|

市场调查报告书

商品编码

1444288

建筑复合材料:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Construction Composite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

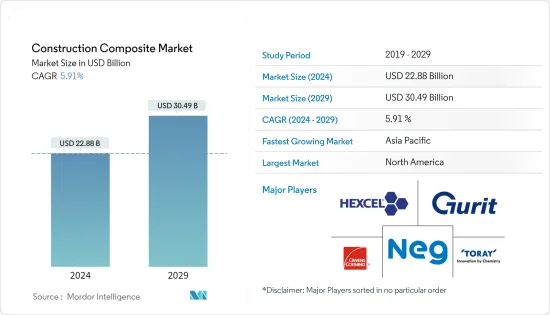

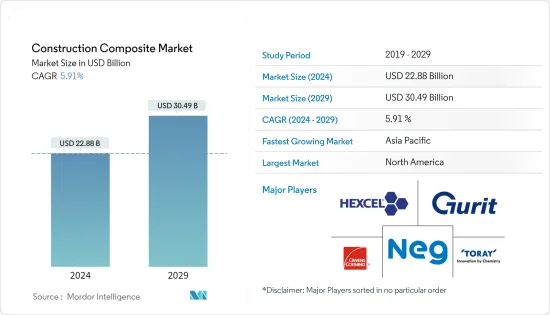

建筑复合材料市场规模预计到 2024 年为 228.8 亿美元,预计到 2029 年将达到 304.9 亿美元,预测期内(2024-2029 年)复合年增长率为 5.91%。

COVID-19对2020年的市场产生了负面影响,因为疫情严重影响了国际贸易,扰乱了製造业、建筑业等多个行业。不过,这些领域的市场需求在2021年已显着恢復。

主要亮点

- 从中期来看,推动所研究市场成长的因素是复合材料在建筑应用中的使用增加以及旧水泥建筑物的修復。

- 另一方面,复合材料的初始生产和安装成本较高以及技术纯熟劳工的缺乏正在阻碍市场成长。

- 建筑业复合材料大规模生产能力的不断提高可能会在未来几年创造市场机会。

- 虽然北美地区预计将在收益方面占据市场主导地位,但亚太地区在预测期内可能会呈现出最高的复合年增长率。

建筑复合材料市场趋势

土木工程和建筑业主导市场

- 土木建筑包括桥樑、水坝、道路、机场、运河、铁路基础设施和相关结构的建设。

- 2021年终,中国多个省份宣布了大型基础设施计划。中国南方广西壮族自治区宣布了一系列大型建设计划,总投资达1,859亿元人民币(291.5亿美元)。这些计划涉及交通、新能源、物流、基础设施等多个领域。

- 此外,作为推动都市化和刺激区域经济长期计画的一部分,中国计划在未来 15 年内将世界第二大铁路网扩大三分之一。根据国有企业中国中铁集团发布的计划,中国的目标是到年终建成约 20 万公里(124,274 英里)的铁路线,其中包括约 7 万公里的高铁。

- 在德国,交通和数位基础设施部计划投资 3.4872 亿美元用于电动的自动驾驶和互联驾驶以及电动车充电基础设施等未来技术。该国还启动了 A49 高速公路计划,该项目将施瓦尔姆施塔特与黑森中部的欧姆塔尔立交桥连接起来。预计这将增加复合材料的消费量。

- 施瓦姆施塔特欧姆塔尔计划采用官民合作关係模式,投资8.1368亿美元。该工程包括 93 公里的道路,计划于 2024 年第三季完工。这些大型铁路和公路建设计划可能会在预测期内推动对建筑复合材料的需求。

- 根据美国人口普查局的数据,2021年代表美国的公路和街道建设年价值为1.0068亿美元,而2020年为1.0232亿美元。

- 在加拿大,政府宣布计划在 2028 年投资近 1,400 亿美元用于该国的主要基础设施开发,作为其投资加拿大计画的一部分。

北美地区占据市场主导地位

- 在北美,由于美国、加拿大和墨西哥等美国建筑业的成长,建筑复合材料的使用正在增加。

- 北美地区是建筑复合材料最大的消费市场之一。美国拥有全世界最大的建筑业。 2021年全年建筑支出为15,903.7亿美元,比2020年的14,692亿美元增加8.2%,导致各种建筑应用中建筑复合材料的消耗增加。

