|

市场调查报告书

商品编码

1443909

邻苯二甲酐:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Phthalic Anhydride - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

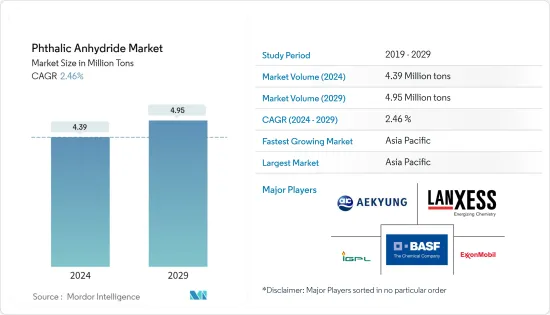

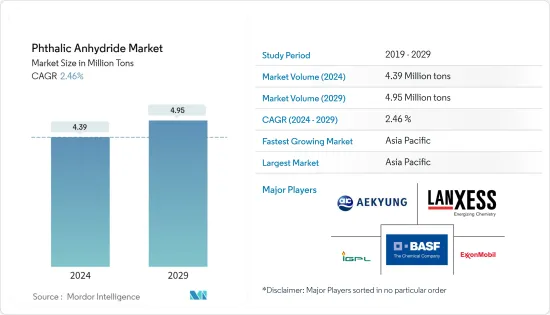

2024年邻邻苯二甲酐市场规模预估为439万吨,预估至2029年将达495万吨,在预测期间(2024-2029年)复合年增长率为2.46%。

由于 COVID-19 爆发、世界各地的国家封锁、製造活动和供应链中断以及生产停顿,市场在 2020 年受到负面影响。然而,情况在 2021 年开始復苏,恢復了预测期内市场的成长轨迹。

主要亮点

- 从中期来看,亚太地区建设活动的增加可能会在预测期内刺激邻苯二甲酐市场。

- 另一方面,邻苯二甲酸酯毒性的有害影响和邻邻苯二甲酐的生物基替代品的开发可能会阻碍市场成长。

- 玻璃纤维增强聚合物的使用增加和邻苯二甲酐衍生物产能的扩大预计将成为未来的市场机会。

邻苯二甲酐市场趋势

醇酸树脂成为成长最快的应用之一

- 从应用来看,醇酸树脂约占全球邻邻苯二甲酐市场的20%。邻苯二甲酐被认为是用于生产醇酸树脂油漆和涂料的主要参考树脂。

- 醇酸树脂是透过将多效价醇与二酸或其酸酐加热而生产的。醇酸涂料是全球消费量最多的涂料。有短油、中油、长油和超长油醇酸树脂可供选择。长油醇酸树脂对木材具有优异的渗透性。因此,它适用于木材着色剂。

- 此外,这些树脂也广泛用于生产高性能材料,例如溶剂型建筑涂料。以顺丁烯二酸酐和顺丁烯二酸酐改质长油醇酸树脂可製备具有优良防腐蚀性能的油漆和邻苯二甲酐。

- 2021年9月,艾仕得宣布在中国北部吉林省吉林市开始兴建最先进的涂料工厂。新工厂占地 46,000平方公尺,将生产轻型汽车、商用车和汽车塑胶零件的移动涂料。

- 2021年5月,PPG宣布完成对其位于中国嘉定的油漆和涂料工厂的1,300万美元投资,包括8条新的粉末涂料生产线和扩建的粉末涂料技术中心。此次扩建将使该厂的产能每年增加8,000多吨。

- 由于油漆和涂料行业的兴起,新兴经济体醇酸树脂的消费量增加等因素正在增加对邻苯二甲酐市场的需求。

亚太地区主导市场

- 中国和印度是亚太地区最大的邻邻苯二甲酐消费国,受多种因素影响,预计未来几年需求将进一步增加。

- 由于萘价格下降和生产营运成本降低,这些国家也增加邻苯二甲酐的产能。

- 根据ITC贸易地图,韩国是最大的邻邻苯二甲酐出口国,出口量为178,000。相较之下,印度是最大的进口国,进口量为13.27万吨,其次是中国,进口量为4.7万吨。

