|

市场调查报告书

商品编码

1444263

机器学习即服务 (MLaaS) - 市场占有率分析、产业趋势与统计、成长预测(2024 年 - 2029 年)Machine Learning As A Service (MLaaS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

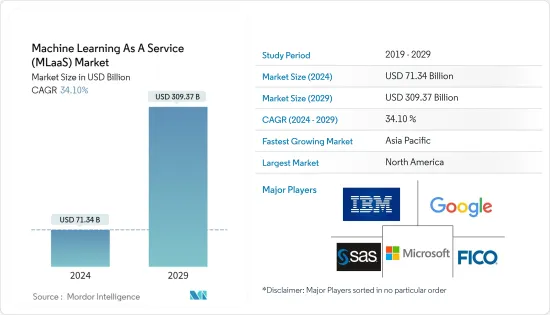

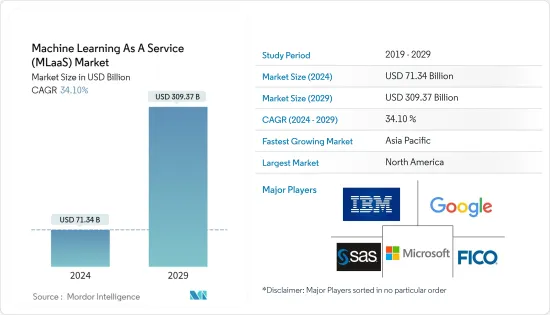

机器学习即服务市场规模预计到 2024 年将达到 713.4 亿美元,预计到 2029 年将达到 3,093.7 亿美元,在预测期内(2024-2029 年)CAGR为 34.10%。

主要亮点

- 机器学习 (ML) 是人工智慧 (AI) 的一个子领域,它使训练演算法能够透过统计方法进行分类或预测,从而揭示资料探勘项目中的关键见解。这些见解推动应用程式和业务内的决策,理想情况下会影响关键成长指标。由于它围绕着演算法、模型复杂性和计算复杂性展开,因此需要熟练的专业人员来开发这些解决方案。

- 机器学习即服务 (MLaaS) 市场可能会在预测期内出现高速成长,因为 MLaaS 演算法用于寻找资料中的模式,且使用者不必担心实际运算。 MLaaS是唯一结合行动应用、企业智慧、工业自动化和控制系统的全端人工智慧平台。

- 随着资料科学和人工智慧的进步,机器学习的效能快速提升。公司正在认识到这项技术的潜力,因此,预计该技术的采用率在预测期内将会增加。公司以基于订阅的模式提供机器学习解决方案,使消费者更容易使用该技术。此外,它还提供按使用量付费的灵活性。

- 此外,MLaaS 广泛应用于诈欺侦测、供应链优化、风险分析、製造等领域。用户可以从头开始自由建立内部基础设施,使管理和储存资料变得更加容易。

- 机器学习新创公司正在获得数百万美元的机器学习投资。例如,2022 年 6 月,Inflection AI 获得了最大的人工机器学习融资轮之一,总额达 2.25 亿美元。它被称为机器学习和人工智慧新创公司。已获得创投家2.25亿美元股权融资。这项机器学习投资预计将改善机器学习,从而在不久的将来实现直觉的人机介面。

- 机器学习即服务利用深度学习技术进行预测分析,以增强决策能力。然而,使用 MLaaS 为 ML 模型所有者带来了安全挑战,也为资料所有者带来了资料隐私挑战。资料所有者担心 MLaaS 平台上资料的隐私和安全。相比之下,MLaaS 平台所有者担心他们的模型可能会被冒充客户的对手窃取。

- COVID-19 大流行导致许多组织加速迁移到公有云解决方案,因为云端服务弹性可以满足服务需求的意外高峰。迁移到云端帮助公司在新冠肺炎 (COVID-19) 疫情期间重塑了开展业务的方式。对人工智慧服务的需求不断增长,许多云端供应商提供 AIaaS 和 MLaaS。

