|

市场调查报告书

商品编码

1444098

灌溉机械:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Irrigation Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

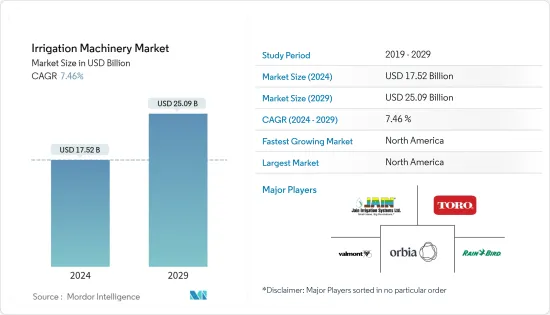

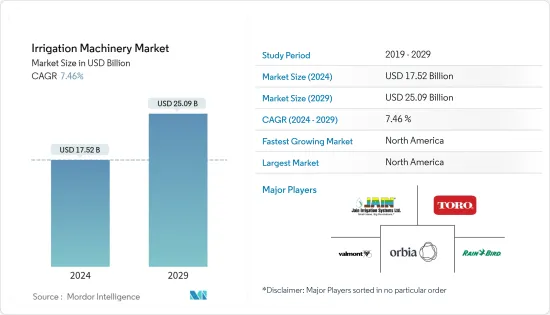

灌溉机械市场规模预计到 2024 年为 175.2 亿美元,预计到 2029 年将达到 250.9 亿美元,预测期内(2024-2029 年)复合年增长率为 7.46%。

主要亮点

- 气候变迁和全球暖化正在改变降雨模式,使农业灌溉变得困难。因此,灌溉机的使用使得向全世界数千英亩的土地供水变得容易。现代灌溉最常用的方法是喷灌和滴灌。它们主要帮助作物生长和保持水分。

- 政府补贴和政策、技术创新以及对水资源短缺日益担忧等重要因素正在推动市场成长。此外,由于缺乏自然灌溉系统和对作物生产力的需求不断增加,灌溉机械市场预计将会成长。

- 喷水灌溉机械是全球灌溉机械市场中最大的部分。几个主要市场参与者正在投资研发,以开发创新产品并保持强大的市场立足点。越来越多地使用高效灌溉系统来提高产量和其他相关效益,再加上主要市场相关人员不断推出先进模型,使该系统成为研究最多的市场之一。

- 北美被认为是成长最快的市场。该地区的公司正在推出新产品,以更快的创新和产品发布来主导所研究的市场。政府政策也透过向农民提供各种补贴来补充市场成长。

灌溉机械市场趋势

政府补助及金融机构支持

政府机构透过促进灌溉机械的普及以及向农民提供多种福利和补贴来促进各国采用先进的灌溉技术。这些补贴帮助农民购买灌溉机械并简化农场灌溉作业,有助于增加世界各地的可灌溉土地。例如,根据世界资料图谱,从 2019 年到 2020 年,世界总灌溉面积增加了 74,613,000 公顷。此外,加强节水和滴灌补贴预计将增加美国的消费量和作物产量。这预计将增加滴灌机械的需求。

除此之外,乌干达是一个主要依赖农业的地区。儘管如此,缺乏供水基础设施和气候变迁导致的降雨量日益不稳定只是农民面临的两个挑战。为了减轻农民的困难,世界银行正在支持乌干达农业部和 40 个地方政府,作为乌干达政府间财政成果转移计画 (UgIFT) 的一部分。 2020 年 9 月,董事会批准向 UgIFT 提供 3 亿美元赠款,用于加强地方政府(LG) 在教育、卫生、水和环境以及小规模灌溉(包括难民居住区)方面的服务提供,并核准了额外融资。这项措施帮助农民以较低的成本购买灌溉设备,学习如何使用它,并了解何时以及如何浇灌作物。

在「每滴更多作物」计画下,为鼓励农民采用滴灌和喷水灌溉,印度政府向农民提供标准单价55%的补贴,向其他种植者提供45%的补贴。按百分比提供赠款或经济援助。提高水利用效率的系统。预计这将加强市场。有关低利率贷款和安装现代先进灌溉系统补贴的优惠政府政策可能会见证全球灌溉机械市场的显着增长。

北美市场占据主导地位

近年来,北美灌溉系统的采用率增加。水资源短缺是严峻的挑战,也是推动机械灌溉系统使用的重要因素。滴灌和喷灌等微灌溉系统可减少水资源浪费并提高生产力。

设备复杂程度的提高和政府以补贴形式采取的措施正在推动市场成长。联邦、州和地方各级的水开发计划以及地下水抽水技术的改进正在为北美灌溉面积的扩大做出贡献。该地区的农民能够以农机贷款的形式及时获得补贴,利率和还款时间表灵活。这扩大了灌溉系统的市场,甚至允许小规模农民投资农业灌溉设备。