- 根据塑胶出口促进委员会(PLEXCONCIL)统计,2021年4月至6月印度塑胶出口总额为34.17亿美元(累计),而2020年4月至6月为22.11亿美元,成长了55%。

- 此外,在全球范围内,中国已成为最大的塑胶消费国。根据中国国家统计局数据,塑胶製品产量从2021年11月的732万吨增加至2021年12月的约795万吨,邻苯二甲酐市场规模扩大。

- 此外,2021年11月,亚洲涂料宣布计画在印度古吉拉突邦工厂投资1.27亿美元,未来两到三年内将涂料产能从13万吨扩大到25万吨。

- 亚太地区也是最大的汽车製造地,占全球近60%的生产份额。根据OICA统计,2021年前9个月汽车总产量为3,267万辆,较去年同期成长11%。

- 因此,预计上述因素将在预测期内推动各种应用的邻邻苯二甲酐的消费。

邻苯二甲酐行业概况

邻苯二甲酐市场分散,拥有大量全球和本地参与者。邻苯二甲酐市场的主要企业(排名不分先后)包括IG Petrochemicals Limited、朗盛、爱敬化学、埃克森美孚公司、BASF公司等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 亚太地区建设活动呈上升趋势

- 其他司机

- 抑制因素

- 邻苯二甲酸酯毒性的有害影响

- 邻苯二甲酐的生物基替代品的开发

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

- 技术简介

- 进出口趋势

- 价格趋势

第五章市场区隔

- 目的

- 塑化剂

- 醇酸树脂

- 不饱和聚酯树脂

- 其他用途(阻燃剂、杀虫剂)

- 最终用户产业

- 车

- 电气和电子

- 油漆和涂料

- 塑胶

- 其他最终用户产业(化学、农业)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业采取的策略

- 公司简介

- AEKYUNG CHEMICAL Co. Ltd

- BASF SE

- Exxon Mobil Corporation

- IG Petrochemicals Ltd.

- Koppers Inc.

- LANXESS

- MITSUBISHI GAS CHEMICAL COMPANY INC.

- NAN YA PLASTICS CORPORATION

- Polynt

- Stepan Company

- Merck KGaA

- EMCO Dyestuff

- Perstorp

- Thirumalai Chemicals Ltd

第七章市场机会与未来趋势

The Phthalic Anhydride Market size is estimated at 4.39 Million tons in 2024, and is expected to reach 4.95 Million tons by 2029, growing at a CAGR of 2.46% during the forecast period (2024-2029).

Due to the COVID-19 outbreak, nationwide lockdown around the globe, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory during the forecast period.

Key Highlights

- In the medium term, the increasing construction activities in Asia-Pacific are likely to stimulate the phthalic anhydride market in the forecast period.

- On the other hand, the harmful effects of phthalates due to their toxicity and the development of bio-based alternatives to phthalic anhydride are likely to hinder the market growth.

- Increasing use of glass fiber-reinforced polymers and capacity expansion for phthalic anhydride derivatives are projected to act as an opportunity for the market in the future.

Phthalic Anhydride Market Trends

Alkyd Resin to Emerge as One of the Fastest-growing Applications

- By application, alkyd resins contribute to approximately 20% of the global phthalic anhydride market. Phthalic anhydride has been considered a major reference resin used to manufacture alkyd resin-based paints and coatings.

- Alkyd resins are produced by heating polyhydric alcohols with diacids or their anhydrides. The alkyd coatings are the most highly consumed coatings across the world. They can be available as short-oil, medium-oil, long-oil, and ultra-long alkyd resins. Long-oil alkyd resins have good wood penetration properties. Thus, they are suitable for wood stains.

- Moreover, these resins are widely used to produce high-performance materials, like solvent-based architectural coatings. Paints and coatings, with excellent anti-corrosive properties, can be prepared by long-oil alkyd resins that are modified with maleic anhydride and phthalic anhydride.