机器学习即服务 (MLAAS) 市场趋势

越来越多地采用物联网和自动化来推动市场

- 物联网营运可确保数千或更多设备在企业网路上正确、安全地运行,并且收集的资料及时、准确。虽然复杂的后端分析引擎负责资料流处理的主要部分,但确保资料品质的方法往往是过时的。一些物联网平台供应商正在利用机器学习技术来提高其营运管理能力,以确保控制庞大的物联网基础设施。

- 机器学习可以透过利用复杂的演算法分析大量资料来揭开物联网资料中隐藏模式的神秘面纱。机器学习推理可以透过在关键流程中使用统计得出的操作的自动化系统来补充或取代手动流程。基于机器学习建构的解决方案可自动执行物联网资料建模流程,从而消除模型选择、编码和验证等迂迴且劳力密集的活动。

- 采用物联网的小型企业可以大幅节省耗时的机器学习流程。 MLaaS 供应商可以更快地进行更多查询,提供更多类型的分析,以便从物联网网路中多个装置产生的大量资料快取中获取更多可操作的资讯。

- 根据Zebra 的製造愿景研究,预计到2022 年,基于物联网和RFID 的智慧资产监控系统的性能将优于基于电子表格的传统方法。根据微软公司进行的研究,85% 的企业至少拥有一个工业物连网用例项目。这一数字预计还会上升,因为 94% 的受访者表示他们将在 2021 年推行 IIoT 计划。这些情况可能会在不久的将来为 MLaaS 供应商创造机会。

- 由于可以轻鬆形成这些连接,许多组织越来越多地使用基于云端的技术,有利于资料传输。这使得组织中的每个员工都可以存取资料,从而提高公司的成本效率。 2023 年 4 月,Oracle Corporation 和 GitLab Inc. 宣布推出扩展 ML 和 AI 功能的新产品。客户可以在 Oracle 云端基础架构 (OCI) 上使用支援 GPU 的 GitLab 执行程式执行 AI 和 ML 工作负载,并可在任何需要的地方(包括本机和多云环境)部署云端服务。

北美预计将占据最大的市场份额

- 由于强大的创新生态系统,在联邦对先进技术的战略投资的推动下,再加上来自全球知名研究机构的有远见的科学家和企业家的存在,北美预计将在市场上占据重要份额,这推动了发展MLaaS 的。

- 例如,2023年5月,美国国家科学基金会(NSF)与高等教育机构、其他联邦机构和其他利害关係人合作,宣布投资1.4亿美元新建七个国家人工智慧研究所(AI) 。透过这项投资,政府旨在推广人工智慧系统和技术,并在美国培养多元化的人工智慧劳动力,以推动对人工智慧相关机会和风险采取一致的方法。地方政府的此类投资将为所研究的市场创造新的成长机会。

- 由于加拿大和美国等国家的显着成长,北美地区占据了 Mlaas 业务的大部分。这些国家拥有各种各样的小型和大型新创公司。因此,机器学习即服务的市场正在北美不断扩大。在技术突破和使用方面,北美是全球机器学习即服务市场成长最快的地区。它拥有投资机器学习即服务的基础设施和资金。此外,国防支出的增加和电信业的技术改进可能会在整个预测期内促进市场成长。

- 该地区也见证了 5G、物联网和互联设备的大幅成长。因此,通讯服务提供者 (CSP) 需要透过虚拟化、网路切片、新用例和服务需求来有效管理日益增长的复杂性。由于传统的网路和服务管理方法不再可持续,预计这将推动 MLaaS 解决方案的发展。

- 此外,该地区的主要科技公司,如微软、Google、亚马逊和 IBM,已成为机器学习即服务竞赛的主要参与者。由于每家公司都拥有相当大的公有云基础设施和机器学习平台,因此对于那些希望将人工智慧用于从客户服务到机器人流程自动化、行销、分析、预测性维护等,以协助训练正在部署的人工智慧资料模型。

