|

市场调查报告书

商品编码

1443903

下一代先进电池:市场占有率分析、行业趋势和统计、成长预测(2024-2029)Next Generation Advanced Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

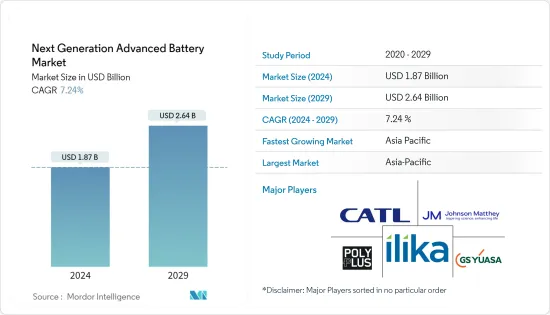

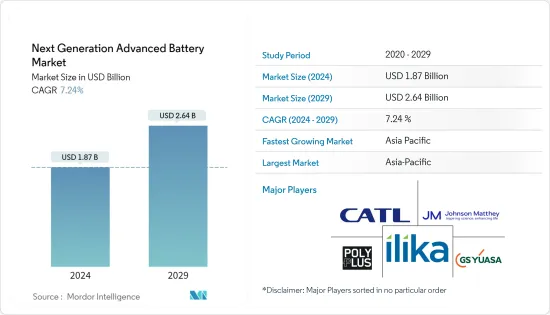

下一代先进电池市场规模预计到 2024 年为 18.7 亿美元,预计到 2029 年将达到 26.4 亿美元,在预测期内(2024-2029 年)增长 7.24%,复合年增长率为

2020 年,市场受到 COVID-19 的负面影响。目前市场处于大流行前的水平。

主要亮点

- 从长远来看,不断增长的需求和电动车的日益普及预计将推动所研究市场的成长。

- 另一方面,高昂的製造和研发成本预计将阻碍预测期内下一代先进电池的成长。

- 儘管如此,下一代先进电池製造设施的发展可能会在预测期内为下一代先进电池市场创造利润丰厚的成长机会。

- 亚太地区在市场中占据主导地位,并且在预测期内也可能出现最高的复合年增长率。这一增长得益于消费性电子产品和电动汽车的引入,以及对该地区国家(包括印度、中国和日本)投资的增加。

下一代先进电池市场趋势

交通运输业预计将主导市场

- 交通系统的电气化越来越受欢迎,各种政府指令正在加速电动车的采用,这直接促进了交通领域下一代先进电池的成长。

- 2021年,各大汽车公司宣布,计画通用汽车到2035年停止销售汽油和柴油汽车,奥迪公司到2033年停止生产这类汽车。汽车製造商正竞相实现车辆电动,公司也正在投资先进技术。用于更有效率、更盈利的电动车的电池。

- 2022年4月,本田宣布将在电动和软体技术方面投资398.4亿美元,以在未来10年加速其全球业务。此外,公司还将在北美建造一条全固态电池示范生产线,投资约3.4265亿美元。该投资公司计划与通用汽车合作,到2024年推出两款中型和大型电动车(EV)车型。

- 根据国际能源总署(IEA)的数据,全球电动车保有量从2015年的125万辆增加到2020年的约1,020万辆。 2020年,电池式电动车占电动车的大部分,约685万辆,而插电式电动车约占685万辆。混合动力汽车保有量约335万辆。

- 此外,铝空气电池比传统锂离子电池具有优势,因为铝作为燃料,空气透过电解质与金属反应发电。它的续航里程与汽油动力车相似,能量密度比锂离子电池更高。然而,作为电动车电池能源储存系统,缺乏政府政策支持和汽车製造商的关注来普及。

- 2021年12月,德国汽车製造商宾士宣布将投资1亿美元开发多种电动车。该公司还计划在未来五年内将固态电池技术整合到有限数量的车辆中。梅赛德斯-奔驰计划向电池公司Factial Energy投资数千万美元,该公司正在开发固态电池。

