|

市场调查报告书

商品编码

1443978

草甘膦 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Glyphosate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

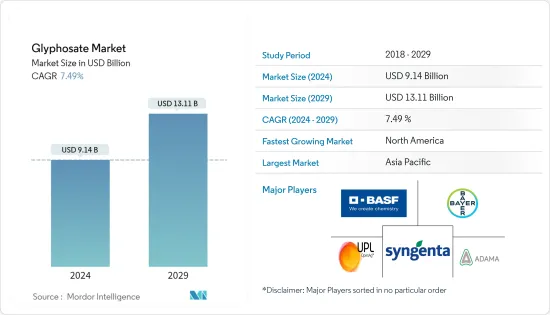

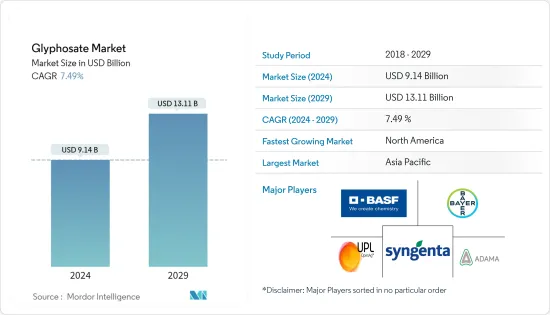

2024年草甘膦市场规模预计为91.4亿美元,预计到2029年将达到131.1亿美元,在预测期内(2024-2029年)CAGR为7.49%。

主要亮点

- 随着耐除草剂作物面积的增加以及越来越多的国家批准作物耐除草剂技术,随着农民的迅速采用,市场预计将无机成长。相对于机械耕作系统的产品优势,如成本低、土壤少、环境退化等,支持了草甘膦市场的扩张。已开发市场对环境危害的担忧仍然存在,但由于缺乏有效的草甘膦替代品,预计市场成长不会放缓。

- 对蔬菜种植者带来的大部分好处都与草甘膦的多功能性和灵活性有关。草甘膦已註册用于几乎所有蔬菜作物,并且可以在大多数情况下使用。就处理的总面积而言,大部分草甘膦的使用发生在农田作物出苗后后期。北美和亚太地区是草甘膦利润丰厚的市场。基因改造作物的采用,加上耕地的可用性,预计将在未来几年推动亚太地区草甘膦市场的发展。

- 草甘膦目前已获批准在欧盟使用,有效期至2022 年12 月15 日。这意味着在此日期之前它可以作为PPP 中的活性物质使用,并且每种产品均已获得国家当局的授权并进行了安全评估。欧洲食品安全局(EFSA)表示需要更多时间重新评估该农药,并将其推迟到 2023 年 7 月。

- 2022年,印度政府因担心对人类和动物健康造成风险,限製印度使用化学草甘膦。然而,政府只允许透过害虫防治业者(PCO)使用它。 PCO 获准使用致命化学物质来治疗囓齿动物等害虫。草甘膦及其製剂已广泛註册,目前在包括欧盟和美国在内的 160 多个国家/地区使用。

草甘膦除草剂市场趋势

基因改造耐除草剂作物的商业化

耐除草剂(HT)作物能够抵抗强效除草剂,为农民提供了有效控制杂草的多种选择。此外,农民不需要翻耕土壤,而他们通常会这样做来除草。据美国农业部称,基改耐除草剂作物目前约占全球草甘膦使用量的 56%。基因改造 (GE) 种子已在美国用于主要农田作物的商业化推广,采用率迅速提高。美国 90% 以上的玉米、陆地棉和大豆现在都是使用基因改造品种生产的。耐除草剂(HT)作物能够耐受强效除草剂(如草甘膦、草铵膦和麦草畏),为农民提供了多种有效杂草控制的选择。

根据美国农业部调查资料,2021年和2022年,大豆HT种植面积小幅增长至95%,棉花在2021年达到94%的高位。2022年,国内玉米麵积约90%种植了HT种子。在美国,没有一种农药能达到如此密集且广泛的使用。未来,草甘膦可能仍然是全球应用最广泛的农药,在量化生态和人类健康影响方面,其需求可能会成长。

大豆、玉米、棉花和甜菜等农田作物的种植面积达数百万英亩,草甘膦处理的总面积和施用量最高。平均而言,每年有 84% 的草甘膦施用在大豆、玉米或棉花上。这三种农田作物的抗草甘膦(GR)品种已被广泛采用。农田作物的平均单次施用量范围为 0.72 至 1.00 磅。 ae/英亩。因此,草甘膦对于农业环境中的使用者来说仍然是一种有用的除草剂,因为它具有广谱应用的性质,使用简单,并且通常具有成本效益。

