|

市场调查报告书

商品编码

1443891

量子点:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Quantum Dots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

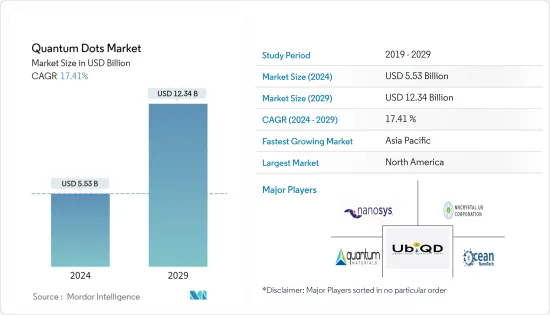

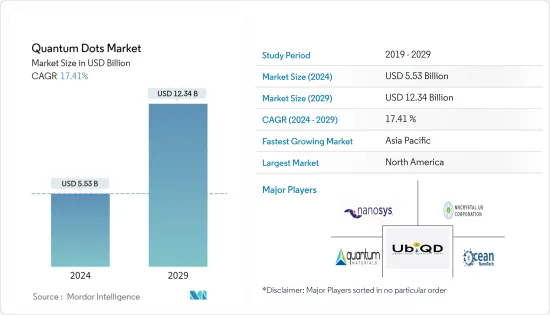

量子点市场规模预计2024年为55.3亿美元,预计到2029年将达到123.4亿美元,在预测期内(2024-2029年)复合年增长率为17.41%增长。

量子点因其理想的发射特性和奈米级尺寸而成为探测等离子体装置的理想选择。量子点(QD)可以用作量子电脑的构建块,因为它们可以根据需要一次发射一个光子。对具有更好性能和高解析度的最佳化设备的需求不断增长,以及对小型化技术的需求不断增长,是所研究市场成长的关键驱动力。

主要亮点

- 镉基量子点已成为一种趋势,具有宽紫外线激发、明亮的光致发光(PL)、窄发射和高光稳定性等优点。因此,镉基量子点在电致发光(EL)和光伏(PV)装置、生物成像、感测器和催化製氢等方面具有应用前景。

- 高品质显示设备对量子点的需求是市场的关键驱动力。量子点的广泛实用化是量子点增强薄膜 (QDEF) 层,可改善液晶电视中的 LED 背光。量子点可用于去除所有中间色以产生纯色,从而创造更宽的色域。此外,它还提高了液晶电视的能源效率。

- 对节能解决方案的需求正在推动市场发展。基于奈米材料的白光发光二极体(LED) 表现出创纪录的每瓦 105 流明的发光效率。随着进一步的发展,新型 LED 的效率可以达到每瓦 200 流明以上,并且在量子点的帮助下,有望成为家庭和办公室的节能光源。

- 2022年6月,北京工业的研究人员开发了钙钛矿量子点(PQD)微阵列,以增强量子点的颜色转换过程,用于LED、microLED、近场显示器和其他设备。这种组装策略克服了喷墨列印生产的传统量子点颜色转换(QDCC)像素面临的通用问题,即像素太薄导致点无法实现有效的颜色转换。

- 此外,由于其物理尺寸较大,量子点无法扩散穿过细胞膜,这在生物应用中可能是潜在的缺点。输送过程对细胞来说是危险的,甚至会破坏它们。在某些情况下,量子点可能对细胞有毒且不适合生物应用,这是市场的重要限制。

- 新型冠状病毒感染疾病(COVID-19) 的全球爆发对市场成长产生了负面影响,由于 COVID-19 传播对经济的影响,企业的业务运营和收益放缓和不确定性。这预计将导致销售下降。花费在新技术上并推迟或取消新技术解决方案的评估和实施。

- 此外,量子点主要应用于电视、显示器、智慧型手机等显示产品。随着感染疾病COVID-19 世界的开放,混合工作文化预计将推动对创新显示产品的需求,从而导致预测期内对量子点的需求增加。

量子点(QD)市场趋势

LED 的普及推动市场成长

- 量子点在显示器中的应用具有多种优势,包括显色性、高照明效率、低成本和大规模生产能力。此外,它们对环境友好,在显示和固态照明应用中引起了极大的关注,特别是基于 QD 的 LED,它表现出高效率和偏振能力。

