|

市场调查报告书

商品编码

1443889

安全机器人:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Security Robot - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

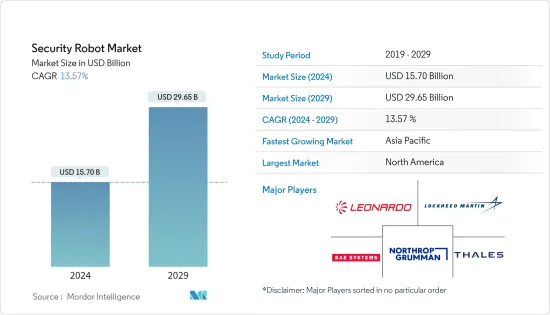

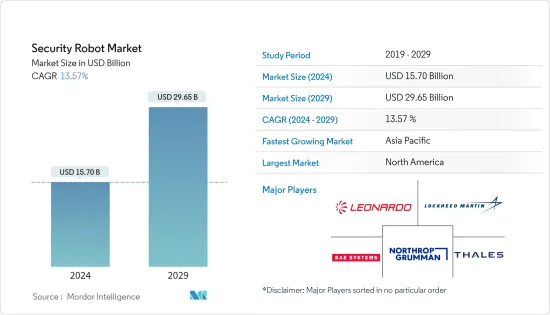

2024年安全机器人市场规模估计为157亿美元,预计2029年将达到296.5亿美元,在预测期间(2024-2029年)复合年增长率为13.57%。

此外,此类机器人技术的快速发展正在创造能够有效保护公众的新功能。

主要亮点

- 自动化和感测器技术的进步正在增加安全机器人在许多应用中的使用。神经网路技术的突破可以让这些机器人随着时间的推移而学习并变得更加有用。这些感测器可帮助机器人分析周围环境并提供更准确的资讯。这些机器人的遥感探测技能可用于监控该区域并发现任何威胁。

- 而且,新技术的发展也显着提高了这些机器人的能力。现在可以将它们部署在困难的地形和环境中,以根据分析执行监控和其他操作。将各种感测器融入安全机器人中,提高了机器人分析环境并提供更可靠资料的能力。这大大有利于其纳入军事装备。

- 根据 Knightscope Inc. 的 K5 等开发成果,机器人安全系统可能有一个未来。以前,这些机器人的功能有限,但自动化和感测器技术的改进使这些机器人在实际应用中非常有用。由于神经网路技术的发展和进步,这些机器人具有随着时间的推移学习和增强其能力的能力。

- 这些机器人比人类收集更多的资料,这一事实使它们比传统保全更类似于行动安全机器人。儘管如此,它们经常被描述为有用的巡逻机器人,最终可能取代人类保全。安全机器人可靠、廉洁,而且比保全更经济,因此在世界各地的各种设施中频繁使用,例如购物中心、停车场和大学。

- 安全机器人发展的一个主要障碍是人们对隐私侵犯日益增长的担忧。安全机器人配备了大量镜头,可以记录车牌、显示行动电话序号以及侦测物体的热量。使用机器人的安全机构将使用资料。

- COVID-19感染疾病增加了将无人技术引入私人安全和资产保护公司业务的可能性。然而,在疫情初期,保全公司员工的感染风险增加。感染从一名工作人员传播到另一名工作人员通常意味着僱用新员工或降低服务品质和安全性。此外,许多国家也减少了进入其领土的移民流量。这些趋势促使安全机器人的引入。

安防机器人市场趋势

商业终端用户产业预计将占据较大份额

- 商业公司透过使用巡逻机器人取代保安,可以提高安全防范水平,获得显着的经济效益。巡逻机器人比保全更有效,因为它们24小时驻守在看守区域。这些公司配备了可以识别个人的360度智慧视讯监控系统,内部分析系统可以预测何时可能发生潜在的危险情境。

- 自动驾驶汽车的研发将耗资数十亿美元,但商业领域的室内机器人将受益于感测器、运算、机器学习和开放原始码软体的技术和经济优势。商业安全预算预计将增加,并且存在大量未开发的市场。因此,安防机器人市场可望快速扩大。

- 正如人们所期望的那样,除了基本的巡逻业务之外,安全机器人还可以在商业领域内及其周围执行广泛的功能。随着IoT(物联网)的发展与进步,现在许多机器人都配备了超音波感测器、光达感测器等各种感测器。这使我们能够识别更多异常情况,尤其是在危险或危险情况下。这些感测器的作用不仅仅是预防犯罪。

