|

市场调查报告书

商品编码

1443922

钽:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Tantalum - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

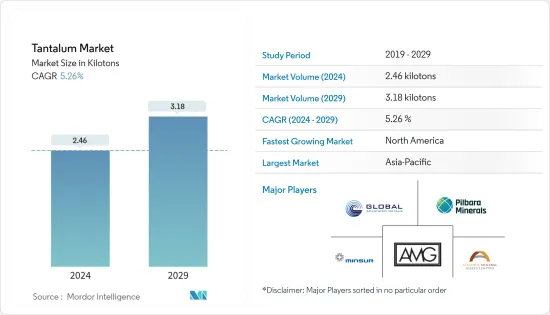

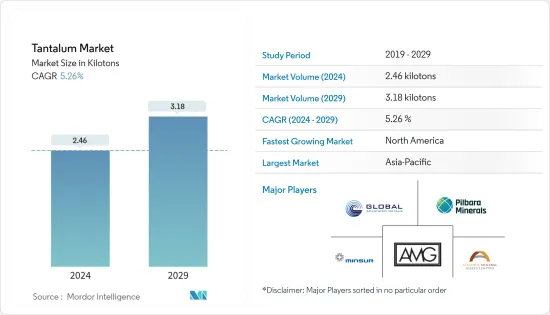

预计 2024 年钽市场规模为 2,460 吨,预计到 2029 年将达到 3,180 吨,在预测期内(2024-2029 年)复合年增长率为 5.26%。

COVID-19 大流行袭击了全球钽市场,终端用户产业受到严重影响。然而,该行业看到电气行业的成长有所改善,这将支持市场开拓。钽市场已从疫情中恢復并正在显着成长。

主要亮点

- 从短期来看,电气和电子行业的成长以及钽合金在航空和燃气涡轮机中的广泛使用预计将在整个预测期内推动市场成长。

- 以聚合物钽电容器取代固体电容器预计将成为所研究市场的一个机会。

- 另一方面,钽的有害影响和终端用户行业需求下降正在阻碍市场成长。

- 亚太地区主导全球市场,中国和韩国等国家是最大的消费国。

钽市场趋势

电容器领域预计将占据较大份额

- 钽电解电容器以钽(Ta)金属为阳极材料製成,依阳极结构不同可分为箔式和钽粉烧结式。钽粉烧结钽电容器依电解质的差异分为固体电解质钽电容器和非固体电解质钽电容器。钽电解电容器的外壳上有CA标誌,但电路上的符号与其他电解电容器相同。

- 钽电解电容器广泛应用于通讯、电脑、航太、军事以及先进电子系统和可携式数位产品。

- 钽电解电容器由非常细的钽粉製成,氧化钽薄膜的介电常数高于氧化铝薄膜的介电常数,从而导致单位体积的电容量较高。

- 钽电解电容器在摄氏 -50 至 100 度之间的温度下运作良好。电解电容器工作在这个范围内,但其电气性能不如钽电解电容器。

- 钽电解电容器上的钽氧化膜不仅耐腐蚀,还能长期保持良好的性能。

- 根据电子情报技术产业协会(JEITA)统计,2021年全球电脑及资讯终端设备出口额达3,780.97亿日圆(约28.6295万美元),成长106.5%。预计未来几年这一数字将进一步增长,从而增加对钽市场的需求。

- 此外,ZVEI 预计,2022 年全球消费性电器产品市场将成长 5%。 2022年,照明产业将再次出现小幅成长,成长6%,达到1,385亿欧元(约1,470.8亿美元)。电气设备(2,874 亿欧元(约 3,052 亿美元))和电器产品(2,687 亿欧元(约 2,853.4 亿美元))分别成长 5%。这种成长预计将增加消费性电器产品应用对钽基电容器的需求。

亚太地区主导市场

- 由于中国和韩国等国家消费量的增加,亚太地区一直是钽消费的主要市场。电子、航太和医疗设备等最终用户产业不断增长的需求是该地区的主要推动力。

- 中国是全球主要钽消费国之一。由于该行业需求的不断增长,预计未来几年中国的市场将会成长。中国是全球最大的电子产品生产基地。智慧型手机、电视、电线、电缆、可携式计算设备、游戏系统和其他个人设备等电子产品在电子行业中成长最快。该国不仅满足国内电子产品需求,也向其他国家出口电子产品,是全球大型公司的各类零件製造商。

