|

市场调查报告书

商品编码

1444065

杀螨剂:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Acaricides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

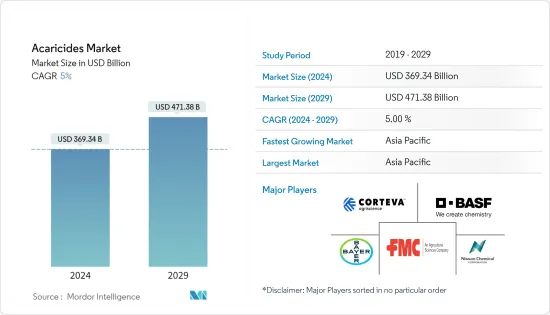

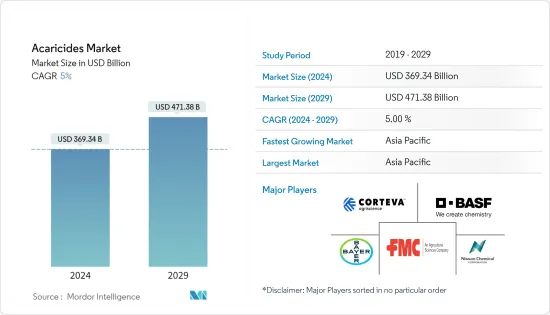

2024年杀螨剂市场规模预计为3,693.4亿美元,预计2029年将达到4,713.8亿美元,在预测期(2024-2029年)成长5%,复合年增长率成长。

COVID-19 的传播导致世界各地实施封锁,扰乱了供应链。由于感染人数不断增加、劳动力短缺和设施关闭,疫情导致全球停工。这些因素导致包括杀螨剂在内的农药产量下降。因此,疫情间接影响了全球杀螨剂的供应。

从长远来看,由于人口增长、耕地减少、对天然产品的需求增加以及对永续农业实践的需求增加,对粮食的需求增加,对杀螨剂的需求可能会增加。据估计,许多作物因螨虫侵袭而造成的产量损失可达 13.8%。蜱虫可以在干燥的天气中生存,但全球气温上升加剧了这个问题。由于近年来世界各地长期干旱的发生率不断增加,预计杀螨剂市场将迅速成长。然而,对杀螨剂使用的严格规定预计将限制未来几年的市场成长。

亚热带和温带地区种植的水果和蔬菜最容易受到螨虫的侵害。亚太市场正在经历显着成长,尤其是在农业领域,因为越来越多地使用杀虫剂来控制蜱虫和蜱传疾病的传播。

杀螨剂市场趋势

对天然产品的需求增加

随着人们对环境问题的日益关注和有机农业面积的增加,世界各地对天然农作物保护产品的需求显着增加。植物源农药在农业的使用也有所增加。据粮农组织称,在德国,植物农药的农业使用量从 2018 年的 15 吨增加到 2019 年的 25 吨。同样在马来西亚,2019 年植物和生物农药的农业用量为 101 吨。农民对作物的需求不断增长,促使公司向市场推出生物基产品。例如,2020年2月,Oro Agri在荷兰霍林赫姆的Horti Contact推出了新型杀虫剂/杀螨剂「Oroganik」。荷兰委员会最近核准了该植物保护产品作为植物保护产品认证(CTGB)。它基于橙油,一种天然来源的活性物质。它是从6%橙油中提取的植物检疫产品,具有杀虫、杀螨和杀真菌特性。有效率且永续地防治白粉病、霜霉病和蓟马等病虫害。随后,2020 年 3 月,生技公司 Idai Nature 与南非公司 Oro Agri 达成独家经销协议,在西班牙商业开发註册天然产品 Oroside。

亚太地区主导杀螨剂市场

亚太地区农业发展迅速,中国和印度成为杀螨剂主要消费国。传统的杀虫剂和杀螨剂广泛用于防治吸液害虫,但大多数都因效果下降和产生高抗性而失败。红蜘蛛被认为是中国的主要害虫,多年来造成了相当大的损失。由于世代重迭、繁殖能力强、虫体小、对杀虫剂抗药性强,防治难度较高。 2020年,成都新阳光作物科技推出了一款新型创新植物源杀螨剂“Marvee”,用于防治红蜘蛛。同样,在印度,许多吸食汁液的害虫,包括螨虫,透过直接取食造成损害。它们中的大多数也充当多种植物病原病毒的载体,尤其是在蔬菜中。为了应对这些挑战,领先的农化公司 Insecticides (India) Limited (IIL) 于 2019 年推出了「Kunoichi」。这是一种对所有阶段的螨虫均有效的杀螨剂。 Kunoichi含有氰吡芬30% SC,由日本日产化学株式会社开发。 IIL是印度合作伙伴,经销日本日产化学有限公司的产品。

杀螨剂行业概况

农用杀螨剂市场整合,少数大型企业占较高市场占有率。该市场在产品创新方面正在经历快速成长,重点是增加各种杀螨剂产品的零售可用性。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对的强度

第五章市场区隔

- 化学类型

- 有机磷酸盐

- 卡巴马特

- 有机氯

- 除虫菊酯

- 拟除虫菊酯

- 其他的

- 目的

- 喷

- 浸没

- 手部敷料

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 西班牙

- 法国

- 义大利

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 其他非洲

- 北美洲

第六章 竞争形势

- 最采用的策略

- 市场占有率分析

- 公司简介

- Corteva Agriscience

- Nissan Chemical Industries Ltd

- BASF SE

- Bayer CropScience

- FMC Corporation

- Syngenta International AG

- UPL Limited

第七章市场机会与未来趋势

第八章 COVID-19 对市场的影响

The Acaricides Market size is estimated at USD 369.34 billion in 2024, and is expected to reach USD 471.38 billion by 2029, growing at a CAGR of 5% during the forecast period (2024-2029).

