|

市场调查报告书

商品编码

1444168

植物生长灯:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Grow Lights - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

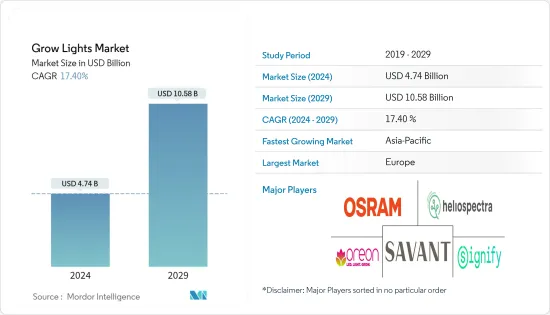

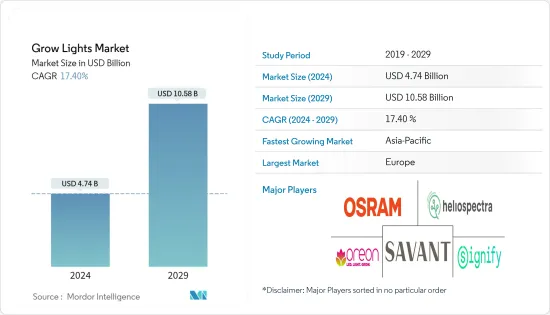

植物生长灯(Grow Lights)市场规模预计到2024年为47.4亿美元,预计到2029年将达到105.8亿美元,预测期间(2024-2029年)将以17.40%的复合年增长率增长。

需要永续发展的植物工厂数量不断增加,都市农业的兴起是当前植物生长灯市场的驱动因素。新鲜、营养丰富的蔬菜、美丽的插花和芬芳的香草一年四季都受到人们的欢迎。随着电子商务的普及,只需按一下按钮即可轻鬆购物。

主要亮点

- 透过分析不同类型光源的单独市场规模来评估植物生长灯市场。调查范围包括各种安装类型的高强度放电 (HID) 灯、发光二极体和萤光等光源,包括室内农业、垂直农业和商业温室等各种应用的新建和维修安装。 会出现。在多个地区。

- 植物生长灯是充当人造光源来刺激植物生长的灯泡。植物生长灯透过发射可见频谱中的电磁辐射来模拟阳光进行光合作用来实现这一点。

- 室内农场支持增加单位面积的作物产量,并透过使用多层盆栽种子来推动市场。室内农业是指在室内大规模和小规模种植植物和作物。因此,室内农业涉及水耕和鱼菜共生等过程,利用人工照明来获得适当的光照水平和养分。然而,建造室内农场的高初始投资和品种限制预计将阻碍市场成长。

- 频谱对植物生长有不同的影响,取决于环境条件、作物类型等。叶绿素负责光合作用,将光能转换为化学能,吸收红色和蓝色频谱中的大部分光进行光合作用。在 PAR 范围的峰值处可以看到蓝光和红光。

- COVID-19感染疾病导致世界各地实施封锁,导致业务运营和生产停止,并在全球范围内产生了重大影响。科技业是受影响最严重的行业之一,必须应对 COVID-19感染疾病所带来的挑战,并重新考虑其在疫情后世界的策略和营运计划。

植物生长灯市场趋势

各国大麻合法化预计将推动市场

- 大麻种植的合法化也增加了对垂直农场和温室的需求,进一步增加了对基于 LED 的植物生长灯的需求。在阳光充足的介质中种植大麻需要考虑多种因素。

- 例如,HPS 灯发出的热量可能会损坏产品。因此,LED在低得多的温度下工作可以解决散发的多余热量。

- 透过垂直农业种植大麻的公司在生产力方面取得了显着的进展。例如,MedMen Cannabis Vertical Farm(美国)安装了欧司朗旗下园艺照明公司 Fluence Bioengineering(美国)提供的 LED 系统。这减少了生产时间,降低了每磅成品的成本,减少了能源消耗,并减少了暖气、通风和空调 (HVAC) 负载。

- 根据《大麻商业时报》报道,美国约 46% 的大麻种植者已在西方註册了其种植地点/设施。 15% 的受访者表示位于东北部,只有 9% 的受访者表示在加拿大有大麻种植业务。

- 此外,美国联邦法律禁止种植、销售和使用大麻。然而,包括加州和美国首都华盛顿特区在内的 18 个州在过去十年中通过重大法律改革已将所有娱乐性大麻合法化。 2022 年 10 月,乔·拜登总统赦免了数千名因持有大麻而被定罪的美国人。这些合法化和政府支持将进一步推动研究市场。

欧洲预计将经历强劲成长

- 预计欧洲地区将在预测期内推动这些照明解决方案的需求。过去十年来,该地区一直使用植物生长灯系统来满足多种受控环境农业 (CEA) 需求,包括温室、垂直农业和室内农业。

