|

市场调查报告书

商品编码

1444128

压铸:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Die Casting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

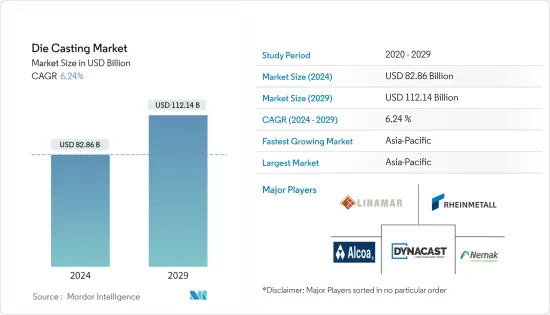

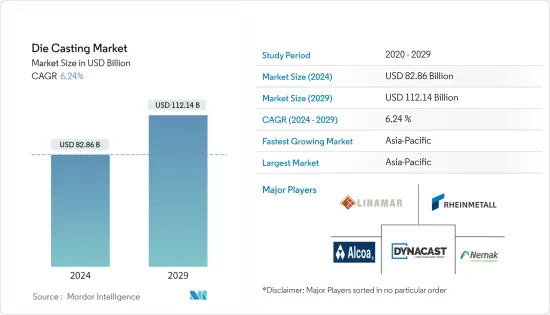

压铸市场规模预计到2024年为828.6亿美元,预计到2029年将达到1121.4亿美元,在预测期内(2024-2029年)复合年增长率为6.24%。

COVID-19的传播对製造业产生了负面影响。全球多个主要经济体陷入封锁,供应链中断。在此期间,所有製造单位和OEM工厂被迫暂停生产和运作。随着经济復苏,需求回归市场,消费者偏好转向轻型车,汽车产业对压铸件的需求庞大。预计这一趋势将持续下去并推动市场成长。

从中期来看,所研究的市场主要由压铸行业供应链的复杂性、汽车市场的扩张、压铸件在工业机械中的普及不断提高、建筑行业的增长以及电气和电子设备中铝铸件的增长,受到采用的推动。 CAFE 标准和 EPA 减少车辆排放气体和提高燃油效率的政策正在推动汽车製造商透过采用非铁金属来减轻车辆重量。此后,采用压铸件作为减重策略,对汽车领域的前市场起到了重要的推动作用。

由于高导热性,电气和电子行业对铝压铸部件的需求不断增长,预计将在预测期内推动成长。此后,采用压铸件作为减重策略,对汽车领域的前市场起到了重要的推动作用。然而,原材料供应紧张、原材料价格波动以及冶金行业排放气体的环境法规对市场成长构成了主要障碍。

由于中国和印度等国家对汽车的需求不断增长,以及铝压铸件在各种应用中的使用不断增加,预计亚太地区将在压铸市场中占据最大份额。在北美,由于建筑和汽车行业产量的增加,铝压铸市场也预计将大幅成长。

压铸市场趋势

铝有望在压铸製程中发挥重要作用

多年来,许多工业应用对铝製高压压铸零件的需求不断增加,因为该工艺可生产轻质零件并为复杂形状提供高度弹性。

近年来,汽车零件由于新技术的演进而不断进步和创新。尤其是轻量材料在汽车零件製造中的应用正在引起全国的关注。

这种流行的一个重要原因是,由于采用製造关键零件的轻量汽车材料,汽车的燃油效率提高了。

此外,必须在不牺牲安全性、品质或性能的情况下实现车辆减重。铝压铸件耐用且可无限回收,由于铝具有多种优点,因此成为製造商的首选。为进一步加强市场开拓,龙头企业的收购、联盟数量也不断增加。 2022年8月,文谦集团宣布将在安徽省六安经济技术开发区兴建新能源汽车铝压铸件生产基地。

2021年10月,Sandhar Engineering Private Limited成立,作为完全子公司,开展製造和组装各种锁定装置、电气、电子、机械、汽车和工业零件的业务。 2021 年 4 月,Jaya Hind Industries 将与 KS Huayu Alutech GmbH (KSATAG) 的汽车缸体和缸头生产技术合作伙伴关係延长至 2027 年。合约范围也扩大到包括 Sunrise Industries 的新零件。电动车、底盘结构件等。2021年3月,Sandhar Technologies与Unicast Autotech签署非约束性谅解备忘录,收购铝压铸业务。

