|

市场调查报告书

商品编码

1444281

铟镓锌氧化物 -市场占有率分析、产业趋势与统计、成长预测(2024-2029)Indium Gallium Zinc Oxide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

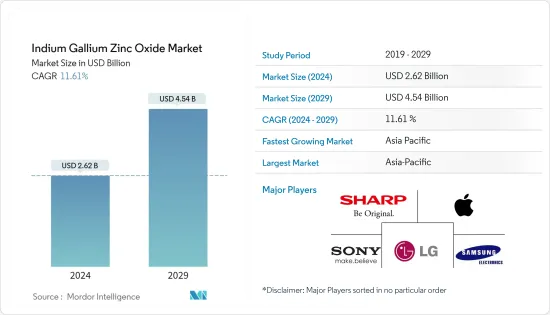

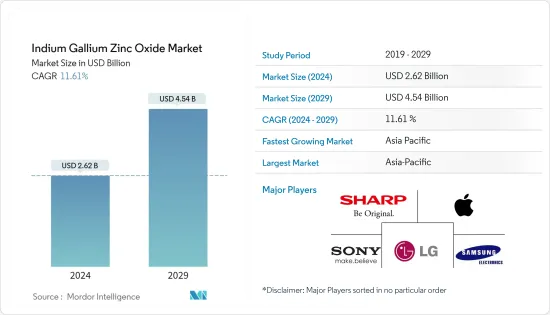

铟镓锌氧化物市场规模预计到2024年为26.2亿美元,在预测期内(2024-2029年)预计到2029年将达到45.4亿美元,复合年增长率为11.61%。

自 2012 年应用于 LCD 以来,氧化铟镓锌 (IGZO) 一直是各种新发展的推动力,不仅适用于液晶,也适用于其他显示技术。由 IGZO 製成的薄膜电晶体是最热门的产品之一,因为与低温多晶硅 (LTPS) 製成的 TFT 相比,它们具有更高的性能,并且可以超薄且灵活地製造。可以整合到各种设备中。

主要亮点

- 全行业向小型化趋势的转变,特别是在实现性能的同时减轻重量和尺寸,使 IGZO 成为受欢迎的选择。

- 经过最初的实施阶段后,IGZO 的应用已扩展到广泛的消费性电器产品,例如配备相同创新技术显示器的智慧型手机和笔记型电脑。这家老牌消费电子公司已经发布了多款采用 IGZO 显示器的产品,包括戴尔公司的 Dell XPS 13 笔记型电脑、雷蛇公司的 Razer Blade 14 游戏笔记型电脑以及苹果公司的 iPad mini 2 和 iPad Air。

- 虽然显示器市场主要由非晶质(a-Si) 和 LTPS LCD 占据主导地位,它们合计占据智慧型手机显示器市场的最大份额,但氧化铟镓锌技术的市场正在稳步增长,并且势头强劲。随着平板电脑、智慧型手机、笔记型电脑和电视等显示设备的触控灵敏度更高、解析度更高、能源效率更高的需求不断增加,对 IGZO 显示器的需求也在增加。

- 供应商的持续开发和IGZO领域不断增加的研究将进一步推动未来市场的成长。 2019 年 6 月,三星电子在佛罗里达州奥兰多举行的 InfoComm 2019 展会上宣布在全球推出 Wall Luxury。最新版本的三星 IGZO 驱动的模组化 MicroLED 萤幕可以客製化为任何尺寸和长宽比,增强了生活空间的内部装饰,让客户在舒适的家中体验卓越的图像品质。

- 游戏市场对于 IGZO 市场来说是一个有吸引力的机会,因为需要更高品质的 HMD 成本和功能改进来支援高品质内容的持续部署。英特尔表示,AR/VR 市场的商机仍然巨大,预计到 2021 年耳机硬体销售额将超过 450 亿美元。

- 由于中国是原料和最终产品的主要供应国之一,预计电子设备将受到新冠肺炎 (COVID-19 ) 感染疾病的严重影响。该行业面临产量减少、供应链中断和价格波动的问题。预计近期各大电子企业的销售将受到影响。

铟镓锌氧化物市场趋势

穿戴式装置获得显着的市场占有率

- 随着消费者健身趋势的兴起,穿戴式装置越来越受到重视。据思科系统公司称,连网穿戴装置的数量预计将从 2018 年的 5.93 亿台成长到 2022 年的 11.5 亿台。

