|

市场调查报告书

商品编码

1444064

风力发电机齿轮箱:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Wind Turbine Gearbox - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

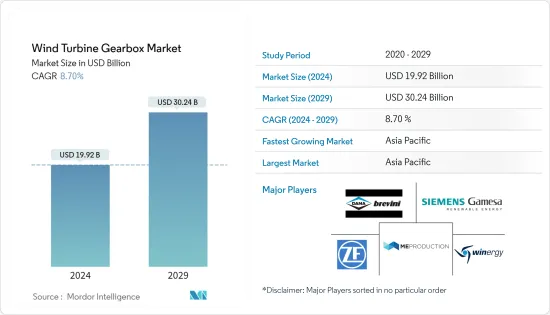

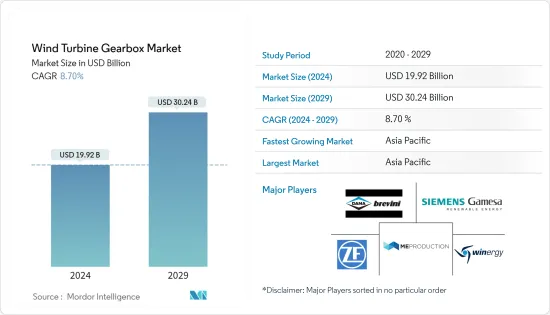

风力发电机齿轮箱市场规模预计到 2024 年为 199.2 亿美元,预计到 2029 年将达到 302.4 亿美元,在预测期内(2024-2029 年)将成长 87 亿美元,复合年增长率为 %。

主要亮点

- 从中期来看,风力发电需求增加和风力发电计划投资增加等因素预计将成为预测期内风力发电机齿轮箱市场最重要的驱动因素之一。

- 同时,太阳能和水力发电等其他再生能源来源也越来越普及。这对预测期内的风力发电机齿轮箱市场构成威胁。

- 儘管如此,风力发电与能源储存的整合以及世界各地雄心勃勃的风力发电计画是预计未来为市场创造多个机会的关键因素。

- 亚太地区预计将成为最大、成长最快的市场,因为该地区风力发电占有很大份额,并且在中国、印度和日本等国家设有製造地和技术中心。

风力发电机齿轮箱市场趋势

离岸部门进一步成长

- 全球离岸风电产业正在快速成长。各国政府和能源公司正在加大对离岸风电发电工程的投资,以利用海上强大而稳定的风能资源。

- 世界风力发电理事会报告称,2022年将新增8吉瓦风力发电装置容量,使全球装置容量达到64吉瓦。这比 2021 年装置容量 56 吉瓦有所增加。离岸风电装置容量的扩大将导致对风力发电机齿轮箱的需求增加,以支持离岸风电场的发展。

- 许多国家由于地理位置和有利的风力条件,离岸风力发电潜力巨大。北欧、美国、中国、台湾等地区正积极开发离岸风资源。这些地区为风力发电机齿轮箱製造商提供了重要的市场机会,以满足离岸风电开发不断增长的需求。

- 例如,2023年1月,德国宣布製定新的离岸风力发电机址发展策略,以实现2030年风电装置容量达到30吉瓦(GW)的目标。联邦海事和水道测量局 (BSH) 制定了这些计划,以确保实现既定目标。

- 同样,印度的目标是透过利用其 7,600 公里广阔海岸线上尚未开发的海上风力发电潜力,实现绿色能源组合多元化。新能源和可再生能源部製定了2030年实现离岸风电装置容量30吉瓦的目标。这些雄心勃勃的目标预计将推动大型离岸风电计划的发展,从而推动对风力发电机齿轮箱的需求。

- 因此,根据上述几点,海工领域预计将在预测期内占据市场主导地位。

亚太地区将经历显着成长

- 亚太地区的风力发电装置正在显着增加。中国、印度、日本和澳洲等国家正大力投资风力发电计划,以满足不断增长的电力需求并减少温室气体排放。该地区风电容量的扩大正在增加对风力发电机齿轮箱的需求。