亚太和北美是潜在市场

亚太地区和北美地区为草甘膦除草剂市场的公司提供了同样有吸引力的机会。由于耐除草剂杂交品种的普及程度不断提高,预计北美地区仍将是草甘膦的最大市场之一。据估计,美国近 56% 的草甘膦用于耐除草剂作物。基因改造作物在北美进行商业化种植,包括马铃薯、南瓜/南瓜、苜蓿、茄子、甜菜、木瓜、油菜籽、玉米、大豆和棉花。

在亚太地区,市场预计将实现更快的成长。该地区拥有世界上最高的耕地面积和最高的农作物多样性。更多采用零耕等先进农业实践预计将带动该地区草甘膦除草剂市场的成长。然而,中国已批准种植耐除草剂杂交品种。

耐除草剂的基因改造作物可以帮助农民在不损害作物的情况下控制杂草。例如,当环斑病毒威胁夏威夷木瓜产业和夏威夷木瓜农民的生计时,植物科学家开发了抗环斑病毒的彩虹木瓜,称为基因改造木瓜,它对病毒有抵抗力,现在在夏威夷各地种植并出口到日本。此外,基因改造(GM)作物有助于减少农业温室气体(GHG)排放,并可能减少生产排放;基因改造产量的增加还可以缓解土地利用变化和相关排放。

环境部批准种植基改芥末,以支持基改作物的商业种植,包括透过提高产量、降低粮食生产成本、减少农药需求以及抵抗病虫害来提高粮食安全。基因转殖芥菜杂交种 DMH-11 是由印度农作物基因操作中心 (CGMCP) 开发的。迄今为止,政府只批准了一种基因改造作物——Bt 棉花——用于商业种植。

草甘膦除草剂产业概况

全球草甘膦市场由拜耳作物科学公司、巴斯夫、先正达公司、安道麦农业解决方案有限公司和 UPL 有限公司等公司占据主导地位。这些公司透过专注于全球范围内的新产品发布、合作伙伴关係、合併和收购来扩大其业务活动。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 市场驱动因素

- 市场限制

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场细分

- 类型

- 基因改造作物

- 非基因改造作物

- 应用

- 谷物和谷物

- 豆类和油籽

- 水果和蔬菜

- 经济作物

- 其他作物类型

- 地理

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 西班牙

- 义大利

- 法国

- 德国

- 俄罗斯

- 英国

- 欧洲其他地区

- 亚太

- 印度

- 中国

- 日本

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 非洲其他地区

- 北美洲

第 6 章:竞争格局

- 最常用的策略

- 市占率分析

- 公司简介

- Adama Agricultural Solutions Ltd

- BASF SE

- Bayer Cropscience AG

- UPL Limited

- FMC Corporation

- Zhejiang Xinan Chemical Industrial Group Company Ltd

- Nufarm Limited

- DuPont

- Syngenta International

- Dow AgroSciences

第 7 章:市场机会与未来趋势

The Glyphosate Market size is estimated at USD 9.14 billion in 2024, and is expected to reach USD 13.11 billion by 2029, growing at a CAGR of 7.49% during the forecast period (2024-2029).

Key Highlights

- With the area under herbicide-tolerant crops increasing and more countries approving herbicide-tolerance technology for crops, the market is expected to grow inorganically with rapid farmer adoption. Product advantages over mechanical tillage systems, like low cost, less soil, and environmental degradation, support the glyphosate market expansion. Its concerns for the environmental hazards remain in developed markets, but the market is not expected to slow down on account of the lack of availability of efficient alternatives to glyphosate.

- Most of the benefits conveyed to vegetable growers relate to glyphosate's versatility and flexibility. Glyphosate is registered for nearly all vegetable crops and can be used in most circumstances. The majority of glyphosate use, in terms of total acres treated, occurs during late postemergence to the crop in field crops. North America and Asia-Pacific are lucrative markets for glyphosate. GM crop adoption, coupled with arable land availability, is expected to drive the Asia Pacific glyphosate market over the coming years.

- Glyphosate is currently approved for use in the European Union until 15 December 2022. This means it can be used as an active substance in PPPs until that date, and each product is authorized by national authorities with a safety evaluation. European Food Safety Authority (EFSA) stated that it required more time to reassess the pesticide, pushing it back to July 2023.

- In 2022, The Indian government restricted the use of chemical glyphosate in India, fearing risks to human and animal health. However, the government allowed its use only through pest control operators (PCOs). PCOs are licensed to use deadly chemicals for treating pests such as rodents. Glyphosate and its formulations are widely registered and are currently used in over 160 countries, including the European Union and the United States.