- 该地区的主要参与者专注于扩展业务,为客户提供无缝体验,从而增加 MlaaS 市场的需求。例如,2022 年 2 月,AWS 宣布在全球扩展 AWS 本地区域。该公司宣布已在美国建成首批 16 个 AWS 本地开发区,并计划在全球 26 个国家的 32 个新都会区推出新的 AWS 本地开发区。

- 该地区的 ML 市场正在因云端而发生变化,无伺服器运算使开发人员能够快速启动并运行 ML 应用程式。此外,机器学习即服务业务的主要驱动力是资讯服务。无伺服器运算带来的最重大变化是消除了扩展实体资料库硬体的需要。

机器学习即服务 (MLAAS) 产业概述

市场的高度整合加剧了微软、IBM、Google和亚马逊等知名企业之间的竞争。为了在机器学习即服务 (MLAAS) 市场中占据重要份额,其他参与者正在积极扩展其产品组合和地理分布。

2023 年 2 月,云端原生服务证明者 Civo 宣布推出 Kubeflow 即服务(其新的机器学习託管服务),以改善开发人员体验并减少从 ML 演算法获取见解所需的时间和资源。透过此次发布,该公司旨在让各种规模的组织都能使用机器学习。

2022年2月,电信巨擘AT&T与人工智慧公司H2O合作,推出了企业导向的人工智慧功能商店。这提供了一个用于协作、共享、重复使用和发现机器学习功能的储存库,以加快人工智慧专案部署并提高投资回报率。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买家的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争激烈程度

- 产业价值链分析

- COVID-19 对市场的影响评估

第 5 章:市场动态

- 市场驱动因素

- 越来越多地采用物联网和自动化

- 越来越多地采用基于云端的服务

- 市场限制

- 隐私和资料安全问题

- 需要熟练的专业人员

第 6 章:市场细分

- 应用

- 行销与广告

- 预测性维护

- 自动化网路管理

- 诈欺侦测和风险分析

- 其他应用(NLP、情绪分析和电脑视觉)

- 组织规模

- 中小企业

- 大型企业

- 最终用户

- 资讯科技和电信

- 汽车

- 卫生保健

- 航太和国防

- 零售

- 政府

- BFSI

- 其他最终用户(教育、媒体和娱乐、农业和贸易市场)

- 地理

- 北美洲

- 欧洲

- 亚太

- 世界其他地区

第 7 章:竞争格局

- 公司简介

- Microsoft Corporation

- IBM Corporation

- Google LLC

- SAS Institute Inc.

- Fair Isaac Corporation (FICO)

- Hewlett Packard Enterprise Company

- Yottamine Analytics LLC

- Amazon Web Services Inc.

- BigML Inc.

- Iflowsoft Solutions Inc.

- Monkeylearn Inc.

- Sift Science Inc.

- H2O.ai Inc.

第 8 章:投资分析

第 9 章:市场的未来

The Machine Learning As A Service Market size is estimated at USD 71.34 billion in 2024, and is expected to reach USD 309.37 billion by 2029, growing at a CAGR of 34.10% during the forecast period (2024-2029).

Key Highlights

- Machine learning (ML) is a subfield of artificial intelligence (AI) that enables training algorithms to make classifications or predictions through statistical methods, uncovering critical insights within data mining projects. These insights drive decision-making within applications and businesses, ideally impacting key growth metrics. Since it revolves around algorithms, model complexity, and computational complexity, it requires skilled professionals to develop these solutions.

- The machine learning as a service (MLaaS) market will likely witness high growth over the forecast period as MLaaS algorithms are used to find patterns in the data, and users don't have to worry about the actual calculations. MLaaS is the only full-stack AI platform combining mobile applications, enterprise intelligence, industrial automation, and control systems.

- With advancements in data science and artificial intelligence, the performance of machine learning accelerated at a rapid pace. Companies are identifying the potential of this technology, and therefore, the adoption rate of the same is expected to increase over the forecast period. Companies offer machine learning solutions on a subscription-based model, making it easier for consumers to use this technology. In addition, it provides flexibility on a pay-as-you-use basis.

