|

市场调查报告书

商品编码

1686570

汽车降雨感应器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Automotive Rain Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

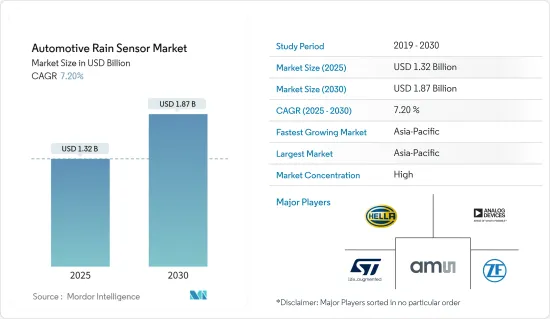

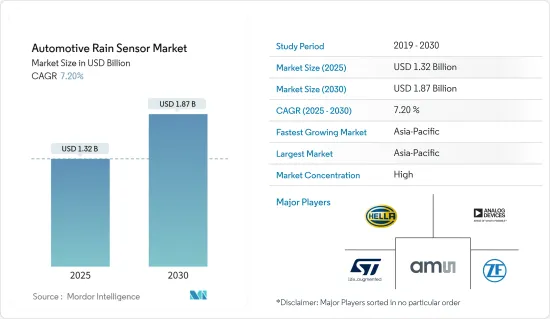

预计 2025 年汽车降雨感应器市场规模为 13.2 亿美元,预计到 2030 年将达到 18.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.2%。

2020 年,市场受到了 COVID-19 疫情的衝击,导致汽车产量下降、供应链中断,影响了汽车降雨感应器的商业性可行性。然而,2021 年上半年市场势头强劲,全球主要地区的电动车销售正在復苏。

预计在预测期内,车辆电气系统的使用不断增加、对车辆驾驶员舒适性和安全性的需求不断增长以及汽车行业的大幅扩张将成为市场成长的主要驱动因素。此外,电动车和自动驾驶汽车技术的发展预计将进一步促进汽车降雨感应器市场的大幅成长。此外,经济状况的改善、客户需求和兴趣的不断增长、技术创新以及政府监管的加强都是推动市场扩张的一些有利因素。此外,各大豪华汽车製造商纷纷推出电动车,以应对日益增长的环境问题和不断上涨的燃油价格。这也可能促进该领域的扩张。由于汽车降雨感应器成本较低,预计经济型和中檔汽车采用此类感测器将推动市场发展。

由于普遍降雨量较大,一些国家建议在汽车上安装降雨感应器。然而,有些地区不需要降雨感应器。中东和北非是降雨稀少的地区。卡达、沙乌地阿拉伯、阿拉伯联合大公国、科威特和埃及等一些国家的降雨量极少,因此自动降雨感应器的必要性不大。例如,中东地区几乎完全是沙漠,因此任何季节的降雨量都很少。中东地区唯一真正出现冬季的地方是沙乌地阿拉伯的山区,那里的气温可能会降至冰点以下。这种典型的气候条件可能会阻碍主要OEM在新兴市场推出具有此类自动雨量感测器技术功能的车型,从而限制预测期内的整体市场发展。

在北美大部分地区,自动雨刷已经是汽车的常见配置,并在大多数车型中广泛普及。降雨感应器可以控制雨刷的速度和频率,不仅是一个方便的功能,而且被认为可以使驾驶更安全。合适的雨刷速度可确保任何天气下都有最佳的可见度。根据汽车製造商介绍,降雨感应器位于后视镜后面,非常适合安装各种感测器,包括摄影机、太阳感测器和环境光感测器。

汽车降雨感应器市场趋势

安全和舒适意识的提高预计将推动需求

降雨感应器是一种驾驶辅助系统,透过在雨天自动启动挡风玻璃雨刷系统来减轻驾驶者的负担,大大提高车内的安全性和舒适性。自动驾驶和连网汽车已经吸引了消费者的兴趣,预计将在预测期内获得广泛认可。 ADAS(先进驾驶辅助系统)有望缩小传统车辆和未来车辆之间的采用差距。例如,

一些政府专注于强制其管辖范围内行驶的车辆配备某些 ADAS 功能,而其他政府则专注于设计和实施 ADAS 功能及其相关规范以提高车辆性能。例如

- 鑑于现代车辆中 ADAS(高级驾驶辅助系统)的普及率越来越高,中国政府最近宣布了三项专门涵盖 ADAS 的新标准:其中第一项新标准是 GB/T 39263-2020,有关高级驾驶辅助系统(ADAS)的术语和定义。标准对各类系统进行了定义,分为资讯支援系统和控制支援系统两大类。

