|

市场调查报告书

商品编码

1443940

金属表面处理:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Metal Finishing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

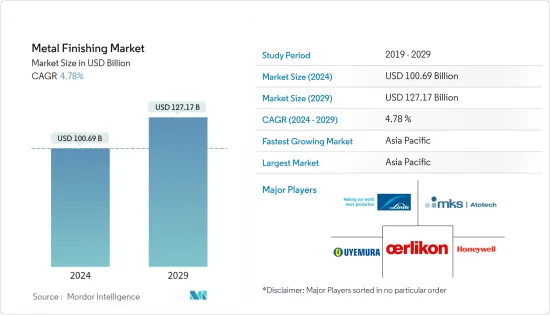

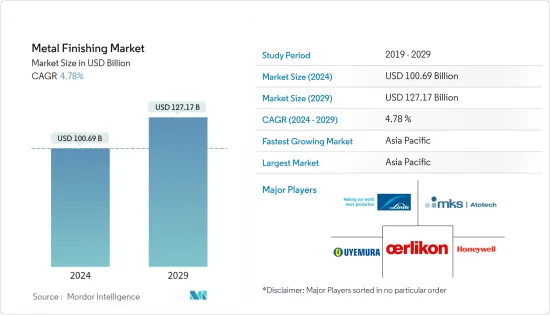

金属表面处理市场规模预计到2024年为1006.9亿美元,预计到2029年将达到1271.7亿美元,在预测期内(2024-2029年)增长4.78%,以复合年增长率增长。

COVID-19 大流行对市场产生了负面影响。这是因为製造设施和工厂因封锁和限制措施而关闭。供应链和运输中断造成了进一步的市场瓶颈。然而,随着所研究市场的需求復苏,该产业在 2021 年出现復苏。

主要亮点

- 短期内,对耐用、耐磨和持久的金属产品的需求不断增加是推动市场成长的一些因素。

- 另一方面,对某些金属表面处理化学品的环境法规以及塑胶替代金属的增加预计将阻碍市场成长。

- 然而,从传统溶剂型技术向新技术的过渡可能会在预测期内提供市场机会。

- 由于汽车、建筑、电子和硬体等最终用户行业的强劲需求,亚太地区主导了全球市场。

金属表面处理市场趋势

汽车产业占市场主导地位

- 金属表面处理市场的需求主要由汽车产业主导。金属表面处理是为车辆金属零件提供保护层最常用的方法之一。

- 金属饰面用于车辆部件,例如引擎、其他引擎盖下部件、动力方向盘系统、煞车部件和系统、空调部件和系统、底盘硬体、空调部件和燃油系统。

- 金属表面处理还包括油漆和陶瓷涂布。许多大大小小的汽车零件都需要光滑的接触表面以减少应力并且没有毛边和缺陷。这使得汽车引擎的表面摩擦和热量更少,产生更多马力并提高整体性能。

- 美国拥有世界主要汽车工业之一,占国内生产总值(GDP)至少3%。 2022年,全国汽车产量近1,006万辆,包括小客车和商用车,比2021年增加10%。因此,国内汽车产量的增加预计将产生汽车需求的上升。金属表面处理市场。

- 在印尼,由于车辆排放气体法规收紧、车辆安全性提高、车辆驾驶员辅助系统以及零售和电子商务领域物流快速增长,对轻型商用车的需求大幅增加。例如,根据 OICA 的数据,2022 年该国生产了约 1,60,171 辆轻型商用车,比 2021 年成长了 1%。预计这将推动金属精加工市场的需求上升。该国的轻型商用车市场。

- 此外,在菲律宾,电子商务对商品的需求不断增加,正在推动轻型商用车在物流中的使用,为国内轻型商用车市场的成长铺平道路。许多电子商务和物流公司在该国不断发展,进一步推动了轻型商用车市场的成长。例如,2022年国内轻型商用车产量达50,560辆,较2021年成长68%。

- 此外,马来西亚放宽的行动限制令使该国许多经济部门得以恢復运营,从而增强了景气,并有助于包括商用车在内的新车生产。您需要它来经营您的业务。例如,马来西亚2022年轻型商用车产量为52,085辆,较2021年成长48%。因此,预计这将支持该国轻型商用车金属饰面的需求。

