|

市场调查报告书

商品编码

1443897

锑:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Antimony - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

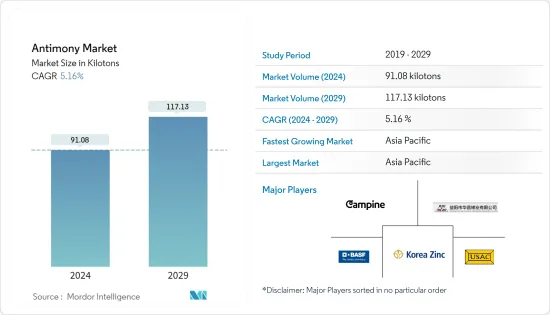

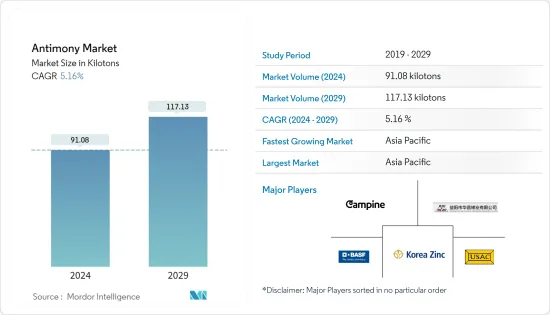

预计2024年锑市场规模为91,080吨,预计2029年将达到117,130吨,在预测期(2024-2029年)复合年增长率为5.16%。

COVID-19 的感染疾病、世界各地的国家封锁、采矿活动和供应链的中断、生产停顿以及劳动力短缺对锑市场产生了负面影响。然而,在预测期内,各种最终用户不断增长的需求可能会推动市场发展。

推动所研究市场的主要因素包括阻燃产品需求的成长和 PET 製造商需求的成长。

在关键应用中替代锑预计将严重阻碍所研究市场的成长。

从回收产品中回收锑可能是未来的机会。

预计亚太地区将在预测期内主导全球市场。

锑市场走势

玻璃纤维复合材料应用的增加

锑用作玻璃纤维复合材料的添加剂。将锑化合物直接添加到树脂中并使用常规混合设备进行分散。

掺有锑的树脂要经常搅拌,以确保物料充分混合。由于其具有优异的耐热性和耐化学性而被广泛使用。

玻璃纤维复合材料市场预计将快速成长。复合材料具有多种形状和形式,具有高强度、低成本、易于加工和出色的美观性,使其成为航太、汽车、建筑、电气和电子等许多应用中传统材料的可行替代品.所有材料都在迅速被替换。

根据美国人口普查局的数据,2021 年 12 月美国建筑业总产值为 16,398.6 亿美元,较去年同期的 15,042 亿美元成长 9%。

除此之外,印度的住宅也在增加,预计未来七年的住宅投资约为1.3兆美元,这将提振所研究的市场。

根据联邦统计局(Destatis)的数据,2021年11月德国主要建筑业的销售额与去年同月相比成长了6.2%。

由于玻璃纤维复合材料的高强度,预计锑市场在预测期内将显着成长。

中国可望主导亚太市场

2021年中国仍是全球最大的锑生产国,占全球矿场产量的55%。根据美国地质调查局(USGS)统计,2021年国内锑矿产总产量达6万吨。

锑与铅熔合,所得合金(固溶体)用于铅酸电池。然而,有关铅排放的环境法规限制了全球铅电池中锑的消耗。含有这种元素的其他合金用于製造子弹、电缆护套、焊料,甚至风琴管。

2021年,原料短缺和全球出货延误限制了锑原料供应和下游锑产品生产。 2021 年 10 月,锑价达到每磅 6.65 美元的高位,而 2020 年年均价格为每磅 2.67 美元。

在半导体工业中,它被用来製造二极体、霍尔效应元件和红外线检测器。智慧型手机、OLED电视和平板电脑等电子产品在消费性电器产品领域成长最快。

此外,中国拥有全球最大的电子产品生产基地。根据ZVEI Dia Elektroindustrie统计,2020年中国电子产业产值约24.3亿美元,预计2021年和2022与前一年同期比较%,锑在国内提供了庞大的市场。

