|

市场调查报告书

商品编码

1444212

电容式压力感测器 -市场占有率分析、产业趋势与统计、成长预测(2024-2029)Capacitive Pressure Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

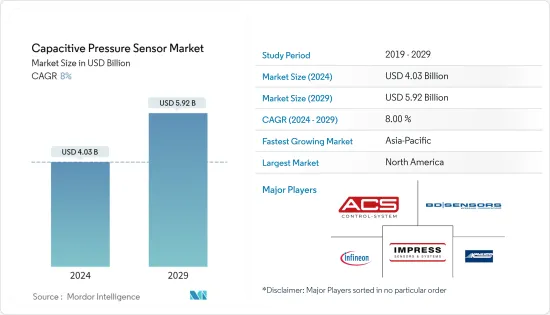

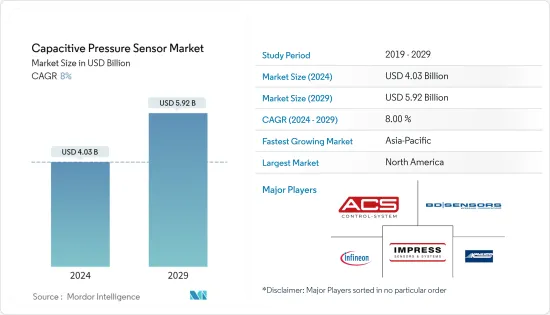

电容式压力感测器市场规模预计到 2024 年为 40.3 亿美元,预计到 2029 年将达到 59.2 亿美元,在预测期内(2024-2029 年)复合年增长率为 8%。

主要亮点

- 带电容单元的压力感测器旨在为现有设备提供独特且准确的结果。陶瓷材料的独特优势使感测器能够提供长期稳定性和可靠性以及耐高压性。

- 与电阻感测技术相比,电容式压力感测器因其卓越的灵敏度、准确性和无磨损问题而变得越来越受欢迎。这些感测器提供了许多出色的功能,并且在许多应用中越来越多地取代电阻感测器。此外,感测器技术的进步正在导緻小型感测器的开发和过渡,为行业领导者创造了许多机会。

- 电容式压力感测器简单而坚固的机械结构可实现多种工业应用。电容式压力感测器使用陶瓷,这使得它们能够承受恶劣的工业条件并提供更快的反应时间。

- 随着 MEMS 技术的进步,电容式压力感测器变得越来越小,并可用于更多产业。电容式压力感测器的小型化降低了製造成本。因此,电容式压力感测器因其廉价、高效和广泛的应用而不断增长。

- 此外,去年汽车尤其是电动车的销量大幅成长。预计未来将进一步成长,也将影响电容式压力感测器市场。

- 此外,由于世界各国政府实施的封锁和其他规则和法规,COVID-19 对市场产生了重大影响。然而,在疫情后的情况下,由于汽车、医疗保健、石油和天然气等行业的快速增长,市场出现了显着增长。

- 不过,进入门槛并不是很高,现在很多公司都提供电容式压力感知器。这导致了非常激烈的价格竞争、产品之间难以区分以及市场成长放缓。

电容式压力感测器的市场趋势

预计汽车产业市场将显着成长

- 设计和製造汽车用压力感测器时最重要的考虑因素之一是它们在各种温度、振动、介质、衝击和电磁条件下都能正常工作。换句话说,感测器必须足够耐用才能执行其功能。

- 随着自动驾驶汽车和电动车的出现,汽车产业的快速发展强调了应用设备的小型化,这主要推动了市场的成长。

- 目前,各大汽车製造商都在提高电动车领域的产能。大众和西门子 2022 年 6 月的声明就是一个例子。他们宣布打算进行 4.5 亿美元的重大投资,这将使 Electrify America 的估值达到 24.5 亿美元。这项共同努力的目标是到 2026 年将美国和加拿大的 Electrify America 充电站数量增加一倍。

- 据EV-Volumes.com称,预计2022年上半年全球电动车新纯电动车和插电式混合动力车销量将超过430万辆。由于汽车的巨大需求及其快速发展,电容式压力感测器市场预计将扩大。

- 此外,根据 IEA 的数据,预计 2022 年将售出 1,020 万辆插电式电动车 (PEV)。此外,2022年欧洲五个主要市场的电动车销量大幅成长。此外,美国全电动汽车和插电式电动车销量将于 2022 年达到顶峰。例如,根据EERE和美国能源局阿贡国家统计局的数据,美国实验性插电式电动车(PEV)的销售到2022年将增加至918,500辆,而2021年为607,600辆。电动车的成长可能会增加全球对电容式压力感测器的需求。

北美地区预计将主导市场

- 由于整个大陆稳定的产业结构,北美预计将主导电容式压力感测器市场。该地区正在进行越来越多的研发 (R&D),使其成为创新和市场启动的领导者。

- 电容式感测器的医疗应用在过去一年中显示出显着增长。人工呼吸器、人工呼吸器、生命征象监测仪和气流应用是主要的医疗最终用户应用。许多科技公司正在进行新的研究并将血压监测产品推向市场。例如,科技巨擘苹果已经申请了血压监测袖带的专利。

