|

市场调查报告书

商品编码

1443902

乙苯:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Ethylbenzene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

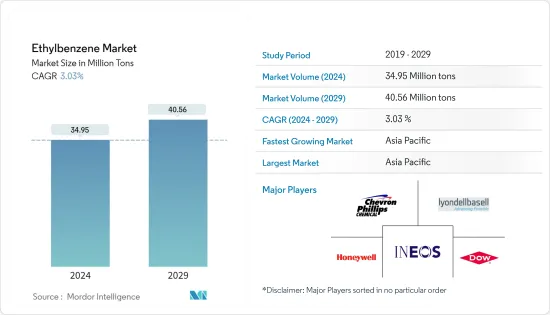

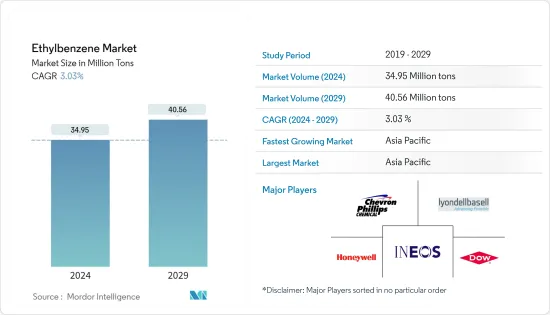

预计2024年乙苯市场规模为3,495万吨,预估至2029年将达到4,056万吨,在预测期间(2024-2029年)复合年增长率为3.03%。

2020年,市场受到COVID-19疾病的负面影响。然而,2021年至2022年市场显着復苏,建筑和汽车製造活动导致对乙苯基聚合物和汽车仪表板和外饰等其他产品的需求復苏。板材、苯丙乳化、油漆、涂料用溶剂、试剂等。此次疫情增加了食品和电子商务产业对包装的需求,从而刺激了所研究市场的需求。

主要亮点

- 各个最终用户产业对苯乙烯的需求不断增加以及天然气回收中乙苯的使用量增加预计将推动市场成长。

- 另一方面,有关乙苯使用的严格规定可能会减缓所研究市场的成长。

- 乙苯作为溶剂和试剂在油漆和涂料、黏剂和清洗剂等各种产品的製造中的应用可能为市场提供新的成长机会。

- 亚太地区主导全球市场,最大的消费国包括中国和韩国。

乙苯市场走势

苯乙烯产量主导市场

- 苯乙烯产量将对乙苯市场需求产生正面影响。苯乙烯是多种工业聚合物的前驱物,例如丙烯腈-丁二烯-苯乙烯、聚苯乙烯、苯乙烯-丁二烯合成橡胶和乳胶、苯乙烯-丙烯腈树脂和不饱和聚酯。

- 上述苯乙烯基聚合物、合成橡胶和树脂广泛应用于各种最终用户产业,例如电子、包装、农业、石化和建筑。聚苯乙烯主要用于一次性产品、包装和低成本消费品。

- 根据世界银行的数据,2021年苯乙烯聚合物的最大出口国是荷兰(620,100,910美元)、土耳其(291,832,220美元)、比利时(248,619,880美元)和希腊(248,619,880美元)和希腊(248,619,619,880美元)和希腊(248,619,619,880美元)和希腊(248,619,619,880美元)。

- 根据OEC统计,2022年9月中国苯乙烯聚合物出口额为7,390万美元。 2021年9月至2022年9月,中国苯乙烯聚合物出口额从5,200万美元增加至7,390万美元,成长2,190万美元(42.1%)。

- 根据世界银行统计,美国初级型态苯乙烯聚合物(发泡聚苯乙烯)出口额为198,686,760美元,数量为97,729,500公斤。

- 2021-22年印度环烃苯乙烯进口量为907,040吨,预计消费量将随着国内需求增加而增加。

- 由于橡胶轮胎的需求不断增加,对苯乙烯的需求不断增加。根据《欧洲橡胶日誌》年度全球产业调查显示,2021年中国主要供应商销售额与前一年同期比较增30%,达15.61亿美元。预计明年这一数字还将进一步增加。上述因素预计将在未来几年对市场产生重大影响。

