|

市场调查报告书

商品编码

1444254

工业包装 -市场占有率分析、行业趋势和统计、成长预测(2024-2029)Industrial Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

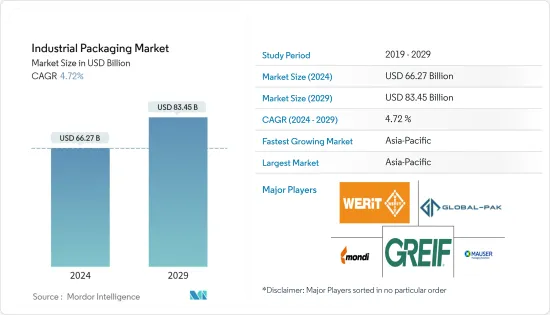

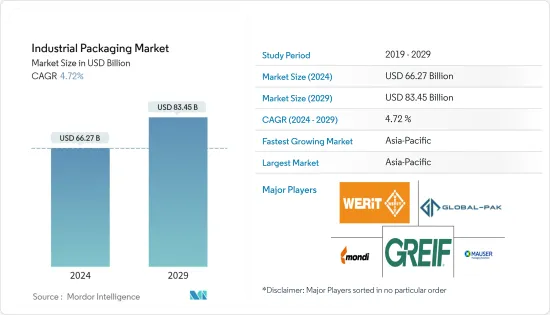

2024年工业包装市场规模预计为662.7亿美元,预计到2029年将达到834.5亿美元,在预测期内(2024-2029年)增长4.72%,以复合年增长率增长。

主要亮点

- 资源和产品向不同地区运输量的增加是导致大宗工业包装材料成长的主要因素之一。工业包装市场高度依赖全球进出口活动。重工业对桶和桶等产品的需求量很大,而物料输送容器和中型散货箱(IBC)等其他产品则在物流和短途货物运输中得到应用。

- 硬质塑胶中型散装容器用于食品和饮料、药品、化学品、油漆、油墨和润滑剂。北美刚性中型散货箱协会 (RIBCA) 促进製造或组装刚性中型散货箱的个人、企业和企业的利益。

- 在德国海德堡举行的客户活动上,工业包装公司 Mauser 最近推出了其新的 skINliner 阻隔技术。毛瑟皮内衬阻隔技术将多层塑胶薄膜技术的先进阻隔性能(例如对碳氢化合物和氧气的阻隔性能)与硬包装的物流和生命週期优势相结合。新的模组化包装设计有利于再利用和回收。

- 公司正在推出新的创新产品,以满足永续和可回收工业包装不断变化的需求。例如,2022年5月,Berry World的英国垃圾袋业务推出了一系列由再生塑胶製成的新高强度垃圾袋。

- 货柜使用的增加正在推动市场发展。透过这种方式,公司共同努力提供新的创新产品来满足客户的需求。 2022 年 4 月,Novvia 集团收购了纺织品、塑胶、玻璃和金属包装产品经销商 Southern Container LLC。透过此次收购,Novia 加强了其 Inmark 业务和市场地位。

- 在过去的几年里,人们对塑胶使用负面影响的认识显着提高。政府当局、协会和非政府组织正在进行许多公共宣传活动和措施来传播这种意识。因此,近年来塑胶包装的消费量大幅下降。

- 随着食品和饮料需求的不断增加,农业面临许多挑战。化肥、作物和农作物运输等材料的供应链挑战只是其中之一。例如,全球化肥市场继续面临 COVID-19 对物流和其他经济影响的挑战。然而,这些影响在不同市场上非常不平衡,而且并非全是负面的。

工业包装市场趋势

食品和饮料有望推动市场

- 食品和饮料行业最常用的工业包装材料是桶子、IBC、瓦楞纸箱、托盘和袋子。但是,包装必须经过食品级认证。例如,IBC吨袋(采用不銹钢罐或塑胶笼吨袋设计)经过DOT/UN认证,确保包装不会污染食品。

- 桶广泛应用于酒精产业。啤酒是全世界运输量最大的酒类。鼓由钢、塑胶或织物製成。然而,美国运输部认为钢桶是最安全的。预计这将导致更多的钢桶饮料储存和运输。

- 精酿啤酒产量的增加预计将增加市场对钢桶的需求。根据酿酒商协会预测,到 2022 年,精酿啤酒将占美国啤酒总产量的 13.2%,与 2021 年的 13.1% 持平。预计这将推动对钢桶的需求。