- 根据世界风力发电理事会统计,仅2022年亚太地区将新增约37吉瓦风力发电装置,代表该地区风力发电显着增长,其中中国贡献了总量的87%,导致风电装机容量增加风力发电机齿轮箱的需求。

- 亚太地区许多国家推出了支持政策和激励措施来推广包括风电在内的可再生能源。这些政策为风力发电发展创造了良好的环境,吸引了风力发电机安装投资。

- 例如,东协各国政府宣布了雄心勃勃的五年永续性计划,作为2021年至2025年东协能源合作行动计划(APAEC)第二阶段的一部分。根据该计划,东南亚国协能源部长同意:到2025年,目标是实现可再生能源占全部区域初级能源供应总量的23%,占东协电力装置容量的35%。实现这些目标将需要大约 35GW 至 40GW 的额外可再生能源。风力发电的风力发电装置。

- 未来十年,由于亚太地区快速扩大的装置基础和政府的支持政策,风力发电机齿轮箱维修和维修市场预计将出现重大成长机会。

风力发电机箱产业概况

风力发电机齿轮箱市场适度整合。主要企业包括(排名不分先后)Siemens Gamesa Renewable Energy SA、Dana Brevini SpA、ME Production A/S、Winergy Group 和 ZF Friedrichshafen AG。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 调查先决条件

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2028 年之前的市场规模与需求预测(美元)

- 最新趋势和发展

- 政府政策法规

- 市场动态

- 促进因素

- 扩大风力发电引进

- 扩大风力发电投资

- 抑制因素

- 普及其他再生能源来源

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对的强度

第五章市场区隔

- 部署地点

- 陆上

- 离岸

- 地区(2028 年之前的市场规模和需求预测,仅限地区)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 阿斯特拉利亚

- 其他亚太地区

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东地区

- 北美洲

第六章 竞争形势

- 併购、合资、合作与协议

- 主要企业采取的策略

- 公司简介

- Dana Brevini SpA

- Siemens Gamesa Renewable Energy SA

- ME Production AS

- Stork Gears &Services BV

- Winergy Group

- ZF Friedrichshafen AG

- Turbine Repair Solutions

- Elecon Engineering Company Limited

第七章市场机会与未来趋势

简介目录

Product Code: 51400

The Wind Turbine Gearbox Market size is estimated at USD 19.92 billion in 2024, and is expected to reach USD 30.24 billion by 2029, growing at a CAGR of 8.70% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, factors such as growing demand for wind energy and increasing investment in wind energy projects are expected to be one of the most significant drivers for the wind turbine gearbox market during the forecast period.

- On the other hand, increasing penetration of other sources of renewable energy such as solar, hydro and others. This poses a threat to the wind turbine gearbox market during the forecast period.

- Nevertheless, energy storage integration with wind energy and ambitious wind energy tsrgets acrossb the globe are significant factors expected to create several opportunities for the market in the future.

- The Asia-Pacific region is expected to be the largest and fastest-growing market, owing to the significant share in terms of wind power generation and the presence of manufacturing and technology hubs in countries like China, India, Japan, etc.

Wind Turbine Gearbox Market Trends

Offshore Segment to Register Higher Growth

- The offshore wind sector has been experiencing rapid growth worldwide. Governments and energy companies increasingly invest in offshore wind projects to harness the strong and consistent wind resources available at sea.

- In 2022, the Global Wind Energy Council reported the addition of 8 GW of offshore wind energy capacity, resulting in a global installed capacity of 64 GW. This marks an increase compared to the 56 GW installed capacity in 2021. The expansion of offshore wind capacity translates into higher demand for wind turbine gearboxes to support the development of offshore wind farms.

- Many countries possess significant offshore wind energy potential due to their geographical location and favorable wind conditions. Regions such as Northern Europe, the United States, China, and Taiwan are actively developing their offshore wind resources. These regions offer substantial market opportunities for wind turbine gearbox manufacturers to cater to the growing demand driven by offshore wind development.

