|

市场调查报告书

商品编码

1640354

电气外壳:市场占有率分析、行业趋势和统计、成长预测(2025-2030)Electrical Enclosures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

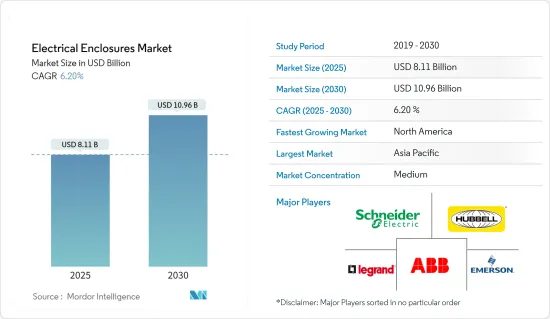

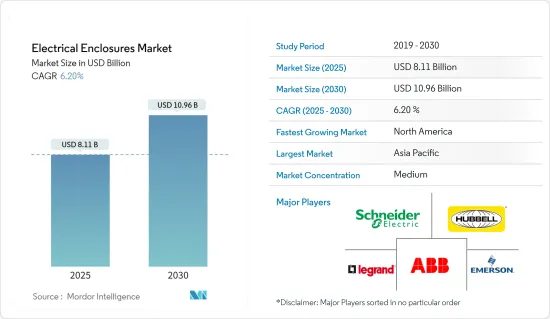

电气外壳市场规模预计到 2025 年为 81.1 亿美元,预计到 2030 年将达到 109.6 亿美元,预测期内(2025-2030 年)复合年增长率为 6.2%。

随着电力和工业基础设施的增加,对职场和劳动力保护的需求也在增加,从而导致工业设备安全标准的采用。因此,电气外壳已成为工业和住宅应用中的重要元件。

主要亮点

- 全球能源消耗持续大幅成长,随着「永远在线」世界趋势的加速,对电力的需求也在增加。据英国石油公司称,冰岛是世界上人均电力消耗量最高的国家,2021年人均用电量为52.98兆瓦时。这是因为该国拥有能源密集产业。这些案例进一步拉动了电子围栏的需求。

- 太阳能和风力发电使用敏感的电气元件和电池,当暴露在自然环境中时可能会导致系统故障。因此,出于安全原因,电气外壳在发电领域被大量使用。

- 工业和工厂自动化的接受将增加需要密封以确保安全和美观的机械、电子机械和固态设备、零件和控制设备的进入,从而推动市场成长。因此,许多国家在全球范围内实施了严格的安全法规,这项参数极大地推动了电气外壳市场的成长。

- 例如,缅因州建筑安全联盟、Safety Works 和缅因州劳工部职场安全与健康部门将于 2022 年 8 月联手,促进职场安全与健康,并为该州的建筑雇主和工人提供安全与健康风险我们会通知您。该联盟透过减少和最大限度地减少与建筑相关的风险(例如跌倒、撞击物体受伤、触电以及被机械或车辆缠住或夹住)来保护工人。

- 随着製造商和领先供应商不断开发电池保护机壳的复合材料解决方案,市场出现了各种新兴市场。例如,2022 年 3 月,墨西哥汽车产业领导者 Katcon 开发了一种多材料工具箱,用于经济高效且可扩展的电动车电池机壳设计。

- 冠状病毒大流行使电气外壳在各个领域的采用变得更加复杂。它带来了社交距离和非接触式操作的独特挑战,并改变了标准操作程序。组织被迫限制劳动力并应对不断增长的需求。多个行业停工,市场受到负面影响。然而,随着监管的放鬆和行业被允许运作,市场开始受到关注。

电气外壳市场趋势

能源电力终端用户产业占较大份额

- 对石化燃料和核能的环境担忧正在推动太阳能和风力发电等替代能源的兴起。太阳能和风风力发电认为是安全、无污染的可再生能源。世界各国都在采用这项技术。

- 太阳能和风能产生的电力使用精密的电气元件和电池,如果暴露在外可能会导致系统故障。因此,出于安全原因,电气外壳在发电领域被大量使用。

- 风能和太阳能装置需要实现抗震保护、EMC屏蔽、电子设备冷却、安全性、耐腐蚀性以及使用电气外壳的电力转换系统和多组件系统的整合。

- 政府法规还支持采用再生能源来源,并部署电气外壳来保护太阳能发电场、风力发电场和发电厂的电气和电子零件和系统,这增加了需求。

- 该地区推出了各种生产再生能源来源的倡议,进一步刺激了对电气外壳的需求。例如,2021年8月,印度政府提案了一套规则,即《2021年电力规则草案》,透过绿色能源开放准入来推广可再生能源。该拟议规则旨在透过解决与绿色能源产业相关的各种问题来促进可再生能源的快速采用。

