|

市场调查报告书

商品编码

1444039

自动驾驶汽车:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Autonomous (Driverless) Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

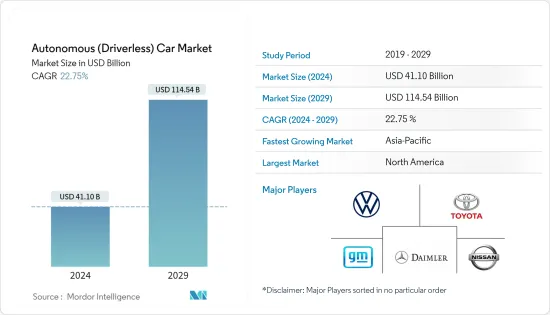

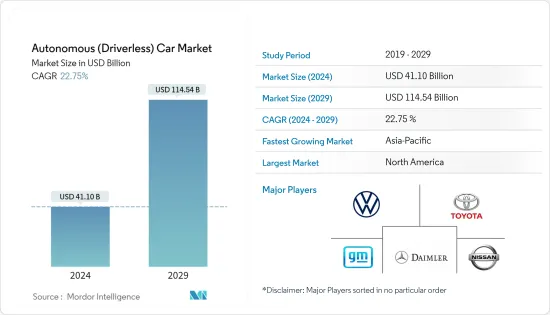

自动驾驶汽车市场规模预计2024年为411亿美元,预计到2029年将达到1145.4亿美元,在预测期内(2024-2029年)复合年增长率为22.75%增长。

COVID-19感染疾病影响了整个汽车产业,迫使汽车製造商减少其生产工厂的产能。疫情也影响了许多OEM从生产到研发的业务,造成短期中断并减缓了自动驾驶汽车的采用和部署。

随着政府对提高道路安全的监管日益严格,采用先进技术并与智慧型手机整合的自动驾驶汽车正在开发中,为市场相关人员创造了吸引客户的机会。人工智慧、机器学习以及雷达、光达、GPS 和电脑视觉等其他感测器领域的最新技术进步使製造商能够提高汽车的自动驾驶能力。

目前,2 级和 3 级自动驾驶汽车在市场上最受关注,但 4 级和 5 级(根据 SAE 标准)预计到 2030 年将获得广泛接受。因此,这些 2 级和 3 级车辆的成长预计将在预测期内推动市场。

预计北美将在市场中发挥关键作用,其次是亚太地区和欧洲。北美主要汽车製造商、科技巨头和专业Start-Ups开始投资自动驾驶汽车(AV)技术的开发。由于中国、日本、印度和韩国等国家对自动驾驶汽车的需求不断增长,预计亚太地区在预测期内也将出现成长。

自动驾驶汽车市场趋势

预计半自动驾驶汽车领域在预测期内将变得越来越重要

根据SAE(汽车工程师学会)国际自动驾驶标准,具有1至3级自动驾驶能力的车辆被视为半自动驾驶汽车细分市场。对更安全、更有效率的驾驶系统日益增长的需求正在推动半自动驾驶汽车的开发和部署。此外,一些地方政府还制定了严格的驾驶和安全法律,以进一步鼓励公司在其车辆中提供这些技术。

多项技术进步有助于营造有利于市场成长的环境。此外,大量小客车的存在增加了改善驾驶体验的需求,从而推动了半自动驾驶车辆的采用。这在 COVID-19 大流行期间的销售中表现得很明显。

即使在疫情期间,自动驾驶汽车的销量也有所增长,2020 年配备 2 级功能的汽车销量约为 1,120 万辆,比 2019 年增长了 78%。由于如此有利的市场条件,世界各地的汽车製造商都在推出新的半自动驾驶车型来吸引消费者。例如,

2021年4月,雪铁龙发表了新款SUV「C5 X」。新车型有汽油版和插电式混合版两种。 C5 X 提供符合现行法规的 2 级半自动驾驶功能。

2021年4月,北京现代汽车推出小型跨界SUV新款途胜L。采用i-GMP平台,搭载1.5升涡轮增压引擎(最大输出147kW、最大扭力253Nm),搭配7速双离合器变速箱。该车配备了现代SmartSense系统,包括23项安全和辅助功能,并支援2级自动驾驶。

基于上述因素,半自动驾驶汽车领域可能会在预测期内获得关注。

北美可能会占据压倒性的市场份额

预计在预测期内,北美将主导自动驾驶汽车市场。由于强大而完善的汽车公司丛集以及谷歌、微软和苹果等一些全球最大科技公司的所在地等因素,该地区成为自动驾驶汽车的先驱。自动驾驶汽车已经在进行测试,尤其是在美国。用于加州、德克萨斯、亚利桑那州、华盛顿州、密西根州和美国其他州。然而,其机动性目前仅限于特定的测试区域和驾驶条件。

