|

市场调查报告书

商品编码

1443967

结构性黏着剂:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Structural Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

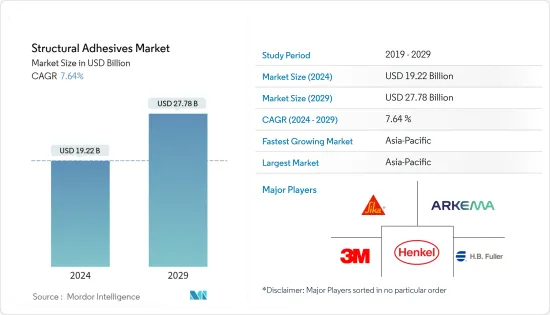

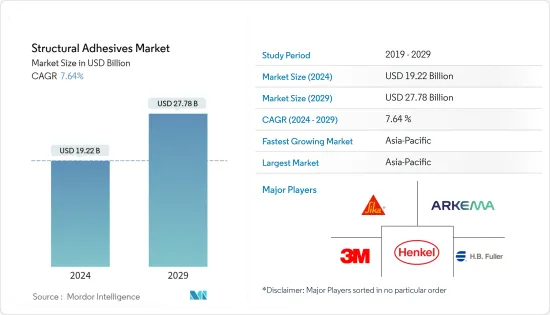

结构性黏着剂市场规模预计到2024年为192.2亿美元,预计到2029年将达到277.8亿美元,在预测期内(2024-2029年)复合年增长率为7.64%,预计将会增长。

2020 年市场受到 COVID-19 的负面影响。然而,由于建筑、汽车和风力发电等各个最终用户产业的消费增加,2021年出现显着反弹。

主要亮点

- 短期内,新兴经济体投资的增加以及全球建筑和汽车行业需求的增加可能会推动市场研究。

- 然而,日益增长的环境和健康担忧预计将阻碍市场成长。

- 增加对水下结构性黏着剂的研究可能是未来市场成长的机会。

- 亚太地区主导市场,其中以中国消费最为突出。

结构性黏着剂市场趋势

建设产业需求增加

- 在建筑领域,结构性黏着剂用于黏合能够承受载荷和应力的材料。这些黏剂具有优异的抗衝击性、断裂韧性和结构弹性,而不影响黏合强度。

- 在建筑领域,结构性黏着剂为混凝土、承载能力材料、铝和钢等金属、塑胶、工程木材等提供耐久性。除了耐用之外,结构性黏着剂还能节能且美观。它还减少了维护需求。这些特性延长了建筑建筑幕墙和桥樑的生命週期。

- 建设产业使用的结构性黏着剂有丙烯酸结构性黏着剂、钢筋黏剂、锚固黏剂、注射黏剂、碳纤维加强黏剂、吊挂黏剂、硅胶结构性黏着剂等。

- 随着全球建设活动的活性化,预计在预测期内对结构性黏着剂的需求将会增加。 2021年全球建筑市场价值约7.2兆美元,2022年可能呈现3.6%的成长率。

- 亚太地区的建筑业是世界上最大的,并且由于人口增长、中等收入群体的增长和都市化而正在以健康的速度扩张。此外,由于中国和印度的住宅建筑市场不断扩大,亚太地区预计将出现最高的成长。根据中国国家统计局的数据,2021 年中国建筑业产值为25.92 兆元(约4.3 兆美元),而2020 年为23.27 兆元(约合3.62 兆美元)。此后有所增加。

- 美国在北美建设产业中占有很大份额。加拿大和墨西哥也对建筑业做出了重大贡献。根据美国人口普查局的数据,2021 年该国新建设将达到 16,264.44 亿美元,高于 2020 年的 14,995.7 亿美元。

- 因此,所有上述因素都可能对所研究市场的需求产生重大影响。

亚太地区主导市场

- 2021年全球结构性黏着剂市场由亚太地区主导。中国是世界上最大的结构性黏着剂消费国之一。

- 根据中国2022年1月公布的五年计划,预计2022年中国建设产业将成长6%左右。中国计划增加装配式建筑的建设,以减少建筑工地的污染和废弃物。

- 此外,据国家发展和改革委员会称,中国政府已核准了26 个基础设施计划,预计投资额约为 1,420 亿美元。这些计划目前正在进行中,预计将于 2023 年完成。