- Moreover, MLaaS is widely used in fraud detection, supply chain optimization, risk analytics, manufacturing, and others. Users can freely build internal infrastructure from scratch, making managing and storing your data easier.

- The ML startups are receiving fundings millions of dollars of ML investment. For instance, In June 2022, Inflection AI secured one of the largest artificial machine learning funding rounds, totaling USD 225 million. It is referred to as a machine learning and AI startup. It has obtained USD 225 million in equity financing from venture capitalists. This ML investment is expected to improve machine learning, allowing for intuitive human-computer interfaces in the near future.

- Machine learning-as-a-service leverages deep learning techniques for predictive analytics to enhance decision-making. However, using MLaaS introduces security challenges for ML model owners and data privacy challenges for data owners. Data owners are concerned about the privacy and safety of their data on MLaaS platforms. In contrast, MLaaS platform owners worry that their models may be stolen by adversaries who pose as clients.

- The COVID-19 pandemic caused many organizations to accelerate their migrations to public cloud solutions since cloud service elasticity can meet unexpected spikes in service demand. Migrations to the cloud helped companies reinvent the way they conduct their businesses during the time of COVID-19. The need for AI services has grown, and many cloud providers offer AIaaS and MLaaS.

Machine Learning as a Services(MLAAS) Market Trends

Increasing Adoption of IoT and Automation to Drive the Market

- IoT operations ensure that thousands or more devices run correctly and safely on an enterprise network and that the data being collected is timely and accurate. While sophisticated back-end analytics engines work on the major bit of data stream processing, ensuring data quality is often left to obsolete methodologies. Some IoT platform vendors are baking machine learning technology to boost their operations management capabilities to ensure rein in sprawling IoT infrastructures.

- Machine learning may demystify the hidden patterns in IoT data by analyzing significant volumes of data utilizing sophisticated algorithms. ML inference may supplement or replace manual processes with automated systems using statistically derived actions in critical processes. Solutions built on ML automate the IoT data modeling process, thus, removing the circuitous and labor-intensive activities of model selection, coding, and validation.

- Small businesses adopting IoT may significantly save on the time-consuming machine learning process. MLaaS vendors may conduct more queries more quickly, providing more types of analysis to get more actionable information from vast caches of data generated by multiple devices in the IoT network.

- As per Zebra's Manufacturing Vision Study, smart asset monitoring systems based on IoT and RFID were predicted to outperform traditional, spreadsheet-based approaches by 2022. According to research conducted by Microsoft Corporation, 85% of businesses have at least one IIoT use case project. This figure was expected to rise, as 94% of respondents said they would pursue IIoT initiatives in 2021. These instances may create opportunities for MLaaS vendors in the near future.

- The increasing use of cloud-based technology in many organizations benefits data transfer due to the ease with which these connections may be formed. This allows every employee in an organization to access data, increasing a company's cost efficiency. In April 2023, Oracle Corporation and GitLab Inc. announced the availability of a new offering that expands ML and AI functionalities. Customers can run AI and ML workloads with GPU-enabled GitLab runners on Oracle Cloud Infrastructure (OCI) and get access to deploy cloud services wherever needed, including on-premises and multi-cloud environments.

North America is Expected to Hold the Largest Market Share

- North America is expected to hold a significant share in the market owing to the robust innovation ecosystem, fueled by strategic federal investments into advanced technology, complemented by the presence of visionary scientists and entrepreneurs coming together from globally renowned research institutions, which has propelled the development of MLaaS.

- For instance, in May 2023, The U.S. National Science Foundation (NSF), in collaboration with higher education institutions, other federal agencies, and other stakeholders, announced to invest USD 140 million to establish seven new National Artificial Intelligence Research Institutes (AI) institutes. Through this investment, the government aims to promote AI systems and technologies and develop a diverse AI workforce in the United States to advance a cohesive approach to AI-related opportunities and risks. Such investments by the regional government will create new growth opportunities for the studied market.