在预测期内,铝压铸市场的成长可能会继续扩大,以满足汽车和非汽车产业对轻质和高导电性金属零件不断增长的需求。

亚太地区可能会经历显着成长

预计在预测期内,亚太地区将在压铸市场中占据最大的市场占有率。由于汽车行业的成长、工业部门的需求以及风力涡轮机和电讯应用范围的扩大,预计亚太地区压铸市场将以更快的速度成长。

印度和中国的廉价劳动力和低製造成本预计将进一步加速亚太地区的市场成长。此外,对电动和混合汽车的需求不断增长,导致汽车製造商在所有类型的车辆中专注于使用铝等轻质材料,而不是较重的钢铁。

此外,製造电动车的公司也积极采购这些压力压铸机并采用该技术,以满足不断增长的消费者需求。

一些公司已经采取了成长策略,例如扩大製造能力,以保持在该市场的竞争力。

压铸业概况

压铸市场由 Neamk、Alcoa Corporation、Linamar Corporation 和 Dynacast 等几家主要企业主导。市场上的这些主要企业致力于透过各种合併、联盟、合资和收购来扩大其全球影响力。例如,

- 2022年3月,利纳马公司收购了GF Casting Solutions (GF) 50%的股权。透过此次收购,利纳马公司增强了产品系列。

- 2022 年 1 月,Gibbs Die Casting 的子公司 Koch Enterprises, Inc. 收购了 Amprod Holdings, LLC。透过此次收购,该公司将产品系列扩展到美国。

- 2022 年 1 月,Sandhar Auto Electric Solutions Private Limited 成立,作为完全子公司,旨在推动电动车业务并提供先进的技术解决方案。 Sandhar Auto Electric Solutions Private Limited 主要从事电池电动汽车、氢燃料电池汽车、生质燃料技术车辆、全地形车辆 (ATV) 和其他先进汽车技术车辆的零件製造业务。涉及。

- 2021 年 8 月,利纳马公司宣布与荷兰的 Innovative Mechatronic Systems BV (IMSystems) 建立合作伙伴关係。此次合作的重点是将阿基米德驱动传动系统推向市场。

- 2021 年 4 月,Aludyne 宣布收购 Shiloh Industries 的 CastLight 部门。该部门生产铝压铸件。

- Endurance Technologies 于 2021 年 2 月宣布,位于印度泰米尔纳德邦 Kancheepuram 的新工厂已开始商业生产。该工厂将生产两轮车和四轮车的整合式铝压铸件和碟式煞车组件。

- 2020 年 4 月,Endurance Technologies 收购了位于义大利特伦蒂诺的 Adler SpA 99% 的控股权。此次收购预计将透过与义大利和德国 10 家製造工厂的合作,加强该公司在泛欧洲的足迹。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 市场限制因素

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 按用途

- 车

- 电气和电子

- 工业的

- 其他用途

- 按流程

- 压力铸造

- 真空压铸

- 挤压铸造

- 其他工艺

- 按原料分

- 铝

- 镁

- 锌

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 泰国

- 马来西亚

- 印尼

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 土耳其

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- Form Technologies Inc.(Dynacast)

- Nemak

- Endurance Technologies Limited

- Sundaram Clayton Ltd

- Shiloh Industries

- Georg Fischer Limited

- Koch Enterprises(Gibbs Die Casting Group)

- Bocar Group

- Engtek Group

- Rheinmetall AG(Rheinmetall Automotive, formerly KSPG AG)

- Rockman Industries

- Ryobi Die Casting Ltd

- Linamar Corporation

- Meridian Lightweight Technologies UK Ltd

- Sandhar Group

- Alcoa Corporation

第七章市场机会与未来趋势

The Die Casting Market size is estimated at USD 82.86 billion in 2024, and is expected to reach USD 112.14 billion by 2029, growing at a CAGR of 6.24% during the forecast period (2024-2029).

The COVID-19 outbreak hit the manufacturing industry adversely. The disruptions were caused in the supply chain as several major economies of the world were in lockdown. All the manufacturing units and OEM plants were forced to halt production and operations during this period. With the recovery of economies, the demand returned to the market witnessing huge demand for die-cast parts in the automotive industry as the consumer preference changed to lightweight vehicles. The trend is expected to continue and drive market growth.

