|

市场调查报告书

商品编码

1444187

电感式接近接近感测器:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Inductive Proximity Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

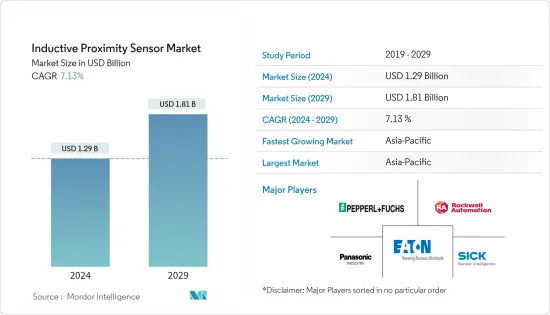

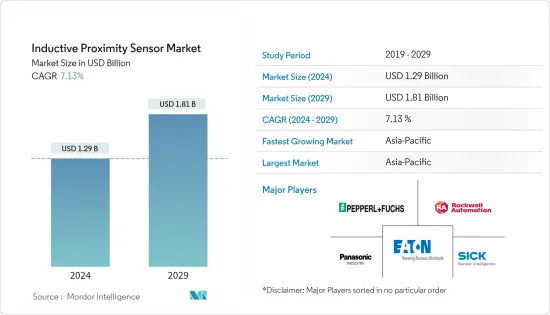

电感式接近接近感测器市场规模预计到 2024 年为 12.9 亿美元,预计到 2029 年将达到 18.1 亿美元,在预测期内(2024-2029 年)增加 71.3 亿美元,复合年增长率为 %。

电感式接近感测器是非接触式设备,使用线圈和振盪器来建立射频场。物体的存在可以改变这个场,并且感测器可以侦测到这种变化。电感式接近感测器可以在不接触物体的情况下检测物体,因此不会对物体造成损坏或磨损。

主要亮点

- 接近感测器常用于许多自动化应用。它们用于感测物体,不需要与目标或被感测物体进行物理接触。因此,这些被称为非接触式感测器。常见的接近感测器类型包括光电感测器、电容式感测器和电感式感测器。

- 电感式接近感测器用于金属物体的非接触式检测。这些感测器的运行原理基于线圈和振盪器,它们在感测表面周围产生电磁场。接近感测器也用于消费性设备中。在智慧型手机中,接近感测器会侦测使用者是否将行动电话靠近脸部。

- 采用 ASIC 技术的 SICK 感测器提高了准确性和可靠性。从具有单一工作距离、双工作距离或三工作距离的矩形和圆柱形标准感测器到用于爆炸性和有毒气体或恶劣环境的专用感测器,公司不断为客户提供满足您要求的正确解决方案。该公司的电感式接近感测器是为涉及特定产业自动化的任何任务提供智慧且可靠的客製化实施途径。

- 对于传统的电感式接近感测器,感测器对感测物体的灵敏度随着与阻尼元件的距离的增加而增加,并且安装周围的金属会影响开关距离。

- 为了解决这个问题,倍加福推出了主动屏蔽技术,无论安装条件如何,都可以实现长开关距离。该公司首次将其整合到 VariKont 系列中。提供较长开关距离的版本,齐平安装为 30 mm,非齐平安装为 50 mm。

- 电感式接近感测器用于多种工业和製造应用,例如安全和库存控制应用。例如,自动生产线用于定位、物体侦测、计数和检查。接近感测器也用于某些工业输送系统中的组件检测。

- 由于需要承受腐蚀性清洗剂、恶劣温度和高压清洗环境,食品和饮料行业被迫采用接近感测器。在食品和饮料行业,清洗过程中会使用食品製造和刺激性化学物质等应用,其中标准感测器会过早腐蚀和失效。电感式接近感测器具有坚固的设计,具有出色的耐高温和高压清洗製程能力。

