|

市场调查报告书

商品编码

1443908

实验室化学品:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Laboratory Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

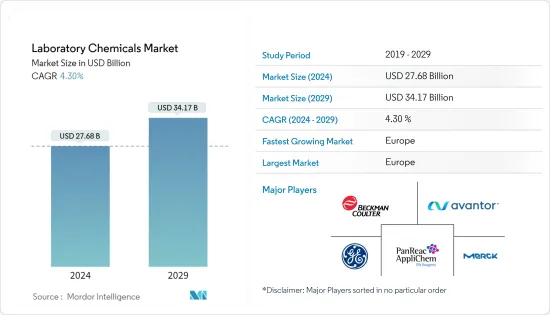

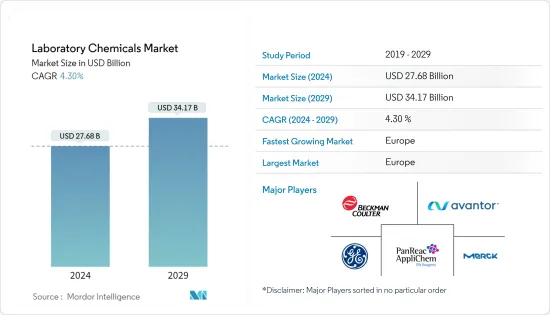

实验室化学品市场规模预计到 2024 年为 276.8 亿美元,预计到 2029 年将达到 341.7 亿美元,在预测期内(2024-2029 年)增加 43 亿美元,复合年增长率为 %。

冠状病毒感染疾病(COVID-19)的爆发对2020年的市场产生了负面影响。然而,自那时以来,市场已达到疫情前的水平,预计在预测期内将稳定成长。

主要亮点

- 实验室化学品市场是由生物和化学科学领域的研发活动的增长以及污水处理中的使用量的增加所推动的。

- 然而,实验室化学品替代品的可用性可能会阻碍市场成长。

- 细胞培养、重组 DNA、生物疗法和奈米材料开发等技术的进步预计将成为未来的市场机会。

- 由于研发活动的增加,预计欧洲地区将主导市场。

实验室化学品市场趋势

工业应用展现出更高的成长潜力

- 实验室化学品广泛用于各种工业製程,从溴化到许多低温反应。

- 最常见的实验室化学过程包括酰氯製备、羧基化、离子交换反应、硝化、Suzuki 偶联和 Williamson 醚合成。

- 这些化学物质对于生产各种商业产品的结晶和蒸馏过程至关重要。

- 农业产量的增加增加了全球市场对硫酸的需求。到 2026 年,最不开发中国家的可用热量预计将达到平均每天 2,450 大卡,其他新兴国家将超过 3,000 大卡。预计这将增加全球市场对作物的需求,进而可能增加对农业研究的需求,并增加化学製造中对实验室化学品的需求。

- 目前,美国拥有全球最大的医疗设备产业。根据美国商务部国际贸易管理局 (ITA) 的 SelectUSA 计划,该国的医疗设备医疗设备是全球最大的,估计价值 1,560 亿美元。

- 根据美国公布的资料。根据 CMS 的数据,医疗保健支出预计在预测期内将大幅增加。

- 为了职业安全、职业安全和事故预防,研发部门不断增加投资,以开发永续对环境风险较小的新化学品。因此,由于工业部门需求的成长,实验室化学品的需求预计也会增加。

欧洲地区预计将主导市场

- 多年来,义大利工业发生了巨大变化,变得更加面向国际市场并更具竞争力。

- 义大利拥有世界上最大的化学品市场之一。该国的化学品收入在欧盟排名第三,占该地区化学品销售额的11%以上。义大利不仅是主要的化学品生产国,也是国际主要的化学品出口国。

- 其重点主要集中在中高技术领域(製药、机械、化工等)。即使在传统领域,义大利工业也非常注重创新,专利申请的快速成长就证明了这一点。

- 近年来,义大利医药工业在生产、投资和贸易方面都有显着成长。 CDMO(合约开发製造组织)是义大利製药业的主要结构,它透过将生产阶段外包给第三方设施来实现产量的高速成长。

- 德国医药市场被世界领先的医药製造公司视为最有前途的子部门,这些公司正在向德国扩张,以巩固其在全球市场的地位。例如,2022年8月,全球重要製药公司拜耳投资2.8698亿美元在其位于德国勒沃库森的工厂开发Solida-1药品生产设施。该工厂计划于 2024 年开始运作,专注于生产治疗癌症和心血管疾病的药物。

