|

市场调查报告书

商品编码

1850026

农业助剂:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Agricultural Adjuvants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

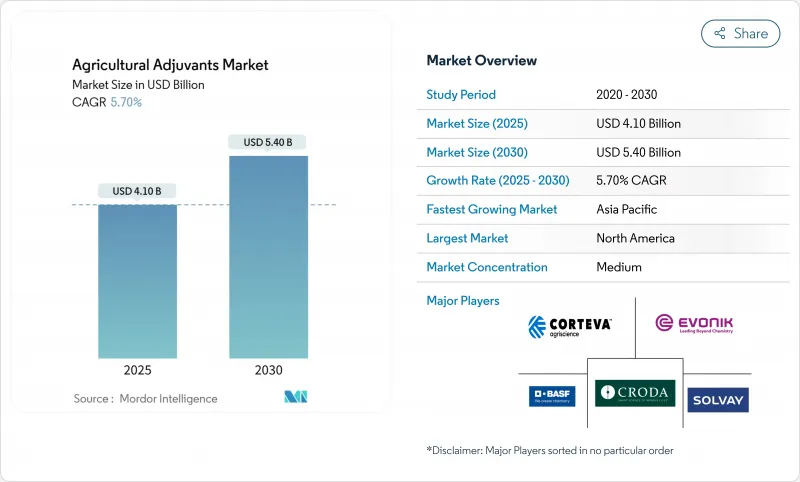

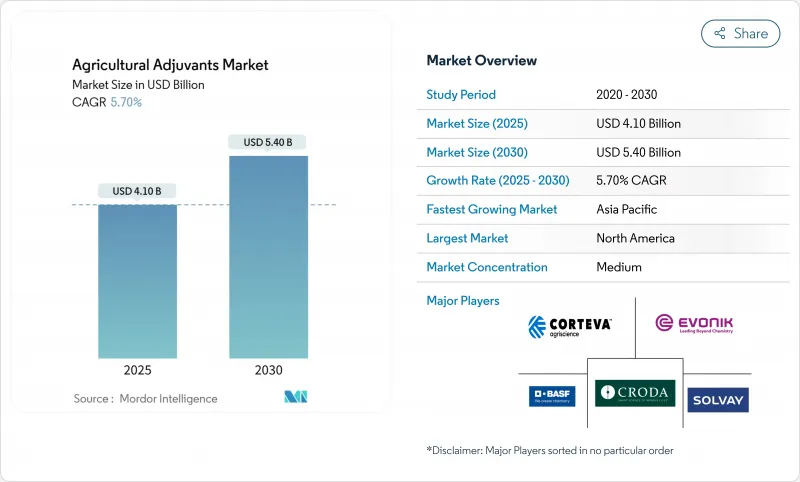

预计到 2025 年,农业助剂市场价值将达到 41 亿美元,到 2030 年将成长至 54 亿美元,复合年增长率为 5.7%。

在耕地面积日益减少的情况下,提高作物产量的需求不断增长;精准施药技术的快速普及需要改善漂移控制;以及抗除草剂种子日益普及,而这些种子需要高度客製化的助剂化学成分才能实现最佳吸收,这些因素共同推动了农业助剂市场的稳步增长。此外,对生物作物保护解决方案的投资不断增加也支撑了市场需求,因为活微生物通常需要保护性载体和润湿剂才能在田间保持药效。亚太地区的现代化倡议正推动全球生产向中国和印度转移,刺激了当地特种界面活性剂和油基载体的生产。同时,欧美地区日益严格的毒理学法规促使供应商研发危害性较低的生物基成分,加速了整个农业助剂市场的产品更新週期。

