|

市场调查报告书

商品编码

1443961

汽车架 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Car Rack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

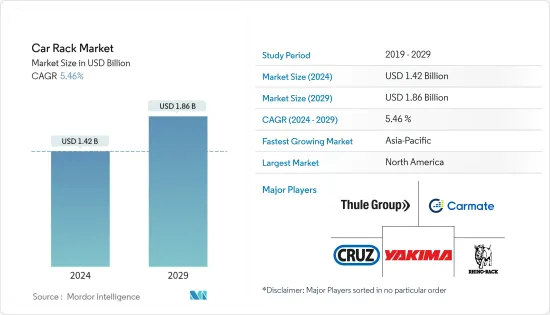

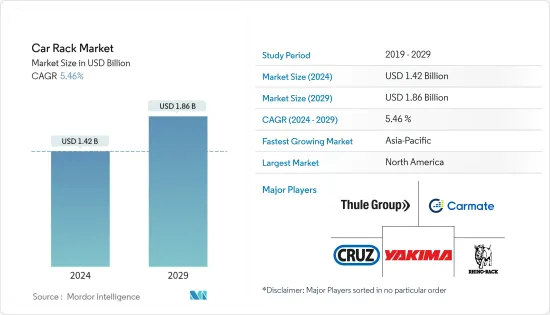

2024年汽车架市场规模估计为14.2亿美元,预计到2029年将达到18.6亿美元,在预测期内(2024-2029年)CAGR为5.46%。

COVID-19 大流行的爆发导致製造业停工、封锁和贸易限制,对汽车电液动力转向产业产生了负面影响。此外,旅行限制和户外探险活动数量的下降极大地削弱了对汽车架的需求。因此,汽车车顶行李架业务的小型或大型公司都受到了严重影响。在 COVID-19之后,随着对定期娱乐活动和健康益处的需求不断增加,山地自行车和滑雪旅行的需求可能会增加,这可能会增加对更多可靠的汽车架和屋顶安装架的需求,从而增加市场价值。此外,製造商正在实施应急计划,以减轻未来业务的不确定性,以保持与汽车行业关键领域客户的连续性。

未来五年,千禧世代对额外行李空间的需求以及休閒活动和旅游日益增长的吸引力是推动市场成长的主要原因。品质(低品质行李架的生锈和腐蚀)和定价困难(影响价格的因素,例如建筑材料/原材料、车顶行李架类型和品牌等产品费用)可能会限制市场的成长。

实用性更强的紧凑型SUV的推出、车辆性能的提高以及越野能力增强的汽车数量的增加正在推动汽车行李架市场的发展,因为这些因素将大大改善车顶行李架的应用。

主要市场参与者正在参与合资企业、新产品发布和产能扩张,以满足快速成长的汽车架市场的需求。例如

主要亮点

- 2022 年 10 月:Yakima Products Inc. 宣布与向零售商提供特殊汽车产品的主要经销商 Meyer Distributing 合作,透过 Meyer Distributing 的网路向汽车零售商分销 Yakima 的产品。

- 2022 年 4 月:Polaris Inc. 与 Rhino-Rack 合作,为 Polaris 的越野车和探险车提供储存产品。

从地理来看,由于人们对户外探险活动的强烈偏好、房车和休閒皮卡车等休閒车的深入渗透以及规模较大的汽车存储原始设备製造商的存在,北美已被确定为汽车行李架市场最大的地区。由于户外活动和旅游业的成长趋势以及SUV等生活方式车辆的日益普及,欧洲和亚太地区成为第二大市场。

车架市场趋势

车顶架细分市场预计在预测期内将以更快的速度成长

由于露营车和越野车的使用不断增加,预计汽车架市场的车顶架部分在预测期内将变得更加重要。随着越野车用户和 SUV 销售的增加,车顶行李架的需求预计将会增加。

2021年,SUV约占全球乘用车总销量的45.9%,较上年增长4%,显示越野应用的巨大潜力以及车顶行李架在全球长途旅行中的使用增加。此外,预计 2021 年将有 2 亿辆 SUV 投入运营,这表明这些车辆和车顶行李架的出行潜力巨大。

根据房车行业协会统计,2021年露营车销量将突破60万辆。露营车通常配备行李架以增加存储容量,因为露营者更喜欢在户外长途度假时携带露营车,通常去偏远地区,并装满生活必需品。露营车销量的成长也导致汽车架销量的成长。

一些原始设备製造商还在其车型中采用了各种技术来提高乘客舒适度和车顶行李架实用性。例如,

- 2022 年 10 月:德国露营车专家 Ququq 推出了世界上第一款露营车套件,其中包括专为大众 ID Buzz 设计的行李架。该设备的价格低于 3000 美元,具有竞争力。

因此,预计上述所有因素的综合作用将推动未来五年车顶行李架週期的成长。

北美将在汽车架市场发展中发挥关键作用

预计北美的汽车架市场在预测期内将主导整个市场。推动美国市场成长的一些主要因素是旅游部门对车辆的需求不断增长(汽车租赁和计程车服务)、休閒车需求的增加(消费者休閒旅游需求的增加)以及大量年轻人搬到美国不同的城市学习和工作。

