|

市场调查报告书

商品编码

1443907

双酚 A (BPA):市场占有率分析、行业趋势和统计、成长预测(2024-2029 年)Bisphenol A (BPA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

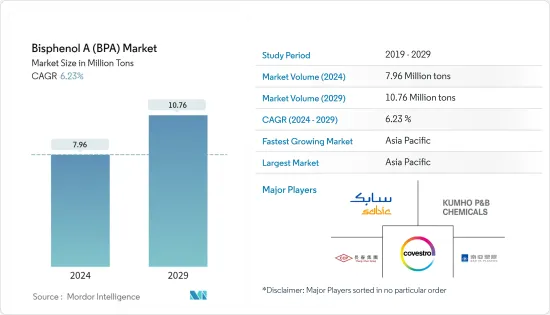

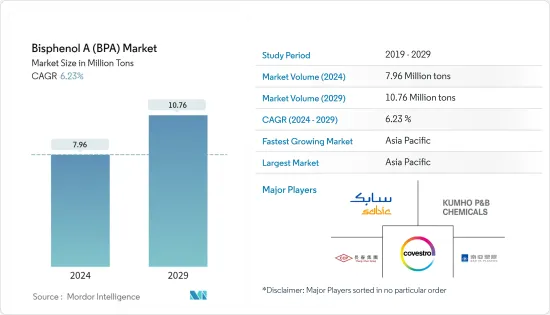

预计2024年双酚A市场规模为796万吨,预计2029年将达到1,076万吨,在预测期间(2024-2029年)复合年增长率为6.23%。

由于建设活动暂停,COVID-19感染疾病影响了油漆和被覆剂、塑胶产品和其他基于双酚 A 的产品的销售。因此,2020年市场受到负面影响。然而,该产业在 2021 年呈现稳定復苏,产量与 COVID-19 之前的感染疾病相似。

主要亮点

- 从中期来看,对聚碳酸酯的强劲需求以及各个最终用户产业对环氧树脂的需求不断增加预计将推动市场成长。

- 然而,环境问题和有关 BPA 使用的法规预计将严重限制市场成长。

- 儘管如此,双酚 A (BPA) 的投资和应用的增加可能很快就会为全球市场创造利润丰厚的成长机会。

- 亚太地区在市场中占据主导地位,预计在预测期内仍将保持最高的复合年增长率。

双酚A市场趋势

聚碳酸酯树脂需求增加

- 聚碳酸酯通常由双酚 A 和碳酰氯在界面过程中反应形成。在所有应用中,聚碳酸酯树脂应用提供了双酚A(BPA)的主要市场需求。

- 双酚 A 是聚碳酸酯饮料瓶和容器的结构成分。聚碳酸酯也广泛用于建筑和施工应用。聚碳酸酯板在各种天窗和窗户应用中用作玻璃的替代品。它们也用作不透明覆层板、拱形穹顶、檐篷、半透明墙壁、建筑幕墙和标誌、体育场屋顶、百叶窗和屋顶圆顶。

- 在所有应用中,聚碳酸酯树脂提供了双酚A的主要市场需求,占全球70%以上的份额。

- 聚碳酸酯是一种高性能热塑性塑料,广泛用于建筑和施工应用。聚碳酸酯板在各种天窗和窗户应用中用作玻璃的替代品。它们也用作不透明覆层板、拱形穹顶、檐篷、半透明墙壁、建筑幕墙和标誌、体育场屋顶、百叶窗和屋顶圆顶。

- 据科思创称,聚碳酸酯的需求量从2020年的420万吨增加到2021年的450万吨。

- 近年来,聚碳酸酯材料在温室中的应用显着增加。德国、荷兰、西班牙、法国等欧洲国家温室种植面积较大。

- 聚碳酸酯比玻璃更耐用,并具有更好的光扩散、绝缘性、更多的设计选择以及多种颜色等特性,使其成为各种商业和工业应用中玻璃材料的替代品。

- 聚碳酸酯市场的主要企业包括科思创股份公司、SABIC、三菱工程塑胶有限公司、乐天化学有限公司、帝人有限公司等。两家公司都在併购和业务扩张方面投入巨资,预计将增加聚碳酸酯中双酚的需求。

- 2022 年 5 月,沙乌地基础工业公司 (SABIC) 宣布其位于中国天津年产能 26 万吨的聚碳酸酯生产基地启动预试运行活动。

- 2022年3月,科思创股份公司在印度新德里附近的大诺伊达工厂启动了两条聚碳酸酯复合生产线,以满足复合塑胶不断增长的需求,特别是汽车、电气和电子产业。预计这些因素将影响预测期内聚碳酸酯应用中双酚 A 的需求。