- 由于技术更先进的汽车的出现,金属表面处理市场可能会长期成长。

亚太地区主导市场

- 在亚太地区,汽车产业投资和生产的增加、电气和电子设备产量的增加以及重型机械需求的激增是推动金属表面处理市场的一些关键因素。跨国公司推动了该地区工业部门的发展。

- 中国在亚太地区金属表面处理市场占有最大的市场占有率。由于国内投资和建设活动的增加,金属表面处理市场的需求预计在整个预测期内都会增加。近年来,中国一直是世界基础建设的主要投资者之一,并做出了重要贡献。例如,根据中国国家统计局(NBS)的数据,2022年中国建筑业产值将达到27.63兆元(41.08581亿美元),比2021年增长6.6%。

- 此外,由于物流和供应链的改善、企业活动的增加以及丰富的国内消费促进政策等因素促进了国内客车生产,中国也是最大的小客车小客车国之一。例如,根据OICA的数据,2022年中国小客车产量为23,836,083辆,较2021年成长11%。因此,由于国内小客车产量的增加,金属表面处理市场的需求呈现上升趋势。

- 由于车辆排放法规收紧、车辆安全性提高、车辆驾驶员辅助系统以及零售和电子商务领域物流快速增长,印度对新型和先进轻型商用车 (LCV) 的需求不断增加。已显着增加。例如,根据OICA的数据,2022年印度轻型商用车产量达617,398辆,较2021年成长27%,较2020年恢復60%。

- 此外,由于印度汽车工业的投资增加和进步,基底金属的消费量预计将增加。例如,塔塔汽车在2022年4月宣布,计画未来5年向小客车业务投资30.8亿美元。因此,汽车产量和汽车行业投资的增加预计将增加国内汽车和交通行业对金属表面处理市场的需求。

- 铜、锡、镍和铝是电子工业中常用的金属。亚洲地区是全球最大的电气和电子设备生产国,主要由中国、日本、韩国、新加坡和马来西亚等国家主导。

- 根据 JEITA(日本电子资讯科技协会)的数据,2022 年 12 月日本国内消费性电器产品出货收益达到 1,252 亿日圆(9.6,404 亿美元)。同时,3月份是2022年消费性电器产品出货收益最强劲的月份,金额约为1,255亿日圆(9.6635亿美元),而5月份则是最弱的月份,金额为864亿日圆( 6.6528亿美元)。因此,由于该国家电出出货的增加,金属表面处理市场的需求预计将增加。因此,凭藉该地区如此有利的趋势和投资,亚太地区有望主导全球市场。

金属表面处理产业概述

金属表面处理市场高度分散。市场的主要企业(排名不分先后)包括OC Oerlikon Management AG、MKS Atotech、Linde plc、C. Uyemura、Honeywell International Inc.等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 非洲汽车产量增加

- 对耐用、耐磨和持久的金属产品的需求不断增加

- 其他司机

- 抑制因素

- 某些化学品的环境法规

- 增加金属对塑胶的替代

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔

- 类型

- 无机金属饰面

- 覆层

- 事前处理/表面处理

- 消耗品和备件

- 电镀

- 镀锌

- 无电电镀

- 化成膜

- 热喷涂粉末涂料

- 阳极处理

- 电解抛光

- 有机金属饰面

- 混合金属饰面

- 无机金属饰面

- 目的

- 车

- 家用电器

- 硬体

- 航太

- 重型设备

- 电子产品

- 建造

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业采取的策略

- 公司简介

- AE Aubin Company

- ALMCOGROUP

- Auromex Co., Ltd.

- C. Uyemura Co., Ltd.

- DuPont

- Grind Master

- Guyson Corporation

- Honeywell International Inc.

- Linde plc

- MKS|Atotech

- OC Oerlikon Management AG

- OTEC Precision Finish, Inc.

