|

市场调查报告书

商品编码

1444038

消泡剂:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Defoamers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

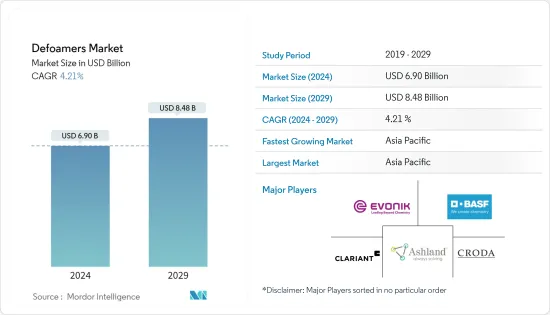

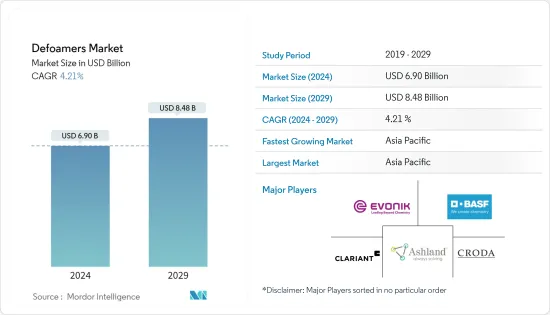

消泡剂市场规模预计2024年为69亿美元,预计到2029年将达到84.8亿美元,在预测期内(2024-2029年)复合年增长率为4.21%增长。

冠状病毒感染疾病(COVID-19)的爆发对消泡剂产业造成了沉重打击。由于全球封锁和各国政府实施的严格监管,大多数生产基地被关闭,造成毁灭性打击。儘管如此,业务已从 2021 年开始復苏,预计未来几年将大幅成长。

主要亮点

- 短期内,全球化学工业的显着成长是推动所研究市场成长的关键因素之一。

- 相反,与产品相关的副作用预计将阻碍预测期内消泡剂市场的成长。

- 然而,对环境友善消泡剂的需求不断增长可能为所研究的市场创造利润丰厚的成长机会。

- 预计亚太地区将主导市场,并且在预测期内也将见证最高的复合年增长率。

消泡剂市场趋势

水和废水处理领域推动市场成长

- 消泡剂应用于工业和都市废水处理技术。使用消泡剂可以提高生产能力、产量并降低营运成本,从而使这些製程受益。

- 污水处理系统中的泡沫可能是由生物活动、机械作用、化学污染、进水中的界面活性剂或某些聚合物处理引起的。因此,消泡剂可减少污水处理厂中泡沫形成对健康的危害。

- 据世界卫生组织称,由于中国城市人口的增长,预计到2030年,中国70%的人口将居住在城市。随着城市人口的增加,他们也面临污水和污泥的涌入。目前,中国80%的污泥被不当倾倒,随着城市中心竞相透过改善污水处理厂来减少污染,这个环境问题正变得越来越有争议。

- 墨西哥水处理产业预计将录得健康成长。例如,根据国家水委员会(CONAGUA)编制的最新国家清单,墨西哥有2,786座工厂,装置容量为196.7 m3 s1,处理流量为144.7 m3 s1。国内正在进行的研究表明,政府主要关注以都市区为主的都市污水处理厂的发展,这有可能扩大市场。

- 在瑞典,儘管大多数家庭都连接到市政污水处理厂,但仍有约 100 万人使用私人污水处理厂。瑞典在多个领域进行研究和开发,包括加强污水净化和污水源分类系统,以实现有效的水资源管理。例如,Veidekke于2022年3月签署了一份在瑞典斯德哥尔摩Sikkla兴建和安装污水处理厂的合约。该合约授予了总部位于斯德哥尔摩的 Vatten 和 Avfor 公司。这是一份以合作协定进行计划的建设合约。初始合约价值约为1.53亿美元。该计划预计将于2027年完工。因此,预计这将为水和废水处理领域的消泡剂市场带来上升的需求。

- 预计中国将为所研究市场的成长做出重大贡献。例如,上海白龙港污水处理设施是亚洲最大的污水处理设施,也是世界上最大的污水处理设施之一。它处理约 360 万人排放的污水。

- 预计上述因素将在预测期内对消泡剂市场产生重大影响。

亚太地区主导市场

- 由于中国和印度等国家的高需求,亚太地区占据了主要市场占有率。

- 由于汽车应用中油漆和涂料行业的需求不断增长,中国已成为亚太地区最大的消泡剂消费国之一。该国是最大的汽车生产国,在SUV市场成长中占据最大的市场占有率。例如,根据OICA的数据,2022年中国汽车产量为27,020,615辆,比2021年成长3%,比2020年成长7%。因此,汽车产量的增加将带动油漆和涂料领域对消泡剂市场的需求上升。