- 这种快速流行导致了环保包装选择的激增。据 Food Dive 称,全球 67% 的消费者认为他们购买的产品采用可回收包装很重要,54% 的消费者表示这是他们在购买时考虑的一个因素。这些情绪将持续下去,高达 83% 的年轻买家表示,他们愿意为永续包装的产品支付更高的价格。

- 纸板主要用于包装加工食品、生鲜食品、水果蔬菜、饮料等。对许多食品来说,纸板包装正成为塑胶包装的可行替代品。例如,纸质包装更容易由回收材料製成,并且可以回收或堆肥。根据酿酒商协会的最新统计,2022年美国精酿啤酒厂数量将达到9,552家,高于2017年的6,661家。

预计亚太地区将占据主要市场占有率

- 在过去的几十年里,作为亚太地区主要市场参与者之一的中国工业部门经历了令人瞩目的成长。该行业的成长使该国成为各种商品的主要製造商和出口国。根据中国国家统计局数据,2022年工业占国内生产毛额的比重为39.9%。

- 此外,工业桶在包装行业的采用正在增加。这家包装材料製造商专注于回收、减薄、包装尺寸优化和安全。工业滚筒为许多企业和企业提供了这些能力,以有效地维持其永续性努力。据工业钢桶研究所 (ISDI) 称,钢桶每年在全球安全运输约 5,000 万吨材料。

- 考虑到不断增长的需求,市场上的几家供应商专注于提供广泛的工业包装产品组合。例如,Plastene 提供各种用于干燥和液体(散装)货物的运输和储存容器(巨型袋/集装袋)。巨型袋越来越多地取代工业客户的塑胶、纸张和纸板包装解决方案。

- 亚太地区的其他地区包括韩国、新加坡和香港。韩国最大的工业是电子、汽车、通讯、造船、化工和钢铁。 2022年,韩国出口额以金额为准前五位的是电子积体电路、汽车、精製石油、电话、智慧型手机和汽车零件。这些主要出口项目占韩国出口总额的三分之一以上(38.8%)(资料来源:国际贸易中心)。主要满足工业包装的需求。

- 人们越来越注重实现物流成本效率,以及危险品和非危险品运输量的增加,使钢桶和中型散货箱成为焦点。进口化学品对于韩国主要出口产品的生产至关重要。韩国化学工业发展迅速,生产规模居世界第五位。儘管如此,对生产高品质、复杂化学品和相关物质的需求为美国化学品製造商提供了利润丰厚的机会。这对出口化学品的桶子等工业包装材料产生了巨大的需求。

工业包装产业概况

工业包装市场仍然高度分散,拥有许多国际、区域和本地供应商。本地工业包装产品製造商以低于国际供应商的价格提供独特和创新的解决方案,从而导致激烈的价格竞争。

- 2022 年 5 月:Berry World 的英国垃圾袋业务推出一系列由再生塑胶製成的新高强度垃圾袋。这些可回收袋将在该公司位于德比郡剪切机的製造地生产,并将在英国销售。

- 2022 年 5 月:Smurfit Kappa Group PLC 计划投资 3,500 万欧元(3,767 万美元)在摩洛哥拉巴特建造一座包装工厂。该公司将涉足製造应用于工业、製药、日常消费品(日常消费品)、农业、陶瓷和汽车等各个领域的产品。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 永续和可回收包装材料的出现

- 扩大货柜的使用

- 市场限制因素

- 由于环境问题日益严重,监管标准会动态变化

第六章市场区隔

- 产品

- 中型散货箱(IBC)

- 包包

- 鼓

- 桶

- 其他产品

- 最终用户产业

- 车

- 食品与饮品

- 化学品和药品

- 石油和天然气、石化产品

- 建筑与建造

- 其他最终用户产业

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 世界其他地区

- 北美洲

第七章 竞争形势

- 公司简介

- WERIT Kunststoffwerke W. Schneider GmbH &Co.

- Mondi PLC

- Greif Inc.

- Mauser Packaging Solutions

- Global-Pak, Inc.

- Berry Global Inc.

- Smurfit Kappa Group PLC

- Tank Holding Corp.