- 日产汽车有限公司将于 2022 年 4 月开始运作其原型生产设施,并计划在 2028 年将迭层固态电池推向市场。这是日产「2030 年雄心」战略的一部分,该战略预计将投资 170 亿美元开发四种新电动车概念。

- 总体而言,汽车製造商正在大力投资固态电池和金属空气电池的开发,使汽车成为下一代先进电池市场的关键领域之一。

亚太地区主导市场

- 截至2021年,亚太地区下一代先进电池技术的潜在市场为中国、印度和日本。

- 截至2022年3月,中国电池能源储存容量已达3GW,较2019年的1.7GW成长76.5%。此外,中国政府预计到2030年将电池储存容量增加到100GW。这种情况为该地区各种下一代先进电池开发商提供了巨大的机会。

- 中国能源储存联盟(CNESA)表示,作为能源储存主要用途的电网辅助服务政策预计将进一步细化,青海、广东、江苏、内蒙古、新疆维吾尔自治区等地区也将制定相关政策。继续。他们说这正在引起轰动。中国能源储存设施的建设与发展。此类政府政策可能会在预测期内增加对先进电池技术的需求。

- 目前,中国正在进行下一代先进电池技术的各种开发计划和投资。 2021年7月,CATL发布了首款新一代钠离子电池及其AB电池组解决方案。在工业部宣布製定此类电池类型标准后,宁德时代将电动车市场转向钠离子电池的努力也得到了中央政府的推动。

- 除了中国场景外,2022年1月,日本国家材料科学研究所(NIMS)和Softbank Corporation公司宣布,锂空气电池的能量密度超过500Wh/kg,显着高于目前的锂离子电池,我们已经开发出电池。调查团队证实,这种电池可以在室温下充电和放电。该团队开发的电池表现出最高的能量密度和最佳的循环寿命性能。这些结果代表了锂空气电池实用化的重要一步。

- 锂空气电池重量轻、容量大,理论能量密度比现有锂离子电池高出数倍,可望有潜力成为终极二次电池。这些潜在的好处可能会导致无人机、电动车和家庭储能係统等各种技术的使用。

- 此外,「印度製造」是印度的一项高度优先运动,并且已经在奖励电动车的生产。汽车电池和网格储存是印度製造业的重点。两轮车、三轮车、小客车和小型客车的电动车市场对价格比对性能更敏感。即使下一代先进电池比性能参数稍高的同类锂离子电池具有价格优势,它们也可能在印度找到比其他地方更好的市场机会,这似乎是有可能的。规模经济的先进电池在印度拥有巨大的市场潜力。

- 印度于 2022 年 3 月核准了四家公司的竞标,以利用 PLI 计划下的先进化学电池 (ACC) 电池储存製造奖励。 Reliance New Energy Solar Limited、Ola Electric Mobility Private Limited、现代环球汽车有限公司和 Rajesh Exports Limited 获得了 181 亿卢比计划的激励,以提高印度当地的电池生产。根据该计划,选定的 ACC 电池製造商预计将在两年内建立生产设施。这种政府支持的奖励预计将为下一代先进电池市场的未来发展创造环境。因此,上述因素预计将在预测期内推动亚太地区下一代先进电池市场的发展。

下一代先进电池产业概述

下一代先进电池市场本质上是适度整合的。市场的主要企业包括(排名不分先后)Sion Power Corporation、Contemporary Amperex Technology、PolyPlus Battery Co. Inc.、GS Yuasa Corporation 和 Saft Groupe SA。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 调查先决条件

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2027 年之前的市场规模与需求预测

- 最新趋势和发展

- 政府政策法规

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 科技

- 固体电解质电池

- 镁离子电池

- 新一代液流电池

- 金属空气电池

- 锂硫电池

- 其他技术

- 最终用户

- 家用电器

- 交通设施

- 工业的

- 能源储存

- 其他最终用户

- 地区

- 北美洲

- 亚太地区

- 欧洲

- 南美洲

- 中东和非洲

第六章 竞争形势

- 併购、合资、合作与协议

- 主要企业采取的策略

- 公司简介

- Pathion Holding Inc.