电感式接近感测器市场趋势

工业部门占主要市场占有率

- 工业应用越来越依赖追踪、监控、测量和通讯。现代工业在很大程度上依赖各种感测器设备向控制系统提供的资讯和资料,理想情况下成本只是一小部分,以实现有效的智慧製造环境。所有工业应用都需要坚固性、高 IP 防护等级、高 EMC 和电压抗扰度、宽温度稳定性以及经济高效的感测器实施。

- 电感式接近感测器主要用于传统开关可能出现问题或无法使用的位置,例如可能存在大量水或污垢的应用。典型范例包括食品和饮料环境中的先进数控工具机和输送机线,以及工业形势中的多种应用。

- 电感式接近感测器技术的使用已在大型工业中实践多年,但技术的改进导致使用电感式接近感测器技术来简化业务、增强工业自动化并改变一些公司的製造形势..,该技术已被各级企业广泛采用。另一个成长要素是支援工业自动化的供应商数量不断增加以及工业物联网 (IIoT) 需求的成长。

- 许多市售 WFI 感测器还可在相同感测范围内检测多种金属。这些感测器通常被称为 Factor 1 或 F1 型号,因为它们没有针对铝等有色金属材料的感应距离缩减係数。此外,侦测距离缩减係数为 1.0(无侦测距离缩减)。

亚太地区将经历显着成长

- 由于中国和印度等新兴国家,与其他地区相比,亚太地区预计将显着成长。此外,Omron Corporation、Panasonic Corporation和奥托尼克斯公司等知名供应商的总部也设在该地区。

- 汽车行业的製造商正在努力满足电动车 (EV) 的需求,并透过生产更轻的车辆和青睐铝而非钢来降低燃料消耗。随着铝和钢混合生产线的日益普及,对具有相同检测距离和适当长检测范围的接近感测器的需求也在增加。

- 汽车和汽车零件行业的生产挂钩奖励(PLI)计划提案了财政奖励,以鼓励先进汽车技术(AAT)产品的国内製造,并吸引对汽车製造价值链的投资。该计划的主要目标包括克服成本障碍、创造规模经济以及在 AAT 产品领域建立强大的供应链。

- 亚太地区是近年来油气产业产能唯一成长的地区。此外,增加对石油和天然气行业的投资将创造机会。例如,据 IBEF 称,到 2022 年,印度石油和天然气探勘和生产活动的投资预计将达到 2,500 万美元。此外,政府加大政策力度,满足能源需求并启动新计划也将有所帮助。我们将积极地将其推向市场。

电感式接近感测器产业概述

电感式接近感测器市场本质上竞争非常激烈。随着大大小小的参与者的存在,市场更加集中。市场主要参与者包括松下公司、Sick AG Pepperl+Fuchs、罗克韦尔自动化公司、伊顿公司、欧姆龙公司、台达电子公司等。

- 2022 年 8 月:电感式接近感测器通常用于车辆(即移动设备),用于旋转臂、抓握臂、自卸车体的位置监控和终端位置监控等任务。罗克韦尔自动化公司与 Bravo Motor 公司合作,专注于生产电池、车辆和能源储存系统。透过新的合作伙伴关係,罗克韦尔自动化将基于循环经济概念,帮助为巴西市场的电池和电动车生产提供尖端解决方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

- COVID-19 对感应式接近接近感测器市场的影响

第五章市场动态

- 市场驱动因素

- 工业自动化的成长

- 对非接触式感测技术的需求不断增长

- 市场挑战

- 感测功能限制

第六章市场区隔

- 按最终用户使用情况

- 工业的

- 车

- 航太和国防

- 包装

- 其他最终用户用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争形势

- 公司简介

- Pepperl+Fuchs

- Rockwell Automation Inc.

- Panasonic Industry Co. Ltd

- Eaton Corporation PLC

- Sick AG

- Omron Corporation

- Delta Electronics Inc.