2021年,美国休閒旅游占旅游业总量的比重超过86%,显示安装在车辆上的优质车顶行李架潜力巨大。骑自行车和徒步旅行被选为加拿大公民最喜欢的第三和第五大户外活动,这些活动通常需要标准的汽车车顶架来安装各种设备和自行车。这一因素进一步增加了该国对汽车货架设备的需求。

儘管受疫情影响用户数量有所下降,但加拿大旅游业的套餐度假和度假租赁领域的用户数量在 2021 年急剧增加,这表明对配备车架的多功能车辆的需求预计将增加以满足旅行的需要。

由于该地区存在 Yakima、Allen Group 和 Saris Group 等知名车顶架製造商,预计预测期内车顶架的使用量将达到最高水准。因此,这些因素预计将在预测期内提振北美汽车架市场。

预计该市场也将受到汽车架原始设备製造商推出新产品的推动。例如

- 2022 年 10 月:Lucid Motors 为 Lucid Air 豪华电动车推出了全新 Lucid Air Crossbars 配件。配件包括能够支撑 165 磅的新型铝製屋顶储存系统。已满载,现已可供订购,将于 2022 年第四季开始出货。

因此,由于上述因素,未来五年北美地区很可能仍将是全球最大的汽车货架市场。

汽车货架产业概况

车架市场由几家主要和本地参与者适度整合。一些主要的市场参与者包括 Thule Group AB、Yakima Products Inc.、Rhino-Rack USA LLC、Car Mate Mfg. 和 Cruzber。製造商正在寻求安装在车辆上的不同的创新设计,这些设计占用的空间更少,并且在设计方面更实用。他们专注于各种成长策略,例如产品开发、合作伙伴关係和零售扩张,以加强他们在市场中的地位。例如,

- 2022 年 9 月,现代摩比斯为印度现代 Tucson、Creta、Venue 和 Kona 电动 SUV 客户推出了新的旅行配件车顶箱、车顶篮和自行车架。这些配件是与 Thule Group AB 共同开发的。

- 2022 年 10 月,Carmate 推出了一款名为 Inno 的新型储物车顶箱,它可以作为手提箱安装在车辆顶部或从车顶拆卸。车顶包厢容量为 160 公升,可容纳长度达 900 毫米的桌椅。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场区隔(市场规模(十亿美元))

- 按应用类型

- 车顶行李架

- 车顶箱

- 自行车车架

- 滑雪架

- 水上活动载体

- 按地理

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 亚太

- 中国

- 印度

- 日本

- 亚太其他地区

- 世界其他地区

- 巴西

- 南非

- 其他国家

- 北美洲

第 6 章:竞争格局

- 供应商市占率

- 公司简介

- Thule Group

- Yakima Products Inc.

- Allen Sports

- Rhino-Rack USA LLC

- Cruzber SA

- ACPS Automotive GmbH

- Malone Auto Racks

- Kuat Car Racks

- Car Mate Mfg Co. Ltd

- Saris

第 7 章:市场机会与未来趋势

The Car Rack Market size is estimated at USD 1.42 billion in 2024, and is expected to reach USD 1.86 billion by 2029, growing at a CAGR of 5.46% during the forecast period (2024-2029).

The outbreak of the COVID-19 pandemic led to manufacturing shutdowns, lockdowns, and trade restrictions which negatively affected the automotive electro-hydraulic power steering industry. Furthermore, the traveling restrictions and the fall in the number of outdoor adventure activities massively dented the demand for car racks. Consequently, the small or large companies in the car roof rack business suffered significantly. Post-COVID-19, with the increasing demand for regular recreational activities and health benefits, the need for mountain biking and ski trips may increase, which may increase the demand for more car racks and rooftop mounts that are dependable, thus increasing the market value. Furthermore, the manufacturers are implementing contingency plans to mitigate future business uncertainties to retain continuity with clients in the critical sectors of the automobile industry.

Over the next five years, the demand for additional baggage space and the growing attraction for leisure activities and tourism amongst the millennial generation are the primary reasons driving the market's growth. Quality (rust and corrosion in low-quality racks) and pricing difficulties (factors impacting the price, such as product expenses like building material/raw material, roof rack type, and brand) may limit the market's growth.

The introduction of more compact SUVs with greater practicality increased vehicular capabilities, and an increased number of competent automobiles for off-roading are driving the car rack market, as these factors will substantially improve the application of roof racks.

Key market players are engaging in joint ventures, new product launches, and capacity expansions to address the rapidly growing car rack market. for instance

Key Highlights

- October, 2022: Yakima Products Inc. announced a tie-up with Meyer Distributing, a major distributor of specialty automotive products to retailers, to distribute Yakima's products through Meyer Distributing's network to automotive retailers.

- April, 2022: Polaris Inc. partnered with Rhino-Rack to offer storage products for Polaris' off-roaders and adventure vehicles.