Over the medium term, the market studied is largely driven by supply chain complexities in the die-casting industry, expanding automotive market, increasing penetration of die-casting parts in industrial machinery, growing constructional sector, and employing aluminum casts in electrical and electronics. CAFE standards and EPA policies to cut down automobile emissions and increase fuel efficiency are driving the automakers to reduce the weight of the automobile by employing lightweight non-ferrous metals. Subsequently, employing die-cast parts as a weight reduction strategy is acting as a major driver for the former market in the automotive segment.

Rising demand for aluminum die-casting parts in the electrical and electronics industry owing to its high thermal conductivity is likely to drive growth during the forecast period. Subsequently, employing die-cast parts as a weight reduction strategy is acting as a major driver for the former market in the automotive segment. However, a crunch in raw material supply, volatility in raw material prices, and environmental regulations on emissions for the metallurgy industries are acting as major barriers to market growth.

The Asia-Pacific region is anticipated to hold the largest market share in the die-casting market due to the rise in demand for automobiles in countries such as China and India and the rise in the use of aluminum die-casting for various applications. North America is also expected to witness significant growth in the aluminum die-casting market due to growing output from the construction and automotive sectors.

Die Casting Market Trends

Aluminum Anticipated to Play Key Role in Die Casting Process

The demand for aluminum high-pressure die-casting parts has been increasing across numerous industrial applications over the years, as the process manufactures lightweight parts and provides high flexibility for complex shapes.

In recent years, automotive parts have witnessed advancements and innovations with the evolution of new technologies. Among them, the use of lightweight materials for the manufacturing of auto components has been gaining attention across the country.

One of the important reasons for this popularity is the enhanced fuel economy of automobiles with the adoption of lightweight automotive materials manufacturing crucial parts.

Additionally, the lightweight of vehicles must be done without compromising on safety, quality, and performance. Aluminum die-cast parts are durable and can be endlessly recycled therefore, aluminum is most preferred by manufacturers due to its varied advantages.

Moreover, there is a rising number of acquisitions and partnerships by the major players to further enhance development in the market. For instance,

- In August 2022, Wencan Group Co., Ltd. announced that it intends to build a production base of aluminum die-cast parts for New Energy Vehicles (NEVs) in Lu'an Economic and Technological Development Zone, Anhui Province.

- In October 2021, Sandhar Engineering Private Limited was incorporated as a wholly owned Subsidiary Company for carrying out the business of manufacturers, and assembling various Locking Devices, Electrical, Electronics, Mechanical, Automobile, and Industrial parts.

- In April 2021, Jaya Hind Industries extended its technical partnership with KS Huayu AlutechGmbH (KSATAG) for the manufacturing of automotive cylinder blocks and cylinder heads till 2027. The scope of the agreement has also been expanded to cover new parts from Sunrise Industries, such as Electric Vehicles, Structural parts for Chassis, etc.

- In March 2021, Sandhar Technologies entered a non-binding Memorandum of Understanding with Unicast Autotech to acquire its aluminum die-casting business

The growth of the aluminum die-casting market is likely to continue to increase during the forecast period to meet the increasing demand for lightweight components and high-conductivity metal parts from the automotive and non-automotive sectors.

Asia-Pacific Region Likely to Witness Significant Growth

The Asia-Pacific region is anticipated to hold the largest market share in the die-casting market during the forecast period. The growing automobile industry, demand from the industrial sector, and increased scope of application in windmills and telecommunications are expected to drive the die-casting market at a faster pace in the Asia-Pacific region.

Cheaper labor and low manufacturing costs in India and China are expected to further accelerate the market growth in the Asia-Pacific region. In addition, increased demand for electric and hybrid vehicles has turned automakers' focus to using lightweight materials like aluminum as a substitute for heavier steel and iron in all types of vehicles. For instance,

- In May 2022, Tamil Nadu Small Industries Development Corporation invested an amount of INR 5.8 Crore to establish a common facility center for aluminum high-pressure die casting.

The growing expansion of automotive manufacturing industries across the country is likely to increase the demand for lightweight materials for automotive applications. For instance,

- In February 2021, MG Motors announced that INR 1,500 crore may be invested in the expansion and localization of its business to increase its production capacity at the Halol plant in Gujarat.

- The government of India has proposed the use of aluminum per vehicle in India from 29 Kg to 160 Kg for the electric vehicle during the forecast period.