预计亚太地区将主导市场

- 亚太地区是各终端用户产业中最大的双酚A生产国和消费国。因此,预计它将主导市场。

- 中国是全球最大的电子产品生产基地。智慧型手机、电视、电线、电缆、可携式运算设备、游戏系统和其他个人电器产品。

- 预计2022年中国消费电器产品产业收益将达2,514亿美元。预计收益将以每年2.04%的速度成长,到2025年市场规模将达到2,660.6亿美元。

- 由于中国将在2022年成为最大的电动车消费国,中国电动车销量的增加预计将推动中国聚碳酸酯市场的发展。因此,中国电动车销量的增加预计将推动中国聚碳酸酯市场的发展。

- 根据OICA统计,2021年中国汽车产量为268222亿辆,年增3%。

- 印度对聚碳酸酯的需求可能会增加,因为印度可能在未来七年内投资约 1.3 兆美元用于住宅建设,建造 6,000 万套新住宅。 2021 财年,基础建设活动占 FDI 流入总额 817.2 亿美元的 13%。

- 2021年日本电子产业总产值中,电子零件和设备约占7.25兆日圆(5,300亿美元)。

- 这些因素对市场产生重大影响。然而,在预测期内,该地区各最终用户产业的 BPA 消费量预计将增加。

双酚A行业概况

双酚 A (BPA) 市场得到整合,前五名公司在全球生产中占据主导地位,并在 2021 年占据重要份额。该市场的主要企业包括(排名不分先后)科思创股份公司、长春集团、南亚塑胶公司、锦湖 P&B 化学公司和 SABIC。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 对聚碳酸酯塑胶的强劲需求

- 各个最终用户产业对环氧树脂的需求不断增长

- 抑制因素

- 有关 BPA 使用的环境问题和法规

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

- 原料分析

- 技术简介

- 贸易分析

- 价格分析

- 监理政策分析

第五章市场区隔

- 目的

- 聚碳酸酯树脂

- 环氧树脂

- 不饱和聚酯树脂

- 阻燃剂

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率分析

- 主要企业采取的策略

- 公司简介

- Chang Chun Group

- Covestro AG

- Dow

- Hexion

- Kumho P&B Chemicals Inc.

- LG Chem

- Lihuayi Weiyuan Chemical Co. Ltd

- Merck KGaA

- Mitsubishi Chemical Corporation

- Mitsui Chemical Inc.

- NAN YA PLASTICS Industry Co. Ltd

- Nantong Stars Synthesize Material Ltd

- NIPPON STEEL Chemical &Material Co. Ltd

- PTT Phenol Company Limited

- SABIC

- Samyang Holdings Corporation

- Shanghai Sinopec Mitsui Chemicals Co. Ltd

- Sinopec Mitsubishi Chemical Polycarbonate(Beijing)Co. Ltd

第七章市场机会与未来趋势

- 增加双酚A(BPA)的投资与应用

The Bisphenol A Market size is estimated at 7.96 Million tons in 2024, and is expected to reach 10.76 Million tons by 2029, growing at a CAGR of 6.23% during the forecast period (2024-2029).

The COVID-19 pandemic has affected the sales of paints and coatings, plastic products, and other bisphenol A-based products, as construction activities were halted. Therefore, the market was negatively impacted in 2020. However, the industry witnessed a steady recovery in 2021 and the production is similar to the pre-COVID-19 period.

Key Highlights

- In the medium term, strong demand for polycarbonate and rising demand for epoxy resins from various end-user industries, are likely to drive the market's growth.

- However, environmental concerns and regulations on the usage of BPA are expected to majorly restrain the market's growth.

- Nevertheless, the rising investments and applications of bisphenol A (BPA) likely to create lucrative growth opportunities for the global market soon.

- The Asia-Pacific region is expected to dominate the market and register the highest CAGR during the forecast period.

Bisphenol-A Market Trends

Increasing Demand for Polycarbonate Resins

- Polycarbonate is commonly formed with the reaction of bisphenol A with carbonyl chloride in an interfacial process. Among all other applications, polycarbonate resins application provides the major market demand for bisphenol A (BPA).

- Bisphenol A is a structural component in polycarbonate-based beverage bottles and containers. Polycarbonates are also widely used in building and construction applications. Polycarbonate sheets are used as a substitute for glass in a variety of skylight and window applications. They are also used as opaque cladding panels, barrel vaults, canopies, translucent walls, facades and signage, sports stadium roofs, louvers, and roof domes.

- Among all other applications, polycarbonate resins provide the major market demand for BPA, with more than 70% of the global share.

- Polycarbonates are a high-performing thermoplastic widely used in building and construction applications. Polycarbonate sheets are used as a substitute for glass in a variety of skylight and window applications. They are also used as opaque cladding panels, barrel vaults, canopies, translucent walls, facades and signage, sports stadium roofs, louvers, and roof domes.