北美地区预计将大幅成长

- 工业自动化和智慧家庭的日益整合预计将显着推动该地区的电气机壳市场,这主要是因为美国是工业自动化的早期采用者。

- 2021 年约 61% 的发电量来自石化燃料。石化燃料能源中约 19% 来自核能,约 20% 来自可再生能源。美国能源资讯署预测,2021年小型太阳能发电将额外发电490亿度。该地区的监管机构是刺激电气外壳需求的关键参与者。

- 在北美,由于人们对安全和节能的兴趣日益浓厚,智慧家庭变得越来越受欢迎。由于消费行为追求清洁环境的行为,智慧设备的技术进步以及将这些设备引入许多家庭预计将成为电气机壳市场机会。

- 此类工厂的不断增加以及与之相关的严格法规预计将呈指数级推动北美地区的电气外壳市场。美国能源局(DOE) 最近宣布为 10 个先导计画投入 6,100 万美元,这些项目将部署新技术,将数千个家庭和职场改造为节能建筑。

电气外壳产业概况

电气外壳市场适度细分。工业 4.0 和各地区能源消耗的增加正在为电气外壳市场创造机会。市场参与企业正在采取产品创新、併购和策略伙伴关係等关键策略,以扩大产品系列併扩大其地理覆盖范围。市场参与企业包括ABB、艾默生电气和施耐德电机。

2022年7月,施耐德电机宣布推出PrismaSeT S。 PrismaSeT S 是一个新的外壳系列,使商业和工业建筑中的配电装置与住宅中的配电装置相媲美,甚至可以承受最苛刻的应用。 PrismaSeT S 透过在製造过程中使用一些回收塑胶材料来支持施耐德电机的永续性努力。

2022年3月,麦格纳国际公司宣布将扩大在加拿大的电池外壳业务,以支援福特汽车的新业务。新工厂占地 17 万平方英尺,将创造多达 150 个新就业岗位,并为福特 F-150 照明生产电池外壳。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业景点-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 电力基础设施发展的成长

- 工业自动化的采用率不断提高

- 市场限制因素

- 品质和安全问题

第六章 市场细分

- 按材质

- 金属

- 非金属

- 按最终用户产业

- 能源动力

- 工业(汽车/製造业)

- 製程工业

- 其他最终用户产业(交通、基础设施、通讯)

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 亚洲

- 中国

- 印度

- 日本

- 澳洲和纽西兰

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Schneider Electric SE

- Legrand SA

- Hubbell Inc.

- Emerson Electric Co.

- ABB Ltd

- Eaton Corporation

- Eldon Holding AB

- AZZ Inc.

- Austin Electrical Enclosures

- Siemens AG

- Pentair PLC

- Rittal GmbH & Co. Kg.

- Adalet(Scott Fetzer Company)

第八章投资分析

第九章 市场机会及未来趋势

The Electrical Enclosures Market size is estimated at USD 8.11 billion in 2025, and is expected to reach USD 10.96 billion by 2030, at a CAGR of 6.2% during the forecast period (2025-2030).

Owing to the increasing power and industrial infrastructure, the need for protection of the workplace and workforce is also increasing, which has led to the adoption of safety standards for the equipment in the industries. It has made electrical enclosures a crucial element in industrial and residential applications.

Key Highlights

- Global energy consumption continues to grow significantly, as electricity demand is increasing as the trend for an ever-connected world accelerates. According to BP, Iceland has the largest per capita electricity consumption worldwide, averaging 52.98 megawatt-hours per person in 2021. It is due to the presence of energy-intensive industries in the country. Such instances are further driving the demand for electrical enclosures.

- Power generated from solar and wind sources uses sensitive electrical components and batteries that, if exposed to the elements, cause a system failure. Therefore, the energy generation sector uses electrical enclosures significantly for safety purposes.

- The acceptance of industrial and factory automation allows the entry of more mechanical, electromechanical, and solid-state devices, components, and controls that need to be enclosed for safety and aesthetic purposes, thereby driving the market growth. As a result, many countries have implemented stringent safety regulations globally, and this parameter is significantly driving the growth of the electrical enclosures market.

- For instance, the Construction Safety Alliance of Maine, SafetyWorks, and the Workplace Safety and Health Division of the Maine Department of Labor joined forces in August 2022 to promote workplace safety and health and inform construction employers and workers in the state about safety and health risks.The alliance will safeguard workers by lowering and minimizing exposure to construction-related risks like falls, injuries from being struck by objects, electrocution, and getting entangled in or between machinery and vehicles.

- The market is witnessing various developments as fabricators, and tier suppliers continue to develop composite solutions for protective battery enclosures. For instance, in March 2022, Mexico-based automotive tier 1 Katcon developed a multi-material toolbox for cost-effective, scalable EV battery enclosure design.