Geographically, North America has been identified as the largest region for the car rack market due to a strong preference for outdoor adventure activities, deep penetration of leisure vehicles like motorhomes and lifestyle pickup trucks, and the presence of sizeable automotive storage OEMs. Europe and Asia-Pacific are the following biggest markets due to the growing trend of outdoor activities and tourism and the rising adoption of lifestyle vehicles like SUVs.

Car Rack Market Trends

Roof Rack Segment is Expected to Grow at a Faster rate During the Forecast Period

The roof rack segment of the car rack market is expected to gain significance over the forecast period, owing to the increasing use of campers and off-road vehicles. With rising off-road vehicle users and SUV sales, the need for roof racks is expected to increase.

In 2021, SUVs accounted for about 45.9% of the total passenger car sales worldwide, growing by 4% from the previous year, indicating the high potential for off-road applications and increased use of roof racks for long-distance traveling across the world. Also, an estimated 200 million SUVs were in operation in 2021, indicating the high potential for these vehicles and roof racks for traveling.

According to RV Industry Association, sales of camper vehicles crossed 600000 units in 2021. Camper vans are generally outfitted with racks to increase their storage capacity since campers prefer to take their camper vehicles on long outdoor vacations, often to remote locations, stuffed with daily necessities. This increase in the sales of camper vehicles is also leading to a rise in the sales of car racks.

Several OEMs also implement various techniques for passenger comfort and roof rack utility in their models. For instance,

- October, 2022 : German camper specialist Ququq launched the world's first camper kit consisting of a luggage rack specially designed for VW I.D. Buzz. The equipment is priced competitively under USD 3000.

Thus the confluence of all the above factors is predicted to drive the growth of the roof rack period in the next five years.

North America to Play Key Role in Development of Car Rack Market

The car rack market in North America is expected to dominate the overall market during the forecast period. Some of the major factors driving the growth of the US market are the growing demand for vehicles from the tourism sector (car rental and taxi services), increasing demand for recreational vehicles (rising demand for recreational travels among consumers), and a large number of young people moving out to different cities in the United States for studies and work.

The share of leisure trips in the United States was valued at more than 86% of the total tourism in 2021, indicating the huge potential for quality roof racks to be mounted on vehicles. Bicycling and hiking have been voted as the third and fifth most popular outdoor activities preferred by Canadian citizens, which usually require standard car roof racks to mount various equipment and bicycles. This factor further increases the need for car rack equipment in the country.

Although there was a decline in the number of users due to the pandemic, the packaged holidays and vacation rentals segment of Canadian tourism observed a steep rise in the users in 2021, pointing toward an expected increase in the need for multipurpose vehicles equipped with car racks for traveling needs.

With the presence of renowned roof rack manufacturers like Yakima, Allen Group, and Saris Group in the geography, the use of roof racks is expected to be the highest during the forecast period. Therefore, such factors are expected to boost the North American car rack market during the forecast period.

The market is also expected to be driven by the launching of new products by car rack OEMs. For instance

- October, 2022: Lucid Motors launched new Lucid Air Crossbars accessories for Lucid Air Luxury EVs. The accessories include a new aluminum roof storage system capable of support 165 Ib. of load and are available for order now, with shipping beginning in Q4 2022.

Thus, North America is likely to remain the world's largest market for car racks over the next five years due to the above factors.

Car Rack Industry Overview

The car rack market is moderately consolidated with several major and local players. Some of the major market players are Thule Group AB, Yakima Products Inc., Rhino-Rack USA LLC, Car Mate Mfg. Co. Ltd, and Cruzber. Manufacturers are looking at different and innovative designs to be installed onto vehicles that consume less space and are more practical in design aspects. They are focusing on various growth strategies, such as product developments, partnerships, and retail expansion to strengthen their position in the market. For instance,

- September, 2022, Hyundai Mobis introduced new touring accessories Roof Box, Roof Basket, and Bike Carrier for Hyundai Tucson, Creta, Venue, and Kona electric SUV customers in India. These accessories have been developed in association with Thule Group AB.

- October, 2022, Carmate introduced a new storage roof box called Inno which can be attached and removed as a suitcase to the roof of the vehicle. The rooftop box has a capacity of 160 liters and can accommodate chairs and tables of up to 900mm in length.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in USD Billion)

- 5.1 By Application Type

- 5.1.1 Roof Rack

- 5.1.2 Roof Box

- 5.1.3 Bike Car Rack

- 5.1.4 Ski Rack

- 5.1.5 Watersport Carrier

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 Rest of Asia-Pacific

- 5.2.4 Rest of the World

- 5.2.4.1 Brazil

- 5.2.4.2 South Africa

- 5.2.4.3 Other Countries

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Thule Group

- 6.2.2 Yakima Products Inc.

- 6.2.3 Allen Sports

- 6.2.4 Rhino-Rack USA LLC

- 6.2.5 Cruzber SA

- 6.2.6 ACPS Automotive GmbH

- 6.2.7 Malone Auto Racks

- 6.2.8 Kuat Car Racks

- 6.2.9 Car Mate Mfg Co. Ltd

- 6.2.10 Saris