- International Paper Company

- Veritiv Corporation

- Nefab Group

- SCHUTZ GmbH &Co. KGaA

- DS Smith PLC

- Amcor PLC

- Packaging Corporation of America

- Pact Group Holdings Ltd

- Visy

- Brambles Ltd(CHEP)

- Snyder Industries LLC

- Myers Containers

第八章投资分析

第九章市场机会与未来趋势

简介目录

Product Code: 54939

The Industrial Packaging Market size is estimated at USD 66.27 billion in 2024, and is expected to reach USD 83.45 billion by 2029, growing at a CAGR of 4.72% during the forecast period (2024-2029).

Key Highlights

- The increasing volume of resources and products being transported across various regions is one of the primary factors that led to the growth of bulk industrial packaging. The industrial packaging market highly depends on global import and export activities. While products such as drums and pails experience huge demand from heavy manufacturing industries, other products, such as material handling containers and intermediate bulk containers (IBCs), include applications in logistics and the short-distance transportation of goods.

- Rigid plastic IBCs are used in food and beverage, pharmaceutical, chemical, paints, inks, and lubricants. North America's Rigid Intermediate Bulk Container Association (RIBCA) fosters the interests of persons, firms, and corporations that manufacture or assemble rigid intermediate bulk containers.

- During a customer event in Heidelberg, Germany, Mauser, an industrial packaging company, recently presented its new skINliner barrier technology. The Mauser skINliner barrier technology combines the advanced barrier performance of multilayer plastic film technology (e.g., against hydrocarbons and/or oxygen) with the logistical and lifecycle benefits of rigid packaging. The new modular packaging design promotes reuse and recyclability.

- Companies are launching new and innovative products in line with the changing demand for sustainable and recyclable industrial packaging. For instance, in May 2022, Berry Global's UK refuse sack business launched a new range of high-strength refuse sacks made from recycled plastics.

- The increase in the utilization of shipping containers drives the market. Thus, companies are collaborating to offer new and innovative products according to the customers' requirements. In April 2022, Novvia Group acquired Southern Container LLC, a fiber, plastic, glass, and metal packaging product distributor. Through this acquisition, Novvia strengthened its Inmark business and its market position.

- Over the last few years, awareness of the harmful effects of plastic usage significantly increased. Many public campaigns and initiatives are taken by governmental authorities, associations, and NGOs to spread this awareness. Thus, plastic packaging consumption significantly declined in the last few years.

- With the increasing demand for food and beverages, the agriculture industry faced many challenges. Supply chain challenges in materials, such as fertilizers, equipment, and transportation of crops, were only one of them. For instance, the global fertilizer market continued to witness challenges to logistical and other economic impacts of COVID-19. However, these impacts are highly uneven across markets, and not all are negative.

Industrial Packaging Market Trends

Food and Beverages Expected to Drive the Market

- The most used industrial packaging for food and beverage industries are drums, IBCs, corrugated boxes, pallets, and sacks. However, the packaging needs to be certified as food-grade. For instance, IBC totes (designed with stainless steel tanks or poly-caged totes) are certified by the DOT/UN and ensure that the packaging does contaminate the food products.

- Drums are widely used in the alcohol industry. Beer is the most-transported alcohol globally. Drums are made of steel, plastics, or fiber. However, steel drums are regarded as the safest by the US Department of Transportation. It is expected to drive further storing and transporting beverages in steel drums.

- The rising production volume of craft beer is expected to increase the demand for steel drums in the market. According to the Brewers Association, the share of craft beer in the total production volume of beer in the United States in 2022 was 13.2%, at par with 13.1% in 2021. It is expected to drive the demand for steel drums.

- This rapid wave of popular interest drove the surge in ecological packaging options. According to Food Dive, 67% of customers globally believe it is critical that the items they buy come in recyclable packaging, with 54% indicating it is a factor they consider when purchasing. These sentiments aren't going away, with a whopping 83% of younger buyers prepared to spend more for products that are packed sustainably.

- Corrugated packaging is mainly used for packaging processed foods, fresh food, produce, and beverages. For many food goods, corrugated packaging is becoming a viable alternative to plastic packaging. Paper packaging, for example, may be created more simply from recycled materials and recycled or composted. According to the most recent Brewers Association figures, there were 9,552 craft brewers in the United States in 2022, up from 6,661 in 2017.

Asia-Pacific Expected to Hold a Significant Market Share

- Over the last few decades, the industrial sector in China, one of the major market shareholders in the Asia-Pacific, witnessed astonishing growth. The sector's growth placed the country among the leading manufacturers and exporters of various goods. According to the National Bureau of Statistics of China, in 2022, the industrial sector contributed 39.9% of the country's GDP.

