|

市场调查报告书

商品编码

1444189

潜舰系统:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Subsea Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

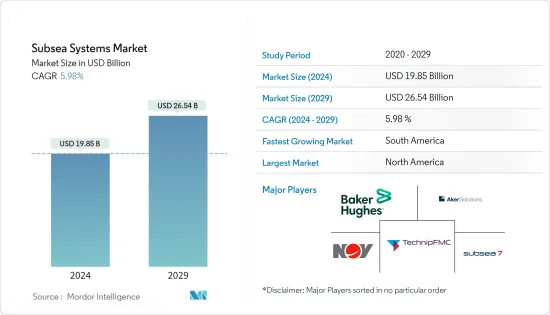

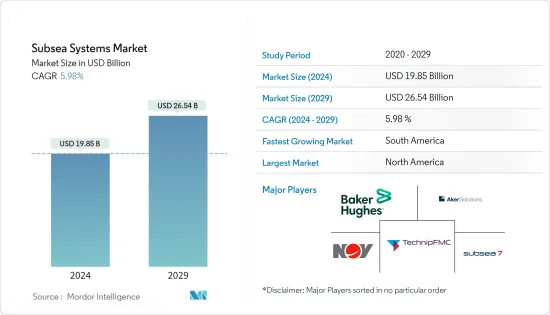

海底系统市场规模预计2024年为198.5亿美元,预计到2029年将达到265.4亿美元,在预测期内(2024-2029年)复合年增长率为5.98%增长。

市场受到 COVID-19 爆发、油价暴跌以及正在进行的计划延误的负面影响。目前市场已恢復至疫情前的水准。

主要亮点

- 经济衰退期后原油价格上涨以及海上石油和天然气行业投资增加等因素预计将成为海上石油和天然气设备和服务市场以及海底系统市场的主要驱动力。预测期.期间.此外,海上计划可行性的提高以及深海和超深海蕴藏量活动的活性化可能会提振市场。

- 然而,海底设备的高安装成本以及与海上钻井和生产相关的风险预计将阻碍海底系统市场的成长。

- 巴西、埃及、美国、伊朗和卡达等国家深海活动的增加可能为潜水艇系统市场的参与者创造一些机会。

- 南美洲预计将成为海底系统成长最快的市场。由于巴西最近在深水和超深水领域的活动以及几个即将开展的计划,大部分需求来自巴西。

海底系统市场趋势

海底生产领域主导市场

- 近年来,随着成熟的陆上油田数量不断增加,海上探勘和生产(E&P)活动也有所增加。例如,在原油产量最重要的盆地二迭纪盆地,老油井的产量开始下降,这些地区需要有更多的发现空间。

- 根据贝克休斯统计,截至2023年3月,亚太地区有90个海上钻井钻机在运作中。随着探勘的增加,随着海洋中更多发现,钻井钻机的数量预计将大幅增加,因此对海底生产系统的需求也将增加。

- 例如,2022年2月,EniSpA宣布在阿布达比进行第一探勘井。该公司还透露,其第一口探勘井 XF-002 已取得积极成果,该井目前正在阿布达比(阿联酋)海上 2 号区块 115 英尺深的水域钻探。

- 随着南美、北美和欧洲地区深水和超深水活动的增加,预计到2025年深水产量将达到760万桶/日,到2040年将达到900万桶/日。对海底生产系统的需求预计将增加并进一步推动市场。

- 因此,石油和天然气行业正在深入该地区勘探石油和天然气,以满足不断增长的需求。因此,海底生产系统的份额预计将成为海底系统领域中最大的份额并推动市场发展。

南美洲主导市场成长

- 随着能源需求的快速成长,各国、各大企业和投资者都将目光转向深海。这是因为深海可以保证数十年的石油和天然气供应。然而,这需要采用能够生产埋藏在海底数千公尺深处的石油和天然气蕴藏量的技术。这增加了对海底系统提高回收率和降低整体成本的需求。