- 随着LED在照明市场的普及,由于量子点在高效能和色彩饱和显示器生产的应用,量子点市场也不断成长。量子点在LED电视等家用电器中的应用,可以吸收和发射比世界上任何其他显示技术亮四倍的纯色光,这增加了其在消费电器产品领域的受欢迎程度。几家主要照明公司正在开发使用 QD 的产品应用,以透过 LED 产生自然光。

- 在农业中,可以生产光转换涂层,预计将提高温室果树的产量和成熟率。荷兰农民越来越多地采用室内农业,使用带有 LED 灯的先进温室,在更小的空间中更快地种植更多作物。

- 在红外线区域具有量子和功率转换效率的胶体 QD LED 已被证明能够整合到无机太阳能电池中,这可能会带来更高的效率。此外,这些因素催生了量子点的许多应用,例如监视、夜视、环境监测和光谱学。

- 此外,绿色 LED 的光输出显着降低通常会导致健身追踪器等客户应用的效率问题和高成本。量子点 (QD)发光二极体(QLED) 具有独特且对未来显示器有吸引力的特性,包括窄频宽下的高色纯度、低工作电压下的高电致发光(EL) 亮度以及易于加工性。我们提供此外,QLED极薄、透明、弹性、节能,且製造成本低得多,吸引了各大显示器製造商的注意。

- 例如,三星最近宣布推出 Neo QLED 和 MicroLED 电视,作为其基于 LCD 的 QLED 面板技术的下一步。同样,LG 和 OnePlus 等其他显示器製造商预计也会追随这一趋势,这有望推动所研究市场的成长。

亚太地区将经历显着成长

- 预计在预测期内,量子点市场将成为亚太地区最高的成长率。亚太市场的成长可归因于消费者对采用技术先进产品的趋势以及各大学和组织参与QD技术的研发,特别是在显示器市场。

- 由于量子基材料的製造成本较低,考虑到客户的价格敏感度以及三星和LG公司等重要电子公司的存在,预计亚太地区量子点市场的市值将激增。

- 此外,由于太阳能应用需求的快速成长,光电子也成为亚太市场的重要成长因素。量子点独特的光学特性,如发光持久性、高量子产率、窄发射频宽和视觉稳定性,使其成为照明解决方案和显示器的合适材料。

- 未来几年,亚太地区,尤其是中国,对量子点(QD)显示器的需求可能会大幅增加,预计将推动量子点市场的发展。电视、显示器和智慧型手机行业支出的增加以及新产品的推出正在增加 QD(量子点)显示器的采用,并可能推动量子点市场的成长。

量子点 (QD) 产业概览

量子点市场高度分散。领先的公司采取了各种策略,如扩张、新产品发布、合资、协议、合作和收购,以扩大他们在这个市场的足迹。市场主要企业包括 Nanosys Inc.、NN-Labs LLC、Ocean NanoTech、Quantum Materials Corporation、Osram Licht AG、Nanoco Group、Nanophotonica Inc. 等。每家公司都利用策略合作活动来增加其市场份额并提高盈利。

2022年4月,UbiQD的量子点技术与SWM的专业知识结合,共同开发了用于发电窗户的下一代量子点中阶。根据美国能源局,建筑物用电量占全国用电量的 76%。 UbiQD 的「发射太阳能聚光器技术」将萤光量子点放置在中阶中的两块玻璃之间,提供多种颜色选择的谨慎色调。量子点部分吸收阳光并将其转化为近红外线光,这些近红外光被隐藏在窗框内的太阳能电池收集并转化为电能。

2022 年 2 月,Nnaosys 与 Smartkem 合作,共同开发用于先进显示器的新一代低成本解决方案印刷 microLED 和量子点材料。两家公司将使用 SmartKem 的高性能有机半导体配方的解决方案印刷显示器与使用 Nanosys 的 microLED 和量子点 nanoLED 技术的 TFT中阶材料相结合,创造出坚固、灵活且轻巧的新型低功耗显示器。应该建立一个显示。关于设备、製程和材料准备的初步检验工作已经进行。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

- COVID-19 对量子点市场的影响

第五章市场动态

- 市场驱动因素

- 高品质显示设备对量子点的需求

- 节能解决方案的需求

- 市场挑战

- 生物应用中的细胞毒性

第六章市场区隔

- 按类型

- III-V族半导体

- II-VI-半导体

- 硅(Si)

- 按用途

- 光电及光学元件

- 药品

- 农业

- 替代能源

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 世界其他地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争形势

- 公司简介

- Nanosys Inc.

- NN-Labs LLC

- Quantum Materials Corporation

- UbiQD Inc.