- GS Yuasa Corporation

- Johnson Matthey PLC

- PolyPlus Battery Co. Inc.

- Ilika PLC

- Sion Power Corporation

- LG Chem Ltd

- Saft Groupe SA

- Contemporary Amperex Technology Co. Ltd

第七章市场机会与未来趋势

The Next Generation Advanced Battery Market size is estimated at USD 1.87 billion in 2024, and is expected to reach USD 2.64 billion by 2029, growing at a CAGR of 7.24% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the long term, the growing demand and increasing adoption of electric vehicles are expected to drive the growth of the market studied.

- On the other hand, high manufacturing and R&D costs are expected to hamper the growth of Next-Generation advanced batteries during the forecast period.

- Nevertheless, the development of manufacturing facilities for next-generation advanced batteries is likely to create lucrative growth opportunities for the Next-Generation advanced battery market in the forecast period.

- Asia-Pacific region dominates the market and is also likely to witness the highest CAGR during the forecast period. This growth is attributed to the increasing investments, coupled with adoption of consumer electronics and electric vechiles in the countries of this region including India, China and Japan.

Next Generation Advanced Battery Market Trends

Transportation Segment Expected to Dominate the Market

- The electrification of the transportation system is gaining popularity, and various government mandates have accelerated the adoption of electric vehicles, which directly aids the growth of next-generation advanced batteries in the transportation sector.

- In 2021, automobile giants announced that General Motors will stop selling petrol and diesel models by 2035, and Audi AG plans to stop producing such vehicles by 2033. The carmakers are rushing to electrify their electric cars, which has led the company to invest in advanced batteries for more efficient and profitable electric vehicles.

- In April 2022, Honda Motors announced that it would invest USD 39.84 billion in electrification and software technologies to accelerate its business globally for the next ten years. It will also build a demonstration production line for all-solid-state batteries in North America, allocating approximately USD 342.65 million. The investment company plans to launch two mid-to-large-scale electric vehicles (EV) models by 2024 with a partnership with General Motors.

- According to the International Energy Agency (IEA), the global electric vehicle stock increased from 1.25 million in 2015 to about 10.2 million in 2020. In 2020, battery-electric vehicles accounted for most of the electric vehicles at about 6.85 million, and plug-in hybrid electric vehicles were about 3.35 million.

- Furthermore, aluminium-air batteries have an advantage over the conventional lithium-ion battery as the aluminium acts as a fuel where air reacts with the metal via an electrolyte to produce power. It has a travel range similar to gasoline-powered cars and a higher energy density than the lithium-ion battery. However, it lacks government policy support and attention from automakers to make it a popular battery energy storage system for electric vehicles.

- In December 2021, Mercedes Benz, a German car manufacturer, announced to invest of USD 100 million in a wide range of electric cars. The company also intends to integrate solid-state battery technology into a limited number of vehicles within the next five years. Mercedes Benz plans to invest tens of millions into Factorial Energy, a battery company to develop solid-state batteries.

- In April 2022, Nissan Motor Company planned to bring laminated solid-state batteries to the market by 2028, with the beginning of a prototype production facility. It is a part of Nissan's Ambition 2030 strategy, plus an investment of USD 17 billion for the four new electric vehicle concepts.

- Overall, automobile manufacturers are investing heavily in developing solid-state batteries and metal-air batteries, making automobiles one of the major sectors of the next-generation advanced battery market.

Asia-Pacific to Dominate the Market

- As of 2021, China, India, and Japan were the potential markets for the next generation advanced battery technology in the Asia-Pacific region.

- As of March 2022, China's battery energy storage capacity reached 3 GW, representing an increase of 76.5% compared to 1.7 GW in 2019. Furthermore, the Chinese Government is expected to increase its battery storage capacity to 100 GW by 2030. Such scenarios are creating vast opportunities for various next-generation advanced battery developers in the region.