亚太地区主导市场

- 亚太地区主导了全球市场占有率。中国、印度和日本等国家建设业和包装产业的成长,以及该地区乙苯作为溶剂和试剂在油漆和涂料、染料、香料、油墨和合成橡胶中的使用量不断增加。

- 乙苯主要用于生产苯乙烯,苯乙烯进一步加工形成聚苯乙烯,而聚苯乙烯是包装产品的主要原料。据印度品牌股权基金会称,印度正在成为全球市场上领先的包装材料出口国。印度包装材料出口额从2018-19年的8.44亿美元增加至2021-22年的11.19亿美元。国内包装需求的成长刺激了所研究市场的需求。

- 由于公共基础设施、可再生能源、基础设施和商业计划投资增加,消费者和投资者信心增强,预计未来几年建筑业将出现温和增长,从而刺激建设业需求预测期内的乙苯。

- 根据中国国家统计局的数据,2021年中国建筑业企业增加付加与前一年同期比较增2.1%至80,138亿元人民币(12,484.2亿美元),导致油漆、被覆剂和乙苯的需求增加。据说增加了。建设产业的基于聚合物的开发刺激了所研究市场的需求。

- 在此期间,由于电动车领域的需求增加,对轻量汽车材料的需求增加。乙苯基聚合物,如丙烯腈、丁二烯和苯乙烯,用于製造各种汽车外观和内装零件,如仪表板、外板和保险桿。

- 2021年中国小客车销量约21,481,537辆,较2020年销量20,177,731小客车增长约6%,导致对生产所用原材料的需求急剧增加。仪表板等汽车零件对所研究市场的需求产生了正面影响。

- 印度小客车市场成长了 27%,预计 2021-22 年销量为 3,082,279 辆,而 2020-21 年销量为 2,433,473 辆。

- 电子情报技术产业协会(JEITA)预计,由于数位化和出口的进步导致需求增加,2021年日本电子和IT企业的全球产值将比与前一年同期比较增长8%,达到37.3兆日圆扩大,达到日元。电子产业的成长预计将增加未来几年乙苯市场的需求。因此,预计上述因素将在未来几年对市场产生重大影响。

乙苯产业概况

乙苯市场本质上是细分的。主要企业包括 LyondellBasell Industries Holdings BV、INEOS、Honeywell International Inc、Chevron Phillips Chemical Company LLC、Dow 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 苯乙烯需求增加

- 增加天然气回收的使用

- 抑制因素

- 关于乙苯使用的严格规定

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

- 技术简介

- 生产过程

- 贸易分析

- 价格指数

- 监理政策分析

第五章市场区隔(市场规模(数量))

- 目的

- 苯乙烯

- 丙烯腈-丁二烯-苯乙烯

- 苯乙烯/丙烯腈树脂

- 苯乙烯-丁二烯合成橡胶和乳胶

- 不饱和聚酯树脂

- 汽油

- 二乙苯

- 天然气

- 画

- 沥青和石脑油

- 苯乙烯

- 最终用户产业

- 包装

- 电子产品

- 建造

- 农业

- 车

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业采取的策略

- 公司简介

- Carbon Holdings Limited(Cairo)

- Changzhou Dohow Chemical Co. Ltd

- Chevron Phillips Chemical Company LLC

- Cos-Mar Company

- Dow

- Guangdong Wengjiang Chemical Reagent Co., Ltd.

- Honeywell International Inc

- INEOS

- J&K Scientific Ltd.

- LyondellBasell Industries Holdings BV

- LLC 'Gazprom neftekhim Salavat'

- PJSC "Nizhnekamskneftekhim"

- ROSNEFT

- Shanghai Myrell Chemical Technology Co., Ltd.

