|

市场调查报告书

商品编码

1443956

潜水泵 - 市场份额分析、行业趋势与统计、成长预测(2024 - 2029)Submersible Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

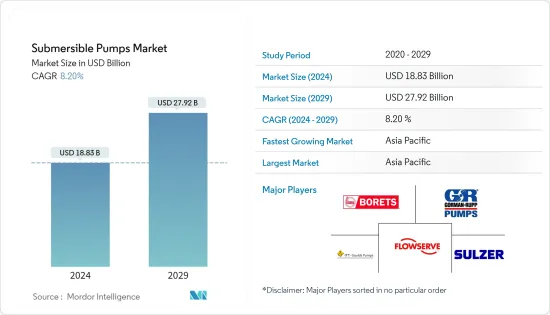

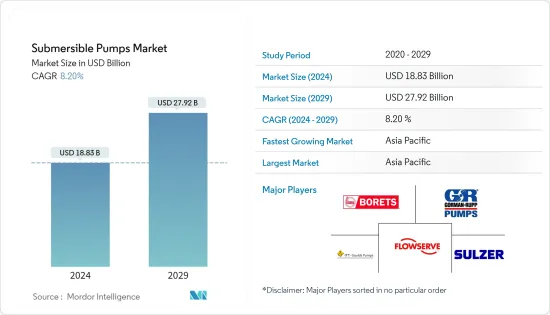

潜水泵市场规模预计到2024年为188.3亿美元,预计到2029年将达到279.2亿美元,在预测期内(2024-2029年)CAGR为8.20%。

主要亮点

- 从中期来看,推动市场的主要因素是各行业废水处理的严格规定、石油天然气和采矿业的復苏、建筑业的成长以及工业基础设施的激增。

- 另一方面,该市场面临着一定的挑战,例如高昂的维护和营运成本以及石油和天然气价格的波动。这些因素成为市场成长的障碍。

- 然而,北美和欧洲等已开发地区的废水和水处理设施正在老化,并逐渐接近其运作生命週期的终点。需要大量投资来重新安装和升级旧基础设施以克服这种情况。然而,一些新兴经济体没有足够的饮用水,并且刚开始建造新的水基础设施。这种升级老化基础设施的倡议可能为潜水泵市场创造机会。

潜水泵浦市场趋势

石油和天然气产业预计将主导市场

- 重型潜水泵可有效处理大量固体,用于钻探石油和天然气井。目前,全球超过 90% 的生产井在自然驱动衰退后使用人工举升来优化产量。过去几年潜水泵的需求波动较大,主要原因是产业不景气。然而,原油价格的復苏和较低的损益平衡价格正在推动市场研究期间的生产活动。

- 例如,根据石油输出国组织(OPEC)的数据,2022年OPEC平均油价为每桶100.08美元,较2021年的每桶69.89美元大幅上涨。

- 目前,石油和天然气生产市场由美国推动,美国正在开发其页岩储量,由于拥有超过一百万口生产井,美国也是最大的人工举升市场之一。页岩储量的不断开采导致废水产生量的增加。水资源的缺乏以及政府对废水处理的监管正在鼓励该行业对产出水进行处理。预计这将为用于从现场泵送废水的潜水泵创造巨大的需求机会。

- 地区国家石油公司率先投资发展油气产业。预计到 2025 年,印度、中国、印尼、越南和其他国家将有许多新的乙烯和石脑油裂解装置投产。例如,2022年1月,乐天化学宣布在印尼建造乙烯裂解装置。该裂解装置的年产能可能为1000吨,预计于2025年开始商业营运。

- 随着人口的成长和都市化的快速发展,对汽油、暖气油、液化石油气等石油产品的需求日益增加。因此,为了满足现有需求,需要建立新的炼油厂,这反过来可能会在预测期内推动潜水泵市场的发展。

- 因此,基于上述因素,预计石油和天然气产业在预测期内将拥有最大的市场份额。

亚太地区可望成为最大市场

- 在亚太地区,印度和中国等国家的工业活动正在增加,从而带动了对原油和化学品等的需求成长。预计在预测期内,中国将带动亚太地区 (APAC) 原油炼製能力大幅成长。

- 亚太地区大部分国家正处于成长阶段,人口成长率高导致对供水的需求增加。

- 此外,印度、孟加拉、印尼等国的过度开采导致水位下降。这意味着对潜水泵的需求增加。

- 根据《2022 年世界投资报告》,印度 2020-21 年 FDI 流入总额为 819.73 亿美元,比前一年增长 10%。因此,在预测期内,高投资、政策和各种行业可能会推动该地区潜水泵市场的发展。