此外,锑作为阻燃剂具有巨大的应用,导致建筑领域的显着成长。根据中国国家统计局数据,2021年中国建筑业产值达约29.31兆元。

整体而言,预测期内国内锑需求预计将增加。

锑行业概况

锑市场本质上是分散的。研究市场的主要企业(排名不分先后)包括Campine NV、益阳华昌锑业、韩国锌业、BASFSE、美国锑业等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 阻燃产品的需求不断成长

- PET 製造商的需求增加

- 抑制因素

- 关键应用中氧化铝和其他金属等替代品的可用性

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔

- 类型

- 金属锭

- 三氧化二锑

- 五氧化二锑

- 合金

- 其他类型

- 目的

- 阻燃剂

- 铅酸蓄电池

- 合金强化剂

- 玻璃纤维复合材料

- 催化剂

- 其他用途(电子等)

- 地区

- 生产分析

- 中国

- 俄罗斯

- 澳洲

- 塔吉克

- 玻利维亚

- 缅甸

- 其他国家

- 消费分析

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 生产分析

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率**/排名分析

- 主要企业采取的策略

- 公司简介

- BASF SE

- Campine

- Yiyang Huachang Antimony Industry Co. Ltd

- Hunan ChenZhou Mining Group Co. Ltd

- Korea Zinc Co. Ltd

- Lambert Metals International

- Mandalay Resources Corp.

- Nihon Seiko

- Nyacol Nano Technologies Inc.

- Suzuhiro Chemical

- Tri-Star Resources PLC

- US Antimony

- Yunnan Muli Antimony Industry Co. Ltd

第七章市场机会与未来趋势

The Antimony Market size is estimated at 91.08 kilotons in 2024, and is expected to reach 117.13 kilotons by 2029, growing at a CAGR of 5.16% during the forecast period (2024-2029).

.

Due to the COVID-19 outbreak, nationwide lockdown around the world, disruption in mining activities and supply chains, production halts, and labor unavailability have negatively impacted the antimony market. However, the increasing demand from various end users will likely drive the market during the forecast period.

The major factors driving the market studied include the rising demand for flame retardant products and increasing demand from PET manufacturers.

Substitutes for antimony in major applications are expected to significantly hinder the growth of the market studied.

Recovery of antimony from recycled products is likely to act as an opportunity in the future.

Asia-Pacific is expected to dominate the global market during the forecast period.

Antimony Market Trends

Increasing Usage in Fiberglass Composite Applications

Antimony is used as an additive in fiberglass composites. Antimony compounds are added directly to the resin, and they are dispersed using normal mixing equipment.

Resin mixed with antimony is stirred frequently to keep the materials well-mixed. It is widely used due to its better heat-resistant and chemical-resistant properties.

The market for fiberglass composites is expected to grow at a fast pace. Composites are rapidly replacing all conventional materials in many applications, such as aerospace, automobiles, construction, electrical, and electronics, due to their high strength, low cost, easy processability, and availability in various forms and shapes with good aesthetics.

According to the US Census Bureau, the total construction output in the United States was estimated to be USD 1639.86 billion in December 2021, indicating a 9% increase compared to USD 1504.2 billion in the same period the previous year.

In addition to this, residential construction has also been increasing in India, as the country is likely to witness an investment of around USD 1.3 trillion in housing over the next seven years, which will boost the market studied.

According to the Federal Statistical Office (Destatis), in Germany, the turnover in the main construction industry in November 2021 was up by 6.2% compared to the corresponding month of the previous year.

Owing to the high strength of fiberglass composites, the antimony market is expected to witness tremendous growth over the forecast period.

China is Expected to Dominate the Asia-Pacific Market

China continued to be the leading global antimony producer in 2021 and accounted for 55% of the global mine production. According to the US Geological Survey (USGS), the total mine production of antimony in the country stood at 60,000 metric ton in 2021.

Antimony is fused with lead, and the resulting alloy (solid solution) is used in lead-acid batteries. However, environmental regulations on lead emissions have restricted the consumption of antimony in lead batteries globally. Other alloys incorporating the element are used to make bullets, cable sheaths, solder, and even organ pipes.