- 用于园艺目的的 LED植物生长灯的使用也在增加,特别是在大都会圈。例如,疫情期间,着名高科技公司欧司朗针对园艺领域推出了新一代LED照明。该公司还称 OslonSquare Hyper Red 是最高效的园艺照明 LED,目前已在市场上销售,波长为 660 nm。

- 此外,市场也见证了供应商的多项基础设施计划。预计这将增加预测期内对植物生长灯的需求。例如,拜耳在亚利桑那州马拉纳开设了一个新的自动化温室设施。这座价值 1 亿美元的设施主要作为玉米的全球产品设计中心,玉米是该设施内种植的唯一作物。儘管先进温室设施取得了许多技术进步,但照明仍然是室内种植系统创新的核心方面。

- 此外,Signify还推出了最新的GreenPowerLED顶部照明紧凑型生产模组。此模组专为垂直增长系统而设计,可用作新解决方案或现有安装。该公司还表示,其新型 GreenPowerLED 模组将主要用于气候控制的封闭式栽培设施,例如城市垂直农场和多层种植系统,以种植生菜和其他绿叶和嫩蔬菜等作物。针对育种和研究中心等进行优化。水果、香草和幼苗。

轻工业成长概况

随着智慧和连网型繫统的进步,植物生长灯市场正在见证 Signify 和 Everlight 等领先公司的创新。随着大规模部署植物生长灯的投资增加,公司正在寻求合併、合作或获得技术能力。主要市场参与者包括 OSRAM Licht AG、Heliospectra AB、Savant Systems Inc.、Signify 和 Lemnis Oreon BV。

2022 年 11 月,Signify 宣布扩大在印度的智慧 Wi-Fi 照明领域,推出两款独特的可携式智慧灯 - 飞利浦 Smart LED Squire 和飞利浦 Smart LED Hero。 Philips Smart LED Squire 和飞利浦 Smart LED Hero 采用圆形设计和即插即用操作,使它们易于在您的家中使用和运输。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业价值链分析

- 评估 COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 越来越多采用室内农业

- 政府加强对引进现代农业方法的支持

- 各国大麻合法化

- 市场约束

- 设定和维护成本高

- 不同作物对光照频谱的要求不同

第六章市场区隔

- 按光源分类

- 高强度放电 (HID) 灯

- 发光二极体

- 萤光

- 其他光源

- 按安装类型

- 新安装

- 改造安装

- 按使用类型

- 室内农业

- 垂直农业

- 商业温室

- 其他使用类型

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争形势

- 公司简介

- Signify Holding

- Savant Systems Inc.

- Heliospectra AB

- OSRAM Licht AG

- Lemnis Oreon BV

- Iwasaki Electric Co. Ltd

- Ennostar Inc.

- EVERLIGHT Electronics CO. LTD

- California LightWorks

- Valoya

- Crecer Lighting

- AB Lighting

第八章投资分析

第9章市场的未来

The Grow Lights Market size is estimated at USD 4.74 billion in 2024, and is expected to reach USD 10.58 billion by 2029, growing at a CAGR of 17.40% during the forecast period (2024-2029).

An increasing number of plant factories need sustainable development, and a rise in urban agriculture are current catalysts for the grow lights market. Fresh and nutritious vegetables, beautiful floral arrangements, fragrant herbs, etc., are in demand all year round. It has become easier to buy at the touch of a button with the pervasiveness of e-commerce.

Key Highlights

- The market for grow lights was evaluated by analyzing separate market sizes for different types of light sources; that includes study's scope includes light sources such as high-intensity discharge (HID) lights, light-emitting diodes, and fluorescent lights for various installation types, including new and retrofit installations across different applications that include indoor farming, vertical farming, and commercial greenhouse in multiple regions.

- A grow light is an electric lamp that functions as an artificial light source to stimulate plant growth. Grow lights execute this via emitting electromagnetic radiation in the visible light spectrum, which simulates sunlight for photosynthesis.

- Indoor farms support growing the total crop yield per unit area by using stacked layers of potted seeds, propelling the market. Indoor farming is growing plants or crops indoors on a large and small scale. Hence, indoor farming executes processes such as hydroponics and aquaponics and utilizes artificial lighting for adequate light levels and nutrients. However, the high initial investment in building indoor farms and limitations on the growing variety of crops is anticipated to hinder the market growth.

- The light spectrum affects plant growth differently, depending on environmental conditions, crop species, etc. Chlorophyll, responsible for photosynthesis to convert light energy to chemical energy, absorbs most light in red and blue spectrums for photosynthesis. Both blue and red light is seen in the PAR range's peaks.

- The COVID-19 pandemic led to lockdowns worldwide with a pause in business operations and production, resulting in an enormous impact globally. As one of the most affected fields, the technology industry had to tackle the challenges of the COVID-19 outbreak and reconsider its strategies and operating plans for the post-pandemic world.