- 灌溉是印度太阳能水泵的主要应用领域。这使得印度成为太阳能潜水泵的庞大市场。印度政府制定了扩大该国再生能源发电能力的雄心勃勃的目标。 2010 年,印度启动了贾瓦哈拉尔·尼赫鲁国家(JNN) 太阳能任务,旨在到2022 年实现太阳能光伏发电量达到100 吉瓦的目标。此外,作为该任务的一部分,新能源和再生能源部(MNRE) 在2019 年)重新启动了用于灌溉和饮用水的太阳能抽水计划,该计划旨在到2024 年推广太阳能泵的采用。因此,由于政府的支持,印度潜水泵市场预计在预测期内将在该地区增长。

- 因此,基于这些发展,亚太地区预计将在预测期内主导潜水泵市场。

潜水泵产业概况

潜水泵市场仍处于分散状态。一些主要参与者包括(排名不分先后)Borets International Ltd、Gorman-Rupp Co、Flowserve Corporation、Grundfos Group 和 Sulzer Ltd. 等。

2022 年 3 月,福斯公司与戈润签署协议,协助解决水和废水处理中最具挑战性的问题。此次合作将把福斯的流量控制解决方案和产品专业知识与戈润的创新、客製化水处理技术相结合,为客户提供独特的整体水处理解决方案。 Flowserve 也坚持透过市场领先的水产业流量控制产品和解决方案升级其水产品组合。最近的累积包括 H2O+ 潜水泵、一套用于海水淡化的高效泵以及 RedRaven 物联网平台。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究范围

- 市场定义

- 研究假设

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场概览

- 介绍

- 2028 年之前的市场规模与美元需求预测

- 最新趋势和发展

- 政府政策法规

- 市场动态

- 司机

- 石油、天然气和采矿业的快速復苏

- 建筑业的蓬勃发展

- 限制

- 潜水泵浦维护与运作成本高限制市场

- 司机

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争激烈程度

第 5 章:市场细分

- 类型

- Borewell潜水泵

- 开井潜水泵

- 无堵塞潜水泵

- 驱动器类型

- 电的

- 油压

- 其他驱动器类型

- 头

- 50m以下

- 50 m 至 100 m 之间

- 100m以上

- 最终用户

- 水和废水

- 石油和天然气工业

- 采矿业和建筑业

- 其他最终用户

- 地理

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 欧洲其他地区

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 中东和非洲其他地区

- 北美洲

第 6 章:竞争格局

- 併购、合资、合作与协议

- 领先企业采取的策略

- 公司简介

- Baker Hughes Co.

- Schlumberger Limited

- Halliburton Co.

- Weir Group PLC

- Sulzer AG

- Grundfos Group

- The Gorman-Rupp Company

- Flowserve Corporation

- Atlas Copco AB

- Ebara Corporation

- Borets International Ltd

- ITT Goulds Pumps

- Franklin Electric Co. Inc.

- KSB AG

第 7 章:市场机会与未来趋势

- 升级老化的供水和污水处理基础设施创造市场机会

The Submersible Pumps Market size is estimated at USD 18.83 billion in 2024, and is expected to reach USD 27.92 billion by 2029, growing at a CAGR of 8.20% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, the major factors driving the market are the strict regulations for wastewater treatment across industries, recovery in the oil and gas and mining industries, growth in the construction industry, and a surge in industrial infrastructure.

- On the other hand, this market faces certain challenges, such as high maintenance and operation costs and volatility in oil and gas prices. These factors act as a roadblock to the growth of the market.

- Nevertheless, wastewater and water treatment facilities in developed regions like North America and Europe are aging and shifting toward the end of their operational lifecycle. High investments are required in reinstalling and upgrading the old infrastructure to overcome this scenario. However, several emerging economies do not have adequate access to drinking water and have just started building new water infrastructure. Such initiatives to upgrade aging infrastructure are likely to create an opportunity for the submersible pumps market.

Submersible Pump Market Trends

The Oil and Gas Industry is Expected to Dominate the Market

- A heavy-duty submersible pump handles a lot of solids efficiently and is used during drilling oil and gas wells. Currently, more than 90% of producing wells in the world use an artificial lift to optimize production after the decline in natural drives. The demand for submersible pumps has been volatile in the past few years, mainly due to the downturn in the industry. However, the recovery in crude oil price and the low breakeven price is driving the production activity in the market studied period.

- For instance, according to the Organisation of the Petroleum Exporting Countries (OPEC), in 2022, the average OPEC oil price was USD 100.08 per barrel, a significant increase from USD 69.89 per barrel in 2021.

- The oil and gas production market is currently driven by the United States, which is exploiting its shale reserve, as well as one of the largest markets for artificial lift due to the presence of more than a million production wells. The increasing exploitation of shale reserves has resulted in increased production of wastewater. The lack of availability of water and government regulation on wastewater treatment are encouraging the industry to treat the produced water. This is expected to create tremendous demand opportunities for submersible pumps that find application in pumping wastewater from the field.