- Sibur-Khimprom CJSC

- TCI Chemicals(India)Pvt. Ltd.

- Versalis SpA

- Westlake Chemical Corporation

第七章市场机会与未来趋势

- 扩大作为溶剂和试剂的应用

The Ethylbenzene Market size is estimated at 34.95 Million tons in 2024, and is expected to reach 40.56 Million tons by 2029, growing at a CAGR of 3.03% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020. However, the market recovered significantly in the 2021-22 period, and the construction and automotive manufacturing activities have reinstated the demand for ethylbenzene-based polymer and other products, including automotive dashboards, exterior panels, styrene-acrylic emulsions, solvents and reagents for paints and coatings, and others. The pandemic had increased the demand for packaging from the food and e-commerce industries, thereby stimulating the demand for the market studied.

Key Highlights

- The increasing demand for styrene from various end-user industries and the increasing usage of ethylbenzene in the recovery of natural gas are expected to drive the market's growth.

- On the other hand, strict rules about using ethylbenzene are likely to slow the growth of the market that was studied.

- Ethylbenzene application as a solvent and reagent in the production of various products, such as paints and coatings, adhesives, and cleaning materials, will likely provide new growth opportunities for the market.

- Asia-Pacific dominated the market across the world, with the largest consumption coming from countries such as China and South Korea.

Ethylbenzene Market Trends

Styrene Production to Dominate the Market

- Styrene production will have a positive influence on ethylbenzene market demand. Styrene is a precursor to several industrial polymers, including acrylonitrile-butadiene-styrene, polystyrene, styrene-butadiene elastomers and latex, styrene-acrylonitrile resins, and unsaturated polyester.

- The aforementioned styrene-based polymers, elastomers, and resins find a wide range of applications in various end-user industries, such as electronics, packaging, agriculture, petrochemicals, and construction. Polystyrene is majorly used in disposables, packaging, and low-cost consumer products.

- According to World Bank, in 2021, the top exporters of styrene polymers were the Netherlands (USD 620,100.91 thousand), Turkey (USD 291,832.22 thousand), Belgium (USD 248,619.88 thousand), and Greece (USD 248,471.97 thousand).

- According to OEC, in September 2022 China's styrene polymers exports accounted for USD 73.9 million. Between September 2021 and September 2022 the exports of China's styrene polymers have increased by USD 21.9 million (42.1%) from USD 52 million to USD 73.9 million.

- According to the World Bank, United States exports of styrene polymers (expansible polystyrene) in primary forms was USD 198,686.76 thousand and a quantity of 97,729,500 Kg.

- The cyclic hydrocarbon styrene imports in India stood at 907.04 kilotons in FY2021-22, and the consumption is likely to increase as per the rising demand in the country.

- The demand for styrene is continuously growing due to an increased demand for rubber tires. According to the European Rubber Journal's annual global sector survey, sales among leading Chinese suppliers increased by 30% year-on-year in 2021 to reach USD 1,561 million. It is further expected to increase in the upcoming year

- Therefore, the aforementioned factors are expected to significantly impact the market in the coming years

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share. With growing construction and packaging industries and increasing applications as solvents and reagents in paints and coatings, dyes, perfumes, inks, and synthetic rubber in countries such as China, India, and Japan, the usage of ethylbenzene has been increasing in the region.

- Ethylbenzene is mainly used for the production of styrene, which further gets processed to form polystyrene, a major raw material for packaging products. According to the India Brand Equity Foundation, India is emerging as a key exporter of packaging materials in the global market. The export of packaging materials from India grew to USD 1,119 million in 2021-22 from USD 844 million in 2018-19. This increase in the demand for packaging within the country is stimulating the demand for the market studied.

- With increasing investments in public infrastructure, renewable energy, infrastructure, and commercial projects, the construction sector is expected to record growth at a moderate pace over the next few years, thereby improving both consumer and investor confidence and, in turn, stimulating the demand for ethylbenzene over the forecast period.