- 该地区也引领航太和国防工业。美国是国防支出最高的国家。根据SIPRI统计,2022年全球军事开支实际成长3.7%,达到2.24兆美元的新高。 2013 年至 2022 年,全球支出大幅成长 19.0%,并且自 2015 年以来每年都持续成长。此外,美国宇航局还宣布了未来计划的计划,重点是扩大和探索太阳系。航太和工业的崛起可能会进一步增加该地区对电容式压力感测器的需求。

- 此外,该地区组织对各行业的大规模投资正在推动电容式压力感测器及其应用市场的发展。

电容式压力感测器产业概况

电容式压力感测器市场高度分散,参与者众多。随着电容式压力感测器的产品成本下降,我们看到提供该产品的公司数量增加。此外,对产品进一步差异化的需求导致供应商采取有竞争力的定价策略。该市场有一些主要参与者,例如 ACS-Control-System GmbH、BD Sensors GmbH、Infineon Technologies 和 TE Connectivity。

- 2023 年 6 月:英飞凌科技股份公司推出两款新型 XENSIV 气压 (BAP) 感测器:KP464 和 KP466。这些感测器专为汽车应用而设计,具有多种优势。 KP464 非常适合引擎控制管理,而 KP466 BAP 感知器专门用于增强座椅舒适度功能。 KP464 和 KP466 感测器是高性能、高精度、紧凑型数位绝对压力感测器,采用电容测量原理。

- 2023 年 5 月:Dwyer Instruments 发布其最新的工业差压变送器。 Dwyer 系列 IDPT 工业差压变送器采用耐用、防水外壳设计,可承受恶劣的工业环境。具有出色的精度和稳定性,非常适合在各种工业应用中长期使用。此压力变送器具有一个范围从 0-0.25" WC 到 0-1" WC 的压电感测器。客户可以选择 0.25% 或 0.25% 的精确度选项。 0.5% 满量程。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究成果

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 技术简介

- 市场驱动因素

- 强调小型化以及将先进技术整合到产品中

- 汽车和工业领域的应用越来越多

- 市场限制因素

- 产品缺乏差异化

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 按最终用户

- 车

- 医疗保健

- 化学和石化

- 航太

- 发电

- 其他最终用户

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争形势

- 公司简介

- ACS-Control-System GmbH

- BD Sensors GmbH

- Impress Sensors &Systems Ltd

- Infineon Technologies Inc.

- Kavlico

- Metallux SA

- Murata Manufacturing Co. Ltd

- TE Connectivity Ltd

- Pewatron AG

- Bourns Ltd

- Sensata Technologies Holding NV

- VEGA Controls Ltd

第七章 投资分析

第八章市场机会及未来趋势

The Capacitive Pressure Sensor Market size is estimated at USD 4.03 billion in 2024, and is expected to reach USD 5.92 billion by 2029, growing at a CAGR of 8% during the forecast period (2024-2029).

Key Highlights

- Pressure sensors with a capacitive cell have been designed to offer unique and accurate results to the existing equipment. The distinct advantages of ceramic material allow sensors to provide long-term stability and reliability with high resistance to pressure.

- Capacitive pressure sensors have become increasingly popular compared to resistive sensing technology due to their impressive sensitivity, accuracy, and lack of wear and tear issues. Due to their numerous standout features, these sensors increasingly replace resistive sensors in many applications. Additionally, advancements in sensor technology have resulted in the creation and shift towards smaller sensors, presenting numerous opportunities for industry leaders.

- The capacitive pressure sensor's simple and robust mechanical structure enables several industrial applications. Capacitive pressure sensors can sustain harsh industrial conditions due to the use of ceramics and provide a quicker response rate.

- As MEMS technology has improved, capacitive pressure sensors have become smaller, which has made them useful in more industries. The miniaturization of capacitive pressure sensors has reduced their production costs. Hence, the capacitive pressure sensor market is growing with its cheap, efficient, and wide array of applications.

- Furthermore, sales of automobiles, particularly electric vehicles, have increased significantly in the last year. That is expected to grow more in the future and thus will impact the market for capacitive pressure sensors as well.

- Additionally, the COVID-19 impacted the market very heavily due to lockdowns and other rules and regulations imposed by governments around the globe. However, in the post pandemic scenario, the market had grown a lot due to the fast growth of the industries that used it, such as the automotive, medical, oil and gas, and other industries.

- However, there is not as much of a barrier to entry, many companies now offer capacitive pressure sensors. This makes prices very competitive and makes it hard to differentiate one product from another, which is slowing market growth.

Capacitive Pressure Sensor Market Trends

Automotive Segment is Expected to Observe Significant Market Growth

- One of the most important things when designing and making pressure sensors for use in cars is that they work well in a wide range of temperatures, vibrations, media, shocks, and electromagnetic conditions. In other words, the sensor must be durable enough to do its job.