- The Coronavirus pandemic complicated the situation of the adoption of electrical enclosures in various sectors. It has changed the standard operating procedure by bringing in unique challenges of social distancing and contactless operation. Organizations were forced to limit their workforce and deal with the increasing demand. With the shutdown of several industries, the market witnessed a negative impact. Although, with the ease of restrictions and the opening of industries at full capacity, the market has started to gain traction.

Electrical Enclosures Market Trends

Energy and Power End-User Industry to Hold a Significant Share

- Environmental issues related to fossil fuels and nuclear energy are prompting a rise in alternative energy sources, such as solar and wind energy. Solar and wind energy are considered safe, pollution-free renewable energy. Countries around the world are embracing this technology.

- Power generated from solar and wind sources uses sensitive electrical components and batteries that, if exposed to the elements, cause a system failure. Therefore, the energy generation sector uses electrical enclosures significantly for safety purposes.

- Wind and solar energy equipment require seismic protection, EMC shielding, electronics cooling, security, resistance to corrosion, and integration of power conversion and multi-component systems, which are achieved using electrical enclosures.

- As electrical enclosures are deployed to protect the electrical and electronic components and systems of solar, wind, and electrical power plants, government regulations also support the adoption of renewable energy sources, thereby boosting the demand for electrical enclosures.

- Regions are coming up with various initiatives to produce renewable energy sources, further fueling the demand for electrical enclosures. For instance, in August 2021, the Indian Government proposed a set of rules, "Draft Electricity Rules, 2021," for promoting renewable energy through green energy open access. The proposed rules aim to push for faster adoption of renewable power by addressing various concerns related to the green energy sector.

North America Is Expected To Witness Significant Growth Rate

- The growing industrial automation and smart home integration are expected to drive the electrical enclosures market significantly in this region, mainly due to the United States being an early adopter of industrial automation.

- About 61% of electricity generation was from fossil fuels in 2021. About 19% of the energy from fossil fuels was from nuclear energy, and about 20% was from renewable energy sources. The U.S. Energy Information Administration estimates an additional 49 billion kWh of electricity generation from small-scale solar photovoltaic systems in 2021. The regulating bodies in the region have been the prime players in stimulating the demand for electrical enclosures.

- There is a significant penetration of smart homes in North America owing to growing security concerns and awareness of energy conservation. The technological advancements in smart devices and the adoption of those devices into many households are expected to act as opportunities for the electrical enclosures market, owing to the consumer behavior of having a clean environment.

- The increasing establishment of such plants and the stringent rules associated with them are expected to drive the electronic enclosures market exponentially in the North American region. The U.S. Department of Energy (DOE) recently announced USD 61 million for ten pilot projects to deploy new technology for transforming thousands of homes and workplaces into energy-efficient buildings.

Electrical Enclosures Industry Overview

The electronic enclosure market is moderately fragmented. Industry 4.0 and the increasing energy consumption in different regions provide opportunities in the electronic enclosures market. The players in the market are adopting major strategies, like product innovations, mergers and acquisitions, and strategic partnerships, to widen their product portfolio and expand their geographical reach. Some of the players in the market are ABB Ltd, Emerson Electric, and Schneider Electric SE, among others.

In July 2022 - Schneider Electric announced the launch of PrismaSeT S, a new series of enclosures that makes the installation of electrical distribution in commercial and industrial buildings equivalent to residential in terms of installation but more resistant to hard applications. PrismaSeT S supports Schneider Electric's initiative for being more sustainable by using parts of recycled plastic materials in its manufacturing process.

In March 2022 - Magna International Inc. announced that the company is expanding its battery enclosures operations in Canada to support new business from Ford Motor Company. The new 170,000-square-foot facility is expected to generate up to 150 new jobs and produce battery enclosures for the Ford F-150 Lighting.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Power Infrastructure Developments

- 5.1.2 Rising Adoption of Industrial Automation

- 5.2 Market Restraints

- 5.2.1 Quality and Safety Concerns

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Metallic

- 6.1.2 Non-metallic

- 6.2 By End-user Industry

- 6.2.1 Energy and Power

- 6.2.2 Industrial (Automotive and Manufacturing)

- 6.2.3 Process Industries

- 6.2.4 Other End-user Industries (Transportation, Infrastructure, and Telecommunication)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Legrand SA

- 7.1.3 Hubbell Inc.

- 7.1.4 Emerson Electric Co.

- 7.1.5 ABB Ltd

- 7.1.6 Eaton Corporation

- 7.1.7 Eldon Holding AB

- 7.1.8 AZZ Inc.

- 7.1.9 Austin Electrical Enclosures

- 7.1.10 Siemens AG

- 7.1.11 Pentair PLC

- 7.1.12 Rittal GmbH & Co. Kg.

- 7.1.13 Adalet (Scott Fetzer Company)