- Ocean NanoTech

- Osram Licht AG

- Nanoco Group

- Nanophotonica Inc.

- Navillum Nanotechnologies

- Quantum Solutions Inc.

第八章投资分析

第9章市场的未来

The Quantum Dots Market size is estimated at USD 5.53 billion in 2024, and is expected to reach USD 12.34 billion by 2029, growing at a CAGR of 17.41% during the forecast period (2024-2029).

Quantum dots are an ideal choice for probing plasmonic devices because of their desirable emission properties and nanoscopic size. Quantum dots (QDs) can be used as the building blocks of quantum computers because they can emit photons one by one on demand. The rising demand for optimized devices with better performance and high resolution and an increase in demand for miniaturized technology are the key driving factors for the growth of the market studied.

Key Highlights

- Cadmium-based QDs are in trend, which have the advantage of broad UV excitation, bright photoluminescence (PL), narrow emission, and high photostability. Thus, Cadmium-based QDs have applications in electroluminescence (EL) and photovoltaic (PV) devices, bio-imaging, sensors, and catalytic hydrogen production.

- The demand for quantum dots in high-quality display devices is a crucial driver for the market. A widespread practical application of QDs is in the quantum dot enhancement film (QDEF) layer, which improves the LED backlighting in LCD televisions. By using quantum dots, one can get rid of all the in-between colors and generate pure colors, thus, creating a much wider color gamut. Additionally, enhanced energy efficiency can be achieved for the LCD TV.

- Demand for energy-efficient solutions is driving the market. Nanomaterial-based white-light-emitting diodes (LEDs) exhibit a record luminous efficiency of 105 lumens per watt. With further development, the new LEDs can reach efficiencies of over 200 lumens per watt, making them a promising energy-efficient lighting source for homes and offices with the help of quantum dots.

- In June 2022, to enhance the color conversion process of quantum dots for use in LEDs, micro-LEDs, near-field displays, and other devices, researchers from the Beijing Institute of Technology developed perovskite quantum dot (PQD) microarrays. The assembly strategy aims to overcome a common problem facing conventional quantum dot color conversion (QDCC) pixels fabricated by inkjet printing: the pixels' thinness prevents the dots from achieving efficient color conversion.

- Moreover, the quantum dots may have a potential drawback when used in biological applications due to their large physical size, owing to which they cannot diffuse across cellular membranes. The delivery process may be dangerous for the cell and even destroy it. In other cases, a QD may be toxic for the cell and inappropriate for any biological application, which is a key restraint for the market.

- The global outbreak of COVID-19 has adversely affected the growth of the market as businesses experienced downturns or uncertainty in their business operations and revenue because of the economic effects resulting from the spread of COVID-19, which is expected to lead them to decrease their spending on new technologies and delay or cancel assessment and implementation of new technology solutions.

- Furthermore, quantum dots are primarily used in the display products such as TV, monitor, and smartphones. As the world is opening up post-COVID-19, it is expected that the hybrid work culture to drive the demand for innovative display products, in turn increasing the demand for quantum dots during the forecast period.

Quantum Dots (QD) Market Trends

LED Penetration to Enhance the Market Growth

- Quantum dots exhibit several advantages, including color rendering, high illumination efficiency, low cost, and capacity for mass production, in terms of their use in displays. Furthermore, they are environmentally friendly, attracting considerable attention in the display and solid-state lighting applications, especially QDs-based LEDs that exhibit high efficiency and polarization features.

- With increasing LED penetration in the lighting market, the quantum dots market is growing due to the application of quantum dots in manufacturing high-efficiency and color-saturated displays. It is increasingly becoming popular in the consumer electronics segment owing to QDs' applications in appliances, such as LED TVs, which absorb and emit light in pure colors, as much as four times brighter than any other display technology in the world. Several major lighting companies are developing product applications using QDs to create more natural light for LEDs.

- In agriculture, it is possible to produce light-converting coatings, expected to increase yield and the speed of ripening of fruit plants in greenhouses. Dutch farmers are increasingly adopting indoor farming, and they can grow more crops faster and in a smaller space with advanced greenhouses using LED lights.

- With quantum and power conversion efficiencies in the infrared range, Colloidal QD LED has proven that it can also be integrated into inorganic solar cells, which may lead to even higher efficiencies. Additionally, such factors have triggered many applications for QDs, including surveillance, night vision, environmental monitoring, and spectroscopy.