- According to Covestro, the demand for polycarbonates grew to 4.5 million tonnes in 2021 from 4.2 million tonnes in 2020.

- Recently, the application of polycarbonate materials highly increased in greenhouses. European countries, such as Germany, the Netherlands, Spain, and France, have larger areas for greenhouse cultivation.

- Polycarbonate with its properties including more durability than glass, greater light diffusion, insulation, more design options, and a variety of colors replaces glass materials in a variety of commercial and industrial uses.

- Some of the major companies in the polycarbonate market include Covestro AG, SABIC, Mitsubishi Engineering-Plastics Corporation, LOTTE Chemical CORPORATION, TEIJIN LIMITED, and others. The companies are investing heavily in mergers, acquisitions, and expansion, which are expected to boost the demand for bisphenol in polycarbonates, for instance,

- In May 2022, Saudi Basic Industries Corporation (SABIC) announced the startup of pre-commissioning activities at a polycarbonate production complex in Tianjin, China, with an annual capacity of 260,000 metric tons per year.

- In March 2022, Covestro AG started two polycarbonate compounding production lines at its Greater Noida plant near New Delhi in India to meet the growing demand for compounded plastics, particularly for the automotive and electrical, and electronics industries.

- Therefore, such factors are expected to affect the demand for bisphenol A in polycarbonate applications over the forecast period.

Asia-Pacific is Expected to Dominate the Market

- The Asia-Pacific region is the largest producer and consumer of bisphenol-A in various end-user industries. Thus, it is expected to dominate the market.

- China is the largest base for electronics production in the world. Electrical and Electronic products, such as smartphones, TVs, wires, cables, portable computing devices, gaming systems, and other personal electronic devices recorded the highest growth in the consumer electronics segment.

- China's revenue in the consumer electronics segment is projected to be USD 251.40 billion in 2022. The revenue is expected to show an annual growth rate of 2.04%, resulting in a projected market volume of USD 266.06 billion by 2025.

- China is the largest consumer of electric vehicles in 2022 Thus, increased electric vehicle sales in China are estimated to drive the polycarbonate market in China. Thus, increased electric vehicle sales in China are estimated to drive the polycarbonate market in China.

- According to OICA, in 2021 china produced 26082.22 billion vehicles, an increase of 3% compared to the same period last year.

- The demand for polycarbonate in India is likely to increase as the country may witness an investment of around USD 1.3 trillion in housing over the next seven years for the construction of 60 million new homes. In FY21, infrastructure activities accounted for a 13% share of the total FDI inflows of USD 81.72 billion.

- Electronic components and devices accounted for about YEN 7.25 trillion(USD 0.53 trillion) of the total production value of the electronics industry in Japan in 2021.

- Such factors are significantly impacting the market. However, the consumption of BPA in the region is expected to increase in various end-user industries during the forecast period.

Bisphenol-A Industry Overview

The bisphenol A (BPA) market is consolidated, and the top five players dominated global production with a significant share in 2021. Some of the key players (not in any particular order) in the market include Covestro AG, Chang Chun Group, Nan Ya Plastics Corporation, Kumho P&B Chemicals Inc., and SABIC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Strong Demand for Polycarbonate Plastics

- 4.1.2 Rising Demand for Epoxy Resins from Various End-user Industries

- 4.2 Restraints

- 4.2.1 Environmental concerns and regulations on the usage of BPA

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Feedstock Analysis

- 4.6 Technological Snapshot

- 4.7 Trade Analysis

- 4.8 Price Analysis

- 4.9 Regulatory Policy Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Polycarbonate Resins

- 5.1.2 Epoxy Resins

- 5.1.3 Unsaturated Polyester Resins

- 5.1.4 Flame Retardants

- 5.1.5 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 ASEAN Countries

- 5.2.1.6 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Spain

- 5.2.3.6 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chang Chun Group

- 6.4.2 Covestro AG

- 6.4.3 Dow

- 6.4.4 Hexion

- 6.4.5 Kumho P&B Chemicals Inc.

- 6.4.6 LG Chem

- 6.4.7 Lihuayi Weiyuan Chemical Co. Ltd

- 6.4.8 Merck KGaA

- 6.4.9 Mitsubishi Chemical Corporation

- 6.4.10 Mitsui Chemical Inc.

- 6.4.11 NAN YA PLASTICS Industry Co. Ltd

- 6.4.12 Nantong Stars Synthesize Material Ltd

- 6.4.13 NIPPON STEEL Chemical & Material Co. Ltd

- 6.4.14 PTT Phenol Company Limited

- 6.4.15 SABIC

- 6.4.16 Samyang Holdings Corporation

- 6.4.17 Shanghai Sinopec Mitsui Chemicals Co. Ltd

- 6.4.18 Sinopec Mitsubishi Chemical Polycarbonate (Beijing) Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Investments and Applications of Bisphenol A (BPA)