- 安全机器人可以在商业应用中自主操作或远端控制。这意味着一个人可以监控多个安全机器人,并可能在发现重要情况时接管。这些可用于公共场所,例如室外空间、大型建筑、停车场、游乐园、商业和学术校园以及混合用途医疗综合体。

- 凭藉自然轮廓导航功能,该机器人还可以在办公室、小型企业、购物中心、工厂、机场等室内使用。它也可以在室内使用,因为它在职场和医院等各个行业都有广泛的应用。机器人变得越来越受欢迎。由于机器人能够提供各种与安全相关的经济效益,因此业内公司正在针对特定应用开发自己的机器人系统。

- 开发能够识别人和车牌、协助身份验证、提供客户服务和双向紧急通讯的机器人也不断增加,以帮助安全专业人员快速、隐密地发现潜在威胁。

- 此外,机器人也被用于其他零售中心,例如美国凤凰城购物中心、美国Park Central 购物中心和阿布达比亚斯购物中心。机器人的日益普及,以及它们在商场和其他建筑物中的使用,不仅可以降低风险,还可以保持高效业务,这意味着安全机器人将在社会中发挥越来越重要的作用。这意味着确实存在。因此,安全机器人正迅速获得商业应用的认可,市场也不断扩大。

预计美国将占最大份额

- 北美是机器人技术应用的主导创新者和先驱,也是最大的市场之一。市场成长的主要原因是许多行业越来越多地采用这些安全机器人。

- 对加拿大和美国的评估是北美安全机器人市场成长分析的一部分。无人解决方案因其可靠性和品质而被美国安全和监控部门广泛使用。学校等公共场所恐怖攻击、武装衝突不断发生。由于此类领土衝突和地缘政治不稳定,对安全机器人的需求正在增加。

- 由于机器学习、电脑视觉和机器人技术的出现带来了各行业的技术进步,美国的安全和设施管理范式正在改变。机器人不仅仅是感测器和计算的集合。这些是可以连接整个世界并提供创新和弹性的基本机器。它们的目的是让人们安全地穿越人口稠密的地区,而不会感到威胁或恐惧,从而促进文化接受度。

- 如果北美的国防支出增加,对安全机器人的兴趣可能会增加。世界各国正在利用尖端技术来保护其边界免受水下威胁。海盗、恐怖分子和海员带来的风险跨越海洋和陆地边界,并在现代世界形势中日益加剧。这引发了人们对国内收入走私的担忧。武器弹药、手枪、毒品和人口贩运继续发生。因此,增加全球国防费用以製止这些暴行似乎是可以接受的。

- 由于海外紧急应变越来越多地使用尖端设备,北美是安防机器人采用率最高的地区之一。该地区在支出和技术进步方面均领先世界,并引进了大量安全机器人。美国拥有庞大的安全和监控机器人市场。加拿大最近大力投资安全机器人的开发。

安防机器人产业概况

全球安全机器人市场高度分散,在已开发地区有一些新参与企业和新兴企业。相对较高的进入和退出障碍提高了市场渗透率。然而,跨不同价值链细分市场的垂直整合趋势往往为市场上的主要供应商提供竞争优势。

2022 年 6 月,埃尔比特系统公司宣布推出 COPAS-L,这是一种用于情报、监视、目标捕获和侦察 (ISTAR) 的新型光电 (EO) 有效载荷。 COAPS-L 是该公司指挥官开放式架构架构镜 (COAPS) 的较小配置,安装在世界各地的主战坦克和装甲战车 (AFV) 上。

2022 年 1 月,莱昂纳多收购了德国国防和安全应用感测器市场的顶级领导者 HENSOLDT AG,扩大了其在感测器、资料管理和机器人领域的产品组合。透过此次收购,李奥纳多也将能够在德国快速扩张的国防工业中建立长期战略地位。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 产业价值链分析

- 技术简介

- 安防机器人相关法规和标准化

- 评估 COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 机器人在安全和监控应用中的使用增加

- 日益增长的安全担忧

- 市场限制因素

- 对隐私和入侵的担忧日益增加

第六章市场区隔

- 按机器人类型

- 无人驾驶的航空机

- 无人地面车辆

- 无人潜水艇

- 按最终用户

- 国防/军事

- 住宅

- 商业的

- 按用途

- 间谍

- 爆炸物检测

- 巡逻

- 救援行动

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 北美洲

第七章 竞争形势

- 公司简介

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Thales SA

- BAE Systems PLC

- Elbit Systems Limited

- Leonardo SPA

- Aerovironment Inc.

- Knight Scope Inc.

