|

市场调查报告书

商品编码

1443874

住宅太阳能:市场占有率分析、行业趋势和统计、成长预测(2024-2029)Residential Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

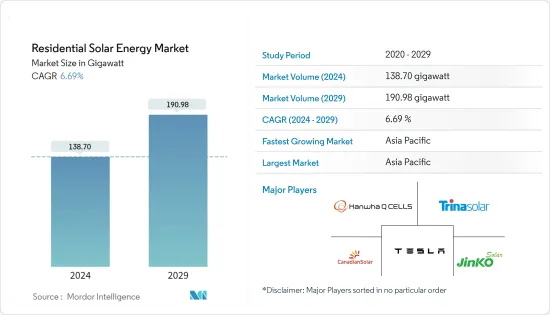

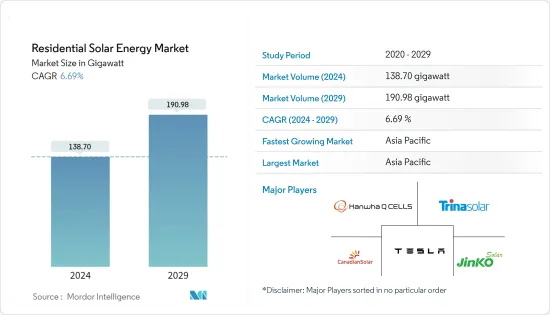

住宅太阳能市场规模预计到2024年为138.70吉瓦,预计到2029年将达到190.98吉瓦,在预测期内(2024-2029年)复合年增长率为6.69%。

主要亮点

- 从中期来看,有利的政府政策、增加即将推出的屋顶太阳能发电工程的投资以及太阳能成本下降导致太阳能部署增加等因素预计将在预测期内推动市场发展。

- 同时,在非洲等地区,缺乏资金筹措选择以及难以整合住宅太阳能发电系统预计将抑制市场成长。

- 也就是说,我们有雄心勃勃的目标来增加可再生能源在能源结构中的份额。这些国家的政府还计划在未来几年透过引入住宅太阳能发电系统来增加可再生能源的份额。预计这将在预测期内为住宅太阳能製造商和供应商提供积极的机会。

- 由于能源需求的增加,亚太地区是预测期内成长最快的市场。这一增长得益于印度、中国和澳大利亚等该地区国家的投资增加以及政府支持政策。

住宅太阳能市场的趋势

屋顶太阳能装置的增加推动市场

- 住宅领域太阳能发电系统安装量的增加主要是出于节省电费的愿望、对替代电力源的需求、减少气候变迁风险。

- 在预测期内,由于太阳能发电成本下降、政府对住宅太阳能发电的支持政策、FIT计划和奖励以及各种太阳能目标,屋顶太阳能发电的需求预计将增加。

- 近年来,住宅屋顶太阳能发电的电力成本迅速下降。价格下降导致全球住宅太阳能发电容量大幅增加。许多国家正在提高住宅屋顶太阳能发电的目标。

- 根据太阳能产业协会(SEIA)统计,2022年,美国住宅太阳能发电装置容量约508千万瓦。总装置容量与前一年同期比较增加23%。

- 根据 SEIA 的 2022 年第三季报告,美国住宅市场创下历史性季度直流电装置容量 157 万千瓦,较 2021 年第三季和 2022 年第二季成长 43%。季增 16%。加州占其中的 36%,因为安装商在当前净计量费率发生变化之前继续促进住宅太阳能销售。

- 根据欧洲联合研究中心分析,欧盟屋顶太阳能光电每年可发电680太瓦时。

- 在德国,联合政府协议已在国家层级强制规定在商业建筑中安装太阳能发电,这将成为新建住宅的标准规则。

- 所有这些因素都推动了研究期间对住宅太阳能的需求。

亚太地区主导市场

- 亚太地区占全球住宅太阳能市场的30%以上,预计在预测期内将保持其主导地位。

- 印度太阳能发电装置容量从2021年的49.3GW大幅成长至2022年的62.8GW。预计这一数字在未来几年将进一步增加。

- 2023年终,中国政府将在50%的政党和政府建筑屋顶、40%的学校、医院等公共设施、30%的工业区域、20%的农村地区安装太阳能电池板。家。我提案用已有31个省份、676个地市州报名参加该计划。

- 新可再生能源发电(MNRE) 的屋顶太阳能併网计划旨在为屋顶系统的前 3kW 容量提供 40% 的补贴,并在 10kW 以内提供 20% 的补贴。 。

- 由于这些因素,亚太地区住宅太阳能发电的需求预计在预测期内将会增加。

住宅太阳能产业概况

住宅太阳能市场较分散。该市场的主要企业包括(排名不分先后)天合光能、阿特斯阳光电力、晶科能源、韩华Q Cells和特斯拉公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2022 年世界可再生能源结构

- 2028年住宅太阳能装置容量及预测

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 有利的政府政策

- 降低太阳能成本

- 抑制因素

- 缺乏融资选择,加上在非洲等地区整合住宅太阳能係统存在困难

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第 5 章市场区隔:区域市场分析(2028 年之前的市场规模/需求预测(仅限区域))

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 卡达

第六章 竞争形势

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Trina Solar Co. Ltd

- Yingli Green Energy Holding Company Limited

- Canadian Solar Inc.

- JinkoSolar Holding Co. Ltd

- JA Solar Holdings Co. Ltd

- Sharp Corporation

- ReneSola Ltd

- Hanwha Q Cells Co. Ltd

- SunPower Corporation

- Tesla Inc.