- The rapid evolution of the automotive sector, with the advent of autonomous vehicles or electric vehicles, emphasizes the miniaturization of equipment for applications, primarily driving the market's growth.

- Major automotive manufacturers are currently increasing their manufacturing capacity in the electric vehicle sector. An example is the announcement by Volkswagen and Siemens made in June 2022. They stated their intention to invest a significant amount of USD 450 million, which would value Electrify America at USD 2.45 billion. This collaborative effort aims to double the number of Electrify America charging stations across the US and Canada by 2026.

- The global sales of electric vehicles will cross 4.3 million new BEVs and PHEVs during the first half of 2022, as stated by EV-Volumes.com. The huge demand for automotive vehicles and their rapid developments are expected to augment the capacitive pressure sensor market.

- Additionally, According to IEA, In 2022, an estimated 10.2 million units of plug-in electric light vehicles (PEVs) were sold. Additionally, electric vehicle sales in Europe's five major markets witnessed a significant increase in 2022. Also, United States sales of all-electric and plug-in electric vehicles peaked in 2022. For instance, according to EERE and the U.S. Department of Energy's Argonne National Laboratory, plug-in electric vehicle (PEV) sales reached 918,500 units in the United States in 2022, compared to 607,600 units in 2021. Such rise in electric vehicles is likely to boost the demand for capacitive pressure sensors gloablly.

North America Region is Expected to Dominate the Market

- North America is expected to dominate the capacitive pressure sensor market due to the stable industrial structure across the continent. More and more research and development (R&D) is being done in the area, making it the leader in innovation and getting it to market.

- Medical applications of capacitive sensors have shown significant growth over the past year. Respirators, ventilators, vital sign monitors, and airflow applications are major medical end-user applications. Many tech companies are conducting new research and launching their products on the market for monitoring blood pressure. For instance, technology giant Apple Inc. filed a patent application for a blood pressure monitoring cuff.

- The region also leads the aerospace and defense industries. The United States is the country with the highest defense spending. According to SIPRI, World military expenditure increased by 3.7% in real terms in 2022, reaching a new peak of USD 2,240 billion. Global spending has experienced a significant growth of 19.0% over the span of 2013-22 and has consistently risen each year since 2015. In addition, NASA has announced its plans for future projects, focusing on expanding and exploring the solar system. Such rise in aerospace and industries are likely to bring more demand for capacitive pressure sensors in the region.

- Additionally, These massive investments across various industries by organizations in the region are driving the market for capacitive pressure sensors and their applications.

Capacitive Pressure Sensor Industry Overview

The Capacitive Pressure Sensor Market is highly fragemented with numerous players. With the declining product cost of capacitive pressure sensors, a rise in the number of players offering the product is observed. Additionally, the need for more differentiation in the product offerings made the vendors adopt competitive pricing strategies. The market has several leading players, such as ACS-Control-System GmbH, BD Sensors GmbH, Infineon Technologies, TE Connectivity, etc.

- June 2023: Infineon Technologies AG introduced its two new XENSIV barometric air pressure (BAP) sensors: the KP464 and KP466. These sensors are specifically designed for automotive applications and offer a range of benefits. The KP464 is ideal for engine control management, while the KP466 BAP sensor is specifically intended for enhancing seat comfort functions. The KP464 and KP466 sensors are high-performance, high-precision, and compact digital absolute pressure sensors that utilize the capacitive measurement principle.

- May 2023: Dwyer Instruments released its latest industrial differential pressure transmitter. The Series IDPT industrial differential pressure transmitter from Dwyer is designed with durable and water-resistant housing, ensuring it can withstand challenging industrial environments. It offers exceptional accuracy and stability, making it ideal for long-term use in various industrial applications. This pressure transmitter features a capacitive pressure sensor for ranges of 0 to 0.25 in w.c. to 0 to 1 in w.c. and a piezo sensor for ranges of 0 to 2.5 in w.c. to 0 to 10 in w.c. Customers can choose between accuracy options of 0.25% or 0.5% full-scale.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Technology Snapshot

- 4.3 Market Drivers

- 4.3.1 Emphasis on Miniaturization and Integration of Advanced Technology in Products

- 4.3.2 Growing Number of Applications in the Automotive and Industrial Sectors

- 4.4 Market Restraints

- 4.4.1 Lack of Product Differentiation

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By End User

- 5.1.1 Automotive

- 5.1.2 Medical

- 5.1.3 Chemical and Petrochemical

- 5.1.4 Aerospace

- 5.1.5 Power Generation

- 5.1.6 Other End Users

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ACS-Control-System GmbH

- 6.1.2 BD Sensors GmbH

- 6.1.3 Impress Sensors & Systems Ltd

- 6.1.4 Infineon Technologies Inc.

- 6.1.5 Kavlico

- 6.1.6 Metallux SA

- 6.1.7 Murata Manufacturing Co. Ltd

- 6.1.8 TE Connectivity Ltd

- 6.1.9 Pewatron AG

- 6.1.10 Bourns Ltd

- 6.1.11 Sensata Technologies Holding NV

- 6.1.12 VEGA Controls Ltd