- National oil companies in the region have taken the lead in investing in and developing the oil and gas industry. A number of new ethylene and naphtha cracker plants are anticipated to come online by 2025 in India, China, Indonesia, Vietnam, and other countries. For instance, in January 2022, Lotte Chemicals announced the construction of an ethylene cracker plant in Indonesia. The cracker plant is likely to have a capacity of 1,000 kilometric ton per annum, and the project is expected to begin commercial operations by 2025.

- The demand for oil products such as gasoline, heating oil, and liquefied petroleum gas is increasing day by day with the growing population and rapid urbanization. Therefore, to meet the existing demand, there is a need for setting up new refineries, which, in turn, may drive the submersible pumps market during the forecast period.

- Therefore, based on the above-mentioned factors, the oil and gas industry is expected to have the largest market share during the forecast period.

Asia-Pacific is Expected to be the Largest Market

- In Asia-Pacific, countries like India and China are witnessing an increase in industrial activities, thereby inducing growth in demand for crude oil and chemicals, among others. China is expected to account for significant growth in crude oil refining capacity during the forecast period in Asia-Pacific (APAC).

- Most of the countries in Asia-Pacific are in a growing phase, and the high rate of population growth has led to the increased requirement for water supply.

- Moreover, excess water extraction in countries such as India, Bangladesh, Indonesia, and others resulted in a decline in the water level. This has translated into an increase in demand for submersible pumps.

- As per the World Investment Report 2022, India's total FDI inflows stood at USD 81,973 million during 2020-21 which represents a 10% increase over the previous year. Thus, high investments, policies, and various industries are likely to propel the submersible pumps market in the region during the forecast period.

- Irrigation is a major application area for solar pumps in India. This makes India a huge market for solar submersible pumps. The Government of India had set ambitious targets to expand the country's renewable energy generating capacity. In 2010, it launched the Jawaharlal Nehru National (JNN) Solar Mission, which aims to reach a target of 100 GW of solar PV by 2022. Furthermore, in 2019, as part of this mission, the Ministry of New and Renewable Energy (MNRE) relaunched the Solar Pumping Programme for Irrigation and Drinking Water, which sought to promote the adoption of solar pumps by 2024. Hence, due to government support, the submersible pumps market in India is expected to grow in the region during the forecast period.

- Therefore, based on such developments, Asia-Pacific is expected to dominate the submersible pumps market during the forecast period.

Submersible Pump Industry Overview

The market for submersible pumps remains to be fragmented. Some of the key players include (not in particular order) Borets International Ltd, Gorman-Rupp Co, Flowserve Corporation, Grundfos Group, and Sulzer Ltd., among others.

In March 2022, Flowserve Corporation signed an agreement with Gradiant to help handle the most challenging problems in water and wastewater treatment. This partnership is going to combine Flowserve's flow control solutions and product expertise with Gradiant's innovative, tailored water treatment technology to provide distinctive total water treatment solutions for customers. Flowserve also persists in upgrading its water portfolio with market-leading flow control products and solutions for the water industry. Recent accumulations include the H2O+ submersible pump, a suite of highly efficient pumps for desalination, and the RedRaven IoT platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rapid Recovery in the Oil and Gas and Mining Industries

- 4.5.1.2 Surge in the Construction Industry

- 4.5.2 Restraints

- 4.5.2.1 High Maintenance and Operation Costs of Submersible Pump Restrain the Market

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Borewell Submersible Pump

- 5.1.2 Openwell Submersible Pump

- 5.1.3 Non-clog Submersible Pump

- 5.2 Drive Type

- 5.2.1 Electric

- 5.2.2 Hydraulic

- 5.2.3 Other Drive Types

- 5.3 Head

- 5.3.1 Below 50 m

- 5.3.2 Between 50 m to 100 m

- 5.3.3 Above 100 m

- 5.4 End User

- 5.4.1 Water and Wastewater

- 5.4.2 Oil and Gas Industry

- 5.4.3 Mining and Construction Industry

- 5.4.4 Other End Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle-East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Baker Hughes Co.

- 6.3.2 Schlumberger Limited

- 6.3.3 Halliburton Co.

- 6.3.4 Weir Group PLC

- 6.3.5 Sulzer AG

- 6.3.6 Grundfos Group

- 6.3.7 The Gorman-Rupp Company

- 6.3.8 Flowserve Corporation

- 6.3.9 Atlas Copco AB

- 6.3.10 Ebara Corporation

- 6.3.11 Borets International Ltd

- 6.3.12 ITT Goulds Pumps

- 6.3.13 Franklin Electric Co. Inc.

- 6.3.14 KSB AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Upgradation of Aging Water and Wastewater Infrastructure to Create Market Opportunities