第七章 市场机会及未来趋势

- 提高可再生能源在全球能源结构中的份额的雄心勃勃的目标

简介目录

Product Code: 48265

The Residential Solar Energy Market size is estimated at 138.70 gigawatt in 2024, and is expected to reach 190.98 gigawatt by 2029, growing at a CAGR of 6.69% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, factors such as favorable government policies, the increasing investment in upcoming rooftop solar projects, and the reduced cost of solar energy, which has led to increased adoption of solar energy, are expected to drive the market during the forecast period.

- On the other hand, the lack of financing options coupled with the difficulties in integrating residential solar PV systems in the regions like Africa is expected to restrain the growth of the market.

- Nevertheless, ambitious targets to increase the renewable share in their energy mix. Governments across these nations have also planned to increase the renewable energy share through the deployment of residential solar PV systems in the coming years. This, in turn, is expected to act as an opportunity to the residential solar energy manufacturers and suppliers during the forecast period.

- Asia-Pacific is the fastest-growing market during the forecast period due to the rising energy demand. This growth is attributed to increasing investments, coupled with supportive government policies in the countries of this region, including India, China, and Australia.

Residential Solar Energy Market Trends

Increasing Rooftop Solar Installations to Drive the Market

- The increasing adoption of solar PV systems in the residential sector is primarily driven by expected savings in electricity costs, the need for an alternative source of electricity, and the desire to mitigate climate change risk.

- During the forecast period, the demand for rooftop solar PV is expected to increase due to decreasing solar PV costs, supportive government policies for residential solar PV, FIT programs and incentives, and various solar energy targets.

- The cost of electricity for residential rooftop solar PV applications has rapidly declined in recent years. The falling price has resulted in a massive increase in the residential PV capacity globally. Many countries are increasing their residential rooftop targets.

- The Solar Energy Industry Association (SEIA) statistics show that, in 2022, residential solar PV installed capacity in the United States accounted for about 5.08 GW. The total installed capacity grew by 23% compared to the previous year.

- According to the SEIA report for Q3 2022, the US residential segment had a historic quarter with 1.57 GW dc installed, a 43% increase over Q3 2021 and a 16% increase over Q2 2022. California made up 36% of this total as installers continue to push to sell residential solar before changes to current net metering rates.

- A European Joint Research Centre analysis shows that EU rooftop PV could produce 680 TWh of solar electricity annually.

- In Germany, according to the coalition agreement, it will become compulsory at the national level to install solar PV on commercial buildings, and it will become a standard rule for new residential buildings.

- All such factors have driven the demand for residential solar energy over the study period.

Asia-Pacific to Dominate the Market

- Asia-Pacific accounted for more than 30% of the global residential solar PV market and is expected to continue its dominance during the forecast period.

- India's solar PV installed capacity increased significantly from 49.3 GW in 2021 to 62.8 GW in 2022. The power is further expected to increase in the coming years.

- By the end of 2023, the Chinese government proposed to cover 50% of rooftop space with solar panels on party and government buildings, 40% of schools, hospitals, and other public facilities, 30% of industrial and commercial areas, and 20% of rural households. A total of 676 counties from 31 provinces have registered for the scheme.

- The Ministry of New and Renewable Energy (MNRE) grid-connected rooftop solar program aims to offer a 40% subsidy for the first 3 kW of generation capacity in rooftop systems and a 20% subsidy up to a 10 kW ceiling.

- Owing to these factors, the demand for residential solar energy is expected to increase in the Asia-Pacific region over the forecast period.

Residential Solar Energy Industry Overview

The residential solar energy market is fragmented. Some of the major players in the market (in no particular order) include Trina Solar Co. Ltd, Canadian Solar Inc., JinkoSolar Holding Co. Ltd, Hanwha Q Cells Co. Ltd, and Tesla Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Renewable Energy Mix, Global, 2022

- 4.3 Residential Solar Energy Installed Capacity and Forecast, till 2028

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Favorable Government Policies

- 4.6.1.2 Reduced Cost of Solar Energy

- 4.6.2 Restraints

- 4.6.2.1 Lack of Financing Options Coupled with the Difficulties in Integrating Residential Solar PV Systems in the Regions like Africa

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION - By Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.1 North America

- 5.1.1 United States

- 5.1.2 Canada

- 5.1.3 Rest of North America

- 5.2 Europe

- 5.2.1 Germany

- 5.2.2 France

- 5.2.3 United Kingdom

- 5.2.4 Italy

- 5.2.5 Rest of Europe

- 5.3 Asia-Pacific

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Japan

- 5.3.4 Australia

- 5.3.5 Rest of Asia-Pacific

- 5.4 South America

- 5.4.1 Brazil

- 5.4.2 Argentina

- 5.4.3 Chile

- 5.5 Middle East and Africa

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 South Africa

- 5.5.4 Qatar

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Trina Solar Co. Ltd

- 6.3.2 Yingli Green Energy Holding Company Limited

- 6.3.3 Canadian Solar Inc.

- 6.3.4 JinkoSolar Holding Co. Ltd

- 6.3.5 JA Solar Holdings Co. Ltd

- 6.3.6 Sharp Corporation

- 6.3.7 ReneSola Ltd

- 6.3.8 Hanwha Q Cells Co. Ltd

- 6.3.9 SunPower Corporation

- 6.3.10 Tesla Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ambitious Targets to Increase the Renewable Share in Total Energy Mix Worldwide

02-2729-4219

+886-2-2729-4219