- 此外,该国也是该地区最大的建筑市场。建筑业的成长预计将导致油漆和涂料的需求增加,进而可能促进该国消泡剂的成长。 2018年至2022年中国建筑业产值显示产业逐步成长。例如,根据中国国家统计局的数据,2022年中国建筑业产值达到高峰约27.63兆元(约4.1兆美元)。

- 中国是世界第二大石油和天然气消费国,但仅是第六大生产国。我国作为石油消费大国,石油消费量逐年成长,且成长波动。但石油供应仍无法满足需求,中国主要依赖进口。例如,根据Trading Economy的数据,中国原油进口额(金额)从2023年4月的24,465,029美元(THO)增加到2023年5月的30,302,574美元(THO)。

- 此外,由于政府的支持和倡议,印度的住宅产业正在崛起,需求进一步增加。据印度品牌股权基金会(IBEF)称,住房与城市发展部(MoHUA)已在2022-2023年预算中拨出98亿日元用于建造住宅,并设立基金以完成停滞的计划,并拨款5000万美元。

- 由于上述原因,亚太地区可能在预测期内呈现最高成长率。

消泡剂产业概况

消泡剂市场本质上是适度整合的。市场的主要企业包括(排名不分先后)BASF股份公司、禾大国际有限公司、亚什兰、赢创工业股份公司和科莱恩。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 化学工业的扩展和适应性

- 增加油漆和涂料的产量

- 其他司机

- 抑制因素

- 与产品相关的副作用

- 原料短缺及出货延误

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 类型

- 油性消泡剂

- 乳液消泡剂

- 硅胶消泡剂

- 粉末消泡剂

- 聚合物消泡剂

- 其他的

- 最终用户产业

- 油漆/涂料

- 油和气

- 纸浆/纸

- 食品与饮品

- 水/污水处理

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率(%)/排名分析

- 主要企业采取的策略

- 公司简介

- Accepta Water Treatment

- Air Products Inc.

- Aqua-Clear, Inc.

- Ashland

- BASF SE

- BRB International

- Buckman

- CLARIANT

- Croda International Plc

- Dow

- Eastman Chemical Company

- ELEMENTIS PLC

- Elkem ASA

- Evonik Industries AG

- Kemira

- SAN NOPCO LIMITED

- Solvay

- Wacker Chemie AG

第七章市场机会与未来趋势

第八章 环保消泡剂需求不断成长

第 9 章 各最终用户产业对聚合物的需求不断增长

The Defoamers Market size is estimated at USD 6.90 billion in 2024, and is expected to reach USD 8.48 billion by 2029, growing at a CAGR of 4.21% during the forecast period (2024-2029).

The COVID-19 epidemic harmed the defoamers sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business is recovering from 2021 and is expected to rise significantly in the coming years.

Key Highlights

- Over the short term, significant growth in the chemical industry worldwide is one of the key factors driving the studied market growth.

- On the flip side, side effects associated with the products are expected to hinder the defoamers' market growth during the forecast period.

- Nevertheless, the rising demand for eco-friendly defoamers will likely create lucrative growth opportunities for the studied market.

- The Asia-Pacific is expected to dominate the market and will also witness the highest CAGR during the forecast period.

Defoamers Market Trends

Water and Wastewater Treatment Segment to Drive the Market Growth

- The defoamers find their applications in industrial and municipal wastewater treatment technologies. The applications of defoamers benefit these processes through increased production capacity, output volume, and reduced operational cost.

- The foam in wastewater treatment systems can result from biological activity, mechanical action, chemical contamination, surfactants in the influent, or some polymer treatments. Thus defoamers reduce the health hazard of foam formation in wastewater treatment plants.

- According to WHO, 70% of the nation's population in China is expected to reside in cities by 2030 due to the increase in the urban population throughout the country. As the urban population increases, they also face an influx of wastewater and sludge. Currently, 80% of sludge in China is improperly dumped, an increasingly controversial environmental issue with urban centers scrambling to decrease pollution by improving their wastewater treatment plants (WWTPs).

- The water treatment industry in Mexico is expected to register a healthy growth rate. For instance, according to the latest National Inventory made by the National Water Commission (CONAGUA), there are 2786 plants in Mexico with an installed capacity of 196.7 m3 s1 and a treated flow of 144.7 m3 s1. Ongoing research in the country indicates the government to majorly focus on developing municipal wastewater treatment plants, mostly in the urban areas, which will likely augment the market.

