|

市场调查报告书

商品编码

1444153

硅胶:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Silicone - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

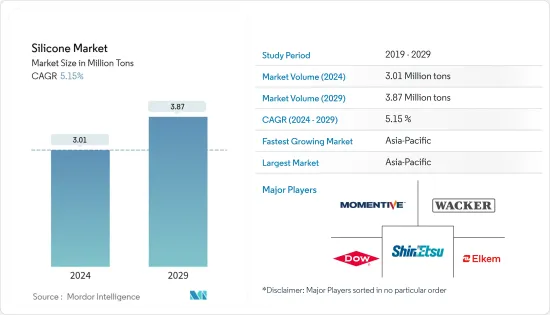

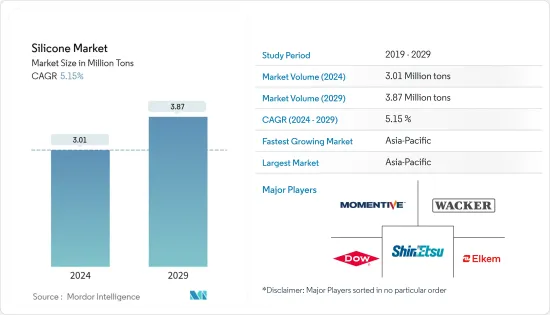

预计2024年硅胶市场规模为301万吨,预计2029年将达到387万吨,在预测期间(2024-2029年)复合年增长率为5.15%。

硅胶市场受到 COVID-19 大流行、一系列全国性封锁、严格的社交距离规范以及全球供应链网路中断的阻碍。世界各地许多工厂和产业关闭,影响了硅胶的需求。然而,健康和卫生意识的增强进一步刺激了医疗保健、个人护理和消费品行业的需求,并刺激了对硅胶的需求。

主要亮点

- 从长远来看,推动硅胶市场成长的主要因素是医疗保健产业的使用量增加、输配电产业的需求增加以及汽车产业的应用增加。

- 另一方面,地缘政治紧张局势和政府监管力度加大的影响可能会阻碍市场成长。

- 各种最终用户对电活性聚合物(EAP)的潜在需求不断增长,可能为预测期内的硅胶市场带来机会。

- 预计亚太地区将在其他地区中占据主导地位,其中中国和印度将推动该地区的成长。

硅胶市场趋势

增加在工业製程的使用

- 工业消泡剂、工业涂料、液压油和润滑剂、RTV(室温硫化)密封剂、模具和聚合物添加剂代表了硅胶在工业加工领域的主要应用。

- 在石油和天然气行业,硅胶广泛用于海上钻井,其中空间和重量限制需要泡沫和废弃物管理。硅胶会释放钻井泥浆中残留的气体。消泡剂可减少能源和化学品的使用,同时提高生产率,因为泡沫的存在会减慢流程并增加维护作业的时间。

- 硅胶也主要用于工业涂料,例如桥樑和隧道中使用的耐腐蚀、耐化学药品和耐热涂料。这些还包括用于石油和天然气(包括炼油厂)、电力和其他行业(包括采矿、废弃物处理以及纸浆和造纸)的涂层结构。

- 因此,全球石油和天然气产业的扩张预计将受益于硅胶的需求。各种正在进行的扩张计划预计将推动成长。例如,国营精製中石油计画于 2022 年上半年开始运作位于中国南部广东省揭阳炼油厂的日产 40 万桶的炼油厂。印度是亚太地区石油和天然气领域的领先经济体。天然气部分。根据印度品牌股权基金会(IBEF)预测,到2045年,印度石油需求预计将达到1,100万桶。此外,印度天然气消费量预计将增加250亿立方公尺。米。到 2024 年。

- 多年来,世界海上钻油平臺的数量一直在缓慢增长,同时由于新契约的赢得以及欧洲、非洲和美国生产活动的增加,需求也随之增加。海洋探勘设备的需求量很大,近年来支撑了包括硅胶消泡剂在内的水处理化学品市场的成长。

- 由于上述所有因素,预计市场在预测期内復苏后将呈现强劲成长。

亚太地区预计将主导市场

- 亚太地区是硅胶的主要消费地区,占最大份额。中国、印度和日本的市场成长是多年来亚太有机硅胶市场成长的主要原因之一。

- 半导体是电子领域的重要组成部分,硅胶用于封装、涂覆、黏合和保护半导体、PCB、ECU硅胶。根据半导体产业协会的数据,2021年中国半导体销售额达1,829.3亿美元,而2020年为1,504亿美元,增加了调查市场的需求。