- 中国是世界上最大的汽车製造国。根据OICA统计,2021年中国汽车产量达2,608万辆,比2020年的2,523万辆成长3%。汽车产量的增加预计将推动结构性黏着剂的需求,特别是在高端汽车製造领域。

- 此外,根据斯德哥尔摩国际和平研究所 (SIPRI) 的数据,中国是仅次于美国的世界第二大军费开支国,2021 年的军事开支预计将达到 2,930 亿美元。与 2020 年相比,成长了 4.7%。中国的2021年预算是其第十四个五年计画的第一个预算,该计画将持续到2025年。

- 印度庞大的建筑业预计到2022年将成为世界第三大建筑市场。印度政府实施的各种政策,例如智慧城市计划和2022年普及住宅,预计将为低迷的建设产业带来动力。

- 汽车和航太部门是结构性黏着剂的其他重要使用者。根据 OICA 的数据,2021 年印度生产了约 4,399,112 辆汽车,比 2020 年的 3,381,819 辆成长了 30%。

- 上述因素预计将影响预测期内亚太地区结构性黏着剂的需求。

结构性黏着剂产业概况

全球结构性黏着剂市场本质上是部分分散的,国内外参与者众多。主要参与者包括(排名不分先后)Henkel AG &Co.KGaA、Sika AG、3M、HB Fuller Company 和 Arkema。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 加大对亚太地区新兴经济体的投资

- 全球建筑和汽车产业的需求增加

- 抑制因素

- 日益增长的环境和健康问题

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 依树脂类型

- 环氧树脂

- 聚氨酯

- 丙烯酸纤维

- 氰基丙烯酸酯

- 甲基丙烯酸甲酯

- 其他树脂类型

- 按最终用户产业

- 建筑学

- 车

- 航太

- 风力发电

- 其他最终用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 合併、收购、合资、合伙和协议

- 市场排名分析

- 主要企业策略

- 公司简介

- 3M

- Arkema

- Bondloc UK Ltd

- DuPont

- Engineered Bonding Solutions LLC

- Forgeway Ltd

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Illinois Tool Works Inc.

- LG Chem

- Parker Hannifin Corp.

- Sika AG

- RS Industrial

第七章 市场机会及未来趋势

- 水下结构性黏着剂生长的研究

The Structural Adhesives Market size is estimated at USD 19.22 billion in 2024, and is expected to reach USD 27.78 billion by 2029, growing at a CAGR of 7.64% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020. However, it recovered significantly in 2021, owing to rising consumption from various end-user industries, such as construction, automotive, and wind energy.

Key Highlights

- Over the short term, the increasing investments in developing Asia-Pacific economies and increasing demand from the global construction and automotive sectors may drive the market studied.

- However, growing environmental and health concerns are expected to hinder the growth of the studied market.

- The growing research on underwater structural adhesives is likely to act as an opportunity for market growth in the future.

- Asia-Pacific dominated the market, with the most significant consumption recorded in China.

Structural Adhesives Market Trends

Increasing Demand from the Construction Industry

- In the construction sector, structural adhesives are used to bond materials to withstand loads or stresses. These adhesives offer good impact resistance, fracture toughness, and structural flexibility without affecting bond strength.

- In the construction sector, structural adhesives provide durability to concrete, load-bearing materials, metals such as aluminum and steel, plastics, engineered woods, etc. Apart from durability, structural adhesives are energy-efficient and aesthetically appealing. They also reduce the need for maintenance. These characteristics extend the life cycle of building facades and bridges.

- Some essential structural adhesives used in the construction industry include acrylic structural adhesives, steel glue, anchor glue, pouring glue, carbon fiber reinforcement glue, dry-hanging adhesives, and silicone structural adhesives.

- With growing construction activity worldwide, the demand for structural adhesives is projected to increase during the forecast period. The global construction market was valued at around USD 7.2 trillion in 2021 and is likely to witness a growth rate of 3.6% in 2022.

