|

市场调查报告书

商品编码

1444000

生物防治 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Biological Control - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

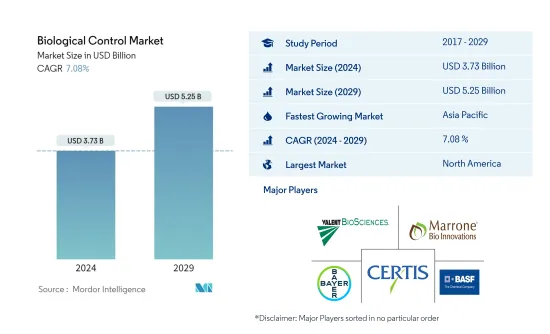

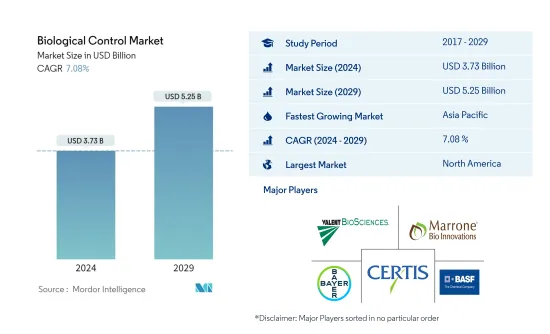

生物防治市场规模预计到 2024 年为 37.3 亿美元,预计到 2029 年将达到 52.5 亿美元,在预测期内(2024-2029 年)CAGR为 7.08%。

主要亮点

- 生物防治方法对环境友好,与合成农业化学品相比对人体没有有害影响,并且在整个季节都有效,因此使其成为害虫防治的理想选择。民众对合成农药对人体危害的日益关注,加上对农业合成化学品的监管不断加强,以及随后世界各地对此类化学品的禁令,将推动来年的生物防治市场。

- 由于生物防治的成本比农药低,因此越来越受欢迎,这促进了市场的扩大。对它的需求日益增长,因为它可以透过减少对环境的排放来取代化学製剂,从而减少土壤和水污染。此外,有机种植面积的增加、监管的宽鬆以及对粮食安全的需求不断增加是推动生物製品销售的主要市场驱动力。然而,产品的自寿命较短和农民的认知度较低可能会限制市场的成长。

- 美国等已开发国家正在采用生物防治,主要是土壤处理,以提高作物早期生产力和活力。农药成本的上升反过来又导致生物防治产品的大量使用。

- 市场仍处于初级阶段。正在加强研发合作、伙伴关係和其他活动,以开发和扩大生物控制市场,随着消费者偏好转向有机食品,该市场预计将成长。例如,2021年3月,拜耳公司推出了Vynyty柑橘,这是一种基于生物和费洛蒙的作物保护产品,用于控制柑橘农场的害虫。该产品目前在西班牙使用,并可供其他地中海国家的柑橘和其他作物种植者使用。

生物防治市场趋势

增加有机农业

有机农业代表了食品工业中一个独特的、快速成长的部分。世界各地的有机农业面积正在迅速成长。根据FiBL统计,2019年全球有机种植面积为7,200万公顷,成长4.1%,2020年达7,490万公顷。

此外,有机农业采用生物防治作为处理害虫的方法,而不是使用合成作物保护化学品,因此市场上生物防治的成长与有机农业的成长成正比。

此外,世界各国政府正在努力促进有机农业的发展,这促使他们做出立法改革,以在未来几年促进有机农业的发展。例如,2021 年,欧盟通过了新立法,为有机农业产业建立有效的法律架构。这项立法加上消费者对有机产品的兴趣增加,将在预测期内推动生物防治市场的成长。同样,生物防治产品领域的创新,加上消费者对合成农药负面影响的认识不断增强,预计很快就会提高生物防治产品的采用率。

北美主导生物防治市场

北美在生物防治市场占据主导地位。在北美,由于可用耕地充足,美国拥有最大的市场,约占北美市场的一半。对有机标籤产品的日益关注和对微生物农药效率的认识推动了该地区的市场。美国农业部门高度发展,最近一直在适应自然和有机的农业方式。因此,生物防治产品的消费呈成长趋势。化学投入成本的增加、对土壤和环境的不利影响以及对平衡植物营养的认识不断提高是推动该国市场需求的主要因素。