- 中国拥有14,000多公里的海岸线和多个大型港口,是世界上最大的海洋国家之一。该国是几个大型造船集团的所在地。中国船舶工业集团公司(CSSC)、中国船舶工业集团公司(CSIC)、中国外运、中远海运和招商局国际是中国造船业的主要企业。中国造船厂正在建造各种船舶,包括散装货船、货柜船、油轮、军舰、客船和豪华船舶,从而创造了对硅胶的需求。

- 此外,中国拥有全球最大的电子产品生产基地。根据ZVEI Dia Elektroindustrie统计,2020年中国电子产业产值约24.3亿美元,预计2021年和2022与前一年同期比较%,成为一个庞大的硅胶市场。

- 此外,根据印度品牌股权基金会(IBEF)的数据,到 2025 年,印度对半导体产品的需求预计将达到 4,000 亿美元。根据生产连结奖励计画(PLI) 计划,印度预计将获得 7,600 亿印度卢比的半导体产业投资,北方邦政府也致力于成为该国的半导体中心。

- 2020年日本电子产业总产值约9.96兆日元,与前一年同期比较96.6%。然而,到2021年8月电子业产值增至71,930亿日元,为2020年前8个月的113.4%,增加了该地区硅胶的消费量。

- 此外,亚太地区是最大的汽车製造地,产量占全球近60%。根据OICA统计,2021年前9个月汽车总产量为3,267万辆,较去年同期成长11%。

- 上述因素可能会导致预测期内该地区硅胶市场需求的增加。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 在汽车领域的应用不断增加

- 增加在医疗保健行业的使用

- 输配电需求不断扩大

- 抑制因素

- 政府规章

- 地缘政治影响

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔

- 科技

- 合成橡胶

- 体液

- 最终用户

- 交通设施

- 建筑材料

- 电子产品

- 卫生保健

- 工业製程

- 个人护理和消费品

- 其他最终用户

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率(%)分析

- 主要企业采取的策略

- 公司简介

- BRB International BV(PETRONAS Chemicals Group Berhad)

- CHT Group

- Dow

- DyStar Singapore Pte Ltd

- Elkem ASA

- Evonik Industries AG

- Hoshine Silicon Industry Co. Ltd

- Jiangsu Mingzhu Silicone Rubber Material Co. Ltd

- Kaneka Corporation

- Mitsubishi Chemical Holdings Corporation

- Momentive

- Shin-Etsu Chemical Co. Ltd.

- Wacker Chemie AG

- Wynca Group

- Zhejiang Sucon Silicone Co. Ltd.

第七章市场机会与未来趋势

The Silicone Market size is estimated at 3.01 Million tons in 2024, and is expected to reach 3.87 Million tons by 2029, growing at a CAGR of 5.15% during the forecast period (2024-2029).

The COVID-19 pandemic, the series of nationwide lockdowns, strict social distancing norms, and disruption in the global supply chain network hampered the silicone market. Many factories and industries were shut down globally, affecting the demand for silicone. However, due to increasing awareness of health and hygiene, a further rise in demand from the healthcare, personal care, and consumer products sectors has stimulated the demand for silicone.

Key Highlights

- Over the long term, the major factors driving the silicone market's growth are the increased usage in the healthcare industry, the growing demand from the power transmission and distribution sector, and rising applications in the automotive industry.

- On the flip side, the impact of geopolitical tensions and the rising number of government regulations are likely to hinder the growth of the market.

- Rising potential demand for electroactive polymers (EAP) from various end-users is likely to be an opportunity for the silicone market over the forecast period.

- Asia-Pacific is expected to dominate the market among other regions, with China and India leading the growth in the region.

Silicone Market Trends

Increasing Usage in Industrial Processes

- Industrial anti-foaming agents, industrial coatings, hydraulic fluids and lubricants, RTV (Room-Temperature-Vulcanizing) sealants, molds, and additives for polymers represent the key application of silicones in the industrial processes sector.

- In the oil and gas industry, silicones are widely used in offshore drilling, where managing foam and waste is essential because of space and weight constraints. Silicones enable gas trapped in the drilling mud to get released. Anti-foaming agents reduce the use of energy and chemicals while increasing production rates, as the presence of foam slows down the process and requires time for maintenance operations.

- Silicone also finds its major application in industrial coatings like anti-corrosion, chemical-resistant, and heat-resistant coatings used on bridges and tunnels. They also include coatings on structures used in oil and gas (including refineries), power, and other industries (including mining, waste treatment, and pulp and paper).

- Thus, expanding the global oil and gas industry is anticipated to benefit from the demand for silicone. Various expansion projects underway are expected to drive the growth. For instance, PetroChina, a state-controlled refinery company, is planning to start its 400,000 barrels per day Jieyang refinery in South China's Guangdong province by the first half of 2022. India is a major economy in the Asia-Pacific region in the oil and gas segment. According to India Brand Equity Foundation (IBEF), the oil demand in India is projected to reach 11 million barrels by the year 2045. Furthermore, natural gas consumption in India is expected to grow by 25 billion cu. m. by the year 2024.