- 到2022年终,欧盟市场上的所有新车可能都必须配备先进的安全系统。欧盟理事会于 2021 年 3 月与欧洲议会达成协议后,通过了有关机动车辆总体安全以及乘员和弱势道路使用者保护的法规,旨在大幅减少道路交通事故死亡和伤害。此外,受政府支持的汽车安全评级机构欧洲新车安全评估协会 (Euro NCAP) 可能要求驾驶员监控系统从 2023 年或 2024 年开始获得五星安全评级。

亚太地区预计将占据汽车降雨感应器市场的较大份额

预计预测期内亚太地区将占据最高复合年增长率。中国、印度等新兴国家的经济成长可能会在未来增加对乘用车的需求。这可能促使全球汽车製造商对技术和现代化大规模生产系统进行大量投资,从而刺激对汽车降雨感应器雨刷系统的需求。此外,基础建设和工业化投资的增加推动了商用车的需求,也可能提振该地区的市场成长前景。根据这份市场研究报告,预计亚太地区将在整个预测期内继续主导降雨感应器雨刷市场。预计中国、印度、印尼、日本和韩国等国家将成为该市场的主要贡献者。例如

- 2021 年 3 月,斯柯达汽车印度公司宣布推出首款量产车——全新中型 SUV Kushaq,该系列共有四款车型,是其 INDIA 2.0计划的一部分。它配备了降雨感应器,可以在需要时自动打开近光灯和雨刷。

欧洲将成为未来成长最快的地区。由于主要汽车製造商的存在,德国引领了区域市场。此外,汽车产量的增加和先进技术的采用可能会促进该地区的市场成长。此外,政府为振兴受到 COVID-19 严重打击的汽车产业而实施的多项有利措施预计将促进这些地区的市场成长。

另外,欧洲地区的主要特征是豪华车产量大、技术力高。消费者对高性能汽车的偏好是汽车降雨感应器市场成长的主要原因。

汽车降雨感应器产业概况

随着国内外企业的参与,汽车降雨感应器市场正在不断巩固。主要企业正在采取产品创新、併购等策略来扩大其地理范围并维持其市场地位。市场的主要企业包括Denso Corporation、HELLA GmbH &Co.KGaA、ZF Friedrichshafen AG、Analog Devices Inc.、Valeo group、ams-OSRAM International GmbH 等。

- 2021年3月,海拉开始与汽车资料供应商Wejo合作。海拉全面的感测器专业知识有望帮助 Wejo 发现其高性能雷达、电池和雨量光学气候感测器的新使用案例。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 波特五力分析

- 新进入者的威胁

- 购买者和消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 按车型

- 搭乘用车

- 商用车

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 巴西

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 世界其他地区

- 北美洲

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- HELLA GmbH & Co. KGaA

- Denso Corporation

- ZF Friedrichshafen AG

- Analog Devices Inc

- STMicroelectronics

- Valeo group

- Semiconductor Components Industries LLC

- ams-OSRAM International GmbH

- HAMAMATSU PHOTONICS KK

第七章 市场机会与未来趋势

The Automotive Rain Sensor Market size is estimated at USD 1.32 billion in 2025, and is expected to reach USD 1.87 billion by 2030, at a CAGR of 7.2% during the forecast period (2025-2030).

The market was negatively affected by the COVID-19 pandemic in 2020 due to low-reported vehicle sales impacting the commercial potential for automotive rain sensors in the wake of a decline in vehicle production and supply chain disruptions. However, by the first half of 2021, the market had gained momentum as electric vehicle sales picked up across major regions globally.

The increasing use of electrical systems in cars and the expanding need for driver comfort and safety in vehicles, coupled with significant expansion of the automotive sector, are anticipated to act as major driving factors for market growth during the forecast period. In addition, the development of electric mobility and autonomous vehicle technology is expected to further contribute to the remarkable growth of the automotive rain sensors market. Moreover, improving economic conditions, increasing customer demand and interest, technical innovation, and stricter government restrictions are all favorable drivers for the market's expansion. Furthermore, leading luxury vehicle manufacturers are introducing electric variants of their vehicles in response to growing environmental concerns and rising fuel prices. It will also aid in the expansion of the sector. Due to the lower cost of automotive rain sensors, adopting such sensors in the economy and mid-range automobiles is expected to enhance market growth.

In general, several nations advise putting a rain sensor on cars because of excessive rain. However, there are some places where it might not even be necessary. The Middle East & North Africa are two places with very little rainfall. Some nations, such as Qatar, Saudi Arabia, the United Arab Emirates, Kuwait, and Egypt, have extremely low levels of precipitation, which lessens the need for automatic rain sensors. For example, rainfall is negligible in all seasons of the Middle East, as the region is nearly all desert. The only real winters in the Middle East happen in the mountainous regions of Saudi Arabia, where temperatures can reach freezing. Such typical climatic conditions discourage key OEMs from launching their models with such automatic rain-sensing technology features and hence are anticipated to limit the overall market development over the forecast period.