例如,美国政府透过美国农业部直接经营贷款、美国农业部经营小额贷款和美国农业部担保经营贷款为农业设备提供资金。 2018 年农业法案进一步提高了美国农民的农业贷款限额,以便更容易为与农业系统(包括灌溉系统)相关的高资本成本提供融资。贷款和补贴的提供增加了对农业灌溉机械的需求,导致该国研究市场的成长。

加拿大统计局报告称,2020 年加拿大总灌溉面积为 605,907 公顷。田间作物占 345,581 公顷,贡献了大部分灌溉量,而饲料作物占 205,866 公顷。该国广阔的灌溉面积随后带动了该地区的灌溉机械市场。

灌溉机械产业概况

灌溉机械市场整合,龙头企业占了研究市场的很大份额。这些公司包括 Orbia (Netafim Limited)、Jain Irrigation Systems Limited、The Toro Company、Vamont Industries 和 Rain Bird Corporation。这些主要企业正在投资新产品的推出和收购以扩大业务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 替代产品的威胁

- 新进入者的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 按灌溉类型

- 喷水灌溉

- 抽油机

- 管子

- 耦合器

- 喷雾/喷灌喷头

- 配件及配件

- 感应器

- 控制器

- 注射器

- 流量计

- 滴灌

- 阀门

- 防回流装置

- 压力调节器

- 筛选

- 发射器

- 管子

- 其他滴灌

- 枢轴灌溉

- 其他灌溉类型

- 喷水灌溉

- 按使用类型

- 谷物和谷物

- 豆类和油籽

- 水果和蔬菜

- 其他使用类型

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 荷兰

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 沙乌地阿拉伯

- 柬埔寨

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 秘鲁

- 南美洲其他地区

- 中东和非洲

- 南非

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 市场占有率分析

- 最采用的策略

- 公司简介

- Nelson Irrigation Corporation

- Orbia(Netafim Limited)

- EPC Industries Limited

- Jain Irrigation Systems Limited

- Tl Irrigation Co.

- The Toro Company

- Valmont Industries

- Deere &Company

- Lindsay Corporation

- Rain Bird Corporation

- Rivulus Irrigation

第七章市场机会与未来趋势

The Irrigation Machinery Market size is estimated at USD 17.52 billion in 2024, and is expected to reach USD 25.09 billion by 2029, growing at a CAGR of 7.46% during the forecast period (2024-2029).

Key Highlights

- The climatic changes and the increase in global warming have brought changes in rainfall patterns, making irrigation in agriculture difficult. Hence, the use of irrigation machinery has made it easy to serve thousands of acres around the world. The most-used modern irrigation methods are sprinkler and drip irrigation. They primarily serve to sustain crop growth and moisture.

- Crucial factors, such as government subsidies and policies, technological innovations, and increasing concern over water scarcity, are driving the market's growth. Also, the market for irrigation machinery is anticipated to grow with increased scarcity of natural irrigation systems and enhanced demand for crop productivity.

- Sprinkler irrigation machinery is the largest segment in the global irrigation machinery market. Several leading market players are investing in R&D to develop innovative products and maintain a strong market foothold. The growing usage of efficient irrigation systems for their better yield output and other associated benefits is coupled with the continuous introduction of advanced models by key market players to make it the largest segment of the market studied.

- North America is considered the fastest-growing market. The companies located in the region are launching new products, thereby dominating the studied market with faster innovations and product launches. Government policies are also supplementing the growth of the market by providing various subsidies to the farmers.

Irrigation Machinery Market Trends

Subsidies from Governments and Support from Financial Institutions

Government organizations are promoting irrigation machinery in various countries to encourage the adoption of advanced irrigation technologies by providing multiple benefits or subsidies to farmers. These subsidies are helping farmers buy irrigation machinery to simplify the irrigation practices on the farm, thereby aiding the increased land under irrigation around the world. For instance, according to the World Data Atlas, the total irrigated area worldwide increased by 74,613 thousand hectares from 2019 to 2020. Additionally, in the United States, increasing water conservation and subsidies for drip irrigation are anticipated to enhance water consumption and crop yield. This is expected to augment the demand for drip irrigation machinery.