- 根据美国人口普查局的数据,2022年2月美国建筑支出经季节调整后的年率估计为17,044亿美元,比1月修正估计值的16,955亿美元增长0.5%。此外,2022 年 2 月的预测比 2021 年 2 月的 15,333 亿美元预测高出 11.2%。 2022年前两个月建筑支出达到2,378亿美元,比2021年同期的2,154亿美元成长10.4%。

- 在加拿大,住宅和商业领域近年来经历了稳定成长。最近,加拿大(更具体地说是多伦多)出现了高层建筑建设热潮。多伦多预计到 2025 年将有 30 多栋高层建筑竣工,高层建筑50 栋高层建筑正处于提案和规划阶段。

- 此外,作为加拿大投资计画的一部分,政府宣布计划在 2028 年之前投资近 1,400 亿加元用于该国的基础设施发展。

建筑复合材料产业概述

全球建筑复合材料市场较为分散。市场的主要企业包括(排名不分先后)赫氏公司、欧文斯科宁、日本电气硝子、东丽工业公司和固瑞特。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 复合材料在建筑应用的使用越来越多

- 老化水泥建筑物的维修

- 抑制因素

- 复合材料的初始生产和安装成本较高

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔(收益市场规模)

- 树脂型

- 聚酯树脂

- 乙烯基酯

- 聚乙烯

- 聚丙烯

- 环氧树脂

- 其他树脂类型

- 纤维类型

- 碳纤维

- 玻璃纤维

- 天然纤维

- 其他纤维类型

- 最终用途部门

- 产业

- 商业的

- 住房

- 公民生活

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业采取的策略

- 公司简介(公司简介、财务状况、产品/服务、近期状况)

- Aegion Corporation

- Exel Composites

- Gurit

- Hexcel Corporation

- Kordsa Teknik Tekstil AS

- Toray Industries Inc.

- Mitsubishi Chemical Corporation

- Nippon Electric Glass Co. Ltd

- Owens Corning

- SGL Carbon

- Teijin Limited

第七章市场机会与未来趋势

- 提升建筑领域复合材料量产能力

The Construction Composite Market size is estimated at USD 22.88 billion in 2024, and is expected to reach USD 30.49 billion by 2029, growing at a CAGR of 5.91% during the forecast period (2024-2029).

COVID-19 negatively impacted the market in 2020 as the pandemic severely affected international trade and hampered several industries, including manufacturing, building, and construction. However, in 2021, the market demand from these sectors recovered significantly.

Key Highlights

- Over the medium term, the factors driving the growth of the market studied are the increasing usage of composites in construction applications and the rehabilitation of old concrete structures.

- On the other hand, the high initial production and installation costs of composites, coupled with the inadequacy of skilled labor, are hindering the market's growth.

- Increasing the ability to mass-produce composites in the construction sector will likely create opportunities for the market in the coming years.

- North America is expected to dominate the market in terms of revenue while the Asia-Pacific region is likely to witness the highest CAGR during the forecast period.

Construction Composites Market Trends

Civil Construction Sector to Dominate the Market

- Civil construction comprises the construction of bridges, dams, roads, airports, canals, railway infrastructure, and related structures.

- Toward the end of 2021, several Chinese provinces announced major infrastructure projects. South China's Guangxi Zhuang Autonomous Region unveiled a batch of major construction projects, with a total investment of CNY 185.9 billion (USD 29.15 billion). Those projects cover many sectors, including transportation, new energy, logistics, and basic infrastructure.

- Furthermore, China plans to expand its railway network, which is the second-largest in the world, by one-third in the next 15 years, as part of a long-term plan to propel urbanization and stimulate local economies. According to a plan issued by the state-owned China State Railway Group, China aims to have about 200,000 km (124,274 miles) of railway tracks by the end of 2035, including about 70,000 km of high-speed railways.

- In Germany, the Ministry of Transport and Digital Infrastructure plans to invest USD 348.72 million in future technologies, such as electric mobility or automated and networked driving for electric vehicle charging infrastructure. Also, the country has started working on the A49 highway project connecting Schwalmstadt and the Ohmtal interchange in Central Hesse. This, in turn, is expected to increase the consumption of composite materials.