- 爱尔兰是着名的製药中心,占全球药品产量的 5% 以上。爱尔兰製药业多年来的发展以世界上最大的九家製药公司的存在为标誌,其中爱尔兰能够生产世界销售额前十名的製药公司中的七家。此外,该产业还受惠于 10 年间投资约 80 亿美元建设新设施。

- 义大利有超过5000家製药公司,主要企业包括Menarini、Chiesi、Angelini、Bracco、Recordati和Alfasigma。为因应市场需求的逐步持续成长,这些企业近十年来维持产值持续成长。

- 受惠于税收优惠,义大利製造业开始维修各类生产工厂,尤其是与工业4.0技术相关的工厂。所有这些发展预计将在预测期内增加对实验室化学品的需求。

实验室化学品行业概况

由于全球和本地公司的存在,实验室化学品市场预计将部分分散。实验室化学品市场公认的主要公司包括(排名不分先后)ITW Reagents Division、Merck KGaA、Beckman Coulter Inc.、General Electric 和 Avantor Inc. 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 扩大生物和化学领域的研发活动

- 污水处理用量增加

- 其他司机

- 抑制因素

- 实验室化学品替代品的可用性

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔

- 类型

- 分子生物学

- 细胞激素和趋化素测试

- 碳水化合物分析

- 免疫化学

- 细胞/组织培养

- 环境测试

- 生物化学

- 其他类型

- 目的

- 工业的

- 学术/教育

- 政府

- 医疗保健(製药)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业采取的策略

- 公司简介

- Avantor Inc.

- BD BioScience

- Beckman Coulter Inc.

- BiosYnth SRL

- Carlo Erba Reagents SRL

- GE Healthcare

- ITW Reagents Division

- Merck KGaA

- Meridian Life Science Inc.

- Mitsubishi Rayon Co. Ltd

- Morphisto GmbH

- PerkinElmer Inc.

- R&D Systems

- Sigma-Aldrich Corp.

- UJIFILM Wako Chemicals

第七章市场机会与未来趋势

- 细胞培养、重组DNA和生物治疗等技术的进步

- 增加奈米材料开发的研究活动

The Laboratory Chemicals Market size is estimated at USD 27.68 billion in 2024, and is expected to reach USD 34.17 billion by 2029, growing at a CAGR of 4.30% during the forecast period (2024-2029).

The COVID-19 outbreak negatively impacted the market in 2020. However, the market has since reached pre-pandemic levels and is expected to grow steadily during the forecast period.

Key Highlights

- The laboratory chemicals market is driven by growing R&D activities in the field of biological and chemical sciences and increasing usage in wastewater treatment.

- However, the availability of substitutes for laboratory chemicals is likely to hinder the market's growth.

- Advancements in technologies, such as cell culture, recombinant DNA, and biotherapeutics, and the development of nanomaterials are projected to act as an opportunity for the market in the future.

- Due to increasing research and development activities, Europe region is expected to dominate the market.

Laboratory Chemicals Market Trends

Industrial Application to Witness the Higher Potential Growth

- Laboratory chemicals are extensively used in various industrial processes, ranging from bromination to numerous cryogenic reactions.

- Some of the most common laboratory chemical processes include acid chloride preparations, carboxylation, ion-exchange reactions, nitration, Suzuki coupling, and Williamson's ether synthesis.

- These chemicals are essential to manufacture various commercial products in re-crystallization and distillation processes.

- Increasing agricultural output is boosting the demand for sulphuric acid in the global market. By 2026, calorie availability is projected to reach 2,450 kcal on average in least-developed countries and exceed 3,000 kcal per day in other developing countries. This is expected to increase the demand for crops in the global market, which, in turn, may increase the demand for agricultural research, thus, driving up the need for laboratory chemicals in chemical manufacturing.

- Currently, the United States is the largest medical device industry in the world. According to SelectUSA, a program by The International Trade Administration (ITA), US Department of Commerce, the medical devices market in the country is the largest medical devices market in the world, which is valued at USD 156 billion and is estimated to reach USD 208 billion by 2023.

- As per data published by the United States; CMS (Office of the Actuary), healthcare expenditure is expected to increase significantly during the forecast period.