影响北美市场采用生物防治的主要因素之一是传统产品因註册或产品性能问题而流失。研究是许多重要公司关注的主要领域,包括 FMC Corporation、Corteva Agriscience 和 Marrone Bio Innovations。例如,2021 年,美国 Botanical Solution Inc. (BSI) 和先正达达成协议,将 BSI 的首款产品 BotriStop 在秘鲁和墨西哥商业化。 BotriStop 被配製为生物杀菌剂,可有效控制蓝莓、葡萄藤和蔬菜中的灰葡萄孢。两家公司将瞄准秘鲁和墨西哥市场的新鲜食品生产需求。

此外,加拿大对生物防治产品的需求主要是由传统农业、近期管理农药化妆品使用的市和省法律的变化以及低风险害虫防治产品的立法和随后的推广推动的。农药成本的上涨也导致了生物防治产品的大量使用。

生物防治产业概况

生物防治市场是一个分散的市场,市场上存在着各种小型和区域性参与者。市场上一些着名的参与者包括 Certis、BASF SE、Marrone Bio Innovations Inc.、Bayer CropScience AG 和 Valent Biosciences。市场主要参与者主要采取不同的策略,例如合作伙伴关係、向新领域拓展业务以及併购,以获得市场据点并为整体市场带来更多收入份额。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 市场驱动因素

- 市场限制

- 波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场细分

- 类型

- 微生物

- 细菌

- 病毒

- 菌类

- 微生物

- 寄生蜂

- 掠夺者

- 昆虫病原线虫

- 微生物

- 目标害虫

- 节肢动物

- 杂草

- 微生物

- 应用

- 种子处理

- 在现场

- 丰收后

- 作物应用

- 谷物和谷物

- 油籽和豆类

- 水果和蔬菜

- 其他作物应用

- 地理

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 亚太地区其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 世界其他地区

- 南非

- 其他国家

- 北美洲

第 6 章:竞争格局

- 最常用的策略

- 市占率分析

- 公司简介

- BASF SE

- Bayer CropScience

- Corteva Agriscience

- UPL Ltd.

- Syngenta Ag

- Koppert BV

- Brettyoung (Lallemand)

- Certis USA LLC

- Chr. Hansen

- Marrone Bio Innovations

- Symbiota

- Precision Laboratories LLC

- Verdesian Life Sciences LLC

- Valent Biosciences Corporation (Sumitomo Chemical Company Limited)

- IsAgro

第 7 章:市场机会与未来趋势

The Biological Control Market size is estimated at USD 3.73 billion in 2024, and is expected to reach USD 5.25 billion by 2029, growing at a CAGR of 7.08% during the forecast period (2024-2029).

Key Highlights

- Biological Control methods are environmentally friendly, have no harmful effects on humans compared to synthetic agrochemicals, and are effective throughout the season, therefore making them ideal for pest control. Rising public concern about synthetic pesticide hazards to the human body coupled with growing regulations on synthetic chemicals in farming and subsequent bans on such chemicals across the world drives the biological control market during the coming year.

- Due to their lower cost than pesticides, biological controls are becoming more popular, which is fostering the expansion of the market. The need for it is growing daily because it can replace chemical agents by reducing emissions into the environment, which in turn leads to less soil and water pollution. Further, the increasing area under organic cultivation, less stringent regulations, and increasing need for food security are the major market drivers that are boosting the sales of biologicals. However, the less self-life of the product and low awareness among the farmers are likely to restrain the market growth.

- The developed country like United States is adopting biological control, mainly in case of soil treatment, to strengthen the crop productivity and vigor at an early stage. The rising cost of pesticides, which has, in turn, led to high usage of biological control products.

- The market is still in its initial stages. Increased R&D collaborations, partnerships, and other activities are underway to develop and expand the biological control market, which is expected to grow as consumer preferences shift toward organic food products. For instance, in march 2021, Bayer AG introduced Vynyty citrus, a crop protection product based on biological and pheromones to control pests on citrus farms. The product is currently being used in Spain and is available to growers of citrus and other crops in other Mediterranean countries.

Biological Control Market Trends

Increasing Organic Farming

Organic farming represents a unique, fast-growing segment of the food industry. The area under organic farming is rapidly growing across the world. According to FiBL statistics, the area under organic cultivation across the world was 72.0 million hectares in 2019, which increased by 4.1% and reached 74.9 million hectares in 2020.