全球农业助剂市场趋势与洞察

粮食需求不断增加,而耕地面积却在减少

全球人口成长要求到2050年粮食产量增加70%,而耕地面积却以每年0.3%的速度持续减少,迫使农民使用能最大限度提高作物保护效果的化学品来提高单位面积产量。助剂兼具润湿、渗透和黏附性能,可减少施药频率和人事费用。在人口稠密的亚洲国家,助剂的普及速度最快,这些国家的土地资源匮乏问题特别严重,稻米产量也接近生物极限。区域性计画对低毒性添加剂进行补贴,正加速小农户对助剂的采用。许多政府也将补贴资格与喷洒品质培训证明挂钩,间接提升了对优质助剂的需求。供应商也积极回应,提供水质调节剂和漂移剂的组合包装,简化了农场的选择。这种商业性吸引力如今也蔓延到了非洲。随着非洲粮食进口的增加,外汇存底日益紧张,政策制定者也面临支持投入集约化生产的压力,公私推广服务机构正在农民田间学校中增设助剂模组,以缩小产量差距。

透过引进精密农业来提高喷洒精度

可变流量喷桿、无人机和机器人喷雾器每英亩喷洒量低至5加仑,因此液滴形成的误差范围很小。特製的聚合物漂移剂可将液滴中位数尺寸扩大到300-400微米,改善高速无人机气流下的叶片着生情况。美国种植者现在利用田间气象资料调整助剂用量,以防止低湿度地区药剂蒸发。设备製造商预先安装了软体库,以便在选择喷嘴尺寸和活性成分时标记正确的添加剂,从而提高合规性。亚太地区的服务公司将无人机喷洒与包含助剂的收费系统捆绑在一起,以确保符合承保标准。加拿大保险计划现在要求在承保非目标损害之前提供漂移控制证明,这使得助剂成为风险缓解投入。鑑于人工微调的局限性,向自动喷雾器的转变进一步提高了对液滴行为一致性的需求。随着数位农艺模型日趋成熟,经数据检验的性能指标有望推动采购转向能够提供经证实、可重复结果的配方。

联合组合药物的毒性阈值应更加严格

欧洲绿色新政的目标是到2030年将化学农药的风险降低50%,监管机构目前正将助剂的毒性与活性成分分开审查。与蜜蜂死亡相关的有机硅界面活性剂面临新的数据要求和更长的等候核准。各公司正在加快改进计划,用生物醚取代可疑的有机硅,但必须承担不断上涨的原料成本。美国环保署预计2026年发布更新的惰性成分评估通讯协定,可能导致类似的逐步淘汰。毒理学预算有限的小型製剂公司面临产品停产的风险。生态标章等认证倾向于具有成熟食品接触特性的助剂,从而缩小了选择范围。随着研发管线压力增大,更安全化学品的授权协议数量增加,推高了后进企业的特许权使用费。

细分市场分析

至2024年,活性助剂将占销售额的62%,凸显其在提高角质层渗透性和系统运输方面的核心作用。随着大豆、玉米和油菜等作物对除草剂的耐受性不断增强,市场需求将持续成长。儘管甲基化种子油和非离子界面活性剂混合物仍是该领域的领先产品,但生物基油衍生物的复合年增长率预计到2030年将达到8.7%。这一成长趋势反映了监管机构对低毒性产品的偏好以及种植者减少农药残留的愿望。因此,预计到2030年,与生质油活性剂相关的农业助剂市场规模将达到12亿美元。

实用助剂,例如防漂移剂、水质调节剂和消泡剂,虽然在农业助剂市场中所占份额虽小,但其战略地位却日益凸显。无人机喷洒细小液滴使得剪切稳定性聚合物的重要性日益凸显,这类聚合物能够在减少漂移的同时保持覆盖率。在灌溉密集的地区,极高的水体pH值推动了能够螯合硬度离子并防止沉淀的水质调节剂的销售。该领域的成功取决于监管机构对漂移指南的严格执行,以及设备製造商整合助剂计量软体的能力。

区域分析

亚太地区将引领全球扩张,到2030年复合年增长率将达6.4%。在印度和中国,政府主导的机械化计画和数位化推广服务正在推动精准农药的使用,从而扩大了先进助剂的应用范围。BASF在湛江投资100亿欧元(109亿美元)建造一体化生产基地,标誌着该公司对该地区消费和出口潜力的长期投资。当地供应商也正在扩大规模以满足需求:沙尔达作物化学公司2025财年第二季销售额成长34%,凸显了整体主要作物性能增强型添加剂日益增长的需求。