- Additionally, a significant drop in light output exhibited by green LEDs has often been the cause of efficiency problems and high costs in customer applications, such as fitness trackers. Quantum dot (QD) lightemitting diodes (QLEDs) offer unique and attractive characteristics for future displays, including high color purity with narrow bandwidths, high electroluminescence (EL) brightness at low operating voltages, and easy processability. Furthermore, QLEDs can also be very thin, transparent, and flexible, and are also energy efficient and cost much less to manufacture, attracting the attention of significant display manufacturers.

- For instance, recently, Samsung unveiled Neo QLED and MicroLED TVs as its next step in the LCD-based QLED panel technology. Similarly, other display manufacturers such as LG and One Plus are expected to follow the trend, which is expected to drive the growth of the market studied.

Asia-Pacific to Witness a Significant Growth Rate

- The quantum dots market is expected to register the highest growth rate for the Asia-Pacific region during the forecast period. The market's growth in the Asia-Pacific region can be attributed to the inclination of consumers toward adopting technologically advanced products and the involvement of various universities and organizations in the R&D of QD technology, specifically in the display market.

- Due to the low manufacturing cost of quantum-based materials, the quantum dots market is expected to witness an upsurge in its market value in the Asia Pacific region, considering the price sensitivity of customers and the presence of critical electronics companies such as Samsung and LG Corporation.

- Furthermore, with the surging demand for solar energy applications, optoelectronics is also an essential growth factor for the Asian-Pacific region's market. Unique optical properties, such as emission tenability, high quantum yield, narrow emission band, and visual stability, make quantum dots the preferred material for lighting solutions and displays.

- In the following years, there is likely to be a significant increase in demand for quantum dots (QD) displays in the Asia-Pacific region, especially in China, which is expected to drive the quantum dots market. With the introduction of new products, rising expenditures of the TV, monitor, and smartphone industries are increasing the adoption of QD (Quantum Dots) displays, which may enhance the growth of the quantum dots market.

Quantum Dots (QD) Industry Overview

The Quantum Dots market is highly fragmented. The major players have used various strategies, such as expansions, new product launches, joint ventures, agreements, partnerships, and acquisitions, to increase their footprints in this market. Key players in the market are Nanosys Inc., NN-Labs LLC, Ocean NanoTech, Quantum Materials Corporation, Osram Licht AG, Nanoco Group, Nanophotonica Inc., and many more. The businesses are leveraging strategic collaborative actions to improve their market percentage and enhance profitability.

In April 2022, UbiQD's quantum dot technology collaborated with SWM's domain expertise to co-develop next-generation quantum dot interlayers for electricity-producing windows. According to the US Department of Energy, buildings account for 76% of domestic electricity use. UbiQD's 'luminescent solar concentrator technology deploys fluorescent quantum dots between two sheets of glass within the interlayer to provide a modest tint with various color options. The Quantum Dots partially absorb sunlight and convert it into near-IR light harvested into electricity by solar cells hidden in the window frame.

In February 2022, Nnaosys partnered with Smartkem to work together on a new generation of low-cost solution printed microLED and quantum dot materials for advanced displays. Both companies believe combining solution printed displays using SmartKem's high-performance organic semiconductor formulations with TFT interlayer materials using Nanosys's microLED and quantum dot nano-led technologies should create a new low-power class of robust, flexible, lightweight displays. Initial validation work on the equipment, processes, and materials readiness has already occurred.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Quantum Dots Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Quantum Dots in High-quality Display Devices

- 5.1.2 Demand for Energy-efficient Solutions

- 5.2 Market Challenges

- 5.2.1 Toxicity of Cells in Biological Applications

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 III-V-semiconductors

- 6.1.2 II-VI- semiconductors

- 6.1.3 Silicon (Si)

- 6.2 By Application

- 6.2.1 Optoelectronics and Optical Components

- 6.2.2 Medicine

- 6.2.3 Agriculture

- 6.2.4 Alternative Energy

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia Pacific

- 6.3.4 Rest of the World

- 6.3.4.1 Latin America

- 6.3.4.2 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nanosys Inc.

- 7.1.2 NN-Labs LLC

- 7.1.3 Quantum Materials Corporation

- 7.1.4 UbiQD Inc.

- 7.1.5 Ocean NanoTech

- 7.1.6 Osram Licht AG

- 7.1.7 Nanoco Group

- 7.1.8 Nanophotonica Inc.

- 7.1.9 Navillum Nanotechnologies

- 7.1.10 Quantum Solutions Inc.