- 随着物联网的出现,穿戴式感测设备在日常生活中的应用越来越重要,例如运动、健康检查、商业等中的生命讯号监测。

- 在非晶质大面积基板上製造的非晶态氧化铟镓锌 (a-IGZO) 薄膜电晶体 (TFT) 由于其与人体的弹性相容性和低成本,对于构建可穿戴感测设备来说是令人兴奋的。它是一个平台。这导致材料具有优异的机械稳定性、良好的导电性和透光性等特性。薄膜电晶体(TFT)和气体感测器在1.9m厚的PMMA上製造,基板表现出优异的电晶体性能。

- 低温溶液处理的非晶质IGZO 薄膜可作为新兴穿戴式电子产品的室温 VOC(挥发性有机化合物)感测器的绝佳候选者。它们用于灵活的电子应用,例如用于生鲜食品的可穿戴电子标籤等。

- 慢性病患者数量的增加增加了传统医疗资源的压力。这推动了穿戴式医疗设备的普及,这些设备可以帮助患者获得更方便、更容易获得的护理服务。这些倡议进一步推动了所研究的细分市场。

- 由于不活跃的生活方式、不健康的用餐和肥胖,一些新兴和已开发地区的糖尿病患者数量不断增加,促使市场相关人员开发智慧穿戴医疗设备。

亚太地区将经历最快的成长

- 亚太地区正经历最快的成长,智慧型手机、电视、笔记型电脑和穿戴式装置等消费性电子产品的普及很高。 IGZO-TFT及其应用已获得JST(日本科学技术振兴机构)的专利并授权给Sharp Corporation。日本Sharp Corporation公司率先开始生产配备IGZO-TFT的液晶面板。Sharp Corporation在智慧型手机、平板电脑、32吋液晶显示器中使用IGZO-TFT,有效推动市场。

- 2019年11月,Sharp Corporation与日本广播公司(NHK)共同开发了30吋4K柔性有机LED(OLED)显示器。有机发光二极体显示器具有在30英寸对角线(约76cm)柔性薄膜基板的每个RGB子像素中形成的发光元件(RGB发光方法),并且是世界上最大的有机发光二极体显示器之一。马苏。世界。此显示器使用 IGZO 薄膜电晶体 (TFT) 来驱动 OLED 元件。

- 中国是有利的市场之一,由于智慧型手机和电视领域提供低成本IGZO,预计将带来高收益,这正在提振市场需求。

- 据报道,包括重庆惠科、京东方科技、中航国际、TCL在内的多家中国企业都对收购中电熊猫液晶科技以加强其在中国液晶显示器行业的地位表现出了浓厚的兴趣。京东方已表示将停止扩大 LCD 产能,但可能会关注 CEC-Panda 的 IGZO 技术,该技术可以驱动 OLED。

- 亚太地区是 2021 年智慧型手机的主要市场,预计该地区将在预测期内继续提供最大的成长机会。可支配收入的增加、通讯基础设施的发展、预算型智慧型手机的出现以及产品发布数量的增加等因素都促进了智慧型手机市场的成长。

- 在印度等开发中国家,资料价格自 2013 年以来下降了 95%,导致智慧型手机用户数量增加。非政府贸易协会和倡导团体印度工商会 (ASSOCHAM) 表示,到 2022 年,印度智慧型手机用户数量预计将增加近一倍,达到 8.59 亿,复合年增长率为 12.9。 %。

铟镓锌氧化物产业概况

由于各公司正在使用氧化铟镓锌进行新技术创新,因此氧化铟镓锌市场适度分散,使市场竞争激烈。市场的最新发展包括:

- 2022年4月,天马微电子宣布与厦门国贸控股集团合作,投资330亿元兴建8.6代a-Si IGZO液晶面板产品线。

- 2022 年 1 月 - Sharp Corporation Visual Solutions Europe 推出首款基于创新 IGZO 面板的专业显示器。 PN-K321H 是同类产品中最薄的型号,可提供四倍全高清 3840x2160 分辨率,呈现令人惊嘆的逼真影像。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

- 调查系统

- 二次调查

- 主要研究途径及主要受访者

- 对资料进行三角测量并产生见解

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 技术简介

- 市场驱动因素

- 高解析度技术的进步

- 致力于节能技术

- 市场限制因素

- 低温多晶(LTPS)等竞品

- 评估 COVID-19 对产业的影响

第五章市场区隔

- 按用途

- 智慧型手机

- 穿戴式装置

- 壁挂式显示器

- 电视机

- 平板电脑、笔记本、笔记型电脑

- 其他应用

- 按最终用户

- 车

- 家用电器

- 卫生保健

- 工业的

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他地区

第六章 竞争形势

- 公司简介

- Sharp Corporation

- Apple Inc.