- The construction sector in the Asia-Pacific region is the largest in the world and is expanding at a healthy rate, owing to the rising population, increase in middle-class income, and urbanization. The highest growth for housing is also expected to be registered in the Asia-Pacific region, owing to the expanding housing construction markets in China and India. According to the National Bureau of Statistics of China, the output value of the construction works in the country in 2021 was CNY 25.92 trillion (~USD 4.03 trillion), increasing from CNY 23.27 trillion (~ USD 3.62 trillion) in 2020.

- The United States occupies a significant share of the North American construction industry. Canada and Mexico also contribute significantly to the construction sector. According to the US Census Bureau, the value of new construction put in place in the country accounted for USD 1,626,444 million in 2021, increasing from USD 1,499,570 million in 2020.

- Therefore, all the factors mentioned above are likely to impact the demand in the market studied significantly.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global structural adhesives market in 2021. China is one of the world's largest consumers of structural adhesives.

- According to China's Five-Year Plan, unveiled in January 2022, the country's construction industry is estimated to register a growth rate of approximately 6% in 2022. China plans to increase the construction of prefabricated buildings to reduce pollution and waste from construction sites.

- Moreover, as per the National Development and Reform Commission, the Chinese government approved 26 infrastructure projects with an estimated investment of around USD 142 billion. These projects are in progress and are estimated to be completed by 2023.

- China is the largest manufacturer of automobiles in the world. According to the OICA, the automotive production in the country reached 26.08 million in 2021, which increased by 3% compared to 25.23 million vehicles produced in 2020. The increase in automotive production is estimated to drive the demand for structural adhesives, especially in the high-end vehicle manufacturing sector.

- Furthermore, as per the Stockholm International Peace Research Institute (SIPRI), China, the world's second-largest spender on the military after the United States, allocated an estimated USD 293 billion to its military in 2021. This was an increase of 4.7% compared to 2020. The 2021 Chinese budget was the first under the 14th Five-Year Plan, which runs until 2025.

- India's massive construction sector is expected to become the world's third-largest construction market by 2022. Various policies implemented by the Indian government, such as the Smart Cities project and Housing for all by 2022, are expected to prove an impetus to the slowing construction industry.

- The automotive and aerospace sectors are the other significant users of structural adhesives. According to OICA, around 4,399,112 vehicles were produced in India in 2021, which increased by 30% compared to 3,381,819 units in 2020.

- The factors above are expected to affect the demand for structural adhesives in the Asia-Pacific region over the forecast period.

Structural Adhesives Industry Overview

The global structural adhesives market is partially fragmented in nature, with the presence of various international and domestic players. Some of the major players include Henkel AG & Co. KGaA, Sika AG, 3M, H.B. Fuller Company, and Arkema (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increase in Investments in Developing Economies in Asia-Pacific

- 4.1.2 Increasing Demand from the Global Construction and Automotive Sectors

- 4.2 Restraints

- 4.2.1 Growing Environmental and Health Concerns

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Resin Type

- 5.1.1 Epoxy

- 5.1.2 Polyurethane

- 5.1.3 Acrylic

- 5.1.4 Cyanoacrylate

- 5.1.5 Methyl Methacrylate

- 5.1.6 Other Resin Types

- 5.2 By End-user Industry

- 5.2.1 Construction

- 5.2.2 Automotive

- 5.2.3 Aerospace

- 5.2.4 Wind Energy

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 Bondloc UK Ltd

- 6.4.4 DuPont

- 6.4.5 Engineered Bonding Solutions LLC

- 6.4.6 Forgeway Ltd

- 6.4.7 H. B. Fuller Company

- 6.4.8 Henkel AG & Co. KGaA

- 6.4.9 Huntsman International LLC

- 6.4.10 Illinois Tool Works Inc.

- 6.4.11 LG Chem

- 6.4.12 Parker Hannifin Corp.

- 6.4.13 Sika AG

- 6.4.14 RS Industrial

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Research on Underwater Structural Adhesives