除了本土企业外,还有其他国家的企业进入该国。例如,

2021年2月,越南本土汽车製造商Vinfast宣布已获得在加州公共道路上测试自动驾驶汽车的许可。该公司寻求许可,以便在美国市场上将电动车商业化。

2021 年 4 月,本田和 Verizon 宣布他们正在 MCity 进行 Verizon 5G 超宽频和 5G行动边缘运算(MEC) 研究。两家公司正在测试如何在本田 SAFE SWARM 上使用 Verizon 5G 超宽频和 MEC 来减少每辆车对人工智慧的需求。

2021 年 3 月,Motional 宣布将使用全电动现代 IONIQ 5 作为下一代机器人计程车的汽车平臺。从 2023 年开始,该合作伙伴关係将允许特定市场的消费者透过 Lyft 应用程式预订 Motional 机器人计程车。 Motional的IONIQ 5将配备4级自动驾驶能力。

因此,北美地区可能会受益于上述发展,并预计在预测期内对自动驾驶汽车的需求将保持稳定。

自动驾驶汽车产业概述

自动驾驶汽车市场适度整合。除了製造商之外,硬体和软体公司等公司也开始专注于满足汽车领域对自动驾驶技术日益增长的需求。因此,汽车领域的伙伴关係、合作和投资显着增加,以开发自动驾驶汽车。在预测期内,这些努力可能会继续增长,这主要是由于各国政府和私营部门对在多个国家推广自动驾驶汽车技术的支持不断增加。

2021 年 1 月,汽车级 Linux 宣布增加 Aicas、AVL 和 Citos 为新的铜牌成员。 AGL 是 Linux 基金会的开放原始码计划,汇集了汽车製造商、供应商和技术公司,以加速包括自动驾驶在内的所有车辆技术的开发。

2021 年 1 月,汽车技术公司 Veoneer Inc. 和 Qualcomm Technologies Inc. 签署协议,两家公司合作提供可扩展的 ADAS(高级驾驶辅助系统)和协作式自动驾驶 (AD) 解决方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 市场限制因素

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 按类型

- 半自动驾驶汽车

- 完全自动驾驶汽车

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- Uber Technologies Inc.

- Daimler AG

- Waymo LLC(Google Inc.)

- Toyota Motor Corp.

- Nissan Motor Co. Ltd

- Volvo Car Group

- General Motors Company

- Volkswagen AG

- Tesla Inc.

- BMW AG

- Aurora Innovation Inc.

第七章市场机会与未来趋势

The Autonomous Car Market size is estimated at USD 41.10 billion in 2024, and is expected to reach USD 114.54 billion by 2029, growing at a CAGR of 22.75% during the forecast period (2024-2029).

The COVID-19 pandemic has impacted the overall automotive sector, compelling automakers to reduce the output at their production plants. The pandemic has also affected the operations of many OEMs, ranging from production to R&D, and created short-term disruptions that have delayed autonomous cars' deployment and rollouts.

Due to increasingly stringent government regulations focusing on increasing road safety, more autonomous cars are being developed with highly advanced technologies integrated with smartphones and creating opportunities for market players to attract customers. The recent technological advancements in the fields of artificial intelligence, machine learning, and other sensors like RADAR, LIDAR, GPS, and computer vision, have enabled manufacturers to increase self-driving capabilities in cars.

At present, Level 2 and Level 3 autonomous cars are most prominent in the market, while Level 4 and Level 5 (as scaled by SAE) are expected to reach wider acceptance by 2030. As a result, the growth of these Level 2 and Level 3 cars is expected to propel the market during the forecast period.

North America is expected to play a significant role in the market, followed by Asia-Pacific and Europe. Major automaker companies, technology giants, and specialist start-ups across North America have started investing in developing autonomous vehicle (AV) technology. As demand for self-driving cars is picking up across countries like China, Japan, India, and South Korea, the Asia-Pacific region is also expected to witness growth over the forecast period.

Autonomous Vehicle Market Trends

Semi-autonomous Cars Segment Anticipated to Gain Significance during the Forecast Period

Following the SAE (Society of Automotive Engineers) International Automated Driving Standards, cars with Level 1-3 automation features have been considered in the market segment for semi-autonomous vehicles. The growing need for safer and more efficient driving systems promotes the development and adoption of semi-autonomous vehicles. Moreover, several regional governments have placed stringent driving and safety laws, further encouraging companies to offer these technologies in their automobiles.