Furthermore, Organic Farming incorporates the use of biological controls as a method to deal with pests rather than using Synthetic Crop Protection Chemicals, therefore Biological Control growth in the market is directly proportional to the increasing organic farming.

Additionally, governments around the world are making efforts for the growth of organic farming and this has led them to make legislative changes that shall boost organic farming in coming years. For instance, in 2021, the EU passed new legislation for an effective legal framework for the organic farming industry. This legislation coupled with increased consumer interest in organic products will drive the growth of the biological controls market during the forecast period. Similarly, innovations in the area of biological control products, coupled with a growing consumer awareness about the negative impact of synthetic pesticides, are expected to boost the adoption rate of biological controls shortly.

North America Dominates the Biological Control Market

North America dominates the biological control market. In North America, the United States holds the largest market, with around half of the North American market, owing to the plenty of available arable lands. Rising concerns over organic labeled products and awareness of microbial pesticides efficiency have driven the market in the region. The United States, with its highly evolved agricultural sector, has been adapting to the natural and organic way of farming lately. Therefore, biological control product consumption is a growing trend there. The increasing cost of chemical inputs, their adverse effect on soil mass and the environment, and the increasing awareness regarding balanced plant nutrition are the major factors driving the market demand in the country.

One of the main factors influencing the North American market adoption of biological control is the loss of conventional products due to registration or product performance concerns. Research is a major area of concentration for many important companies, including FMC Corporation, Corteva Agriscience, and Marrone Bio Innovations. For instance, in 2021, Botanical Solution Inc. (BSI), US, and Syngenta reached an agreement to commercialize BSI's first product, BotriStop, in Peru and Mexico. BotriStop was formulated as a biofungicides to effectively control Botrytis cinerea in blueberries, vines, and vegetables. The companies would target the fresh food production demand in Peruvian and Mexican markets.

Furthermore, the demand for biological control products in Canada is largely driven by conventional agriculture, recent changes to municipal and provincial laws governing the cosmetic use of pesticides, and legislation and ensuing promotion for lower-risk pest control products. The rise in the cost of pesticides also has, in turn, led to the high usage of biological control products.

Biological Control Industry Overview

The biological control market is a fragmented market with the presence of various small and regional players operating in the market. Some of the notable players in the market include Certis, BASF SE, Marrone Bio Innovations Inc., Bayer CropScience AG, and Valent Biosciences. The major players in the market are mainly focusing on adopting different strategies, such as partnerships, expanding operations into new areas, and mergers and acquisitions in order to obtain a stronghold in the market and to bring more revenue share to the overall market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Microbials

- 5.1.1.1 Bacteria

- 5.1.1.2 Viruses

- 5.1.1.3 Fungi

- 5.1.2 Macrobials

- 5.1.2.1 Parasitoids

- 5.1.2.2 Predators

- 5.1.3 Entomopathogenic Nematodes

- 5.1.1 Microbials

- 5.2 Target Pest

- 5.2.1 Arthropods

- 5.2.2 Weeds

- 5.2.3 Microorganisms

- 5.3 Application

- 5.3.1 Seed Treatment

- 5.3.2 On-field

- 5.3.3 Post Harvest

- 5.4 Crop Application

- 5.4.1 Grains and Cereals

- 5.4.2 Oilseeds and Pulses

- 5.4.3 Fruits and Vegetables

- 5.4.4 Other Crop Applications

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Italy

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Rest of the World

- 5.5.5.1 South Africa

- 5.5.5.2 Other Countries

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 BASF SE

- 6.3.2 Bayer CropScience

- 6.3.3 Corteva Agriscience

- 6.3.4 UPL Ltd.

- 6.3.5 Syngenta Ag

- 6.3.6 Koppert BV

- 6.3.7 Brettyoung (Lallemand)

- 6.3.8 Certis USA LLC

- 6.3.9 Chr. Hansen

- 6.3.10 Marrone Bio Innovations

- 6.3.11 Symbiota

- 6.3.12 Precision Laboratories LLC

- 6.3.13 Verdesian Life Sciences LLC

- 6.3.14 Valent Biosciences Corporation (Sumitomo Chemical Company Limited)

- 6.3.15 IsAgro