- According to the National Bureau of Statistics of China, in 2021, the value added of construction enterprises in China was CNY 8,013.8 billion (USD 1,248.42 billion), up by 2.1 percent over the previous year, thereby enhancing the demand for paints and coatings and ethylbenzene-based polymers from the construction industry, which in turn stimulates the demand for the studied market.

- The demand for lightweight automotive materials has increased during this period, owing to the increased demand from the electric vehicle segment. Ethylbenzene-based polymers, including acrylonitrile-butadiene-styrene and others, are used for manufacturing various automotive exterior and interior parts, including dashboards, exterior panels, bumpers, and others.

- In 2021, around 2,14,81,537 passenger cars were sold in China compared to 2,01,77,731 passenger cars sold in 2020, witnessing an increase of about 6%, thus leading to a surge in the demand for raw materials used to produce automotive parts such as dashboards, among others, which in turn positively impacted the demand for the market studied.

- The Indian passenger vehicle market saw a staggering 27% growth, as the sales estimated for FY2021-22 are 30,82,279, compared to 24,33,473 in FY 2020-21.

- According to the Japan Electronics and Information Technology Industries Association (JEITA), with the advance of digitalization boosting demand and expanding exports, global production by Japanese electronics and IT companies grew by 8% year on year in 2021, reaching JPY 37,300 billion. This growth in the electronics segment will enhance the demand for the ethylbenzene market in the coming years.

- Therefore, the aforementioned factors are expected to have a significant impact on the market in the coming years.

Ethylbenzene Industry Overview

The ethylbenzene market is partially fragmented in nature. The major companies include LyondellBasell Industries Holdings B.V., INEOS, Honeywell International Inc, Chevron Phillips Chemical Company LLC, and Dow, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Styrene

- 4.1.2 Increasing Use in Recovery of Natural Gas

- 4.2 Restraints

- 4.2.1 Strict Regulations on the Use of Ethylbenzene

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Technological Snapshot

- 4.5.1 Production Process

- 4.6 Trade Analysis

- 4.7 Price Index

- 4.8 Regulatory Policy Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Styrene

- 5.1.1.1 Acrylonitrile-Butadiene-Styrene

- 5.1.1.2 Styrene-Acrylonitrile Resins

- 5.1.1.3 Styrene-Butadiene Elastomers and Latex

- 5.1.1.4 Unsaturated Polyester Resins

- 5.1.2 Gasoline

- 5.1.3 Diethylbenzene

- 5.1.4 Natural Gas

- 5.1.5 Paint

- 5.1.6 Asphalt and Naphtha

- 5.1.1 Styrene

- 5.2 End-user Industry

- 5.2.1 Packaging

- 5.2.2 Electronics

- 5.2.3 Construction

- 5.2.4 Agriculture

- 5.2.5 Automotive

- 5.2.6 Other End-User Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Carbon Holdings Limited (Cairo)

- 6.4.2 Changzhou Dohow Chemical Co. Ltd

- 6.4.3 Chevron Phillips Chemical Company LLC

- 6.4.4 Cos-Mar Company

- 6.4.5 Dow

- 6.4.6 Guangdong Wengjiang Chemical Reagent Co., Ltd.

- 6.4.7 Honeywell International Inc

- 6.4.8 INEOS

- 6.4.9 J&K Scientific Ltd.

- 6.4.10 LyondellBasell Industries Holdings B.V.

- 6.4.11 LLC 'Gazprom neftekhim Salavat'

- 6.4.12 PJSC "Nizhnekamskneftekhim"

- 6.4.13 ROSNEFT

- 6.4.14 Shanghai Myrell Chemical Technology Co., Ltd.

- 6.4.15 Sibur-Khimprom CJSC

- 6.4.16 TCI Chemicals (India) Pvt. Ltd.

- 6.4.17 Versalis S.p.A.

- 6.4.18 Westlake Chemical Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing use in applications as solvent and reagents