北美是目前最成熟的市场,但随着精密农业设备的持续扩张,其市场规模仍将以4.2%的复合年增长率成长,到2024年将占据35%的市场份额。濒危物种保护法规正在推动防漂移聚合物的应用。此外,玉米带地区井水碱度的变化也促使种植者需要使用水质调节剂。预计2030年,北美农业助剂市场规模将超过3.3亿美元。

欧洲市场维持了4%的稳定成长,这得益于从农场到餐桌的策略性推动化学品生产转向可再生原料。能够证明产品具有生物降解性和低生态毒性的供应商获得了定价权。 Bionema公司的生物降解型Soiljet BSP100符合欧盟的性能和环境标准,为新参与企业树立了标竿。南美洲的复合年增长率达5.6%。巴西加快农药註册流程缩短了与新型活性成分相符的助剂的上市时间。非洲市场成长了5%,这得益于商业农场的扩张以及捐助者支持的作物保险鼓励使用核准的化学品,但成本敏感性抑制了优质产品的应用。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 粮食需求不断增加,而耕地面积却在减少

- 精密农业的引进提高了喷洒精度

- 转向使用耐除草剂种子会增加对助剂的需求。

- 扩大生物作物投入需要配套的助剂

- 监管压力加大,导致喷雾漂移问题日益突出,同时对助剂的需求也不断增长。

- 生物基界面活性剂创新激增,旨在降低毒性

- 市场限制

- 提高组合药物的毒性阈值

- 石化原料价格波动

- 低利润作物中农民的成本敏感性

- 与下一代RNAi活性物质的兼容性问题

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按类型

- 活化佐剂

- 界面活性剂

- 油基佐剂

- 实用佐剂

- 漂移控制代理

- 水处理剂

- 消泡剂

- 酸化剂和缓衝剂

- 活化佐剂

- 透过使用

- 除草剂助剂

- 杀虫剂助剂

- 杀菌剂助剂

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 亚太其他地区

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- BASF SE

- Corteva Agriscience

- Evonik Industries

- Solvay SA

- Croda International

- Nufarm Ltd

- Helena Agri-Enterprises

- AkzoNobel NV

- Brandt Consolidated

- Wilbur-Ellis Company

- Adjuvant Plus Inc.

- Huntsman Corporation

- Clariant AG

- Momentive Performance Materials

- Interagro Ltd

第七章 市场机会与未来展望

The agricultural adjuvants market is valued at USD 4.1 billion in 2025 and is forecast to expand to USD 5.4 billion by 2030, reflecting a 5.7% CAGR.

Steady growth stems from the escalating need to lift crop productivity while arable land continues to shrink, the rapid spread of precision-spraying technologies that need improved drift control, and the rising popularity of herbicide-tolerant seeds that depend on highly tailored adjuvant chemistry for optimal uptake. Rising investment in biological crop protection solutions also underpins demand because live microbes often require protective carriers and wetting agents to remain effective in the field. In addition, Asia-Pacific's modernization initiatives are redirecting global production footprints toward China and India, stimulating local output of specialty surfactants and oil-based carriers. At the same time, tightening toxicology regulations in Europe and North America push suppliers to design lower-hazard, bio-based ingredients, accelerating product renewal cycles across the agricultural adjuvants market.

Global Agricultural Adjuvants Market Trends and Insights

Growing Food Demand versus Declining Arable Land

Global population growth requires a 70% rise in food output by 2050 while arable land continues to contract 0.3% each year, compelling growers to lift yields per hectare through chemistry that maximizes pesticide performance. Adjuvants that combine wetter, penetrant, and sticker functions cut application frequency and lower labor costs. Adoption is highest in densely populated Asian countries where land scarcity is acute and rice yields already approach biological ceilings. Regional programs that subsidize low-toxicity additives are accelerating uptake among smallholders. Many governments also tie subsidy eligibility to proof of spray-quality training, indirectly boosting demand for premium adjuvants. Suppliers respond with packs that bundle water conditioners with drift agents to simplify choice at the farm gate. The commercial pull now extends to Africa, where rising cereal imports strain foreign exchange reserves, pushing policymakers to support input intensification. Public-private extension services are therefore adding adjuvant modules to farmer field schools to close the yield gap.