Due to the COVID-19 outbreak, lockdowns were imposed worldwide, resulting in supply chain disruptions. The outbreak resulted in global shutdowns due to an increase in the number of cases, the shortage of labor, and the closing down of facilities. Such factors led to low production of agrochemicals, including acaricides. Thus, the pandemic indirectly impacted acaricide supplies on a global level.

Over the long term, the growing food demand with expanding population, decreasing arable land, increasing demand for natural products, and increasing demand for sustainable agricultural practices may increase the demand for acaricides. It has been estimated that the yield losses due to attacks by mites could be as high as 13.8% in many crops. Mites survive in dry weather, and increasing global temperatures add to this problem. The acaricides market is projected to grow rapidly due to the increasing incidences of prolonged dry spells worldwide in recent years. However, the strict regulations over the use of acaricides are expected to restrain the market's growth in the coming years.

Fruits and vegetables grown in the sub-tropical and temperate zones are most susceptible to mites. The Asia-Pacific market is growing at an impressive rate, especially in agriculture, due to the increasing usage of crop protection chemicals to control the spread of tick and mite-borne diseases.

Acaricides Market Trends

Increasing Demand for Natural Products

With the rising environmental concerns and increasing area under organic farming, the demand for natural crop protection products has significantly increased worldwide. The use of botanical insecticides in agriculture also increased. According to FAO, in Germany, the agricultural use of botanical insecticides increased to 25 ton in 2019 from 15 ton in 2018. Also, in Malaysia, the agricultural use of botanical and biological insecticide in 2019 was 101 metric ton. The growing demand for natural products from agricultural producers to treat their crops has led the companies to introduce bio-based products in the market. For instance, in February 2020, Oro Agri launched its new insecticide/acaricide, Oroganic, at HortiContact in Gorinchem, in the Netherlands. The Dutch Board recently approved this plant protection product for the Authorization of Plant Protection Products (CTGB). It is based on orange oil, an active substance of natural origin. It is a phytosanitary product obtained from 6% orange oil, with insecticidal, acaricidal, and fungicidal properties. It fights diseases and pests such as powdery mildew, mildew, or thrips efficiently and sustainably. Later, in March 2020, a biotech company Idai Nature reached an exclusive distribution agreement with the South African company Oro Agri to commercially develop its registered natural product, OROCIDE, in Spain.

Asia-Pacific Dominates the Acaricides Market

The agricultural industry in the Asia-Pacific region is evolving rapidly, and China and India are the major consumers of acaricides. Conventional insecticides or acaricides are extensively used to control sucking pests, but most of them have failed due to lower efficacy and the development of high folds of resistance. Red spider mites are considered a major pest in China, causing considerable losses over the years. They have overlapping generations, a strong reproductive capacity, small insect bodies, and high insecticide resistance, making them difficult to control. In 2020, Chengdu Newsun Crop Science Co. Ltd launched its novel and innovative botanical acaricide, 'Marvee,' to control red spider mites. Similarly, in India, many sucking pests, including mites, cause damage by direct feeding. Most of them also act as vectors for several plant pathogenic viruses, particularly in vegetables. To address these challenges, the leading agrochemical company Insecticides (India) Limited (IIL) launched 'Kunoichi' in 2019. It is a miticide that is effective at all stages of the mite. Kunoichi comprises Cyenopyrafen 30% SC, and it was developed by Nissan Chemical Corporation, Japan. IIL is the Indian partner of Nissan Chemical Corporation, Japan, for marketing its products.

Acaricides Industry Overview

The market for agricultural acaricides is consolidated, with a few major players occupying the higher market share. Key participants in the agricultural acaricides market are BASF SE, UPL, Bayer CropScience, FMC Corporation, and Nissan Chemical Industries Ltd. The market is witnessing rapid growth in terms of product innovation, with a focus on increasing retail availability of various acaricide products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Chemical Type

- 5.1.1 Organophosphates

- 5.1.2 Carbamates

- 5.1.3 Organochlorines

- 5.1.4 Pyrethrins

- 5.1.5 Pyrethroids

- 5.1.6 Other Chemical Types

- 5.2 Application

- 5.2.1 Spray

- 5.2.2 Dipping

- 5.2.3 Hand Dressing

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 Spain

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Corteva Agriscience

- 6.3.2 Nissan Chemical Industries Ltd

- 6.3.3 BASF SE

- 6.3.4 Bayer CropScience

- 6.3.5 FMC Corporation

- 6.3.6 Syngenta International AG

- 6.3.7 UPL Limited