- SZ DJI Technology Co. Ltd

- SMP Robotics

- Boston Dynamics Inc.

- FLIR Systems Inc.

- Kongsberg Gruppen

- Qinetiq Group PLC

- RoboTex Inc.

- Recon Robotics Inc.

第八章投资分析

第九章市场机会与未来趋势

The Security Robot Market size is estimated at USD 15.70 billion in 2024, and is expected to reach USD 29.65 billion by 2029, growing at a CAGR of 13.57% during the forecast period (2024-2029).

Also, the rapid evolution in the technology of such robots has led to new functions which enable them to protect the public efficiently.

Key Highlights

- The development of automation and sensor technologies has led to a rise in the use of security robots in numerous applications. Because of breakthroughs in neural network technology, these robots might learn over time and become more useful. These sensors help robots analyze their surroundings and provide more precise information. These robots' skills for remote sensing can be used to monitor the region and spot any threats.

- Moreover, the development of new technologies has also significantly improved the capabilities of these robots. Presently, they can be deployed on challenging terrains and environments to perform surveillance and other actions based on analytics. The inclusion of different sensors in security robots has improved the capabilities of robots in analyzing their environment and providing more reliable data. This has significantly benefitted their incorporation into military devices.

- Robotic security systems may have a future, according to developments like K5 by KnightscopeInc. Earlier, these robots had limited capabilities, but with improvements in automation and sensor technology, these robots have been created to be useful in practical applications. These robots now have the ability to learn over time and enhance their functioning due to the development and advancements of neural network technology.

- The fact that these robots gather a lot more data than people shows that they are more comparable to mobile security robots than traditional security guards. They are frequently portrayed, despite this, as helpful patrol bots that could eventually take the place of human security guards. Because they are trustworthy, incorruptible, and more economical than security employees, security robots are frequently utilized at a variety of establishments around the world, including malls, parking lots, and universities.

- The main obstacle to the development of security robots is the growing worry over the invasion of privacy. Security robots have a large number of cameras that can record license plates, view the serial numbers of cell phones, and detect heat in items. The security agency using the robot uses the data.

- The COVID-19 pandemic increased the prospect of the introduction of unmanned technologies in the business of private security and asset protection companies. However, the risk of infection of the personnel of security companies rose during the initial days of the pandemic. The spread of infection from one personnel to another often led to the need to hire new employees or reduce the quality of service and safety. Besides, many countries reduced the inflow of immigrants to their territories. Such trends prompted the adoption of security robots.

Security Robots Market Trends

Commercial End-user Industry is Expected to Hold a Significant Share

- Commercial businesses can raise their degree of security and get significant financial advantages by using patrol robots in place of security guards. Since patrol robots are stationed in secured areas around-the-clock, they are more effective than security officers. They are equipped with a 360-degree intelligent video surveillance system that can recognize individuals, and their internal analytics system can forecast when potentially dangerous scenarios may occur.

- While R&D for autonomous vehicles costs billions of dollars, indoor robots for business areas benefit from the technology and financial advantages of sensors, computation, machine learning, and open-source software. The commercial security budget is expected to increase, and there is a sizable untapped market; thus, the market for security robots is expected to expand quickly.

- Security robots can perform a wide range of functions in and around the commercial sector in addition to basic patrolling duties, as is to be expected. Many robots can now be equipped with a variety of sensors, including ultrasonic and LiDAR ones, as the IoT (Internet of Things) continues to develop and advance. This allows them to identify more anomalies, particularly in risky or hazardous circumstances. These sensors make it possible to do more than just prevent crime.

- Security robots can be operated autonomously or under remote control in commercial applications. This implies that a single person might keep an eye on several security robots and take over if something significant is found. They can be employed in outdoor spaces, big buildings, and public places like parking lots, amusement parks, business and academic campuses, and multi-building medical complexes.

- With their contour-based natural navigation capabilities, the robots can also be employed inside, such as in offices, small enterprises, malls, factories, airports, etc. Because of their numerous applications in a variety of industries, including workplaces and hospitals, indoor robots are becoming increasingly popular. Companies in the industry are creating unique robotic systems for certain applications since robots have the ability to provide a variety of safety-related and economic benefits.

- In order to help security experts discover potential threats swiftly and covertly, robots are also increasingly being developed as capable of recognizing people, and license plates, helping with identity, to provide customer services, and two-way emergency contact.

- Moreover, other retail centers, like the Phoenix Shopping Center in the United States, Park Central Mall in the United States, Yas Mall in Abu Dhabi, and others, have used robots. The fact that robots are getting more popular and are being used in malls and other structures to not only lessen risks but also to maintain efficient operations implies that security robots are playing an increasingly important role in society. As a result, the market is expanding due to the quick acceptance of security robots in commercial applications.

