|

市场调查报告书

商品编码

1444155

三聚氰胺:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Melamine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

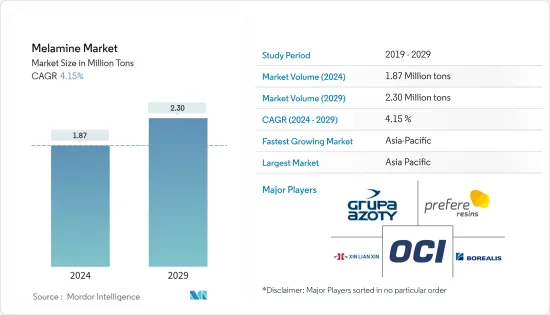

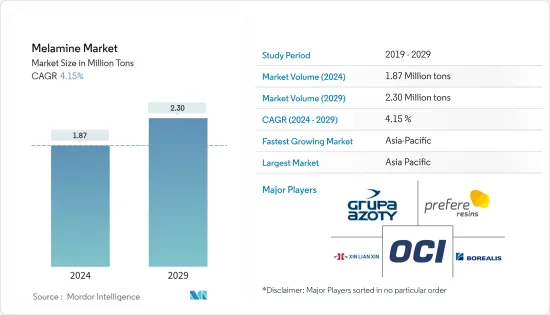

预计2024年三聚氰胺市场规模为187万吨,预计2029年将达230万吨,在预测期间(2024-2029年)复合年增长率为4.15%。

三聚氰胺市场受到 2020 年 COVID-19感染疾病的负面影响。 2021年市场有所改善。建筑和汽车製造活动从封锁中復苏,导致对层压板、油漆和涂料以及木材黏剂等建筑材料的需求增加。建设产业正在迅速復苏,预计未来几年将进一步成长,可能会增加对三聚氰胺的需求。

主要亮点

- 短期内,建设产业对层压板、涂料和木材黏剂的需求不断增长预计将推动市场成长。

- 液化木材、大豆、粉末涂料等替代品的出现,以及消费者对三聚氰胺模塑材料甲醛排放的日益担忧,预计将阻碍市场成长。

- 然而,三聚氰胺基泡沫的成长趋势可能会在未来带来机会。

- 亚太地区主导全球市场,最大的消费来自中国和印度。

三聚氰胺黏剂市场趋势

层压板市场占据主导地位

- 三聚氰胺树脂是一种聚合物,可用作层压板的外层或装饰层,以及用于製造柜檯和桌面、厨柜、地板材料、家具等。

- 三聚氰胺树脂具有硬度、透明度、耐污性、不变色和整体耐用性。在该应用中,用于饱和覆盖层或装饰片材的树脂是透过每摩尔三聚氰胺约2摩尔甲醛反应来製备的。

- 这些板材通常应用于墙壁、柱子、桌面、家具、悬吊天花板等表面装饰计划。

- 据加拿大建筑协会称,建筑业是加拿大最大的雇主之一,为国家的经济成功做出了重大贡献。它是国家经济的支柱。根据加拿大建筑协会的数据,建筑业僱用了超过 140 万人,每年为加拿大经济创造约 1,410 亿美元的收入。此外,该产业占该国内生产总值(GDP)的7.5%。

- 根据美国人口普查资料,2022 年 2 月的建筑支出总额约为 17,044 亿美元,而 2022 年 1 月为 16,955 亿美元。

- 根据美国人口普查局的数据,2022 年 7 月美国住宅建筑业价值为 9,297 亿美元,而 2021 年 7 月为 8,155 亿美元,成长 14%。老化住宅代表了一个不断成长的改造市场,因为旧建筑通常需要添加新设备或维修/更换旧零件。该国住宅上涨也鼓励住宅在住宅装修上投入更多资金。