- Autonics Corporation

- Datalogic SpA

- Riko Opto-electronics Technology Co. Ltd

- Fargo Controls Inc.

- Hans Turck GmbH and Co. Kg

- Keyence Corporation

- Honeywell International

- Balluff GmbH

- KA Schmersal GmbH &Co.

- EUCHNER USA Inc.

- Baumer Holding AG

第八章投资分析

第9章 市场的未来

The Inductive Proximity Sensor Market size is estimated at USD 1.29 billion in 2024, and is expected to reach USD 1.81 billion by 2029, growing at a CAGR of 7.13% during the forecast period (2024-2029).

Inductive proximity sensors are non-contact devices that set up a radio frequency field with a coil and an oscillator. The presence of an object can alter this field, and the sensor can detect this alteration. The inductive proximity sensors can detect an object without touching it and therefore do not cause damage or abrasion to the object.

Key Highlights

- Proximity sensors are generally used in many automation applications. They are used to sense objects and do not require physical contact with the target or object being sensed. Thus, they are referred to as non-contact sensors. The common proximity sensor types include photoelectric, capacitive, and inductive sensors.

- Inductive proximity sensors are utilized for the non-contact detection of metallic objects. The operating principle of these sensors is based on the coil and oscillator, which creates an electromagnetic field in the near surroundings of the sensing surface. Proximity sensors are also found in consumer devices. In smartphones, proximity sensors detect if a user is holding the mobile near their face.

- With ASIC technology, SICK sensors provide enhanced precision and reliability. The company can offer the right solution to meet the customer's requirements every time, from cuboid standard sensors or cylindrical, with single, double, or triple operating distances, to special sensors for use in explosive and toxic atmospheres or harsh environments. The company's inductive proximity sensors are the intelligent, reliable route to implementing industry-specific and customized to any task involving automation.

- In the case of conventional inductive proximity sensors, if the distance to the damping element increases, the sensor becomes more sensitive to the detection object, and the metal surrounding the installation affects the switching distance.

- To tackle this issue, Pepperl+Fuchs has introduced active shielding technology, which enables high switching distances regardless of the installation conditions. The company has integrated it into the VariKont series for the first time. They are available in versions with high switching distances of 30 mm for flush mounting and 50 mm for non-flush mounting.

- The inductive proximity sensors are used in several industrial and manufacturing applications for safety and inventory management applications. An automated production line, for example, is used for positioning, object detection, counting, and inspection. The proximity sensors are also used for part detection in several industrial conveyor systems.

- The need to withstand harsh cleaning agents, severe temperatures, and high-pressure wash-down environments is compelling the food and beverage industry to adopt proximity sensors. In the food and beverage sector, applications like food production and harsh chemicals are used during cleaning, where a standard sensor will corrode and fail prematurely. The inductive proximity sensor exhibits a robust design with superior resistance to high temperature and high-pressure cleaning processes.

Inductive Proximity Sensors Market Trends

Industrial Segment to Hold Significant Market Share

- Industrial applications are becoming dependent on tracking, monitoring, measuring, and communication. Modern industries depend heavily on the information and data that various sensory devices supply to the control system, ideally in fractions of a second, to be an effective smart manufacturing environment. All industrial applications require robustness, high IP protection classes, advanced EMC and voltage immunity, and wide-range temperature stability parallel to cost-efficient sensor implementation.

- Inductive proximity sensors are majorly used where a more traditional switch might prove problematic or impossible to use, like in an application where lots of water and dirt might be present. Typical examples would be an advanced CNC machine or a conveyor line in a food and beverage environment and multiple uses in the industrial landscape.

- Although large industries practiced the use of inductive proximity sensor technology over a few years, improved technology has led to its widespread adoption by all-tier companies to streamline operations, enhance industrial automation, and change the manufacturing landscape of several companies. Another growth factor is the increase in the number of vendors that enable industrial automation and growth in the Industrial Internet of Things (IIoT) demand.