Along with this, Uganda is a region primarily dependent on agriculture. Still, the lack of water infrastructure and increasingly erratic rainfall due to climate change are just two of the challenges faced by its farmers. To help ease the hardships of farmers, the World Bank is supporting the Ministry of Agriculture and 40 local governments across Uganda as part of the Uganda Intergovernmental Fiscal Transfers Program for Results (UgIFT). In Sep 2020, the Board of Directors approved USD 300 million in additional financing to the UgIFT to boost local government (LGs) service delivery in education, health, water and environment, and micro irrigation, including in areas hosting large populations of refugees. This initiative helped farmers buy irrigation equipment at a lower cost, learn to use the irrigation equipment, and understand when and how to water crops.

The Indian government, under the Per Drop More Crop scheme, offers subsidies or financial assistance at a rate of 55% of the indicative unit cost to farmers and a rate of 45% to other cultivators in order to encourage farmers to install drip and sprinkler irrigation systems to promote the water use efficiency. This is expected to strengthen the market. Owing to favorable government policies regarding low-interest loans and subsidies for implementing modern and advanced irrigation systems, the irrigation machinery market is likely to witness significant growth worldwide.

North America Dominates the Market

The rate of adoption of irrigation systems in North America has increased over the past few years. Water scarcity is a significant challenge and a key driver for using irrigation machinery systems. Micro irrigation systems, such as drip and sprinklers, reduce water wastage and increase productivity.

The growing sophistication of equipment and government initiatives in the form of subsidies is driving market growth. Water development programs at the federal, state, and local levels and improvements in groundwater pumping technologies are contributing to the expansion of the irrigated area in North America. Farmers in the region have been able to avail themselves of timely subsidies in the form of agriculture equipment loans at flexible interest rates and repayment schedules. This has helped even small-scale farmers invest in agricultural irrigation equipment, thereby expanding the market of irrigation systems.

For instance, the US government extends loans on farm equipment through USDA Direct Operating Loans, USDA Operating Microloans, and USDA Guaranteed Operating Loans. The 2018 Farm Bill further increased the farm loan limit for US farmers to better access credit for high capital costs related to agriculture systems, including irrigation systems. The availability of loans and subsidies is propelling the demand for agricultural irrigation machinery, resulting in the growth of the market studied in the country.

As reported by Statistique Canada, the total irrigated area in the country in 2020 was 605,907 hectares. With 345,581 hectares, the field crops contributed to most of the irrigation, while the forage crops accounted for 205,866 hectares. The large, irrigated area in the country is driving the market for irrigation machinery subsequently in the region.

Irrigation Machinery Industry Overview

The irrigation machinery market is consolidated, with major players occupying a significant share of the market studied. These players include Orbia (Netafim Limited), Jain Irrigation Systems Limited, The Toro Company, Vamont Industries, and Rain Bird Corporation. These key players are investing in new product launches and acquisitions for business expansions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of Substitute Products

- 4.4.4 Threat of New Entrants

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Irrigation Type

- 5.1.1 Sprinkler Irrigation

- 5.1.1.1 Pumping Unit

- 5.1.1.2 Tubing

- 5.1.1.3 Couplers

- 5.1.1.4 Spray/Sprinklers Heads

- 5.1.1.5 Fittings and Accessories

- 5.1.1.6 Sensors

- 5.1.1.7 Controllers

- 5.1.1.8 Injectors

- 5.1.1.9 Flow Meters

- 5.1.2 Drip Irrigation

- 5.1.2.1 Valves

- 5.1.2.2 Backflow Preventers

- 5.1.2.3 Pressure Regulators

- 5.1.2.4 Filters

- 5.1.2.5 Emitters

- 5.1.2.6 Tubing

- 5.1.2.7 Other Drip Irrigations

- 5.1.3 Pivot Irrigation

- 5.1.4 Other Irrigation Types

- 5.1.1 Sprinkler Irrigation

- 5.2 By Application Type

- 5.2.1 Grains and Cereals

- 5.2.2 Pulses and Oilseeds

- 5.2.3 Fruits and Vegetables

- 5.2.4 Other Application Types

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Netherlands

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Saudi Arabia

- 5.3.3.5 Cambodia

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Peru

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Most Adopted Strategies

- 6.3 Company Profiles

- 6.3.1 Nelson Irrigation Corporation

- 6.3.2 Orbia (Netafim Limited)

- 6.3.3 EPC Industries Limited

- 6.3.4 Jain Irrigation Systems Limited

- 6.3.5 T-l Irrigation Co.

- 6.3.6 The Toro Company

- 6.3.7 Valmont Industries

- 6.3.8 Deere & Company

- 6.3.9 Lindsay Corporation

- 6.3.10 Rain Bird Corporation

- 6.3.11 Rivulus Irrigation