The supply of antimony raw materials and downstream production of antimony products were constrained in 2021 due to raw material shortage combined with worldwide shipping delays. The antimony price reached a high of USD 6.65 per pound in October 2021 compared to the annual average price of USD 2.67 per pound in 2020.

In the semiconductor industry, it is used to manufacture diodes, hall-effect devices, and infrared detectors. Electronic products, such as smartphones, OLED TVs, tablets, etc., have the highest growth in the consumer electronics segment.

Moreover, China has the world's largest electronics production base. According to ZVEI Dia Elektroindustrie, the electronics industry of China was valued at about USD 2,430 million in 2020, and it is forecasted to grow at 11% and 8% Y-o-Y in 2021 and 2022, thus providing a huge market for antimony in the country.

Furthermore, antimony has a huge application as a flame retardant, thus leading to massive growth in the construction sector. According to the National Bureau of Statistics of China, in 2021, the construction output in China was valued at approximately CNY 29.31 trillion.

Overall, the demand for antimony is expected to increase in the country during the forecast period.

Antimony Industry Overview

The antimony market is fragmented in nature. Some of the major players (not in any particular order) in the market studied include Campine NV, Yiyang Huachang Antimony Industry Co. Ltd, Korea Zinc Co. Ltd, BASF SE, and US Antimony, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand for Flame Retardant Products

- 4.1.2 Increasing Demand from PET Manufacturers

- 4.2 Restraints

- 4.2.1 Availability of Substitutes such as Aluminum Oxide and Other Metals in Major Applications

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Metal Ingot

- 5.1.2 Antimony Trioxide

- 5.1.3 Antimony Pentoxide

- 5.1.4 Alloys

- 5.1.5 Other Types

- 5.2 Application

- 5.2.1 Flame Retardants

- 5.2.2 Lead-acid Batteries

- 5.2.3 Alloy Strengthening Agents

- 5.2.4 Fiberglass Composites

- 5.2.5 Catalysts

- 5.2.6 Other Applications (Electronics)

- 5.3 Geography

- 5.3.1 Production Analysis

- 5.3.1.1 China

- 5.3.1.2 Russia

- 5.3.1.3 Australia

- 5.3.1.4 Tajikistan

- 5.3.1.5 Bolivia

- 5.3.1.6 Burma

- 5.3.1.7 Other Countries

- 5.3.2 Consumption Analysis

- 5.3.2.1 Asia-Pacific

- 5.3.2.1.1 China

- 5.3.2.1.2 India

- 5.3.2.1.3 Japan

- 5.3.2.1.4 South Korea

- 5.3.2.1.5 Rest of Asia-Pacific

- 5.3.2.2 North America

- 5.3.2.2.1 United States

- 5.3.2.2.2 Canada

- 5.3.2.2.3 Mexico

- 5.3.2.3 Europe

- 5.3.2.3.1 Germany

- 5.3.2.3.2 United Kingdom

- 5.3.2.3.3 Italy

- 5.3.2.3.4 France

- 5.3.2.3.5 Rest of Europe

- 5.3.2.4 South America

- 5.3.2.4.1 Brazil

- 5.3.2.4.2 Argentina

- 5.3.2.4.3 Rest of South America

- 5.3.2.5 Middle-East and Africa

- 5.3.2.5.1 Saudi Arabia

- 5.3.2.5.2 South Africa

- 5.3.2.5.3 Rest of Middle-East and Africa

- 5.3.1 Production Analysis

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Campine

- 6.4.3 Yiyang Huachang Antimony Industry Co. Ltd

- 6.4.4 Hunan ChenZhou Mining Group Co. Ltd

- 6.4.5 Korea Zinc Co. Ltd

- 6.4.6 Lambert Metals International

- 6.4.7 Mandalay Resources Corp.

- 6.4.8 Nihon Seiko

- 6.4.9 Nyacol Nano Technologies Inc.

- 6.4.10 Suzuhiro Chemical

- 6.4.11 Tri-Star Resources PLC

- 6.4.12 US Antimony

- 6.4.13 Yunnan Muli Antimony Industry Co. Ltd