- Sony Corporation

- ASUSTEK Computer Inc.

- LG Electronics

- AU Optronics

- Samsung Electronics Co. Ltd

- Fujitsu Limited

第七章 投资分析及未来趋势

- 投资分析

- 未来市场展望

The Indium Gallium Zinc Oxide Market size is estimated at USD 2.62 billion in 2024, and is expected to reach USD 4.54 billion by 2029, growing at a CAGR of 11.61% during the forecast period (2024-2029).

Ever since its incorporation in LCDs back in 2012, Indium Gallium Zinc Oxide (IGZO) has become a driving force in various new developments not just specific to liquid crystals but in other display technologies. Thin-film transistors consisting of IGZO are among the products gaining the most traction owing to their enhanced performance compared to TFTs made with low-temperature-poly-silicon (LTPS), as well as their ability to be made ultra-thin and flexible for integration into a wide variety of devices.

Key Highlights

- A shift toward the trend of miniaturization across the industries, particularly aiming to reduce the weight and size while achieving performance, has made the IGZO a popular choice.

- Post the initial incorporation phase, IGZO's application has extended to a wide range of consumer electronics, such as smartphones and laptops, featuring the same innovative technology display. Established consumer electronics players have launched a few products, such as Dell XPS 13 laptop from Dell Inc., Razer Blade 14 gaming laptop from Razer Inc., and iPad mini 2 & iPad Air from Apple, featuring the IGZO display.

- The market for displays was predominantly dominated by Amorphous Silicon (a-Si) and LTPS LCD, combining to form the largest percentage of the smartphone displays market, but steady, the market for indium gallium zinc oxide technology is gaining traction. As the demand for enhanced touch sensitivity, higher resolution, and power-efficient display devices, such as tablets, smartphones, laptops, and televisions, are on the rise, demand for IGZO displays is gaining momentum.

- Continuous developments from the vendors and increasing research in the IGZO space would augment the market's growth in the coming times. In June 2019, Samsung Electronics Co. Ltd announced the global launch of the Wall Luxury at InfoComm 2019 in Orlando, Florida. The latest version of Samsung's modular MicroLED screen with IGZO can be custom-tailored to any size and aspect ratio, enhancing the interior of the living space, ensuring customers can experience superior picture quality in the comfort of their own homes.

- The gaming market is an attractive opportunity for the IGZO market, owing to the demand for higher-quality HMDs cost and functionality improvements to support the ongoing rollout of high-quality content. According to Intel, the revenue opportunity of the AR/VR market remains strong, and it is estimated to exceed USD 45 billion in headset hardware sales by the year 2021.

- The electronics devices are expected to be impacted significantly by the COVID-19 outbreak, as China is one of the major suppliers of raw materials and finished products. The industry is facing a reduction in production, disruption in the supply chain, and price fluctuations. The sales of prominent electronic companies are expected to be affected in the near future.

Indium Gallium Zinc Oxide Market Trends

Wearable Devices to Gain Significant Market Share

- Wearable devices have gained significant traction, owing to the boom in the fitness trend across consumers. According to Cisco Systems, the number of connected wearable devices is expected to increase from 593 million in 2018 to 1,105 million in 2022.

- With the advent of the internet of things, wearable sensing devices are gaining importance in the daily lives of applications like vital signal monitoring during sports and health diagnostics, enterprises, etc.

- Amorphous indium gallium zinc oxide (a-IGZO) thin-film transistors (TFTs) fabricated on flexible large-area substrates are an exciting platform to build wearable sensing devices due to their flexibility conformability to the human body, and low cost. This provides material properties of superb mechanical stability, good electrical conductivity, and optical transparency. Thin film transistors (TFTs) and gas sensors are fabricated on a 1.9 µm thick PMMA, where the substrate exhibits excellent transistor performances.

- Low-temperature solution-processed amorphous IGZO film can serve as a good candidate for room-temperature VOCs (volatile organic compounds) sensors for emerging wearable electronics. These are used in flexible electronic applications such as wearable electronic tags used in perishable food, etc.