United States Expected to Account for the Largest Share

- North America is among the leading innovators and pioneers in terms of the adoption of robotics and is one of the largest markets. The primary reason for the growth of the market is the increasing adoption of these security robots across numerous industries.

- The assessment of Canada and the United States is part of the market growth analysis for security robots in North America. Due to their dependability and quality, unmanned solutions are widely used by US security and surveillance services. There have been more terrorist attacks and ongoing armed confrontations in public venues like schools. Security robots are becoming more and more necessary due to such territorial disputes and geopolitical instability.

- As a result of technological advancements in different industries brought about by the advent of machine learning, computer vision, and robotics, the security and facility management paradigm is changing in the United States. Robots are more than just a jumble of sensors and calculations. They are fundamental machines that can connect to the entire world and provide both innovation and flexibility. They are designed to traverse populated areas safely and without coming across as threatening or terrifying, which promotes cultural acceptance.

- Raising defense spending in North America would fuel the escalation of interest in security robots. Nations worldwide are using cutting-edge technology to defend their borders against underwater threats. The risks posed by pirates, terrorists, and sailors generating issues across marine and land boundaries have escalated in the contemporary global context. This leads to concerns about revenue trafficking in the nation. Weapons and ammunition, handguns, drugs, and human trafficking continue to occur. So, it seems acceptable to expand defense spending globally in an effort to stop these atrocities.

- Due to the increased use of cutting-edge equipment for overseas contingency operations, North America is one of the top regions for the adoption of security robots. The region leads the world in both spending and technological advancements, and it has deployed a substantial number of security robots. In the US, there is a huge market for robots that are used for security and surveillance. Canada recently made considerable investments in the creation of security robots.

Security Robots Industry Overview

The global security robots market is highly fragmented, with several new entrants and start-ups in developed regions. Relatively high barriers to entry and exit lead to higher market penetration. However, the tendency to vertically integrate across different value chain segments tends to offer a competitive edge to leading vendors in the market. Lockheed Martin Corporation and Northrop Grumman are some of the key players in the security robot market.

In June 2022, Elbit Systems unveiled COPAS-L, a new Electro-Optical (EO) payload for Intelligence, Surveillance, Target Acquisition, and Reconnaissance (ISTAR). COAPS-L is a miniaturized configuration of the Company's Commander Open Architecture Panoramic Sight (COAPS) that is in service onboard Main Battle Tanks and Armored Fighting Vehicles (AFV) around the world.

In January 2022, Leonardo bought HENSOLDT AG, a top German leader in the market for sensors for defense and security applications, with an expanding portfolio in sensors, data management, and robotics. Leonardo would also be able to build a long-term strategic position in the quickly expanding German defense industry thanks to this acquisition.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Technology Snapshot

- 4.5 Regulatory and Standardizations Related to Security Robots

- 4.6 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Usage of Robots in Security and Surveillance Applications

- 5.1.2 Rising Safety Concerns

- 5.2 Market Restraints

- 5.2.1 Rising Concerns About Privacy and Intrusion

6 MARKET SEGMENTATION

- 6.1 By Type of Robot

- 6.1.1 Unmanned Aerial Vehicles

- 6.1.2 Unmanned Ground Vehicles

- 6.1.3 Autonomous Underwater Vehicles

- 6.2 By End-user

- 6.2.1 Defense and Military

- 6.2.2 Residential

- 6.2.3 Commercial

- 6.3 By Application

- 6.3.1 Spying

- 6.3.2 Explosive Detection

- 6.3.3 Patrolling

- 6.3.4 Rescue Operations

- 6.3.5 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 South Korea

- 6.4.3.5 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Lockheed Martin Corporation

- 7.1.2 Northrop Grumman Corporation

- 7.1.3 Thales SA

- 7.1.4 BAE Systems PLC

- 7.1.5 Elbit Systems Limited

- 7.1.6 Leonardo SPA

- 7.1.7 Aerovironment Inc.

- 7.1.8 Knight Scope Inc.

- 7.1.9 SZ DJI Technology Co. Ltd

- 7.1.10 SMP Robotics

- 7.1.11 Boston Dynamics Inc.

- 7.1.12 FLIR Systems Inc.

- 7.1.13 Kongsberg Gruppen

- 7.1.14 Qinetiq Group PLC

- 7.1.15 RoboTex Inc.

- 7.1.16 Recon Robotics Inc.