- Many WFI sensors on the market also provide multi-metal detection at the same sensing range. These sensors are commonly referred to as Factor 1 or F1 models since they have no sensing range reduction factor for non-ferrous materials like aluminum. Moreover, their sensing range reduction factor would be equal to 1.0 (no reduction in sensing distance).

Asia-Pacific to Witness Significant Growth

- Asia-Pacific is anticipated to witness a considerable growth rate compared to other regions because of developing countries like China and India. Additionally, prominent vendors, such as Omron Corporation, Panasonic Corporation, and Autonics Corporation, are headquartered in the region.

- Manufacturers in the automotive industry strive to meet the demand for electric vehicles (EVs) and low fuel consumption by building lighter-weight vehicles and favoring aluminum over iron. As the prevalence of mixed production lines containing both aluminum and iron increases, the need for the same sensing distance proximity sensors with suitably long sensing ranges is also rising.

- The Production Linked Incentive (PLI) Scheme for the automobile and auto component industry proposes financial incentives for boosting domestic manufacturing of advanced automotive technology (AAT) products and gaining investments in the automotive manufacturing value chain. The prime objectives of the schemes include overcoming cost disabilities, creating economies of scale, and building a robust supply chain in areas of AAT products.

- Asia-Pacific is the only region to witness capacity growth in the oil and gas industry in recent years. Moreover, growing investment in the oil and gas industry would create opportunities. For instance, according to IBEF, the investment in oil and gas exploration and production activities in India is anticipated to reach USD 25 million by 2022. Additionally, the growing government policies and initiatives toward the fulfillment of energy demands and initiation of new projects will contribute positively to the market.

Inductive Proximity Sensors Industry Overview

The inductive proximity sensors market is very competitive in nature. The market is concentrated due to the presence of various small and large players. Some of the significant players in the market are Panasonic Corporation, Sick AG Pepperl+Fuchs, Rockwell Automation Inc., Eaton Corporation PLC, Omron Corporation, Delta Electronics Inc., and many more.

- August 2022: Inductive proximity sensors are often used in vehicles, i.e., in mobile equipment, for tasks such as position monitoring or end position monitoring of swivel arms, gripping arms, and dump bodies. Rockwell Automation Inc. partnered with Bravo Motor Company, focusing on producing batteries, vehicles, and energy-storage systems. With the new alliance, Rockwell Automation will contribute to providing cutting-edge solutions for manufacturing batteries and electric vehicles in the Brazilian market based on the circular economy concept.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Inductive Proximity Sensor Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Industrial Automation

- 5.1.2 Increase in the Demand for Non-contact Sensing Technology

- 5.2 Market Challenges

- 5.2.1 Limitations in Sensing Capabilities

6 MARKET SEGMENTATION

- 6.1 By End-user Application

- 6.1.1 Industrial

- 6.1.2 Automotive

- 6.1.3 Aerospace and Defense

- 6.1.4 Packaging

- 6.1.5 Other End-user Applications

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Rest of Asia Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Pepperl+Fuchs

- 7.1.2 Rockwell Automation Inc.

- 7.1.3 Panasonic Industry Co. Ltd

- 7.1.4 Eaton Corporation PLC

- 7.1.5 Sick AG

- 7.1.6 Omron Corporation

- 7.1.7 Delta Electronics Inc.

- 7.1.8 Autonics Corporation

- 7.1.9 Datalogic SpA

- 7.1.10 Riko Opto-electronics Technology Co. Ltd

- 7.1.11 Fargo Controls Inc.

- 7.1.12 Hans Turck GmbH and Co. Kg

- 7.1.13 Keyence Corporation

- 7.1.14 Honeywell International

- 7.1.15 Balluff GmbH

- 7.1.16 K.A. Schmersal GmbH & Co.

- 7.1.17 EUCHNER USA Inc.

- 7.1.18 Baumer Holding AG