亚太地区主导市场

- 亚太地区在整体市场占有率占据主导地位。中国、印度和日本建设活动的扩大以及对层压板、木材黏剂、油漆和涂料的需求增加正在增加该地区三聚氰胺的使用。

- 中国占全球涂料市场四分之一以上。根据中国涂料工业协会统计,近年来该产业成长了7%。

- 中国政府推出了一项大规模建设计画,包括为未来十年内2.5亿人搬入新大都市做准备。此类计划将增加对使用三聚氰胺製造油漆的油漆的需求。

- 预计2023年至2026年中国整体建设产业实际成长4.6%。中国国家统计局发布的报告显示,2022年上半年交通运输投资成长6.7%。

- 印度政府与日本政府合作启动了德里-孟买工业走廊项目,旨在在德里-孟买工业走廊地区投资2000亿美元,开发新型工业城市。类似的计划可能会在班加罗尔-清奈走廊等地区启动。

- 根据中国民航局统计,目前全国机场计划已復工80%以上,全国有65个机场计划。其中,27个机场是国家重大机场计划。预计此类计划将增加对三聚氰胺的需求。

三聚氰胺黏剂产业概况

三聚氰胺市场较为分散,前五家企业约占总产能的40%。这些公司包括(排名不分先后)OCI NV、Borealis AG、河南新联新化工集团、Prefere Resins Holding GmbH 和 Grupa Azoty。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 建设产业需求旺盛

- 其他司机

- 抑制因素

- 消费者越来越重视三聚氰胺模塑材料的甲醛排放

- 液化木材、大豆和粉末涂料等替代品的可用性

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

- 原料分析及趋势

- 生产过程

- 进出口趋势

- 价格趋势

- 专利分析

- 监理政策分析

第五章市场区隔(市场规模(数量))

- 目的

- 层压板

- 木材黏剂

- 成型材料

- 油漆和涂料

- 其他用途(阻燃剂和纤维树脂)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率(%)分析

- 主要企业采取的策略

- 公司简介

- BASF SE

- Borealis AG

- Cornerstone Chemical Company

- Grupa Azoty

- Gujarat State Fertilizers &Chemicals Limited(GSFC)

- Prefere Resins Holding GmbH

- Methanol Holdings(Trinidad)Limited(MHTL)

- Mitsui Chemicals Inc.

- Hexion

- Nissan Chemical Corporation

- OCI NV

- Qatar Melamine Company

- Sichuan Chemical Works Group Ltd

- Henan Xinlianxin Chemicals Group Co. Ltd

- Eurochem Group

第七章市场机会与未来趋势

- 三聚氰胺发泡体的成长趋势

The Melamine Market size is estimated at 1.87 Million tons in 2024, and is expected to reach 2.30 Million tons by 2029, growing at a CAGR of 4.15% during the forecast period (2024-2029).

The melamine market was negatively impacted during the COVID-19 pandemic in 2020. The market improved in 2021. With construction and automotive manufacturing activities recovering from the lockdown, the demand for construction materials such as laminates, paints, and coatings, and wood adhesives increased. The construction industry is recovering rapidly and is estimated to grow further in the coming years, which may boost the demand for melamine.

Key Highlights

- Over the short term, the rising demand for laminates, coatings, and wood adhesives from the construction industry is expected to drive the market's growth.

- The availability of substitutes like liquefied wood, soy, and powder coatings and increasing consumer concerns about formaldehyde emissions from melamine-based molding compounds are expected to hinder the market's growth.

- However, the increasing trend of melamine-based foams is likely to act as an opportunity in the future.

- Asia-Pacific dominates the market across the world, with the largest consumption from China and India.

Melamine-based Adhesives Market Trends

Laminates Segment to Dominate the Market

- Melamine resins are the polymers of choice used in the outer or decorative layer of laminates and in manufacturing counters and tabletops, kitchen cabinets, flooring, furniture, etc.

- Melamine resins impart a hardness, transparency, stain resistance, freedom from discoloration, and overall durability. For this application, the resin used to saturate the overlay or decorative sheet is prepared by reacting approximately two moles of formaldehyde per mole of melamine.