- For instance, in January 2023, Germany announced the formulation of new development strategies for offshore wind turbine sites in order to achieve a target of 30 gigawatts (GW) of installed wind power capacity by 2030. The Federal Maritime and Hydrographic Agency (BSH) has devised these plans to ensure the successful attainment of the set target.

- In a similar vein, India aims to diversify its green energy portfolio by tapping into the untapped offshore wind energy potential across its extensive 7,600-kilometer coastline. The Ministry of New and Renewable Energy has established a target of achieving 30 GW of offshore wind capacity by 2030. These ambitious goals are projected to spur the development of large-scale offshore wind projects, thereby driving the demand for wind turbine gearboxes.

- Therefore as per the above-mentioned points the offshore segment is expected to dominate the market during the forecasted period.

Asia-Pacific to Witness Significant Growth

- The Asia Pacific region has been witnessing substantial growth in wind power capacity installations. Countries like China, India, Japan, and Australia are making significant investments in wind energy projects to meet their growing electricity demands and reduce greenhouse gas emissions. This region's expansion of wind power capacity drives the demand for wind turbine gearboxes.

- According to Global Wind Energy Council the Asia-Pacific region added almost 37GW of wind energy capacity in 2022 alone signifying significant growth of wind energy in the region with China contributing 87% of its 2022 additions consequently driving the demand for wind turbine gearboxes.

- Many countries in the Asia Pacific region have implemented supportive policies and incentives to promote renewable energy, including wind power. These policies create a conducive environment for wind energy development and attract investments in wind turbine installations.

- For instance, ASEAN governments have unveiled an ambitious five-year sustainability plan as part of the second phase of the ASEAN Plan of Action for Energy Cooperation (APAEC) from 2021 to 2025. As per this plan, energy ministers from ASEAN countries have agreed to a target of achieving a 23% share of renewable energy in the total primary energy supply across the region, along with a 35% share in ASEAN's installed power capacity by 2025. Meeting these targets would necessitate the addition of approximately 35GW-40GW of renewable energy capacity by 2025. This is expected to increase the installations of wind energy in the region due to the high wind energy potential in the majority of the countries.

- Over the next decade, the wind turbine gearbox repair and refurbishment market is anticipated to witness substantial growth opportunities driven by the rapidly expanding installed base in the Asia-Pacific region and supportive government policies.

Wind Turbine Gearbox Industry Overview

The wind turbine gearbox market is moderately consolidated. Some of the major companies (in no particular order) include Siemens Gamesa Renewable Energy SA, Dana Brevini SpA, ME Production A/S, Winergy Group, and ZF Friedrichshafen AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Wind Energy

- 4.5.1.2 Growing Investments in Wind Energy

- 4.5.2 Restraints

- 4.5.2.1 Increasing Penetration of Other Sources of Renewable Energy

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Geography [Market Size and Demand Forecast till 2028 (for regions only)]

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Asia-Pacific

- 5.2.2.1 China

- 5.2.2.2 India

- 5.2.2.3 Japan

- 5.2.2.4 Asutralia

- 5.2.2.5 Rest of Asia-Pacific

- 5.2.3 Europe

- 5.2.3.1 United Kingdom

- 5.2.3.2 Germany

- 5.2.3.3 France

- 5.2.3.4 Spain

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Chile

- 5.2.4.4 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of Middle East

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Dana Brevini SpA

- 6.3.2 Siemens Gamesa Renewable Energy SA

- 6.3.3 ME Production AS

- 6.3.4 Stork Gears & Services BV

- 6.3.5 Winergy Group

- 6.3.6 ZF Friedrichshafen AG

- 6.3.7 Turbine Repair Solutions

- 6.3.8 Elecon Engineering Company Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Energy Storage Integration

02-2729-4219

+886-2-2729-4219