- In September 2021, Axalta announced that it broke ground to construct a state-of-the-art coatings facility in Jilin City, Jilin Province, North China. The 46,000-square-meter new plant will produce mobility coatings for light vehicles, commercial vehicles, and automotive plastic components.

- In May 2021, PPG announced the completion of a USD 13 million investment in its Jiading, China, paint and coatings facility, including eight new powder coating production lines and an expanded Powder Coatings Technology Center. The expansion will increase the plant's capacity by more than 8,000 metric tons annually.

- Factors, such as the growing consumption of alkyd resins in developing economies due to the rising paints and coatings industry, increase the demand for the phthalic anhydride market.

Asia-Pacific Region to Dominate the Market

- China and India are the largest consumers of phthalic anhydride in the Asia-Pacific region, and the demand is expected to grow further, in the coming years, due to several factors.

- With decreasing prices of naphthalene and low operating costs involved in the production, the manufacturing capacity of phthalic anhydride is also increasing in these countries.

- According to the ITC trade map, South Korea is the largest exporter of phthalic anhydride, exporting 178 thousand tons. In contrast, India is the largest importer with an import quantity of 132.7 thousand tons, followed by China with 47 thousand tons.

- According to The Plastics Export Promotion Council (PLEXCONCIL), India's plastics export increased by 55% to USD 3,417 million (cumulative value) in April-June 2021 compared to USD 2,211 million in April-June 2020.

- Additionally, China is the largest consumer of plastics in the global scenario. According to the National Bureau of Statistics of China, about 7.95 million metric tons of plastic products were produced in December 2021, compared with 7.32 million metric tons in November 2021, thus augmenting the phthalic anhydride market.

- Furthermore, in November 2021, Asian Paints announced plans to invest USD 127 million in the Gujarat plant, India, to expand paints manufacturing capacity from 130,000 kilo liters to 250,000 kilo tons in the next two to three years.

- Also, the Asia-Pacific region is the largest automotive manufacturing hub, registering almost 60% production share of the world. According to OICA, in the first nine months of 2021, the total production of vehicles stood at 32.67 million units, an increase of 11% compared to the same period last year.

- Hence, the aforementioned factors are expected to drive the consumption of phthalic anhydride for various applications during the forecast period.

Phthalic Anhydride Industry Overview

The phthalic anhydride market is fragmented, with a large number of global and local players. The major players (not in any particular order) in the phthalic anhydride market are I G Petrochemicals Limited, LANXESS, Aekyung Chemical Co. Ltd, ExxonMobil Corporation, and BASF SE, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Construction Activities in Asia-Pacific

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Harmful Effects of Phthalates Due to Its Toxicity

- 4.2.2 Development of Bio-based Alternatives for Phthalic Anhydride

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Technological Snapshot

- 4.6 Import and Export Trends

- 4.7 Price Trends

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Plasticizers

- 5.1.2 Alkyd Resins

- 5.1.3 Unsaturated Polyester Resins

- 5.1.4 Other Applications (fire retardant, insecticides)

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Electrical and Electronics

- 5.2.3 Paints and Coatings

- 5.2.4 Plastics

- 5.2.5 Other End-user Industries (chemical, agriculture)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AEKYUNG CHEMICAL Co. Ltd

- 6.4.2 BASF SE

- 6.4.3 Exxon Mobil Corporation

- 6.4.4 I G Petrochemicals Ltd.

- 6.4.5 Koppers Inc.

- 6.4.6 LANXESS

- 6.4.7 MITSUBISHI GAS CHEMICAL COMPANY INC.

- 6.4.8 NAN YA PLASTICS CORPORATION

- 6.4.9 Polynt

- 6.4.10 Stepan Company

- 6.4.11 Merck KGaA

- 6.4.12 EMCO Dyestuff

- 6.4.13 Perstorp

- 6.4.14 Thirumalai Chemicals Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Use of Glass Fiber-reinforced Polymers