- Because of remarkable growth in countries such as Canada and the United States, the North American region accounts for most of Mlaas business. These countries are home to a wide diversity of small and large start-ups. As a result, the market for machine learning as a service is expanding in North America. Regarding technological breakthroughs and use, North America is the fastest-growing region worldwide in the machine learning as a service market. It has the infrastructure and funds to invest in machine learning as a service. Furthermore, increased defense spending and technical improvements in the telecommunications industry will likely boost market growth throughout the forecast period.

- The region also witnessed a significant proliferation of 5G, IoT, and connected devices. As a result, communications service providers (CSPs) need to manage an ever-growing complexity efficiently through virtualization, network slicing, new use cases, and service requirements. This is expected to drive MLaaS solutions as traditional network and service management approaches are no longer sustainable.

- Moreover, major technology firms in the region, such as Microsoft, Google, Amazon, and IBM, have stepped up as major players in the ML-as-a-service race. Because each of the companies has a sizeable public cloud infrastructure and ML platforms, this allows the companies to make machine learning-as-a-service a reality for those looking to use AI for everything ranging from customer service to robotic process automation, marketing, analytics, predictive maintenance, etc., to assist in training the AI date models being deployed.

- The key players in this region focus on expanding to offer their clients seamless experiences, increasing the MlaaS market's demand. For instance, In February 2022, AWS announced the global expansion of AWS local zones. It told the completion of its first 16 AWS Local Zones in the United States, and it plans to launch new AWS Local Zones in 32 new metropolitan areas in 26 countries worldwide.

- The region's ML marketplace is changing due to the cloud, and serverless computing allows developers to get ML applications up and running quickly. Additionally, the prime driver of the ML-as-a-service business is information services. The most significant change serverless computing has brought in is eliminating the need to scale physical database hardware.

Machine Learning as a Services(MLAAS) Industry Overview

The high market consolidation has increased the competition among prominent players such as Microsoft, IBM, Google, and Amazon. To capture a significant share of the Machine Learning-as-a-Service (MLAAS) Market, other players are actively expanding their product portfolios and geographical presence.

In February 2023, Civo, the cloud-native service prover, announced to launch of Kubeflow as a service, its new Machine Learning managed service, to improve the developer experience and reduce the time and resources required to gain insights from ML algorithms. Through this launch, the company aims to make ML accessible to all sizes of organizations.

In February 2022, Telecom giant AT&T and AI company H2O collaborated and launched an artificial intelligence feature store for enterprises. This delivers a repository for collaborating, sharing, reusing, and discovering machine learning features to speed AI project deployments and improve ROI.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of IoT and Automation

- 5.1.2 Increasing Adoption of Cloud-based Services

- 5.2 Market Restraints

- 5.2.1 Privacy and Data Security Concerns

- 5.2.2 Need for Skilled Professionals

6 MARKET SEGMENTATION

- 6.1 Application

- 6.1.1 Marketing and Advertisement

- 6.1.2 Predictive Maintenance

- 6.1.3 Automated Network Management

- 6.1.4 Fraud Detection and Risk Analytics

- 6.1.5 Other Applications (NLP, Sentiment Analysis, and Computer Vision)

- 6.2 Organization Size

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 End-User

- 6.3.1 IT and Telecom

- 6.3.2 Automotive

- 6.3.3 Healthcare

- 6.3.4 Aerospace and Defense

- 6.3.5 Retail

- 6.3.6 Government

- 6.3.7 BFSI

- 6.3.8 Other End-Users (Education, Media and Entertainment, Agriculture, and Trading Market Place)

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 IBM Corporation

- 7.1.3 Google LLC

- 7.1.4 SAS Institute Inc.

- 7.1.5 Fair Isaac Corporation (FICO)

- 7.1.6 Hewlett Packard Enterprise Company

- 7.1.7 Yottamine Analytics LLC

- 7.1.8 Amazon Web Services Inc.

- 7.1.9 BigML Inc.

- 7.1.10 Iflowsoft Solutions Inc.

- 7.1.11 Monkeylearn Inc.

- 7.1.12 Sift Science Inc.

- 7.1.13 H2O.ai Inc.