Several technological advancements have helped foster a conducive environment for the market's growth. Moreover, the presence of a high number of passenger cars has elevated the rising need to enhance the driving experience and is promoting the adoption of semi-automated vehicles. This has been evident in sales during the COVID-19 pandemic.

Even during the pandemic, autonomous cars witnessed a rise in sales, as in 2020, around 11.2 million cars were sold with Level 2 features, which was an increase of 78% over 2019. Owing to such a favorable environment in the market, automakers worldwide are introducing new semi-autonomous vehicle models to attract consumers. For instance,

In April 2021, Citroen unveiled its new model, C5 X SUV. This new model was offered in both gasoline and plug-in hybrid versions. C5 X offers semi-autonomous Level 2 driving in compliance with current legislation.

In April 2021, Beijing Hyundai Motor Co. Ltd launched the new Tucson L, a compact crossover SUV. The vehicle is built on the i-GMP platform, and it is equipped with a 1.5 liters turbocharged engine (maximum power output of 147 kW, peak torque of 253 Nm), mated to a 7-speed dual-clutch transmission. The vehicle features the Hyundai Smart Sense system, which includes 23 safety and assistance functions and supports Level 2 autonomous driving.

Based on the aforementioned factors, the semi-autonomous cars segment is likely to gain prominence over the forecast period.

North America Likely to Hold Dominant Share in the Market

North America is expected to dominate the autonomous (driverless) car market during the forecast period. The region has been a pioneer of autonomous vehicles due to factors like strong and established automotive company clusters and being home to the world's biggest technology companies like Google, Microsoft, Apple, etc. Particularly in the US, self-driving cars have already been tested and used in California, Texas, Arizona, Washington, Michigan, and other states of the US. However, their mobility is currently restricted to specific test areas and driving conditions.

Apart from various local companies, the country is witnessing the entry of companies from other countries. For instance,

In February 2021, Vietnam's domestic automaker Vin Fast announced that it had obtained a permit to test autonomous vehicles on California's public streets. The company sought this permit to commercialize its electric vehicles in the US market.

In April 2021, Honda and Verizon announced that they are working at MCity to explore Verizon 5G Ultra-Wideband and 5G Mobile Edge Compute (MEC). The companies are testing how using Verizon 5G Ultra-Wideband and MEC in the Honda SAFE SWARM can reduce the need for AI onboard each vehicle.

In March 2021, Motional announced that it would be using the all-electric Hyundai IONIQ 5 as the vehicle platform for its next-generation robotaxi. Through its partnership, consumers in select markets will be able to book a Motional robotaxi through the Lyft app starting in 2023. Motional's IONIQ 5 will be equipped with Level 4 autonomous driving capabilities.

Thus, the North American region is likely to benefit from the aforementioned developments, and it is expected to witness stable demand for autonomous cars during the forecast period.

Autonomous Vehicle Industry Overview

The autonomous (driverless) car market is a moderately consolidated one. Apart from manufacturers, players, including hardware and software firms, have started focusing on catering to the growing demand for autonomous driving technology in the automotive sector. Thus, partnerships, collaborations, and investments toward developing autonomous vehicles have increased significantly in the automotive sector. These initiatives are likely to continue growing during the forecast period, primarily due to increasing support from governments and private sectors across several countries to promote autonomous driving vehicle technology.

In January 2021, Automotive Grade Linux announced that it had included Aicas, AVL, and Citos as new bronze members. AGL is an open-source project at the Linux Foundation that brings together automakers, suppliers, and technology companies to accelerate the development of all vehicle technologies, including autonomous driving.

In January 2021, automotive technology company Veoneer Inc. and Qualcomm Technologies Inc. signed an agreement under which the companies will collaborate on delivering scalable Advanced Driver Assistance Systems (ADAS) and Collaborative and Autonomous Driving (AD) solutions.

Some of the leading companies in the autonomous (driverless) car market include Volkswagen, Toyota Motor Corporation, General Motors Company, Ford Motor Company, Nissan Motor Company Ltd, Daimler AG (Mercedes-Benz), BMW, Volvo Cars, and Tesla Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Semi-autonomous Vehicles

- 5.1.2 Fully-autonomous Vehicles

- 5.2 By Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Uber Technologies Inc.

- 6.2.2 Daimler AG

- 6.2.3 Waymo LLC (Google Inc.)

- 6.2.4 Toyota Motor Corp.

- 6.2.5 Nissan Motor Co. Ltd

- 6.2.6 Volvo Car Group

- 6.2.7 General Motors Company

- 6.2.8 Volkswagen AG

- 6.2.9 Tesla Inc.

- 6.2.10 BMW AG

- 6.2.11 Aurora Innovation Inc.