Glyphosate Herbicide Market Trends

Commercialization of Genetically Engineered Herbicide-tolerant Crops

Herbicide-tolerant (HT) crops, which resist potent herbicides, provide farmers with various options for effective weed control. Also, the farmers do not need to till the soil, which they normally do to get rid of weeds. According to the USDA, genetically engineered herbicide-tolerant crops now account for about 56% of global glyphosate use. Genetically Engineered (GE) seeds were commercially introduced in the United States for major field crops, with adoption rates increasing rapidly. Over 90 percent of US corn, upland cotton, and soybeans are now produced using GE varieties. Herbicide-tolerant (HT) crops, which tolerate potent herbicides (such as glyphosate, glufosinate, and dicamba), provide farmers with a wide variety of options for effective weed control.

According to USDA survey data, in 2021 and 2022, soybean HT acreage increased slightly to 95 percent, and cotton reached a high of 94 percent in 2021. In 2022, approximately 90 percent of domestic corn acres were planted with HT seeds. No pesticide has come remotely close to such intensive and widespread use in the United States. Glyphosate may remain the most widely applied pesticide worldwide in the future, and its demand may grow in quantifying ecological and human health impacts.

With millions of acres planted, large field crops, such as soybeans, corn, cotton, and sugar beets, have the highest total area treated and pounds applied with glyphosate. On average, 84% of glyphosate, in terms of volume, is applied to soybeans, corn, or cotton per year. These three field crops have glyphosate-resistant (GR) varieties that have been widely adopted. The average single application rate for field crops ranges from 0.72 to 1.00 lbs. a.e./acre. Thus, glyphosate remains a useful herbicide for users in agricultural settings because of its nature of the broad-spectrum application, is simple to use, and is often cost-effective.

Asia-Pacific and North America are Potential Markets

The Asia-Pacific and the North American regions present equally attractive opportunities to companies operating in the glyphosate herbicide market. On account of the increasing levels of penetration of herbicide-tolerant hybrids, the North American region is expected to remain one of the largest markets for glyphosate. It is estimated that almost 56% of glyphosate usage in the United States is for herbicide-tolerant crops. GM crops are grown commercially in North America, including potato, squash/pumpkin, alfalfa, aubergine, sugar beet, papaya, rape oilseed, maize, soya beans, and cotton.

In the Asia-Pacific region, the market is expected to achieve faster growth. The region has the highest arable land in the world with the highest crop diversity. Increased adoption of advanced agricultural practices such as zero-tillage is expected to deliver growth to the glyphosate herbicide market in the region. However, China has provided approval to grow herbicide-tolerant hybrids.

GMO crops that are tolerant to herbicides help farmers control weeds without damaging the crops. For example, when the ringspot virus threatened the Hawaii papaya industry and the livelihoods of Hawaiian papaya farmers, plant scientists developed the ringspot virus-resistant Rainbow papaya called GMO papaya, which is resistant to a virus and now it is grown all over Hawaii and exported to Japan. In addition, Genetically modified (GM) crops can help reduce agricultural greenhouse gas (GHG) emissions and possible decreases in production emissions; GM yield gains also mitigate land-use change and related emissions.

Environment Ministry Approves the Cultivation of GM Mustard for those supporting commercial cultivation of GM crops, including greater food security due to increased yields, reduced costs for food production, reduced need for pesticides, and resistance to pests and disease. The transgenic mustard hybrid DMH-11 has been developed by the Centre for Genetic Manipulation of Crop Plants (CGMCP) in India. The government has so far approved only one GM crop, Bt cotton, for commercial cultivation.

Glyphosate Herbicide Industry Overview

The global glyphosate market is consolidated with the dominance of players such as Bayer CropScience AG, BASF Corporation, Syngenta AG, Adama Agricultural Solutions Ltd, and UPL Limited. These companies are expanding their business activities by focusing on new product launches, partnerships, mergers, and acquisitions across the world.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 GM Crops

- 5.1.2 Non-GM Crops

- 5.2 Application

- 5.2.1 Grains and Cereals

- 5.2.2 Pulses and Oilseeds

- 5.2.3 Fruits and Vegetables

- 5.2.4 Commercial Crops

- 5.2.5 Other Crop Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 Italy

- 5.3.2.3 France

- 5.3.2.4 Germany

- 5.3.2.5 Russia

- 5.3.2.6 United Kingdom

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Adama Agricultural Solutions Ltd

- 6.3.2 BASF SE

- 6.3.3 Bayer Cropscience AG

- 6.3.4 UPL Limited

- 6.3.5 FMC Corporation

- 6.3.6 Zhejiang Xinan Chemical Industrial Group Company Ltd

- 6.3.7 Nufarm Limited

- 6.3.8 DuPont

- 6.3.9 Syngenta International

- 6.3.10 Dow AgroSciences