- 中国是最大的飞机製造国之一,也是国内航空客运最大的市场之一。过去五年,中国民航机持有规模稳定成长。此外,中国航空公司计划在未来20年购买约7,690架新飞机,金额约1.2兆美元。波音公司预测,未来10年,中国的平均RPK(营收旅客周转量)成长率将以每年6.1%的速度成长。因此,航太应用对冷凝器和发动机涡轮叶片的需求正在增加,并且预计将进一步增加所研究市场的需求。

- 印度数位经济预计到2025年将达到1兆美元,印度电子系统设计与製造业(ESDM)产业预计到2025年将创造超过1,000亿美元的经济价值。印度製造、国家电子政策、电子产品零净进口和零缺陷等多项政策将承诺发展国内製造业、减少进口依赖并促进出口和製造业。

- 政府推出了一项旨在促进印度电子产品生产的新计划,即修改电子製造群计划 (EMC 2.0)、电子元件和半导体製造促进计划 (SPECS) 以及生产相关奖励(PLI)。根据 PLI 计划,政府可能在五年内提供 55 亿美元的激励措施,鼓励製造商增加在印度的产量。这可能会增加国内电子产品的产量。

- 韩国是亚太地区另一个重要的出口型经济体。韩国的电子工业产量位居世界第三,消费量量则位居世界第五。 2021年电子产品价值将达2,007.9亿美元。

钽行业概况

钽矿业公司对钽市场进行了部分整合。主要企业(排名不分先后)包括 Global Advanced Metals Pty Ltd、AMG Advanced Metallurgical Group NV、Pilbara Minerals、Alliance Mineral Assets Limited 和 Minsur (Mining Taboca)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 电气和电子产业的需求不断增加

- 钽合金在航空和燃气涡轮机中的广泛应用

- 抑制因素

- 对钽的负面影响以及最终用户产业需求的减少

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

- 进出口趋势

- 技术简介

- 价格指数

- 监理政策分析

第五章市场区隔

- 产品

- 金属

- 碳化物

- 粉末

- 合金

- 其他产品型态

- 目的

- 电容器

- 半导体

- 发动机涡轮叶片

- 化学加工设备

- 医疗设备

- 其他应用(包括弹道学、切削工具和光学应用)

- 地区

- 生产分析

- 美国

- 澳洲

- 巴西

- 中国

- 刚果

- 衣索比亚

- 奈及利亚

- 盧安达

- 其他国家

- 消费分析

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 其他中东和非洲

- 生产分析

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业采取的策略

- 公司简介(概要、财务状况、产品/服务、近期状况)

- AMG Advanced Metallurgical Group NV

- Alliance Mineral Assets Limited

- China Minmetals Corporation

- CNMC Ningxia Orient Group Co. Ltd

- Ethiopian Mineral Development Share Company

- Global Advanced Metals Pty Ltd

- Jiangxi Tungsten Industry Group Co. Ltd

- Minsur(Mining Taboca)

- Pilbara Minerals

- Piran Resources Limited(Pella Resources Limited)

- Tantalex Resources Corporation

- Tantec GmbH

- Techmet(KEMET GROUP)

- Taniobis GmbH

第七章市场机会与未来趋势

- 用聚合物钽电容取代固体电容

- 其他机会

The Tantalum Market size is estimated at 2.46 kilotons in 2024, and is expected to reach 3.18 kilotons by 2029, growing at a CAGR of 5.26% during the forecast period (2024-2029).

The COVID-19 pandemic hurt the tantalum market globally as end-user industries were significantly affected. However, growth in the electrical segment is improving in the industry, which will assist the market development. The tantalum market has recovered from the pandemic and is growing significantly.

Key Highlights

- Over the short term, the growth of the electrical and electronic industry and the extensive usage of tantalum alloys in aviation and gas turbines are projected to fuel market growth throughout the forecast period.