Precision-Farming Adoption Boosting Spray Accuracy

Variable-rate booms, drones, and robotic sprayers apply as little as 5 gallons per acre, creating a narrow margin for error in droplet formation. Specialty polymer drift agents enlarge median droplet size to 300-400 microns and improve leaf deposition under high-speed airflow from drones. United States growers now calibrate adjuvant doses with field-level weather feeds to prevent evaporation in low-humidity bands. Equipment makers preload software libraries that flag the correct additive when a nozzle size or active ingredient is selected, raising compliance. Asia-Pacific service companies bundle drone spraying with adjuvant-inclusive fee structures that guarantee coverage standards. Insurance programs in Canada have begun to require drift-control certification before indemnifying off-target damage, turning adjuvants into a risk-mitigation input. The move toward autonomous sprayers further elevates the need for consistent droplet behavior because human fine-tuning is limited. As digital agronomy models mature, data-validated performance metrics are anticipated to shift purchasing toward formulations with proven, repeatable results.

Tightening Toxicology Thresholds for Co-Formulants

European Green Deal targets call for a 50% cut in chemical pesticide risk by 2030, and regulators now scrutinize adjuvant toxicity independently of actives. Organosilicone surfactants linked to bee mortality face new data demands that lengthen approval queues. Companies accelerate reformulation programs to swap suspect silicones for biogenic ethers but must absorb higher raw-material costs. The United States Environmental Protection Agency is anticipated to release updated inert ingredient assessment protocols in 2026, potentially triggering parallel phase-outs. Smaller formulators with limited toxicology budgets risk product discontinuations. Certifications such as Eco-Label prefer adjuvants with established food-contact clearances, narrowing the candidate pool. As pipeline pressure rises, licensing deals for safer chemistry climb, inflating royalty costs for latecomers.

Other drivers and restraints analyzed in the detailed report include:

- Shift to Herbicide-Tolerant Seeds Elevating Adjuvant Need

- Regulatory Pressure On Spray Drift And Higher Utility Adjuvant Demand

- Volatile Petrochemical Feedstock Pricing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Activator adjuvants captured 62% of 2024 revenue, underscoring their central role in improving cuticular penetration and systemic movement. Demand climbs as herbicide-tolerant crops spread across soy, corn, and canola. Within the segment, methylated seed oil and non-ionic surfactant blends remain staples, yet bio-based oil derivatives post an 8.7% CAGR to 2030. That trajectory partly mirrors regulatory preference for low-toxicity options and grower interest in lower residue. As a result, the agricultural adjuvants market size tied to bio-oil activators is projected to reach USD 1.2 billion by 2030.

Utility adjuvants, including drift control agents, water conditioners, and antifoams, represent a smaller but increasingly strategic slice of the agricultural adjuvants market. Drone spraying, which relies on fine droplets, elevates the importance of high-shear-stable polymers that reduce drift yet preserve coverage. Water pH extremes in well-irrigated regions propel conditioner sales that sequester hardness ions and prevent precipitation. The segment's success relies on regulators enforcing drift guidelines and equipment makers integrating adjuvant dosing software.

The Agricultural Adjuvants Market Report is Segmented by Type (Activator Adjuvants and Utility Adjuvants), Application (Herbicide Adjuvants, Insecticide Adjuvants, and More), and by Geography (North America, South America, Europe, Asia-Pacific, Middle East, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific heads global expansion with a 6.4% CAGR to 2030. Government-led mechanization programs and digital extension services in India and China encourage precise pesticide use, opening space for advanced adjuvants. BASF's EUR 10 billion (USD 10.9 billion) Verbund complex in Zhanjiang signals a long-term bet on regional consumption and export potential. Local suppliers also scale to meet demand: Sharda Cropchem's 34% revenue growth in Q2 FY25 underscores appetite for performance-boosting additives across staple crops.