- These sheets are commonly applied to the surface decoration projects, such as walls, columns, tabletops, furniture, and suspended ceilings.

- According to the Canadian Construction Association, the construction sector is one of Canada's largest employers and a major contributor to the country's economic success. It is the backbone of the country's economy. As per the Canadian Construction Association, the construction sector employs more than 1.4 million people and generates about USD 141 billion for the Canadian economy annually. Also, the industry accounts for 7.5% of the country's Gross Domestic Product (GDP).

- According to the US Census data, the total construction spending in February 2022 was around USD 1,704.4 billion compared to USD 1,695.5 billion in January 2022.

- As per the United States Census Bureau, the residential construction industry in the United States was valued at USD 929.7 billion in July 2022, as compared to USD 815.5 billion in July 2021, registering a growth of 14%. The aging houses signal a growing remodeling market, as old structures normally need to add new amenities or repair/replace old components. Rising home prices in the country have also encouraged homeowners to spend more on home improvements.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region dominates the overall market share. With growing construction activities and the increasing demand for laminates, wood adhesives, and paints and coatings in China, India, and Japan, the usage of melamine is increasing in the region.

- China accounts for more than one-fourth of the global coatings market. According to the China National Coatings Industry Association, the industry registered a 7% growth in recent years.

- The Chinese government rolled out massive construction plans, including making provisions for the movement of 250 million people to its new megacities over the next 10 years. Such plans will increase the demand for paints where melamine is used to prepare paints.

- The overall Chinese construction industry is expected to increase by 4.6% in real terms in 2023-2026. According to the report published by the National Bureau of Statistics of China, transportation investment increased by 6.7% in the first half of 2022.

- The Indian government launched the Delhi-Mumbai Industrial Corridor program in collaboration with the Japanese government, which aims at developing new industrial cities with an investment of 200 billion USD in the Delhi-Mumbai Industrial Corridor region. Similar programs may be launched in regions such as the Bangalore Chennai Corridor etc.

- According to the Civil Aviation Administration of China, the government has resumed construction work on more than 80% of total airport projects, representing 65 airport projects across the country. Out of these, 27 airports are national major airport projects. Such projects are expected to increase the demand for melamine.

Melamine-based Adhesives Industry Overview

The melamine market is fragmented, and the top five players account for around 40% of the total production capacity. These companies include (not in any particular order) OCI NV, Borealis AG, Henan Xinlianxin Chemicals Group Co. Ltd, Prefere Resins Holding GmbH, and Grupa Azoty.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Strong Demand from the Construction Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Increasing Consumer Concerns About Formaldehyde Emission from Melamine-based Molding Compounds

- 4.2.2 Availability of Substitutes, like Liquefied Wood, Soy, and Powder Coatings

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Feedstock Analysis and Trends

- 4.6 Production Process

- 4.7 Import-export Trends

- 4.8 Price Trends

- 4.9 Patent Analysis

- 4.10 Regulatory Policy Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Laminates

- 5.1.2 Wood Adhesives

- 5.1.3 Molding Compounds

- 5.1.4 Paints and Coatings

- 5.1.5 Other Applications (Flame Retardants and Textile Resins)

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Russia

- 5.2.3.6 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Borealis AG

- 6.4.3 Cornerstone Chemical Company

- 6.4.4 Grupa Azoty

- 6.4.5 Gujarat State Fertilizers & Chemicals Limited (GSFC)

- 6.4.6 Prefere Resins Holding GmbH

- 6.4.7 Methanol Holdings (Trinidad) Limited (MHTL)

- 6.4.8 Mitsui Chemicals Inc.

- 6.4.9 Hexion

- 6.4.10 Nissan Chemical Corporation

- 6.4.11 OCI NV

- 6.4.12 Qatar Melamine Company

- 6.4.13 Sichuan Chemical Works Group Ltd

- 6.4.14 Henan Xinlianxin Chemicals Group Co. Ltd

- 6.4.15 Eurochem Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Trend of Melamine-based Foams