In addition, the companies manufacturing electric vehicles are also actively procuring these pressure diecasting machines and are adopting this technology to make themselves ready for growing consumer demand.

Several players adopt growth strategies, such as manufacturing capacity expansion, to stay competitive in this market. For instance,

- In July 2021, YIZUMI established the Die Casting Technical Service Center (TSC) in the United States and India that offers integrated solutions for die casting cells, dies, die casting process, and product debugging.

- In February 2021, Endurance Technologies commenced commercial production at its new plant in Vallam, Vadagal, Kancheepuram, Tamil Nadu. The plant manufactures aluminum die-castings and carries out the integration of disc brake components with control brake modulators for supplying machined aluminum castings to Hyundai, Kia, and Royal Enfield.

Die Casting Industry Overview

The Die Casting market is dominated by several key players such as Neamk, Alcoa Corporation, Linamar Corporation, Dynacast, and many others. These key players in the market are focusing on expanding their presence globally through various mergers, partnerships, joint ventures, and acquisitions. For instance,

- In March 2022, Linamar Corporation acquired a 50% interest in GF Casting Solutions (GF). Through this acquisition, Linamar Corporation enhanced its product portfolio in automotive applications.

- In January 2022, Koch Enterprises, Inc., a subsidiary of Gibbs Die Casting acquired Amprod Holdings, LLC. Through this acquisition, the company expanded its product portfolio across the United States.

- In January 2022, Sandhar Auto Electric Solutions Private Limited was incorporated as a wholly owned Subsidiary Company to undertake e-mobility business and to provide Advanced Technology Solutions. Sandhar Auto Electric Solutions Private Limited is primarily involved in the business of manufacturing parts/components for Battery Electric Vehicles, Hydrogen Fuel Cell Vehicles, Biofuel based technology Vehicle, All Terrain Vehicles (ATVs), and any other Advanced Automotive Technology Vehicles.

- In August 2021, Linamar Corporation announced the partnership with Netherlands-based Innovative Mechatronic Systems B.V. (IMSystems). The partnership focuses on bringing the Archimedes Drive transmission system to market.

- In April 2021, Aludyne announced that it had acquired Shiloh Industries CastLight division. This division manufactures aluminum die-casting parts.

- In February 2021, Endurance Technologies announced that it had started commercial production at the new plant in Kancheepuram, Tamil Nadu, India. The plant will manufacture aluminum die-castings and integration of disc brake components for two and four-wheelers.

- In April 2020, Endurance Technologies acquired a controlling equity stake of 99% in Adler SpA, based out of Trentino, Italy. The acquisition is expected to improve the company's reach across Europe, with the aid of ten manufacturing plants combined in Italy and Germany.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Billion)

- 5.1 By Application

- 5.1.1 Automotive

- 5.1.2 Electrical and Electronics

- 5.1.3 Industrial

- 5.1.4 Other Applications

- 5.2 By Process

- 5.2.1 Pressure Die Casting

- 5.2.2 Vacuum Die Casting

- 5.2.3 Squeeze Die Casting

- 5.2.4 Other Processes

- 5.3 By Raw Material

- 5.3.1 Aluminum

- 5.3.2 Maginesium

- 5.3.3 Zinc

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 France

- 5.4.2.3 Germany

- 5.4.2.4 Italy

- 5.4.2.5 Russia

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Thailand

- 5.4.3.6 Malaysia

- 5.4.3.7 Indonesia

- 5.4.3.8 South Korea

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Turkey

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Form Technologies Inc. (Dynacast)

- 6.2.2 Nemak

- 6.2.3 Endurance Technologies Limited

- 6.2.4 Sundaram Clayton Ltd

- 6.2.5 Shiloh Industries

- 6.2.6 Georg Fischer Limited

- 6.2.7 Koch Enterprises (Gibbs Die Casting Group)

- 6.2.8 Bocar Group

- 6.2.9 Engtek Group

- 6.2.10 Rheinmetall AG (Rheinmetall Automotive, formerly KSPG AG)

- 6.2.11 Rockman Industries

- 6.2.12 Ryobi Die Casting Ltd

- 6.2.13 Linamar Corporation

- 6.2.14 Meridian Lightweight Technologies UK Ltd

- 6.2.15 Sandhar Group

- 6.2.16 Alcoa Corporation