- The Schwalmstadt-Ohmtal project is based on a public-private partnership model with an investment of USD 813.68 million. The construction, which comprises 93 km of road, is expected to be completed in the third quarter of 2024. These massive railway and road construction projects may drive the demand for construction composites during the forecast period.

- According to US Census Bureau, annual value of highway and street construction put in place of United states, in 2021 accounted for USD 100.68 million, compared to USD 102.32 million in 2020.

- In Canada, as part of the "Investing in Canada" plan, the government announced plans to invest nearly USD 140 billion in major infrastructure developments in the country by 2028.

North America Region to Dominate the Market

- In North America, the utilization of construction composites is increasing due to the growing construction sector in countries such as the United States, Canada, and Mexico.

- The North American region is one of the largest consumption markets for construction composites. The United States has one of the world's largest construction industries. In the full year 2021, construction spending amounted to USD 1,590.37 billion, 8.2% above USD 1,469.2 billion in 2020, thereby increasing the consumption of construction composites from various construction applications.

- According to the US Census Bureau, during February 2022, the construction spending in the country was estimated at a seasonally adjusted annual rate of USD 1704.4 billion, 0.5% more than the revised January estimate of USD 1,695.5 billion. Moreover, the February 2022 estimation is 11.2% more than the February 2021 estimate of USD 1,533.3 billion. During the first two months of 2022, construction spending amounted to USD 237.8 billion, 10.4% percent above USD 215.4 billion for the same period in 2021.

- In Canada, the residential and commercial sectors have been witnessing steady growth in the recent past. There has been a boom in the construction of skyscrapers in Canada (more specifically in Toronto) in recent times. Over 30 high-rise buildings are expected to be completed by 2025, and another 50 such buildings are in the proposal and planning phases in Toronto.

- Moreover, as part of the ''Investing in Canada Plan'', the government has announced plans to invest nearly USD 140 billion in infrastructure developments in the country by 2028.

Construction Composites Industry Overview

The global construction composite market is fragmented. Some major players in the market (in no particular order) include Hexcel Corporation, Owens Corning and Nippon Electric Glass Co. Ltd., Toray Industries Inc., and Gurit.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Use of Composites in Construction Applications

- 4.1.2 Rehabilitation of Old Concrete Structures

- 4.2 Restraints

- 4.2.1 High Initial Production and Installation Costs of Composites

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Revenue)

- 5.1 Resin Type

- 5.1.1 Polyester Resin

- 5.1.2 Vinyl Ester

- 5.1.3 Polyethylene

- 5.1.4 Polypropylene

- 5.1.5 Epoxy Resin

- 5.1.6 Other Resin Types

- 5.2 Fiber Type

- 5.2.1 Carbon Fibers

- 5.2.2 Glass Fibers

- 5.2.3 Natural Fibers

- 5.2.4 Other Fiber Types

- 5.3 End-use Sector

- 5.3.1 Industrial

- 5.3.2 Commercial

- 5.3.3 Housing

- 5.3.4 Civil

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) ** / Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles (Overview, Financials, Products and Services, and Recent Developments)

- 6.4.1 Aegion Corporation

- 6.4.2 Exel Composites

- 6.4.3 Gurit

- 6.4.4 Hexcel Corporation

- 6.4.5 Kordsa Teknik Tekstil AS

- 6.4.6 Toray Industries Inc.

- 6.4.7 Mitsubishi Chemical Corporation

- 6.4.8 Nippon Electric Glass Co. Ltd

- 6.4.9 Owens Corning

- 6.4.10 SGL Carbon

- 6.4.11 Teijin Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Ability to Mass Produce Composites in the Construction Sector

![北美建筑用复合材料市场:趋势、机会与竞争分析 [2024-2030]](/sample/img/cover/42/1496916.png)

![欧洲建筑市场的复合材料:市场规模、趋势与成长分析[2024-2030]](/sample/img/cover/42/1496923.png)

![全球建筑市场复合材料:趋势、机会与竞争分析[2024-2030]](/sample/img/cover/42/1496919.png)