North America, while the most mature market, still contributes incremental volume at a 4.2% CAGR as precision-farming fleets continue to expand and account for 35% share in 2024. Regulatory emphasis on endangered species drives uptake of drift-control polymers. Growers also require water conditioners to cope with variable well-water alkalinity across the Corn Belt. The agricultural adjuvants market size for North America is forecast to add USD 330 million by 2030.

Europe posts steady 4% growth as the Farm to Fork strategy shifts chemistry toward renewable feedstocks. Suppliers that can certify biodegradability and low ecotoxicity gain pricing power. Bionema's biodegradable Soil-Jet BSP100 met EU performance and environmental criteria, setting a benchmark for new entrants. South America records a 5.6% CAGR; expedited pesticide registrations in Brazil shorten the time to market for adjuvants that fit new active ingredients. Africa advances 5% on commercial farm expansion and donor-backed crop insurance that encourages approved chemical use, though cost sensitivity tempers premium-grade adoption.

- BASF SE

- Corteva Agriscience

- Evonik Industries

- Solvay SA

- Croda International

- Nufarm Ltd

- Helena Agri-Enterprises

- AkzoNobel NV

- Brandt Consolidated

- Wilbur-Ellis Company

- Adjuvant Plus Inc.

- Huntsman Corporation

- Clariant AG

- Momentive Performance Materials

- Interagro Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing food demand versus declining arable land

- 4.2.2 Precision-farming adoption boosting spray accuracy

- 4.2.3 Shift to herbicide-tolerant seeds elevating adjuvant need

- 4.2.4 Expansion of biological crop-inputs requiring compatible adjuvants

- 4.2.5 Regulatory pressure on spray drift and higher utility adjuvant demand

- 4.2.6 Surge in bio-based surfactant innovation lowering toxicity

- 4.3 Market Restraints

- 4.3.1 Tightening toxicology thresholds for co-formulants

- 4.3.2 Volatility in petrochemical feedstock pricing

- 4.3.3 Farmer cost-sensitivity in low-margin crops

- 4.3.4 Compatibility issues with next-gen RNAi actives

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Activator Adjuvants

- 5.1.1.1 Surfactants

- 5.1.1.2 Oil Adjuvants

- 5.1.2 Utility Adjuvants

- 5.1.2.1 Drift Control Agents

- 5.1.2.2 Water Conditioners

- 5.1.2.3 Antifoaming Agents

- 5.1.2.4 Acidifiers and Buffers

- 5.1.1 Activator Adjuvants

- 5.2 By Application

- 5.2.1 Herbicide Adjuvants

- 5.2.2 Insecticide Adjuvants

- 5.2.3 Fungicide Adjuvants

- 5.2.4 Other Applications

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 South America

- 5.3.2.1 Brazil

- 5.3.2.2 Argentina

- 5.3.2.3 Rest of South America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 Asia-Pacific

- 5.3.4.1 China

- 5.3.4.2 India

- 5.3.4.3 Japan

- 5.3.4.4 Australia

- 5.3.4.5 Rest of Asia-Pacific

- 5.3.5 Middle East

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle East

- 5.3.6 Africa

- 5.3.6.1 South Africa

- 5.3.6.2 Nigeria

- 5.3.6.3 Rest of Africa

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Corteva Agriscience

- 6.4.3 Evonik Industries

- 6.4.4 Solvay SA

- 6.4.5 Croda International

- 6.4.6 Nufarm Ltd

- 6.4.7 Helena Agri-Enterprises

- 6.4.8 AkzoNobel NV

- 6.4.9 Brandt Consolidated

- 6.4.10 Wilbur-Ellis Company

- 6.4.11 Adjuvant Plus Inc.

- 6.4.12 Huntsman Corporation

- 6.4.13 Clariant AG

- 6.4.14 Momentive Performance Materials

- 6.4.15 Interagro Ltd