In most parts of North America, automatic wipers are already commonplace in vehicles and have advanced across most car segments. Rain sensors that manage the speed and frequency of wipers are not only a convenience feature, but they are also thought to make driving safer. In all weather situations, the proper wiper speed ensures optimal visibility. According to automakers, the rain sensor's location behind the rearview mirror is also perfect for a cluster of sensors, such as a camera, sun sensor, and ambient light sensor.

Automotive Rain Sensors Market Trends

RISING AWARENESS TOWARDS SAFETY AND COMFORT EXPECTED TO DRIVE DEMAND

The rain sensor is a driver assistance system that takes the strain off the driver by automatically activating the windshield wiper system when it rains, thereby significantly improving in-vehicle safety and comfort. Autonomous cars and connected vehicles are gaining consumers' interest and are anticipated to gain wider acceptance over the forecast period. The advanced driver assistance systems (ADAS) featured are expected to diminish the penetration gap between traditional cars and tomorrow's cars. For instance,

While some governments are focusing on mandating certain ADAS features across vehicles operating in their region, others are focusing on designing and implementing standards for ADAS features and their associated specifications to improve the vehicle's performance. For instance,

- Reflecting the increasing availability of advanced driver assistance systems (ADAS) on modern vehicles, the Chinese government has recently published three new standards that specifically cover advanced driver assistance systems. The first of these new standards is GB/T 39263-2020 on terms and definitions for advanced driver assistance systems (ADAS). The standard specifies definitions for various systems, which are split into two categories; information assistance systems and control assistance systems.

- By the end of 2022, all new cars on the EU market may have to be equipped with advanced safety systems. Following an agreement with the European Parliament in March 2021, the council adopted a regulation on the general safety of motor vehicles and the protection of vehicle occupants and vulnerable road users to reduce road casualties significantly. Additionally, Euro NCAP, a government-backed group that rates cars for safety, may require a driver-monitoring system to earn a five-star safety rating starting in 2023 or 2024.

ASIA-PACIFIC REGION IS EXPECTED TO HOLD THE HIGH MARKET SHARE IN THE AUTOMOTIVE RAIN SENSOR MARKET

During the forecast period, Asia-Pacific is expected to dominate with the highest CAGR. The economic growth of emerging countries such as China and India may increase the demand for passenger cars in the future; this is expected to induce global automobile manufacturers to invest heavily in technology and modern mass production systems, fueling the demand for automotive rain-sensing wiper systems. Moreover, increased investments in infrastructure development and industrialization that fuel the demand for commercial vehicles may also boost the market's growth prospects in this region. According to this market study report, APAC is expected to continue dominating the rain-sensing windshield wipers market throughout the forecast period. Countries like China, India, Indonesia, Japan, and South Korea will be the major market contributors. For instance,

- In March 2021, Skoda Auto India announced the launch of the all-new midsize SUV Kushaq, its first production car of four models, as part of the INDIA 2.0 project. The car features rain sensors that automatically switch on the low beam or windscreen wipers when required.

Europe is to be the fastest-growing region in the future. Germany leads this regional market due to the presence of major automakers in the country. Additionally, increased vehicle production and the adoption of advanced technologies may boost the market growth in this region. Furthermore, several favorable government initiatives implemented to revitalize the automobile industry, which was hit hard by COVID-19, are expected to drive market growth in these regions.

Additionally, the European region's higher production of luxury cars and high technological capabilities are key characteristics. Consumer's prefer high-performance vehicles, which is the major reason for the growth of the automotive rain sensor market.

Automotive Rain Sensors Industry Overview

The automotive rain sensors market is consolidated, with the presence of national and international players in the market. The major players follow strategies like product innovation, mergers, and acquisitions to expand their reach and hold their market position. The major players in the market are Denso Corporation, HELLA GmbH & Co. KGaA, ZF Friedrichshafen AG, Analog Devices Inc., Valeo group, ams-OSRAM International GmbH, etc.

- In March 2021, HELLA entered a collaboration with vehicle data provider Wejo. HELLA's comprehensive sensor expertise is expected to enable Wejo to identify new use cases for high-performance radar, battery, and rain-light-climate sensors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Spain

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Rest of World

- 5.2.4.1 Brazil

- 5.2.4.2 Saudi Arabia

- 5.2.4.3 United Arab Emirates

- 5.2.4.4 South Africa

- 5.2.4.5 Rest of World

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 HELLA GmbH & Co. KGaA

- 6.2.2 Denso Corporation

- 6.2.3 ZF Friedrichshafen AG

- 6.2.4 Analog Devices Inc

- 6.2.5 STMicroelectronics

- 6.2.6 Valeo group

- 6.2.7 Semiconductor Components Industries LLC

- 6.2.8 ams-OSRAM International GmbH

- 6.2.9 HAMAMATSU PHOTONICS KK