- About 1 million people in Sweden still include private sewage treatment plants despite most homes connected to municipal sewage treatment facilities. Sweden conducts research and development in various areas, including enhanced wastewater purification and source-sorting wastewater systems for effective water resource management. For instance, Veidekke secured a contract to construct and install a wastewater treatment plant in Sickla, Stockholm, Sweden, in March 2022. The contract was awarded by Stockholm Vatten och Avfall. It is an execution contract under which the project will be carried out as a collaborative contract. The initial contract value is around USD 153 million. This project is anticipated to be completed in 2027. Therefore, this is expected to create an upside demand for the defoamers market from the water and wastewater treatment segment.

- China is expected to be the major contributor to the growth of the studied market. For instance, the Bailonggang wastewater treatment plant in Shanghai is the largest in Asia and one of the biggest in the world. It disposes of the wastewater produced by around 3.6 million people.

- The factors above are expected to significantly impact the defoamers market during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific accounted for the major market share, owing to the high demand from countries like China and India.

- Due to increased demand for the paints and coatings industry in automobile applications, China is one of the largest consumers of defoamers in the Asia-Pacific region. The country is the largest producer of automobiles and contains the largest market share in the growth of the SUV market. For instance, according to OICA, in 2022, automobile production in China amounted to 2,70,20,615 units, which showed an increase of 3% compared to 2021 and 7% compared to 2020. Therefore, increasing the production of automobiles is expected to create an upside demand for the defoamers market from the paints and coatings segment.

- Moreover, the country is the largest construction market in the region. The growth in the construction sector is expected to lead to an increase in the demand for paints and coatings and, in turn, is likely to push the growth for defoamers in the country. The output value of construction in China from 2018 to 2022 indicates progressive growth in the industry. For instance, according to the National Bureau of Statistics of China, in 2022, the construction output value in China peaked at around CNY 27.63 trillion (USD 4.10 Trillion).

- China is the world's second-largest consumer of oil and gas but only the sixth-largest producer of the same. As a big oil consumer, China's oil consumption is increasing yearly with fluctuating growth rates. However, the oil supply still cannot meet the demand, and China mainly relies on imports. For instance, according to Trading Economics, imports of Crude Petroleum (value) in China increased to 3,03,02,574 USD THO in May 2023 from 2,44,65,029 USD THO in April of 2023.

- Furthermore, the residential sector in India is on an increasing trend, with government support and initiatives further boosting the demand. According to the India Brand Equity Foundation (IBEF), the Ministry of Housing and Urban Development (MoHUA) allocated USD 9.85 billion in the 2022-2023 budget to construct houses and create funds to complete the halted projects.

- Owing to the reasons above, Asia-Pacific will likely witness the highest growth rate during the forecast period.

Defoamers Industry Overview

The Defoamers Market is moderately consolidated in nature. The major players in this market (not in any particular order) include BASF SE, Croda International Plc, Ashland, Evonik Industries AG, and CLARIANT, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Expansion and adaptability in the chemical industry

- 4.1.2 Increasing Paints and Coatings Production

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Side Effects Associated with the Products

- 4.2.2 Raw Material Shortage and Shipping Delays

- 4.2.3 Other Restraints

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Oil-based Defoamer

- 5.1.2 Emulsion Defoamer

- 5.1.3 Silicone-based Defoamer

- 5.1.4 Powder Defoamer

- 5.1.5 Polymer-based Defoamers

- 5.1.6 Other Types

- 5.2 End-user Industry

- 5.2.1 Paints and Coatings

- 5.2.2 Oil and Gas

- 5.2.3 Pulp and Paper

- 5.2.4 Food and Beverages

- 5.2.5 Water and Wastewater Treatment

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Accepta Water Treatment

- 6.4.2 Air Products Inc.

- 6.4.3 Aqua-Clear, Inc.

- 6.4.4 Ashland

- 6.4.5 BASF SE

- 6.4.6 BRB International

- 6.4.7 Buckman

- 6.4.8 CLARIANT

- 6.4.9 Croda International Plc

- 6.4.10 Dow

- 6.4.11 Eastman Chemical Company

- 6.4.12 ELEMENTIS PLC

- 6.4.13 Elkem ASA

- 6.4.14 Evonik Industries AG

- 6.4.15 Kemira

- 6.4.16 SAN NOPCO LIMITED

- 6.4.17 Solvay

- 6.4.18 Wacker Chemie AG