the world's fifth-largest reserves of rare earth elements, roughly twice as much as Australia. Still, it imports most of its occasional Earth needs in finished form from its geopolitical rival, China.

- Japan is looking forward to increasing its stockpiles of rare earth minerals. Furthermore, the country is expected to help domestic companies to obtain stakes in overseas mines and to process raw materials into the valuable minerals required for next-generation vehicles, communications equipment, and other cutting-edge technologies. According to UN Comtrade data, Japan slashed rare earth supplies from China from over 90% of imports to 58% within a decade. It aims to bring that below 50% by 2025.

- Furthermore, the demand and production of ceramics are the highest in Asia-Pacific. The increasing ceramic demand from industries such as aerospace and defense, energy, healthcare, and consumer goods is driving the production of ceramics in the region.

- Hence, such market trends will significantly impact the rare Earth elements market in the coming years.

Rare Earth Elements Industry Overview

The rare Earth elements market is fragmented, with numerous players holding insignificant shares to affect the market dynamics individually. Some prominent players in the market include (not in any particular order) Lynas Rare Earths Ltd, Minmetals Land Limited, Aluminum Corporation of China Ltd, Iluka Resources Limited, and Rare Element Resources Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 High Demand from Emerging Economies

- 4.1.2 Dependency of 'Green Technology' on Rare Earth Elements

- 4.2 Restraints

- 4.2.1 Inconsistent Supply of Rare Earth Elements

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Element

- 5.1.1 Cerium

- 5.1.1.1 Oxide

- 5.1.1.2 Sulfide

- 5.1.1.3 Other Elements

- 5.1.2 Neodymium

- 5.1.2.1 Alloy

- 5.1.3 Lanthanum

- 5.1.3.1 Alloy

- 5.1.3.2 Oxide

- 5.1.3.3 Other Elements

- 5.1.4 Dysprosium

- 5.1.5 Terbium

- 5.1.6 Yttrium

- 5.1.7 Scandium

- 5.1.8 Other Elements

- 5.1.1 Cerium

- 5.2 Application

- 5.2.1 Catalysts

- 5.2.2 Ceramics

- 5.2.3 Phosphors

- 5.2.4 Glass and Polishing

- 5.2.5 Metallurgy

- 5.2.6 Magnets

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aluminum Corporation of China Ltd

- 6.4.2 ARAFURA RESOURCES

- 6.4.3 Avalon Advanced Materials Inc.

- 6.4.4 Minmetals Land Limited

- 6.4.5 China Nonferrous Metal Industry's Foreign Engineering and Construction Co. Ltd

- 6.4.6 Eutectix

- 6.4.7 Iluka Resources Limited

- 6.4.8 Lynas Rare Earths Ltd

- 6.4.9 MEDALLION RESOURCES LTD

- 6.4.10 NORTHERN MINERALS

- 6.4.11 Peak Resources

- 6.4.12 Rare Element Resources Ltd

- 6.4.13 Rio Tinto

- 6.4.14 Shin-Etsu Chemical Co. Ltd

- 6.4.15 Ucore Rare Metals Inc.

- 6.4.16 Xiamen Tungsten Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Scandium Usage in Aerospace Applications