- The number of offshore drilling rigs globally has risen at a gradual rate over the years, and this, along with the new contract awards and the increase in production activities from Europe, Africa, and the United States, has led to an increase in the demand for offshore exploration equipment, in turn supporting the growth of the water treatment chemicals including silicone-based anti-foaming agents' market in the recent past.

- Due to all the above factors, the market is expected to witness strong post-recovery growth during the forecast period.

Asia-Pacific Region is Expected to Dominate the Market

- Asia-Pacific is the major consumer of silicone, accounting for the largest share. The growing market in China, India, and Japan has been one of the prominent reasons for the growth of the Asia-Pacific silicone market over the years.

- Semiconductors form a major part of the electronics segment, which involves the usage of silicones as silicone encapsulates, coat, and adhere to and protect semiconductors, PCBs, and ECUs , and others. According to the Semiconductor Industry Association, the semiconductor sales value in China stood at USD 182.93 billion in 2021, compared to USD 150.4 billion in 2020, thereby, increased the demand for studied market.

- With a coastline of over 14,000 km and several large ports, China is one of the world's largest maritime countries. The country has several large shipbuilding conglomerates: China State Shipbuilding Corporation (CSSC), China Shipbuilding Industry Corporation (CSIC), Sinotrans, COSCO shipping, and CMHI are a few major names in the country's shipbuilding industry. The Chinese shipyards build a variety of ships, such as bulk carriers, container ships, oil tankers, naval vessels, passenger vessels, luxury vessels, and others, thereby creating demand for silicone.

- Moreover, China has the world's largest electronics production base. According to ZVEI Dia Elektroindustrie, China's electronics industry was valued at about USD 2,430 million in 2020, and it is forecasted to register 11% and 8% Y-o-Y in 2021 and 2022, thus providing a huge market for silicone.

- Also, acccording to India Brand Equity Foundation (IBEF), India's demand for semiconductor goods will reach USD 400 billion by FY2025. With India estimated to receive INR 76,000 crore as investments in the semiconductor sector under the Production Linked Incentive (PLI) scheme, the Uttar Pradesh government is also aiming to emerge as a semiconductor hub in the country.

- The total production value of the electronics industry in Japan was around JPY 9.96 trillion in 2020, which was 96.6% of the production value compared to the last year. However, the electronics industry production till August 2021 increased to JPY 7.193 trillion, which was 113.4% of the first eight months' value in 2020, thereby increasing the consumption of silicone in the region.

- Furthermore, the Asia-Pacific region is the largest automotive manufacturing hub, registering almost 60% production share of the world. According to OICA, in the first nine months of 2021, the total production of vehicles stood at 32.67 million units, an increase of 11% compared to the same period last year.

- The factors mentioned above may contribute to the increasing demand in the silicone market in the region during the forecast period.

Silicone Industry Overview

The silicone market is consolidated, with most of the share accounted for by key players. Some of the market's major players (not in any particular order) include Wacker Chemie AG, Dow, Shin-Etsu Chemical Co. Ltd, Momentive, and Elkem ASA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Application in Automotive Sector

- 4.1.2 Increasing Usage in Healthcare Industry

- 4.1.3 Growing Demand from Power Transmission and Distribution

- 4.2 Restraints

- 4.2.1 Government Regulation

- 4.2.2 Geopolitical Impact

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Elastomers

- 5.1.2 Fluids

- 5.2 End-user

- 5.2.1 Transportation

- 5.2.2 Construction Materials

- 5.2.3 Electronics

- 5.2.4 Healthcare

- 5.2.5 Industrial Processes

- 5.2.6 Personal Care and Consumer Products

- 5.2.7 Other End-users

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BRB International B.V. (PETRONAS Chemicals Group Berhad)

- 6.4.2 CHT Group

- 6.4.3 Dow

- 6.4.4 DyStar Singapore Pte Ltd

- 6.4.5 Elkem ASA

- 6.4.6 Evonik Industries AG

- 6.4.7 Hoshine Silicon Industry Co. Ltd

- 6.4.8 Jiangsu Mingzhu Silicone Rubber Material Co. Ltd

- 6.4.9 Kaneka Corporation

- 6.4.10 Mitsubishi Chemical Holdings Corporation

- 6.4.11 Momentive

- 6.4.12 Shin-Etsu Chemical Co. Ltd.

- 6.4.13 Wacker Chemie AG

- 6.4.14 Wynca Group

- 6.4.15 Zhejiang Sucon Silicone Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Potential Demand For Electro Active Polymers (EAP)