- Occupational and industrial safety and disaster prevention have led to increasing investments in the R&D department to formulate new chemicals that are equally sustainable and less hazardous to the environment.

- Hence, growing demand from the industrial sector is expected to increase the demand for laboratory chemicals.

Europe Region is Expected to Dominate the Market

- The Italian industry has changed significantly over the years, orienting itself toward international markets and strengthening its competitiveness.

- Italy has one of the world's largest chemical marketplaces. The country has the third-largest chemical revenue in the European Union, accounting for above 11% of regional chemical sales. Aside from being a major chemical producer, Italy is also a major chemical exporter internationally.

- Its focus has been mainly on medium to high-technology sectors (such as pharmaceuticals, mechanics, and the chemical industry). Even in the traditional sectors, the Italian industry focused on strong innovation, as evidenced by the sharp increase in patent applications.

- The Italian pharmaceutical industry has grown considerably in production, investments, and trade over recent years. CDMO (Contract Development Manufacturing Organization) is the main structure of the Italian pharmaceutical industry, which functions by outsourcing production stages to third-party facilities, thereby enabling high production growth.

- The pharmaceutical market in Germany is identified as a top-prospect sub-sector by world-leading pharmaceutical manufacturing companies, which are expanding into the country to strengthen their position in the global market. For instance,

- In August 2022, the critical global pharmaceutical player, Bayer, is undergoing the development of the Solida-1 pharmaceutical production facility at its site in Leverkusen in, Germany, for an investment of USD 286.98 million. The facility, which is expected to come on stream in 2024, shall be dedicated to producing drugs for treating cancer and cardiovascular diseases.

- Ireland is a prominent pharmaceutical location contributing to more than 5% of global pharmaceutical production. The growth in Ireland's pharmaceutical sector over the years is marked by the presence of 9 of the world's largest pharmaceutical companies, enabling the country to produce 7 of the top 10 selling drugs globally. Further, the sector has benefitted from around USD 8 billion investment in setting up new facilities over the 10 years.

- Italy boasts over 5,000 pharmaceutical companies, with top players including Menarini, Chiesi, Angelini, Bracco, Recordati, and Alfasigma, among others. Responding to the gradual and continuous rise in market demand, these companies have maintained continued growth in production value through the last decade.

- The Italian manufacturing sector has started renovating various production plants, particularly concerning Industry 4.0 technologies, supported by tax incentives.

- All such developments are expected to boost the demand for laboratory chemicals during the forecast period.

Laboratory Chemicals Industry Overview

The laboratory chemicals market is estimated to be partially fragmented, with the presence of global and local players. Major recognized players in the laboratory chemicals market (not in any particular order) include ITW Reagents Division, Merck KGaA, Beckman Coulter Inc., General Electric, and Avantor Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing R&D Activities in the Field of Biological and Chemical Sciences

- 4.1.2 Increasing Usage in Wastewater Treatment

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Substitutes for Laboratory Chemicals

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Molecular Biology

- 5.1.2 Cytokine and Chemokine Testing

- 5.1.3 Carbohydrate Analysis

- 5.1.4 Immunochemistry

- 5.1.5 Cell/Tissue Culture

- 5.1.6 Environmental Testing

- 5.1.7 Biochemistry

- 5.1.8 Other Types

- 5.2 Application

- 5.2.1 Industrial

- 5.2.2 Academia/Educational

- 5.2.3 Government

- 5.2.4 Healthcare (Pharmaceutical)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Avantor Inc.

- 6.4.2 BD BioScience

- 6.4.3 Beckman Coulter Inc.

- 6.4.4 BiosYnth SRL

- 6.4.5 Carlo Erba Reagents SRL

- 6.4.6 GE Healthcare

- 6.4.7 ITW Reagents Division

- 6.4.8 Merck KGaA

- 6.4.9 Meridian Life Science Inc.

- 6.4.10 Mitsubishi Rayon Co. Ltd

- 6.4.11 Morphisto GmbH

- 6.4.12 PerkinElmer Inc.

- 6.4.13 R&D Systems

- 6.4.14 Sigma-Aldrich Corp.

- 6.4.15 UJIFILM Wako Chemicals

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancement in Technologies, such as Cell Culture, Recombinant DNA, and Biotherapeutics

- 7.2 Increasing Research Activities for Development of Nanomaterials