- Moreover, the adoption of industrial drums in the packaging industry is increasing. The packaging manufacturer is focusing on recycling, downgauging, optimizing pack size, and safety. Industrial drums offer many corporations and companies these features to effectively maintain sustainability initiatives. According to the Industrial Steel Drum Institute (ISDI), steel drums provide safe transport for approximately 50 million metric tons of material worldwide annually.

- Considering the growing demand, several vendors operating in the market are focusing on offering a broad portfolio of industrial packaging products. For instance, Plastene offers a variety of transport and storage containers (Jumbo bags/FIBCs) for both dry and liquid (bulk) goods. Jumbo bags increasingly substitute plastic, paper, and cardboard packaging solutions for industrial customers.

- The rest of Asia-Pacific comprises South Korea, Singapore, and Hong Kong. South Korea's largest industries are electronics, automobiles, telecommunications, shipbuilding, chemicals, and steel. South Korea's 5 biggest export products by value in 2022 were electronic integrated circuits, cars, refined petroleum oils, phone devices, smartphones, and automobile parts or accessories. Those major exports accounted for well over a third (38.8%) of South Korea's overall exports (source: International Trade Center). It majorly catered to the demand for industrial packaging.

- Increasing focus on achieving cost-effectiveness in logistics and growing transportation of hazardous and non-hazardous materials brought steel drums and IBCs to the center stage. Imported chemicals are essential in producing some of Korea's top exports. Korea's chemistry industry is rapidly developing, and the country is ranked on the world's 5th production scale. Still, the demands for high-quality, sophisticated chemical products and associated substances production present a lucrative opportunity for United States chemical manufacturers. It led to major demand for industrial packaging, such as drums, to export chemicals.

Industrial Packaging Industry Overview

The Industrial Packaging market remains highly fragmented, with numerous international, regional, and local vendors. Local manufacturers of industrial packaging products cater to unique, innovative solutions at a lower price than international vendors, resulting in an intense price battle.

- May 2022: Berry Global's UK refuse sack business launched a new range of high-strength refuse sacks manufactured from recycled plastics. The recyclable sacks would be manufactured at the company's Heanor, Derbyshire manufacturing site and offered in the United Kingdom.

- May 2022: Smurfit Kappa Group PLC planned to invest EUR 35 million (USD 37.67 million) to build a packaging plant in Rabat, Morocco. It would be involved in manufacturing its products for applications in various sectors, including industrial, pharmaceuticals, fast-moving consumer goods (FMCG), agriculture, ceramics, and automotive.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of Sustainable and Recyclable Packaging Materials

- 5.1.2 Increasing Utilization of the Shipping Containers

- 5.2 Market Restraints

- 5.2.1 Dynamic Changes in Regulatory Standards Due to Increasing Environmental Concerns

6 MARKET SEGMENTATION

- 6.1 Product

- 6.1.1 Intermediate Bulk Containers (IBCs)

- 6.1.2 Sacks

- 6.1.3 Drums

- 6.1.4 Pails

- 6.1.5 Other Products

- 6.2 End-user Industry

- 6.2.1 Automotive

- 6.2.2 Food and Beverage

- 6.2.3 Chemicals and Pharmaceuticals

- 6.2.4 Oil and Gas and Petrochemicals

- 6.2.5 Building and Construction

- 6.2.6 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Russia

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Rest of the World

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 WERIT Kunststoffwerke W. Schneider GmbH & Co.

- 7.1.2 Mondi PLC

- 7.1.3 Greif Inc.

- 7.1.4 Mauser Packaging Solutions

- 7.1.5 Global-Pak, Inc.

- 7.1.6 Berry Global Inc.

- 7.1.7 Smurfit Kappa Group PLC

- 7.1.8 Tank Holding Corp.

- 7.1.9 International Paper Company

- 7.1.10 Veritiv Corporation

- 7.1.11 Nefab Group

- 7.1.12 SCHUTZ GmbH & Co. KGaA

- 7.1.13 DS Smith PLC

- 7.1.14 Amcor PLC

- 7.1.15 Packaging Corporation of America

- 7.1.16 Pact Group Holdings Ltd

- 7.1.17 Visy

- 7.1.18 Brambles Ltd (CHEP)

- 7.1.19 Snyder Industries LLC

- 7.1.20 Myers Containers

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219