- Replacing solid capacitors with polymer tantalum capacitors is expected to act as an opportunity for the studied market.

- On the flip side, the harmful effects of tantalum and the decrease in demand from end-user industries are hindering the market's growth.

- Asia-Pacific dominates the market across the world, with the largest consumption from countries such as China and South Korea.

Tantalum Market Trends

Capacitor Segment is Anticipated to Hold a Significant Share

- A tantalum electrolytic capacitor is made of tantalum (Ta) metal as anode material, which can be divided into foil and tantalum powder sintered types according to different anode structures. Among tantalum powder sintered tantalum capacitors, there are tantalum capacitors with solid and non-solid electrolytes due to different electrolytes. The shell of tantalum electrolytic capacitors is marked with CA, but the symbol in the circuit is the same as that of other electrolytic capacitors.

- Tantalum electrolytic capacitors are widely used in communications, computers, aerospace, and military, as well as advanced electronic systems, portable digital products, and other fields.

- Since tantalum electrolytic capacitors are made of very fine tantalum powder, and the dielectric constant of the tantalum oxide film is higher than that of the alumina oxide film, the capacitance per unit volume of tantalum electrolytic capacitors is large.

- Tantalum electrolytic capacitor can work normally at the temperature of -50 ~100 . Although the aluminum electrolytic capacitor can work in this range, its electrical performance is not as good as that of the tantalum electrolytic capacitor.

- Tantalum oxide film in tantalum electrolytic capacitors is not only corrosion-resistant but also maintains good performance for a long time.

- According to the Japan Electronics and Information Technology Industries Association (JEITA), the global computers and information terminal devices export reached JPY 378,097 million (~USD 2,862.95 million) in 2021, with a growth of 106.5%. This is further expected to grow in the coming years, thereby enhancing the demand for the tantalum market.

- Additionally, according to ZVEI, the global consumer electronics market is expected to grow by 5% in 2022. In 2022, the lighting segment should again manage a slightly higher growth of 6% to EUR 138.5 billion (~USD 147.08 billion), while domestic electric appliances (to EUR 287.4 billion (~USD 305.20 billion)) and consumer electronics (to EUR 268.7 billion (~USD 285.34 billion)) might each increase by 5%. This growth is expected to enhance the demand for tantalum-based capacitors from consumer electronics applications.

Asia-Pacific to Dominate the Market

- Asia-Pacific was the major market for the consumption of tantalum, owing to increasing consumption from countries such as China and South Korea. The increase in demand from end-user industries, including electronics, aerospace, and medical equipment, primarily drives the region.

- China is one of the major consumers of tantalum globally. Due to the increasing demand from its industries, the market studied is expected to grow in China in the coming years. China is the largest base for electronics production in the world. Electronic products, such as smartphones, TVs, wires, cables, portable computing devices, gaming systems, and other personal devices, recorded the highest growth in the electronics segment. The country not only serves domestic demand for electronics but also exports electronic output to other countries and is also a leading manufacturer of various components worldwide.

- China is one of the largest aircraft manufacturers and one of the largest markets for domestic air passengers. The civil aircraft fleet in the country has been increasing steadily for the past five years. Moreover, Chinese airline companies plan to purchase about 7,690 new aircraft in the next 20 years, which were valued at approximately USD 1.2 trillion. Boeing estimated that the domestic average RPK (Revenue Passenger Kilometer) growth rate in China is expected to increase at an annual rate of 6.1% in the next 10 years. Therefore, the demand for capacitors and engine turbine blades aerospace application is increasing, which further is expected to boost the demand for the market studied.

- India is expected to have a digital economy of USD 1 trillion by 2025, and the Indian electronics system design and manufacturing (ESDM) sector is expected to generate over USD 100 billion in economic value by 2025. Several policies, such as Make in India, National Policy of Electronics, Net Zero Imports in Electronics, and Zero Defect Zero Effect, offer a commitment to growth in domestic manufacturing, lowering import dependence, and energizing exports and manufacturing.

- The government launched new schemes to promote electronics production in India, the scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS) and the scheme for modified Electronics Manufacturing Clusters (EMC 2.0), alongside Production Linked Incentive (PLI). According to the PLI scheme, the government is likely to offer incentives as manufacturers increase production in India with USD 5.5 billion available over five years. This is likely to boost the production of electronics in the country.