- 2021年巴西原油和冷凝油油产量平均为299万桶/日,较2019年平均增加超过15万桶/日。根据EIA的数据,巴西在深层石油和超级原油开发方面处于世界领先地位。深海计划。近年来,石油和天然气产业自由化等政府政策的变化吸引了外国投资。

- 来自世界各地的许多外国公司都将巴西视为未来十年海上碳氢化合物活动的潜在投资市场。例如,2022年10月,ONGC Videsh Ltd (OVL)计划在巴西海上油气田投资10亿美元。在预测期内,此类计划可能会对海底系统市场产生正面影响。

- 同样,阿根廷国营能源公司YPF预计其第一个海上计划的日产量将达到20万桶,随着生产的恢復,对该国海底系统的需求可能会增加。

- 因此,即将推出的深水和超深水计划可能会在预测期内推动南美洲地区海底系统市场的成长。

海底系统产业概况

潜舰系统市场适度整合。市场主要企业包括(排名不分先后)Subsea 7 SA、TechnipFMC PLC、Akastor ASA、National-Oilwell Varco Inc.、Baker Hughes Co.等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查范围

- 市场定义

- 调查先决条件

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2028 年之前的市场规模与需求预测(十亿美元)

- 2019年至2028年离岸资本投资历史及以水深分類的需求预测(单位:十亿)

- 2019年至2028年各地区离岸资本投资历史及需求预测(单位:十亿)

- 最新趋势和发展

- 政府政策法规

- 市场动态

- 促进因素

- 提高海上石油和天然气计划的可行性

- 美洲、亚太、中东和非洲地区深水油气探勘和生产活动不断增加。

- 抑制因素

- 禁止多地区海洋探勘生产活动

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 类型

- 海底生产系统

- 海底处理系统

- 作品

- 海底脐带立管和出油管 (SURF)

- 树

- 井口

- 歧管

- 其他配置

- 地区

- 北美洲

- 加拿大

- 墨西哥

- 美国

- 其他北美地区

- 欧洲

- 挪威

- 英国

- 法国

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 伊朗

- 伊拉克

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 併购、合资、合作与协议

- 主要企业采取的策略

- 公司简介

- Akastor ASA

- Subsea 7 SA

- TechnipFMC PLC

- National-Oilwell Varco Inc.

- Baker Hughes Co.

- Schlumberger Ltd

- Halliburton Co.

- Oceaneering International

- Kerui Group Co. Ltd

- Dril-Quip Inc.

第七章市场机会与未来趋势

The Subsea Systems Market size is estimated at USD 19.85 billion in 2024, and is expected to reach USD 26.54 billion by 2029, growing at a CAGR of 5.98% during the forecast period (2024-2029).

The market was negatively impacted by the outbreak of COVID-19, the crash in the price of crude oil, and delays in ongoing projects. Currently, the market has rebounded to pre-pandemic levels.

Key Highlights

- Factors such as the increase in oil prices after the downturn period and growing investments in the offshore oil and gas sector are expected to be major drivers for the offshore oil and gas equipment and services market and, in turn, the subsea systems market during the forecast period. Moreover, the improving viability of offshore projects and rising activity in deepwater and ultra-deepwater reserves are likely to boost the market.

- However, the high installation cost of subsea equipment and risks associated with offshore drilling and production are expected to hinder the growth of the subsea systems market.

- Increasing deepwater activities in countries like Brazil, Egypt, the United States, Iran, and Qatar is likely to create several opportunities for the players in the subsea systems market.

- South America is expected to be the fastest-growing market for subsea systems. The majority of the demand comes from Brazil due to its recent activities in deepwater and ultra-deepwater and several upcoming projects.

Subsea Systems Market Trends

Subsea Production Segment to Dominate the Market

- With the rising number of maturing onshore oilfields in recent years, there has been growth in offshore exploration and production (E&P) activities. For instance, in the Permian Basin, the most critical basin in terms of crude oil production, the production from old wells has started to decline, and there needs to be more scope for discovery in these areas.

- According to Baker Hughes, as of March 2023, Asia-Pacific has 90 active offshore rigs. With the increasing exploration, rig counts are expected to grow significantly as more offshore discoveries are made, which, in turn, will boost the demand for the subsea production system.