- According to the China Energy Storage Alliance (CNESA), the refinement of policy related to grid ancillary services - energy storage's primary application - as well as policy developments in regions including Qinghai, Guangdong, Jiangsu, inner Mongolia, and Xinjiang, have created a wave of energy storage construction and development in China. Such government policies will likely boost the demand for advanced battery technologies during the forecast period.

- At present, various development projects and investments in the next generation advanced battery technologies are happening in China. In July 2021, CATL unveiled the first next-generation sodium-ion battery and its AB battery pack solutions. Also, CATL's quest to shift the electric vehicle market toward a sodium-ion cell received a boost from the central government after the Ministry of Industry and Information Technology announced the creation of standards for such battery types.

- In addition to the scenario in China, in January 2022, Japan's National Institute for Material Science (NIMS) and the Softbank Corp. developed a lithium-air battery with an energy density of over 500Wh/kg-significantly higher than currently lithium-ion batteries. The research team confirmed that this battery could be charged and discharged at room temperature. The battery developed by the team shows the highest energy densities and best cycle life performances. These results signify a major step toward the practical use of lithium-air batteries.

- The lithium-air batteries are expected to have the potential to be the ultimate rechargeable batteries: they are lightweight and high capacity, with theoretical energy densities several times that of currently available lithium-ion batteries. Because of these potential advantages, they may use various technologies, such as drones, electric vehicles, and household electricity storage systems.

- Further, "Make in India" is a high-priority movement for India and has already provided incentives to produce electric cars. Batteries for cars and grid storage are high on the agenda for manufacturing in India. The EV market for two-wheelers, three-wheelers, cars, and minibusses is more price-sensitive than performance sensitive. If the next generation advanced batteries have a price advantage over a comparable lithium-ion battery whose performance parameters are marginally higher, it would still find a better market opportunity in India than elsewhere. The advanced batteries made with economies of scale have huge market potential in India.

- In March 2022, India approved bids for four companies to avail incentives under the PLI Scheme for the Advanced Chemistry Cell (ACC) Battery Storage Manufacturing. Reliance New Energy Solar Limited, Ola Electric Mobility Private Limited, Hyundai Global Motors Company Limited, and Rajesh Exports Limited received incentives under India's INR 181 billion program to boost local battery cell production. Under the scheme, selected ACC battery storage manufacturers were expected to set up a production facility within two years. Such government-supportive incentives are expected to create an environment for the future development of the next generation advanced battery market.

- Therefore, the above-mentioned factors are expected to drive the next-generation advanced battery market in the Asia-Pacific region during the forecast period.

Next Generation Advanced Battery Industry Overview

The next-generation advanced battery market is moderately consolidated in nature. Some of the major players in the market (in no particular order) include Sion Power Corporation, Contemporary Amperex Technology Co. Ltd, PolyPlus Battery Co. Inc., GS Yuasa Corporation, and Saft Groupe SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Solid Electrolyte Battery

- 5.1.2 Magnesium Ion Battery

- 5.1.3 Next-generation Flow Battery

- 5.1.4 Metal-Air Battery

- 5.1.5 Lithium-Sulfur Battery

- 5.1.6 Other Technologies

- 5.2 End User

- 5.2.1 Consumer Electronics

- 5.2.2 Transportation

- 5.2.3 Industrial

- 5.2.4 Energy Storage

- 5.2.5 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Asia-Pacific

- 5.3.3 Europe

- 5.3.4 South America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Pathion Holding Inc.

- 6.3.2 GS Yuasa Corporation

- 6.3.3 Johnson Matthey PLC

- 6.3.4 PolyPlus Battery Co. Inc.

- 6.3.5 Ilika PLC

- 6.3.6 Sion Power Corporation

- 6.3.7 LG Chem Ltd

- 6.3.8 Saft Groupe SA

- 6.3.9 Contemporary Amperex Technology Co. Ltd