- The rising number of chronic patients increases the conventionally available healthcare resources burden. This, in turn, promotes the popularity of wearable medical devices that could assist patients with more convenient and accessible care services. These initiatives further drive the studied segment.

- Due to inactive lifestyles, unhealthy diets, and obesity, some of the emerging and developed regions are witnessing a rising number of diabetic patients, encouraging the market players to develop smart wearable medical devices.

Asia Pacific to Witness Fastest Growth

- Asia-Pacific is witnessing the fastest growth due to the high amount of penetration of consumer electronic devices such as smartphones, televisions, laptops, wearables, etc. IGZO-TFT and its applications are patented by JST (Japan Science and Technology Agency) and have been licensed to Sharp. Sharp, a Japanese firm, was the first to start production of LCD panels incorporating IGZO-TFT. Sharp uses IGZO-TFT for smartphones, tablets, and 32" LCDs, which drives the market efficiently.

- In November 2019, Sharp Corporation and Japan Broadcasting Corporation (NHK) co-developed a 30-inch 4K flexible organic LED (OLED) display. The OLED display, with light-emitting elements formed onto each of the RGB subpixels (RGB light emission method) of a 30-inch-diagonal (approx. 76 cm) flexible film substrate, is one of the largest displays of its kind in the world. This display employs IGZO thin-film transistors (TFTs) to drive the OLED elements.

- China is one of the lucrative markets and computes high revenue rotation because of the availability of low-cost IGZO in the segment of smartphones and televisions, which drives the demand in the market.

- Reportedly, several Chinese companies, including Chongqing HKC, BOE Technology, AVIC International Holding, and TCL, show a keen interest in taking control of CEC-Panda LCD Technology to consolidate their position in China's liquid-crystal display industry. Though BOE stated that it would stop expanding its LCD production capacity, it is probably eyeing CEC-Panda's IGZO technology that can drive OLED.

- Asia-Pacific was the prominent market for smartphones in 2021, and the region is expected to continue to offer maximum growth opportunities over the forecast period. Factors such as growing disposable income, development of telecom infrastructure, the emergence of budget-centric smartphones, and the rising number of product launches contribute to the growth of the smartphone market.

- Developing nations, such as India, witnessed a fall in data costs by 95% since 2013, resulting in an increase in smartphone users. According to the Associated Chambers of Commerce and Industry of India, a non-governmental trade association and advocacy group (ASSOCHAM), the number of smartphone users in the country is expected to almost double to 859 million by 2022, growing at a CAGR of 12.9%.

Indium Gallium Zinc Oxide Industry Overview

The indium gallium zinc oxide market is moderately fragmented as the players are innovating with new technologies using indium gallium zinc oxide, which is making the market competitive. Some of the recent developments in the market are -

- April 2022 - Tianma Microelectronics Co. Ltd announced collaborating with Xiamen International Trade Holding Group Co. Ltd, investing CNY 33 billion to build a product line categorizing the 8.6 generation a-Si IGZO LCD panel.

- January 2022 - Sharp Visual Solutions Europe unveiled its first professional display based on an innovative IGZO panel. The PN-K321H is the slimmest model in its class and achieves quad full-HD 3840x2160 resolution for stunning realistic image production.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research Approach and Key Respondents

- 2.4 Data Triangulation and Insight Generation

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Market Drivers

- 4.4.1 Advancement in High Resolution Technologies

- 4.4.2 Emphasis on Energy-saving Technology

- 4.5 Market Restraints

- 4.5.1 Competitors, Such as Low-temperature Polycrystalline Silicon (LTPS)

- 4.6 Assessment of the Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Smartphones

- 5.1.2 Wearable Devices

- 5.1.3 Wall-Mounted Displays

- 5.1.4 Televisions

- 5.1.5 Tablets, Notebook and Laptops

- 5.1.6 Other Appplications

- 5.2 By End-User

- 5.2.1 Automotive

- 5.2.2 Consumer Electronics

- 5.2.3 Healthcare

- 5.2.4 Industrial

- 5.2.5 Other End-users Industries

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Sharp Corporation

- 6.1.2 Apple Inc.

- 6.1.3 Sony Corporation

- 6.1.4 ASUSTEK Computer Inc.

- 6.1.5 LG Electronics

- 6.1.6 AU Optronics

- 6.1.7 Samsung Electronics Co. Ltd

- 6.1.8 Fujitsu Limited

7 INVESTMENT ANALYSIS AND FUTURE TRENDS

- 7.1 Investment Analysis

- 7.2 Future of the Market