- Plating Equipment Ltd

- POSCO

- Quaker Chemical Corporation

- sequa gGmbH

- TIB Chemicals AG

第七章市场机会与未来趋势

- 从传统溶剂型技术转向新技术的转变

- 其他机会

The Metal Finishing Market size is estimated at USD 100.69 billion in 2024, and is expected to reach USD 127.17 billion by 2029, growing at a CAGR of 4.78% during the forecast period (2024-2029).

.

The COVID-19 pandemic negatively impacted the market. This was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, the increasing demand for durable, wear-resistant, and long-lasting metal products are some of the factors driving the market's growth.

- On the other hand, the environmental restrictions on some metal finishing chemicals and increasing metal replacement with plastics are expected to hinder the market's growth.

- However, the shift from traditional solvent-borne technologies to newer technologies will likely provide market opportunities during the forecast period.

- Asia-Pacific dominated the global market, with robust demand from end-user industries such as automotive, construction, electronics, and hardware.

Metal Finishing Market Trends

Automotive Segment to Dominate the Market

- The automotive industry dominated the demand for the metal finishing market. Metal finishing is one of the most common methods used to provide a protective layer on the metal components of vehicles.

- Metal finishing is used in vehicle parts such as engines, other under-the-hood components, power steering systems, brake parts and systems, air conditioning components and systems, chassis hardware, climate control components, and fuel systems.

- Metal finishing also includes the application of paints or ceramics. Many small and large automobile parts require their contact surfaces to be smooth, stress-relieved, and without burrs or defects. This enables the automotive engines to achieve a surface with less friction and heat, generating more horsepower and overall better performance.

- The United States is one of the major automotive industries in the world, contributing at least 3% to the country's overall gross domestic product (GDP). The country produced close to 10.06 million units of automobiles, including passenger and commercial vehicles, in 2022, which showed an increase of 10% compared to 2021. Therefore, increasing the production of automobiles in the country is expected to create an upside demand for the metal finishing market.

- In Indonesia, the increasing regulations on vehicle emissions, vehicle safety advancement, driver-assist systems in vehicles, and rapidly growing logistics in the retail and e-commerce sectors have significantly driven the demand for light commercial vehicles. For instance, according to OICA, in 2022, around 1,60,171 units of light commercial vehicles were produced in the country, which showed an increase of 1% compared to 2021. This is expected to create an upside demand for the metal finishing market from the country's light commercial vehicle market.

- Moreover, in the Philippines, the increased demand for goods through e-commerce is pushing the use of light commercial vehicles in logistics, paving the way for light commercial vehicle market growth in the country. Many e-commerce and logistics companies are growing in the country, further boosting the light commercial vehicle market's growth. For instance, in 2022, light commercial vehicle production in the country amounted to 50,560 units, which shows an increase of 68% compared to 2021.

- Furthermore, due to the relaxation of movement control orders in Malaysia, many economic sectors were allowed to re-open businesses in the country, which helped to improve business confidence and contributed to the production of new vehicles, including commercial vehicles, which are much-needed for running businesses. For instance, in 2022, light commercial vehicle production in Malaysia amounted to 52,085 units, which shows an increase an 48% compared to 2021. Therefore, this is expected to support the demand for metal finishing from the country's light commercial vehicles.

- The metal finishing market has the potential for growth in the long term with the emergence of more technologically developed cars.

Asia-Pacific Region to Dominate the Market

- In the Asia-Pacific region, the increasing investments and production in the automotive industry, rising production of electricals and electronics, and surging demand for heavy equipment are some of the major factors driving the market for metal finishing. Multinational companies drive the industrial sector in this region.

- China holds the largest Asia-Pacific market share for the metal finishing market. The demand for the metal finishing market is expected to rise throughout the forecast period due to rising investments and construction activity in the country. China is a huge contributor, as it has been one of the leading investors in infrastructure worldwide over the past few years. For instance, according to the National Bureau of Statistics (NBS) of China, in 2022, the output value of construction works in China amounted to 27.63 trillion yuan (USD 4108.581 billion), an increase of 6.6% compared with 2021.

- Moreover, China is also one of the largest producers of passenger cars due to the improving logistics and supply chains, increased business activity, and the country's raft of pro-consumption measures, among other factors contributing to the passenger car production in the country. For instance, according to OICA, in 2022, passenger car production in China amounted to 2,38,36,083 units, which showed an increase of 11% compared to 2021. Therefore, increasing the production of passenger cars in the country is expected to create an upside demand for the metal finishing market.