- South Korea is another important export-based economy in the Asia-Pacific region. South Korea has the third-largest electronics industry in the world in terms of production and fifth-largest in terms of consumption. In 2021, the electronics are valued at USD 200.79 billion.

Tantalum Industry Overview

The tantalum market is partially consolidated in terms of tantalum mining companies. The major companies (not in a particular order) include Global Advanced Metals Pty Ltd, AMG Advanced Metallurgical Group NV, Pilbara Minerals, Alliance Mineral Assets Limited, and Minsur (Mining Taboca).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Electrical and Electronics Industry

- 4.1.2 Extensive Usage of Tantalum Alloys in Aviation and Gas Turbines

- 4.2 Restraints

- 4.2.1 Harmful Effects of Tantalum and Decrease in Demand from End-user Industries

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Import-Export Trends

- 4.6 Technological Snapshot

- 4.7 Price Index

- 4.8 Regulatory Policy Analysis

5 MARKET SEGMENTATION (Market Size by Volume)

- 5.1 Product

- 5.1.1 Metal

- 5.1.2 Carbide

- 5.1.3 Powder

- 5.1.4 Alloys

- 5.1.5 Other Product Forms

- 5.2 Application

- 5.2.1 Capacitors

- 5.2.2 Semiconductors

- 5.2.3 Engine Turbine Blades

- 5.2.4 Chemical Processing Equipment

- 5.2.5 Medical Equipment

- 5.2.6 Other Applications (includes Ballistics, Cutting Tools, Optical Applications)

- 5.3 Geography

- 5.3.1 Production Analysis

- 5.3.1.1 United States

- 5.3.1.2 Australia

- 5.3.1.3 Brazil

- 5.3.1.4 China

- 5.3.1.5 Congo

- 5.3.1.6 Ethiopia

- 5.3.1.7 Nigeria

- 5.3.1.8 Rwanda

- 5.3.1.9 Other Countries

- 5.3.2 Consumption Analysis

- 5.3.2.1 Asia-Pacific

- 5.3.2.1.1 China

- 5.3.2.1.2 India

- 5.3.2.1.3 Japan

- 5.3.2.1.4 South Korea

- 5.3.2.1.5 Rest of Asia-Pacific

- 5.3.2.2 North America

- 5.3.2.2.1 United States

- 5.3.2.2.2 Canada

- 5.3.2.2.3 Mexico

- 5.3.2.3 Europe

- 5.3.2.3.1 Germany

- 5.3.2.3.2 United Kingdom

- 5.3.2.3.3 Italy

- 5.3.2.3.4 France

- 5.3.2.3.5 Rest of Europe

- 5.3.2.4 South America

- 5.3.2.4.1 Brazil

- 5.3.2.4.2 Argentina

- 5.3.2.4.3 Rest of South America

- 5.3.2.5 Middle-East and Africa

- 5.3.2.5.1 Saudi Arabia

- 5.3.2.5.2 Rest of Middle-East and Africa

- 5.3.1 Production Analysis

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles (Overview, Financials, Products and Services, and Recent Developments)

- 6.4.1 AMG Advanced Metallurgical Group NV

- 6.4.2 Alliance Mineral Assets Limited

- 6.4.3 China Minmetals Corporation

- 6.4.4 CNMC Ningxia Orient Group Co. Ltd

- 6.4.5 Ethiopian Mineral Development Share Company

- 6.4.6 Global Advanced Metals Pty Ltd

- 6.4.7 Jiangxi Tungsten Industry Group Co. Ltd

- 6.4.8 Minsur (Mining Taboca)

- 6.4.9 Pilbara Minerals

- 6.4.10 Piran Resources Limited (Pella Resources Limited)

- 6.4.11 Tantalex Resources Corporation

- 6.4.12 Tantec GmbH

- 6.4.13 Techmet (KEMET GROUP)

- 6.4.14 Taniobis GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Replacement of Solid Capacitors with Polymer Tantalum Capacitors

- 7.2 Other Opportunities