- For instance, in February 2022, EniSpA announced its first exploration well in Abu Dhabi. The company also revealed that it had recorded positive results from its first exploration well, XF-002, currently under drilling in offshore Block 2 Abu Dhabi (UAE) at 115 feet of water depth.

- With the increasing deepwater and ultra-deepwater activities in the South American, North American, and European regions, the deepwater fields' production is expected to reach 7.6 million barrels per day by 2025 and 9 million barrels per day by 2040. Hence, the demand for subsea production systems is expected to increase and further drive the market.

- Therefore, the oil and gas industry is shifting toward deeper regions to search for oil and gas to meet the increasing demand. Hence, the subsea production systems share is expected to be the largest among subsea system segments and drive the market.

South America to Dominate the Market Growth

- As the energy demand increases rapidly, various countries, major companies, and investors are shifting their interest toward deep water, as it holds the potential for a guaranteed supply of oil and gas for a few decades. However, this requires employing technology to produce oil and gas reserves buried thousands of meters deep in the ocean floor. This has increased the need for subsea systems to improve recovery and reduce overall costs.

- In 2021, Brazil produced an average of 2.99 million barrels per day of crude oil and condensate, representing an average increase of more than 150,000 barrels per day compared with 2019. According to the EIA, Brazil is a global leader in developing deep and ultra-deepwater projects. In recent years, changes in government policies, such as liberalization in the oil and gas sector, have attracted foreign investment.

- Many foreign players worldwide are scouting Brazil for a potential investment market in offshore hydrocarbon activities during the next decade. For instance, in October 2022, ONGC Videsh Ltd (OVL) planned to invest USD 1 billion in a Brazilian offshore hydrocarbon block. Such projects are likely to impact the subsea systems market during the forecast period positively.

- Similarly, Argentina's state-backed energy company YPF expects its first offshore project to produce up to 200,000 barrels per day, which would drive the demand for subsea systems in the country as production resumes.

- Hence, the upcoming projects in deep-water and ultra-deep-water are likely to drive the growth of the subsea systems market during the forecast period in the South American region.

Subsea Systems Industry Overview

The subsea systems market is moderately consolidated. Some of the key players in the market (in no particular order) include Subsea 7 SA, TechnipFMC PLC, Akastor ASA, National-Oilwell Varco Inc., and Baker Hughes Co., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Historic and Demand Forecast of Offshore CAPEX in billions, by Water Depth, 2019-2028

- 4.4 Historic and Demand Forecast of Offshore CAPEX in billions, by Region, 2019-2028

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 Improved Viability Of Offshore Oil And Gas Projects

- 4.7.1.2 Rising Deep Water Oil & Gas Exploration And Production Activities In The Americas, Asia-pacific, And Middle-east & Africa Region

- 4.7.2 Restraints

- 4.7.2.1 Ban On Offshore Exploration And Production Activities In Multiple Regions

- 4.7.1 Drivers

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitute Products and Services

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Subsea Production Systems

- 5.1.2 Subsea Processing Systems

- 5.2 Component

- 5.2.1 Subsea Umbical Riser and Flowlines (SURF)

- 5.2.2 Trees

- 5.2.3 Wellhead

- 5.2.4 Manifolds

- 5.2.5 Other Components

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 Canada

- 5.3.1.2 Mexico

- 5.3.1.3 United States of America

- 5.3.1.4 Rest of the North America

- 5.3.2 Europe

- 5.3.2.1 Norway

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Rest of the Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of the South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Iran

- 5.3.5.4 Iraq

- 5.3.5.5 Rest of the Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Akastor ASA

- 6.3.2 Subsea 7 SA

- 6.3.3 TechnipFMC PLC

- 6.3.4 National-Oilwell Varco Inc.

- 6.3.5 Baker Hughes Co.

- 6.3.6 Schlumberger Ltd

- 6.3.7 Halliburton Co.

- 6.3.8 Oceaneering International

- 6.3.9 Kerui Group Co. Ltd

- 6.3.10 Dril-Quip Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technology Advancements In Subsea Production And Processing Systems