Grow Light Market Trends

Legalization of Cannabis in Different Countries is Expected to Drive the Market

- The legalization of cannabis cultivation has also resulted in an increased requirement for vertical farms and greenhouses, further boosting the demand for LED-based grow lights. Cannabis grown under a sunless medium needs to have various factors considered.

- For instance, the heat emitted from HPS lights can damage the product. Hence, LEDs, which run at much lower temperatures, can solve the excessive heat emitted.

- Companies growing cannabis through vertical farming have observed significant results in terms of productivity. For instance, MedMen Cannabis Vertical Farm (US) deployed LED systems offered by Fluence Bioengineering (US), a horticulture lighting company owned by OSRAM, which resulted in reduced production time, lower cost per pound of the finished product, decreased energy consumption, and reduced heating, ventilation, and air conditioning (HVAC) load.

- According to Cannabis Business Times, around 46% of cannabis cultivators in the United States registered their growing sites/facilities in the West. 15% reported locations in the Northeast, and only 9% reported cannabis growing operations in Canada.

- Further, Federal United States law prohibits the cultivation, sale, and use of cannabis. But 18 states, including California and the national capital Washington DC, have all legalized cannabis for recreational use in a big-bang legislative shift over the past decade. In October 2022, President Joe Biden pardoned thousands of Americans convicted of cannabis possession. These legalization and government support further drive the studied market.

Europe is Expected to Witness Significant Growth

- The European region is expected to drive the demand for these lighting solutions during the forecast period. The region has used grow light systems for the past decade in multiple controlled environment agriculture (CEA) needs, such as greenhouses, vertical farming, and indoor farming.

- The usage of LED grow lights for horticulture purposes is also increasing, especially in metropolitan areas. For instance, during the pandemic, Osram GmbH, a prominent high-tech company, unveiled its new generation of LED lighting for the horticulture sector. The OslonSquare Hyper Red, which the company also describes as the most efficient LED for horticulture lighting, is currently available in the market and offers a wavelength of 660 nm.

- Moreover, the market is also witnessing multiple infrastructural schemes by vendors. This is expected to increase the demand for grow lights during the forecast period. For instance, Bayer opened a new, automated greenhouse facility in Marana, Arizona. The USD 100 million worth of facility will primarily serve as a global product design center for corn, and the only crop is grown in that facility. The number of technological advancements in an advanced greenhouse facility is numerous, but one facet that remains a core area of innovation for indoor growing systems is lighting.

- Furthermore, Signify launched its latest GreenPowerLED top lighting compact production module. The module is designed for a vertical growth system and can be used as a new solution or in existing installations. The company also established that the new GreenPowerLED module is optimized for closed, climate-controlled cultivation facilities, such as urban vertical farms, and propagation and research centers that primarily use multilayer growth systems to grow crops, such as lettuce and other leafy greens, soft fruits, herbs, and young plants.

Grow Light Industry Overview

With smart and connected systems advancements, the grow lights market is witnessing technological innovations by major players like Signify and Everlight. With more investments toward large-scale deployment of grow lights, companies seek to merge, partner, or acquire technical capabilities. Some of the key market players are OSRAM Licht AG, Heliospectra AB, Savant Systems Inc., Signify, and Lemnis Oreon BV.

In November 2022, Signify announced the expansion of its Smart Wi-Fi lighting field in India with the launch of two unique portable smart lamps, Philips Smart LED Squire and Philips Smart LED Hero. The Philips Smart LED Squire and Philips Smart LED Hero have a round-shaped design and plug-and-play operation, which makes them easy to use and carry anywhere in the home.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in the Adoption of Indoor Farming Practices

- 5.1.2 Growing Government Support for the Adoption of Modern Agricultural Methods

- 5.1.3 Legalization of Cannabis in Different Countries

- 5.2 Market Restraint

- 5.2.1 High Set-up and Maintenance Costs

- 5.2.2 Varying RequirementsiIn Lighting Spectrums for Different Crops

6 MARKET SEGMENTATION

- 6.1 By Light Source

- 6.1.1 High-intensity Discharge (HID) Lights

- 6.1.2 Light Emitting Diodes

- 6.1.3 Fluorescent Lights

- 6.1.4 Other Light Sources

- 6.2 By Installation Type

- 6.2.1 New Installations

- 6.2.2 Retrofit Installations

- 6.3 By Application Type

- 6.3.1 Indoor Farming

- 6.3.2 Vertical Farming

- 6.3.3 Commercial Greenhouse

- 6.3.4 Other Application Types

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Signify Holding

- 7.1.2 Savant Systems Inc.

- 7.1.3 Heliospectra AB

- 7.1.4 OSRAM Licht AG

- 7.1.5 Lemnis Oreon BV

- 7.1.6 Iwasaki Electric Co. Ltd

- 7.1.7 Ennostar Inc.

- 7.1.8 EVERLIGHT Electronics CO. LTD

- 7.1.9 California LightWorks

- 7.1.10 Valoya

- 7.1.11 Crecer Lighting

- 7.1.12 AB Lighting