- In India, increasing regulations on vehicle emissions, vehicle safety advancement, driver-assist systems in vehicles, and rapidly growing logistics in the retail and e-commerce sectors have been significantly driving the demand for new and advanced Light commercial vehicles (LCVs). For instance, according to OICA, in 2022, light commercial vehicle production in India amounted to 6,17,398 units, showing an increase of 27% compared to 2021 and a recovery of 60% compared to 2020.

- Furthermore, increased investments and advancements in the automobile industry in India are expected to increase the consumption of base metals. For instance, in April 2022, Tata Motors announced plans to invest USD 3.08 billion in its passenger vehicle business over the next five years. Therefore, increasing automobile production and investment in the automobile industry is expected to have an upside demand for the metal finishing market from the country's automotive and transportation industry.

- Copper, tin, nickel, and aluminum are common metals the electronics industry uses. The Asian region is the largest producer of electrical and electronics globally, with countries such as China, Japan, South Korea, Singapore, and Malaysia dominating globally.

- In Japan, according to JEITA (Japan Electronics and Information Technology Association), domestic shipments of consumer electronics in Japan reached a value of JPY 125.2 billion (USD 964.04 million) in December 2022. While March was the strongest month for consumer electronics shipments during 2022, with around JPY 125.5 billion (USD 966.35 million), May was the weakest, with the value falling to JPY 86.4 billion (USD 665.28 million). Therefore, increasing consumer electronics shipments from the country is expected to increase demand for the metal finishing market.

- Hence, with such favorable trends and investments in the region, Asia-Pacific is expected to dominate the global market.

Metal Finishing Industry Overview

The Metal Finishing market is highly fragmented. The major players in this market (not in a particular order) include OC Oerlikon Management AG, MKS Atotech, Linde plc, C. Uyemura Co., Ltd, and Honeywell International Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Automotive Production in Africa

- 4.1.2 Increasing Requirement for Durable, Wear-resistant, and Long-lasting Metal Products

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Environmental Restrictions on Some Chemicals

- 4.2.2 Increasing Replacement of Metal with Plastics

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Value)

- 5.1 Type

- 5.1.1 Inorganic Metal Finishing

- 5.1.1.1 Cladding

- 5.1.1.2 Pretreatment/Surface Preparation

- 5.1.1.3 Consumables and Spares

- 5.1.1.4 Electroplating

- 5.1.1.5 Galvanization

- 5.1.1.6 Electro-less Plating

- 5.1.1.7 Conversion Coatings

- 5.1.1.8 Thermal Spray Powder Coating

- 5.1.1.9 Anodizing

- 5.1.1.10 Electro-polishing

- 5.1.2 Organic Metal Finishing

- 5.1.3 Hybrid Metal Finishing

- 5.1.1 Inorganic Metal Finishing

- 5.2 Application

- 5.2.1 Automotive

- 5.2.2 Appliances

- 5.2.3 Hardware

- 5.2.4 Aerospace

- 5.2.5 Heavy Equipment

- 5.2.6 Electronics

- 5.2.7 Construction

- 5.2.8 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 A.E. Aubin Company

- 6.4.2 ALMCOGROUP

- 6.4.3 Auromex Co., Ltd.

- 6.4.4 C. Uyemura Co., Ltd.

- 6.4.5 DuPont

- 6.4.6 Grind Master

- 6.4.7 Guyson Corporation

- 6.4.8 Honeywell International Inc.

- 6.4.9 Linde plc

- 6.4.10 MKS | Atotech

- 6.4.11 OC Oerlikon Management AG

- 6.4.12 OTEC Precision Finish, Inc.

- 6.4.13 Plating Equipment Ltd

- 6.4.14 POSCO

- 6.4.15 Quaker Chemical Corporation

- 6.4.16 sequa gGmbH

- 6.4.17 TIB Chemicals AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shift from Traditional Solvent-borne Technologies to Newer Technologies

- 7.2 Other Opportunities